Everest Joins Race to Make mRNA Covid Vaccines for China

Key takeaways:

1、Everest will pay up to $150 million or more to potentially bring an mRNA vaccine being developed by Canada’s Providence Therapeutics to China

2、Deal comes as Beijing appears increasingly receptive to mRNA vaccines, even though Providence’s jabs have yet to be approved in its home Canada market

By Richard Barbarossa

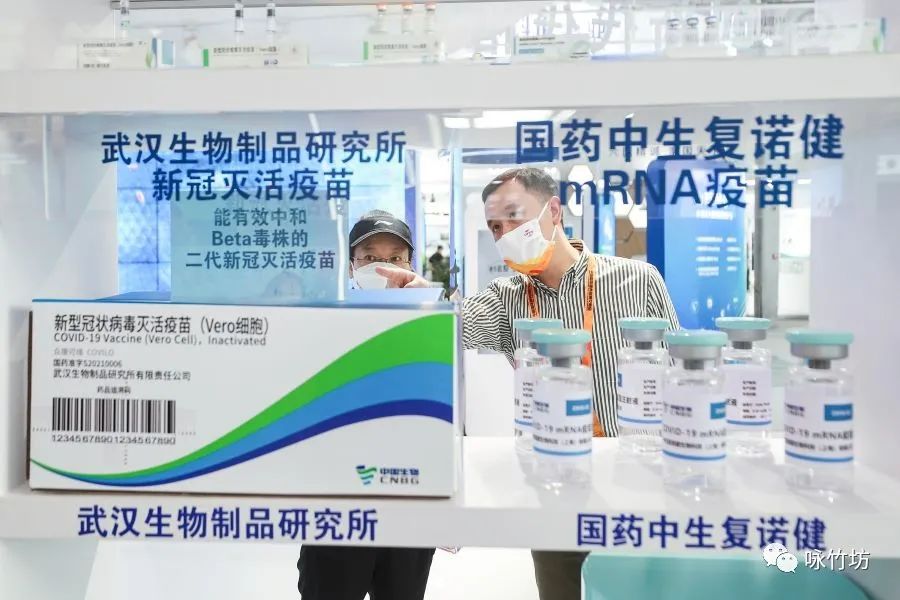

China may still be without a Covid-19 vaccine based on messenger RNA (mRNA) technology, generally considered the most effective for preventing infections. But many are racing to bring such vaccines to the country, even as the latest official data shows 1 billion Chinese have now been vaccinated using several homegrown shots based on older technologies.

That crowd gained another member last week when cancer and autoimmune disorder drug startup Everest Medicines Ltd. (1952.HK) announced aChinese distribution deal for an mRNA jab being developed by Canada’s Providence Therapeutics Holdings Inc.

Everest’s deal comes as China signals it may soon approve mRNA vaccines after relying on domestically-produced jabs based on inactivated virus up until now. It had previously resisted such a move, but may be reconsidering that position with the emergence of the more virulent Delta strain that is proving harder to combat with the older technology.

mRNA vaccines deliver genetic instructions that teach human cells how to make a spike protein that triggers an immune response, producing antibodies to fight the virus. That differs from traditional inactivated vaccines that elicit the immune response by injecting a weakened or dead form of the virus into people’s bodies.

One of the two most widely used mRNA Covid vaccines is made by a collaboration between Germany’s BioNTech and U.S. behemoth Pfizer, now known as Comirnaty; the other is Moderna Inc.’s SPIKEVAX. Comirnaty gained full approval for use in people 16 and older in the U.S. last month, underscoring the efficacy and safety of the vaccines, which have also been shown to be highly effective against the Delta variant.

In July China completed a review of Comirnaty, which will be produced and marketed in China by Fosun Pharma (2196.HK) working with BioNTech, Caixin reported. That vaccine will be used as a booster shot for people who have received inactivated-virus vaccines, the report said.

