Prospects for 2022:a big correction maybe on it‘s way

A series of forward-looking posts will be launched in January to predict the important opportunities or risk points in the market next year, so that everyone can be prepared. First of all, of course, it is the stock market that everyone is most concerned about, so usually the first content is the stock market.

First, the understanding of fundamentals

Compared with the stock market in 2021, the stock market in 2022 is simpler. First of all, from the global fundamentals, Entering the third year of the epidemic in 2022, Take the Spanish pandemic as an example, The impact of this kind of great plague on the market is generally only three years, so from 2022, the epidemic can no longer be regarded as the core factor affecting the market, and the response of countries to the epidemic has gradually shifted towards influenza, so the negative impact of the epidemic on the current economy has become less and less, at least this is not the reason for the stock market to fall. (This is except for China. After all, China's non-group immunization route will have a great impact if it breaks out in an all-round way.)

At first glance, the bad news of global stock markets seems to have no other bad news except the Federal Reserve's interest rate hike and tightening monetary policy. In addition, it is difficult for the ruling party of the United States to offer tough austerity policies in response to the mid-term elections in 2022. Therefore, before the mid-term elections, I am afraid that the Fed's austerity measures will be much less than the market expects now. Therefore, before the mid-term elections, the global stock market may still be in the honeymoon period, and it is bearish. At present, there is really no fundamental reason.

Second, the time period factor

Although fundamentals can't find a reason to be bearish, let's look at technical factors. An effective way to capture the inflection point of the big market, the effect of cycle analysis is remarkable. There will be a resonance point in global stock markets in 2022, and the time coincidentally appears after October.

Around 2000, China joined the WTO, and the global trade economy was highly integrated and divided, which greatly strengthened the linkage of global stock markets. To put it simply, if there were problems in Sino-US economies, enterprises in other countries in the world would also be implicated, thus making it easier for stock market cycles in various countries to form resonance points.

