AMD Q2: Fly to the moon!

AMD$AMD(AMD)$ , the chip giant, released its second-quarter financial report last night. As usual, its performance exceeded market expectations.

When talking about the competition with old rival Intel, AMD CEO Su Zifeng said that he would "fight for every CPU slot"!

With strong performance and advanced product portfolio, AMD eagerly raised its annual revenue growth rate in 2021 from 50% previously expected to 60%.

If AMD is on the road of revival before 2021, AMD will start to be aggressive after that, and its old rival Intel will be attacked from left to right!

Under the blessing of favorable financial reports, AMD's share price rose slightly by 1% after hours, which seems to be sorry for the financial reports that exceeded expectations, but in fact it is not difficult to understand. After all, it has become AMD's tradition that financial reports exceeded expectations!

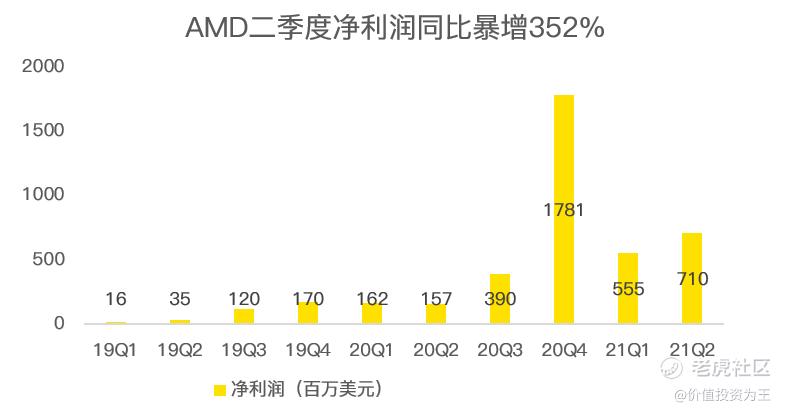

The volume and price rose together, and AMD's net profit soared by 352%!

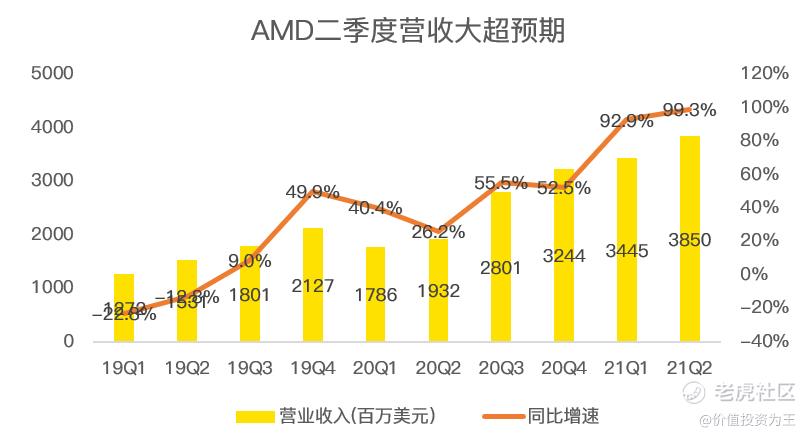

Before the release of the second quarterly report, AMD gave the guidance that the revenue was 3.6 billion US dollars, up and down 100 million US dollars, and the gross profit margin was 47%. Bloomberg analysts unanimously expected revenue of 3.613 billion.

After the transcript was announced, AMD's actual revenue in the second quarter was USD 3.85 billion, up 99.3% year-on-year, and its gross profit margin was 48%, both exceeding expectations.

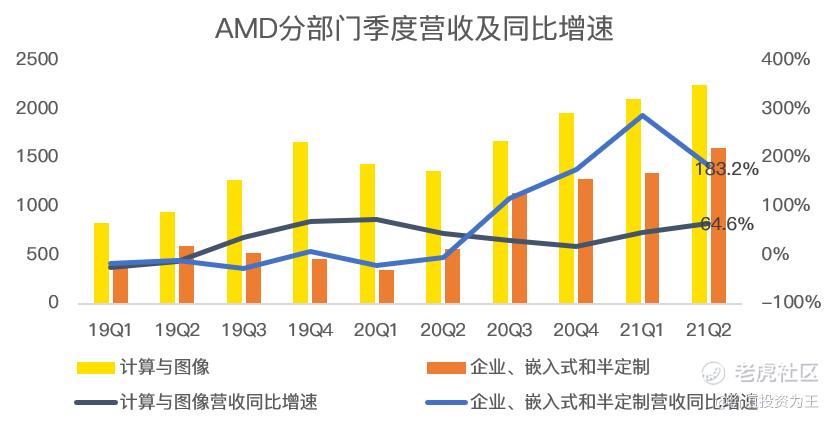

In AMD's revenue structure, it is divided into two types of sources, one is computing and graphics business, including CPU and GPU sales of desktop and notebook computers; The other is enterprise, embedded and semi-customized business, including data center and game console revenue.

The computing and graphics business achieved revenue of US $2.25 billion in the second quarter, up 64.6% year-on-year, far exceeding the growth rate in the previous four quarters.

The reason for driving revenue growth is the rising volume and price. Due to the rich combination of Ruilong desktop and notebook processors, the average price of ASP for client processors is rising year-on-year and month-on-month, and the average price of high-end Radeon graphics cards is also increasing.

Enterprise, embedded and semi-customized businesses achieved revenue of US $1.6 billion in the second quarter, up 183% year-on-year and 19% quarter-on-quarter. The growth was driven by the increase in EPYC processor revenue and semi-customized product sales.

The rising volume and price also brought about the outbreak of profitability. In the second quarter, AMD's net profit was US $710 million, a sharp increase of 352% year-on-year, and its net interest rate reached 18.4%.

