Understand The P/E Ratio

The price-to-earnings ratio, or P/E ratio, helps you compare the price of a company's stock to the earnings the company generates. This comparison helps you understand whether markets are overvaluing or undervaluing a stock.

The P/E ratio is a key tool to help you compare the valuations of individual stocks or entire stock indexes, such as the S&P 500. In this article, we'll explore the P/E ratio in depth, learn how to calculate a P/E ratio, and understand how it can help you make sound investment decisions.

What Is the P/E Ratio?

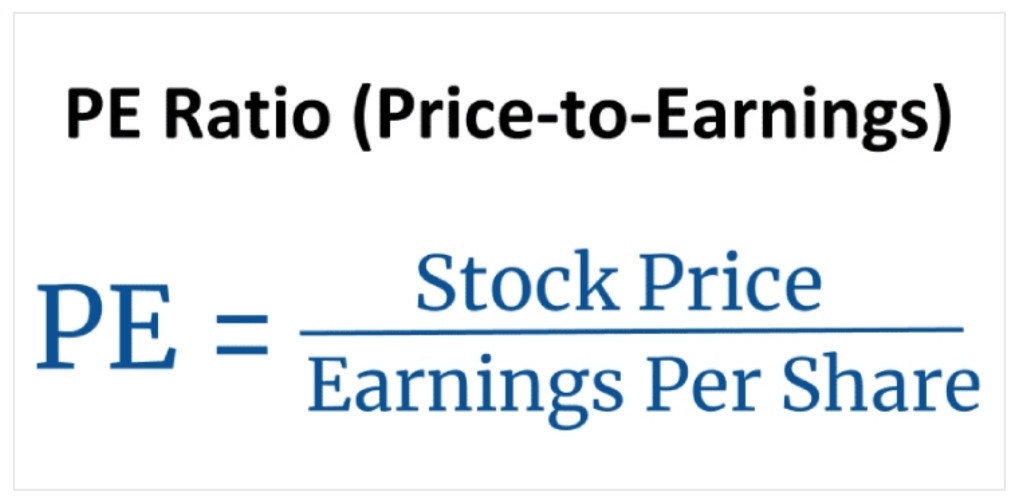

The P/E ratio is derived by dividing the price of a stock by the stock's earnings. Think of it this way: The market price of a stock tells you how much people are willing to pay to own the shares, but the P/E ratio tells you whether the price accurately reflects the company's earnings potential, or it's value over time.

If a company's stock is trading at $100 per share, for example, and the company generates $4 per share in annual earnings, the P/E ratio of the company's stock would be 25 (100 / 4). To put it another way, given the company's current earnings, it would take 25 years of accumulated earnings to equal the cost of the investment.

Generally speaking, a low PE ratio indicates that a stock is cheap, while a high ratio suggests that a stock is expensive.

However, the PE ratio can also indicate how much investors expect earnings to grow in the future. The higher the ratio, the better the growth prospects.

A simple way to think about the PE ratio is how much you are paying for one dollar of earnings per year. A ratio of 10 indicates that you are willing to pay $10 for $1 of earnings. It effectively gives you an "earnings yield" of 10%.

If earnings remain constant, a PE ratio of 10 means it will take ten years to earn back your initial investment.

The PE ratio is commonly used to value individual stocks, or even entire markets or industries. You can also use it to compare two or more stocks or markets against one another.

Key Takeaways:

1. The price-to-earnings (P/E) ratio relates a company's share price to its earnings per share.

2. A high P/E ratio could mean that a company's stock is overvalued, or else that investors are expecting high growth rates in the future.

3. Companies that have no earnings or that are losing money do not have a P/E ratio because there is nothing to put in the denominator.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- 咪咕蜡·2021-09-06我记得是不是还有个PB ,这两个有啥差别嘛1Report

- coldeye·2021-09-05Good, one of key tool to help you compare the valuations of individual stocks.2Report

- 山头的小猪·2021-09-06PE越低越好,越低就说明目前被低估,潜力很大1Report

- XD绿意盎然·2021-09-06其实就是一个简单的判断企业运营情况的标准,但不是唯一标准1Report

- 霎风雨·2021-09-06还有动态静态和未来之分,大家也可以关注一下1Report

- 王无所不知·2021-09-06小白学到了,咱之后还会分享啥,来个预告1Report

- 维克多1·2021-09-06太棒了,博主说的很清楚,我已经明白了1Report

- JL28168·2021-09-05Good sharing1Report

- DanielC·2021-09-25Good sharing1Report

- xifu·2021-09-06Cool2Report