24 August 2021: Chinese stocks development & Internationalisation of Renminbi RMB?

$老虎證券(TIGR)$ $富途控股(FUTU)$ $阿里巴巴(BABA)$ $騰訊控股(00700)$ $新東方(EDU)$

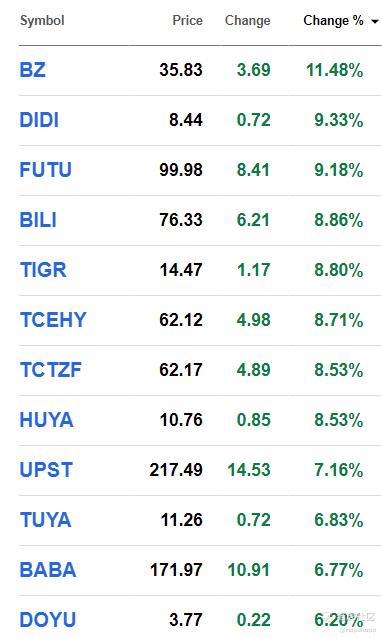

Since my writeup of "19 August 2021: Scenario analysis on Chinese Stocks" and "20 August 2021: Been adding in small volume even if Chinese market falls another 5%", chinese stocks listed in US have rebounded fiercely with Huya up almost 20% since its near term low of 8.8 USD (from what I remembered) and Bilibili by around 20% from 62.49 USD to around 76 USD.

"19 August 2021: Scenario Analysis on Chinese stocks. Time for me to go in to add small positions!"

https://www.laohu8.com/post/838871107

"20 August 2021: Been adding in small volume even if Chinese market falls another 5%"

https://www.laohu8.com/post/836041683

By the way, I still think it would be best to keep out of educational stocks like New Oriental, Gaotu, etc which is consistent with the view that I should stay out of stocks that are not consistent with policy direction. As for Alibaba (USD shares), it has also benefited from the rebound of Chinese stocks after it hit around 153.45 USD and is currently trading at 172 USD, which is only up 12% as of now.

For gaming and gaming streaming business like Huya and Douyu, it may still be subject to more news on policy intentions such as reducing game and streaming time for youth below 18 years old. If this is to happen, one still has to be careful though I do have an increasing position in Huya after gathering more Huya shares from 9 to 10 USD.

There have been more positive news these few days since last Friday and the tide may be smooth until another negative news, which the Chinese authorities have to be careful on how they manage the narrative to the market so that this is not perceived as drastic as that of the conversion of K12 education firms into not-for-profit firms.

There has been more news release like PBOC, Shanghai Branch is taking more initiatives in promoting the use of RMB for trade settlement involving commodities like crude oil, iron ore, grain and overseas contracting projects, etc. Will this move indicate that there is room or flexibility to allow the greater magnitude of exchange of RMB for overseas investment in equities. bonds, etc? This is what I had been thinking for the last few weeks and will patiently wait for this to take place should it happen. As for Tiger Brokers, it had moved from a low of 12.65 USD to around 14.5 USD now, which is still below the 20% mark gain from Huya's all-time low. Futu had rebounded by around 20% from 84 USD to around 101 USD as of the price now. Should my view be right on the RMB point, there is alot of room for imagination for Tiger Broker and Futu though Tiger Brokers has since moved beyond China and has emerged as a leading investment and trading platform in Asia.

As always, the above should not be construed as any investment or trading advice.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

worth to keep in long term