Regarding the second quarter results, AMD CEO Su Zifeng said: "Our business performed exceptionally well in the second quarter, with revenue and operating profit margin doubling, and profitability (net profit under non-GAAP) more than tripling year-on-year. Due to the strong demand in all our businesses, our growth rate is obviously faster than the market. We now expect our annual revenue to increase by about 60pc year-on-year in 2021, driven by strong execution and customer preference for our leading products. "

Aggressive momentum brought by technology to the king!

AMD's revival is based on the iteration of technical strength, which is different from its competitor Intel's obsession with producing its own chips, while AMD outsources it to Taiwan Semiconductor Manufacturing.

By focusing on technology rather than production, AMD's products began to eat into Intel's market share.

'Generation after generation, we have to raise our technical standards, and if we do, we can keep increasing our share,' Mr. Su said in an interview.

Last year, the application of AMD products in the world's top 500 supercomputers increased fivefold year-on-year; Alphabet Cloud took the lead in adopting the third generation AMD EPYC processor, and its performance improved by 56%; Tesla Motors is using an AMD Ryzen embedded processor and an AMD RDNA 2-based GPU to power infotainment systems for the new Tesla Motors Model S and Model X cars …

According to passmark's data, AMD's market share in all CPUs reached 44.1% in the second quarter, while Intel's market share dropped from 82.5% at its peak to 55.8%.

【小于】 img src= "https://static.tigerbbs.com/d39b42c52aeab5e8c537adc3396fb656 "tg-width=" 688 "tg-height=" 382 ">

Unlike AMD, which focuses on improving its technical strength, Intel's new CEO announced that it would increase its chip foundry business after taking office. In March this year, Intel announced that it would spend 20 billion US dollars to build two chip factories in Arizona, USA. In July this year, it was reported that Intel was negotiating with Global Foundries, a professional chip manufacturer, for an acquisition amount of US $30 billion, which was split from AMD in 2008.

Different strategic choices may help AMD keep leading in technology. Su Zifeng said at the financial report meeting that even if the market demand for personal computers declines in 2022, AMD can still continue to grow. She predicted that the company's competition situation will be very good, and AMD needs to do better.

Advanced product technology not only brings about a sharp increase in revenue and net profit, but also makes AMD aggressive in the future, whether it is the cash in AMD's hands or the ongoing $4 billion repurchase plan.

The growth rate of performance in the third quarter will slow down!

For the third quarter results, AMD gave the following guidelines:

It is estimated that the revenue in the third quarter will be about 4.1 billion US dollars, with a fluctuation of 100 million US dollars, an increase of about 46% year-on-year and an increase of about 6% quarter-on-quarter.

Year-on-year revenue growth will be driven by all business growth, and it is expected that month-on-month growth will be mainly driven by data center and game business growth.

AMD expects non-GAAP gross profit margin to be about 48% in the third quarter.

Driven by strong growth across all businesses, AMD now expects full-year revenue growth of about 60pc in 2021, up from a previous forecast of 50pc. AMD now expects a non-GAAP gross profit margin of about 48% for the whole year of 2021, which is higher than the previous forecast of 47%.

AMD's high-speed growth momentum in the first half of the year cannot be maintained for a long time. Even if the growth rate of performance in the third quarter will slow down, it still exceeds market expectations.

In addition to the performance forecast, the market is also concerned about AMD's acquisition of Xilinx, which has been approved by British regulators and the European Union. At present, it is being approved by China, and AMD still expects to complete the acquisition by the end of this year.

Summary:

AMD's second-quarter financial report once again exceeded market expectations. Although the stock price performance was not hot enough, it still could not prevent AMD from revealing aggressive momentum in every financial data.

On the one hand, AMD's success is its own efforts; On the other hand, its competitor Intel sticks to chip manufacturing and insists on IDM mode, which hinders the application of advanced technology to a certain extent.

Looking ahead, AMD is expected to usher in a more brilliant moment under the leadership of Su Zifeng!$AMD (AMD) $$Intel (INTC) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- desjou·2021-07-29TOPIt's a good buy now14Report

- MengKeng·2021-07-30TOPI like his term "fight for every CPU slot", it also meant he will also fight for the company and the shares will rise10Report

- HzxS·2021-07-29TOP$Taiwan Semiconductor Manufacturing(TSM)$ same to TSMC ???10Report

- Huatheng·2021-07-30Pls like. Thanks7Report

- JayNayHayDay·2021-07-30To the moon! Like pls8Report

- Way88·2021-07-30不是他,CEO是她。AMD从100美元到120美元!1Report

- Gobbler·2021-07-29The moon is not far enough. Mars is the new target.2Report

- HYCTRADING·2021-08-04AMD has a very commited and strong management to continue to grow3Report

- Yslo·2021-07-30I think price still can go up further1Report

- SilverAmour·2021-07-30AMD looks promising to fly higher ??2Report

- Bodoh·2021-07-30What quality journalism2Report

- KayuHuat·2021-07-29To the Sun! Not to the moon2Report

- boonk·2021-07-29Reach 120 by aug3Report

- YauKC·2021-07-29yean. let's fly2Report

- SebbyBoy·2021-07-29So what’s a good entry peice?2Report

- Neelie78·2021-08-05Yes. But funny that this article refers the CEO as “Mr Su”. Isn’t the CEO Ms Lisa Su?LikeReport

- MengYang·2021-08-02gogo AmD1Report

- ZZX86·2021-08-01It sure do man!1Report

- Willretard8·2021-07-30What a “fight for every cpu slot”. Give you [Strong]LikeReport

- M3Mike·2021-07-30Chips demand super hot, many backlogs to clear, plus Cloud data centers growing super fast.LikeReport