Perhaps with China’s growing acceptance of mRNA vaccines in mind, Shanghai-based Everest’s plan announced last week would see it make Providence’s Covid vaccine for sale on the Chinese mainland, and in Taiwan, Hong Kong, Macau and Singapore. The deal also includes Cambodia, Indonesia, Laos, Malaysia, Myanmar, Pakistan, Philippines, Thailand and Vietnam.

Everest will pay Providence $50 million in cash up-front and a maximum of $100 million in profit-sharing on eventual sales of the drug. Beyond that, the Canadian company would receive additional royalties in the “mid-to-high single-digit percentage of the aggregate net sales of vaccines” within a calendar year, according to the filing. The term of the agreement is 15 years.

Everest will also give Providence up to $300 million in new shares as part of a collaboration that could use the Canadian company’s mRNA technology in other products.

Of course, the deal hinges on Providence getting a Covid vaccine to market. But investors seemed to like the tie-up, even as Everest has yet to start generating revenue from any of the other drugs in its pipeline, as all await Chinese regulatory clearance. The company’s stock initially spiked by 6% after Everest announced the tie-up last week, though it has given back all those gains since then.

The company’s other drugs include Trodelvy (Sacituzumab govitecan), a breast cancer treatment owned by Gilead Sciences that is on sale in the U.S. and was granted a “priority review” by China’s National Medical Products Administration (NMPA) in May.

Volatile Shares

Since raising HK$3.5 billion ($450 million) in its Hong Kong IPO last October, Everest’s shares have traded in a broad range. At one point they almost doubled from their IPO price of HK$55 to a peak of HK$104.80 in February, before plunging as low as HK$45.20 at the end of last month. But according stock info site Simply Wall Street, its last close of HK$59.75 is just below what it deems to be fair value at HK$62.74.

Everest’s new Providence tie-up could help to commercialize any of three potential Covid vaccines now in the Canadian company’s pipeline.

The most advanced of those is PTX-Covid19-B, which began Phase 2 human clinical trials last month after demonstrating strong ability to neutralize the virus and produced a level of antibodies that compared favorably to those of other mRNA vaccines now in use. The other two are in the pre-clinical stages of development and are aimed at ensuring protection against future variants and offering long-term immunity.

While there is no forecast timeline for when Providence’s vaccines could be approved in Canada, regulators in Ottawa have issued orders to dramatically speed up the clinical trial and approval process for drugs combating the coronavirus.

In throwing its hat into the mRNA ring, Everest joins other Chinese companies like behemoth China National Pharmaceutical Group Corp. (1099.HK), commonly known as Sinopharm, as well as Suzhou Abogen Biosciences and Walvax Biotechnology Co. Ltd. (300142.SZ), which are working with the PLA Academy of Military Science.

Startup AIM Vaccine Co. Ltd., which filed for a Hong Kong listing earlier this month to fund its research, has one mRNA vaccine set to start pre-clinical trials in the second quarter of 2022, with final approval targeted for the fourth quarter of next year.

The upside profit potential for getting a Covid vaccine to market is huge. Moderna’s SPIKEVAX leapt to the third spot among the world’s top 10 vaccines by revenue in 2020, generating $3.8 billion, despite only being widely approved for use that same year, according to a report by China Insights Consultancy Ltd. cited in AIM’s listing documents.

Calgary-based Providence initially developed mRNA for oncological treatments, but has more recently turned its expertise to vaccines to prevent and limit the severity of coronavirus infections. Its Everest agreement is the latest in a flurry of deals this month that also includes ones with Northern RNA Inc., which will provide raw materials for the vaccine; and Emergent BioSolutions Inc. (EBS.US), which will mass produce the jab.

In June Providence also signed a deal to provide technology for India-based Biological E. Ltd. to manufacture mRNA vaccines in India, with a minimum production capacity of 600 million doses in 2022 and an eventual target capacity of 1 billion doses annually.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.