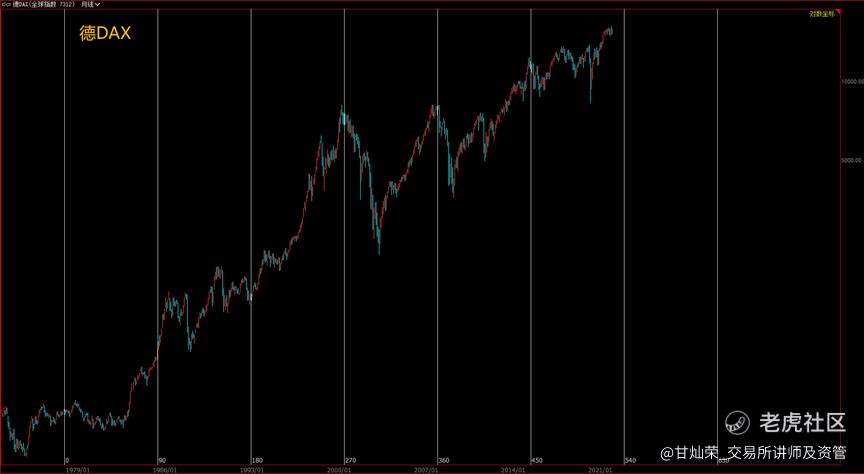

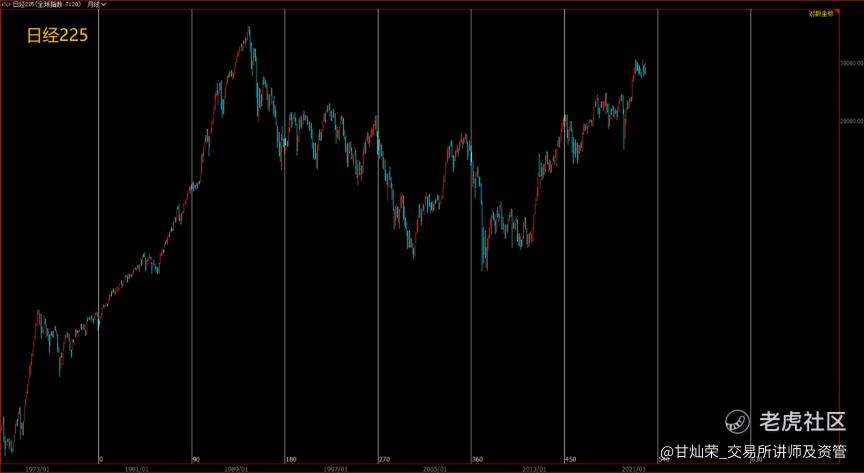

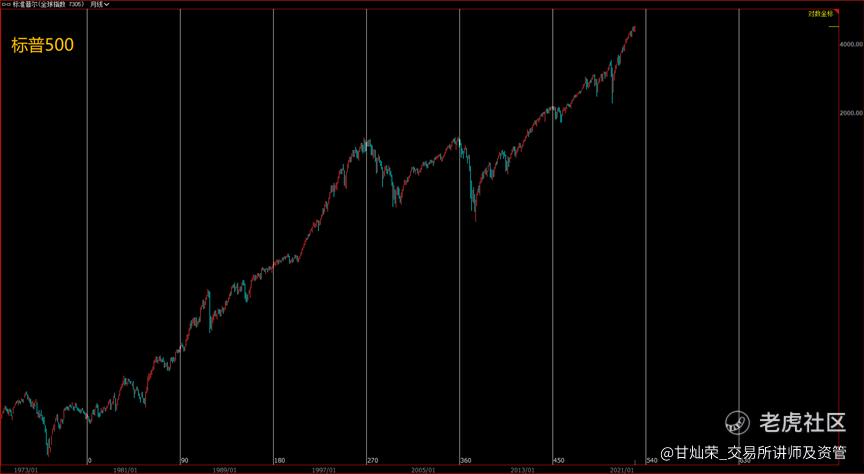

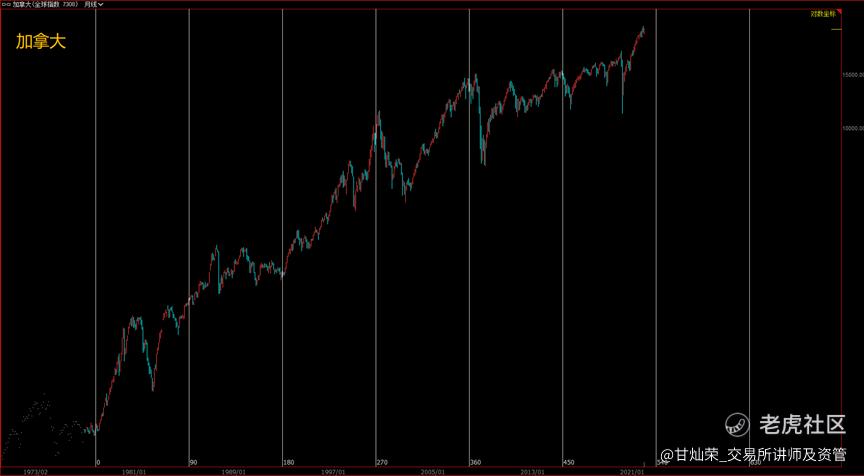

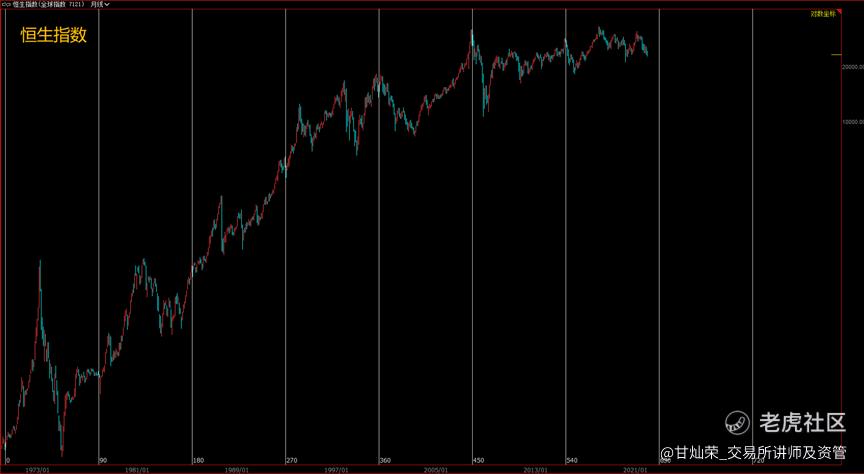

Let's take the United States as an example. The Internet bubble in 2000 and the financial crisis in 2008 all caused deep adjustment in global stock markets, and the interval between these two crises is about 90 months. Let's take this interval to see the performance of global stock markets.

It can be seen from S&P that since 1978, when US stocks entered the long bull market, there has been an important time point every 90 months, which was almost a low point before 2000 and a high point after 2000. At these time points, there are major events. In 1978, China reformed and opened up and China and the United States established diplomatic relations; In 1985, the United States became a debtor country for the first time, and the United States and Japan signed the Plaza Agreement; In 1992, the Soviet Union disintegrated. Looking back at these times, every major event is of great benefit to the economic development of the United States. The reform and opening up of China, the most populous country in the world in 1978, brought a new engine to the global economy. In 1985, the United States established the strategic practice of issuing bonds internally, printing money and harvesting externally. Within a few years, it forced the appreciation of the yen to puncture the economic bubble of the second largest economy at that time. In 1992, the disintegration of the Soviet Union further established the position of the United States as the global hegemon. Therefore, the time before 2000 is an inflection point that is good for the United States.

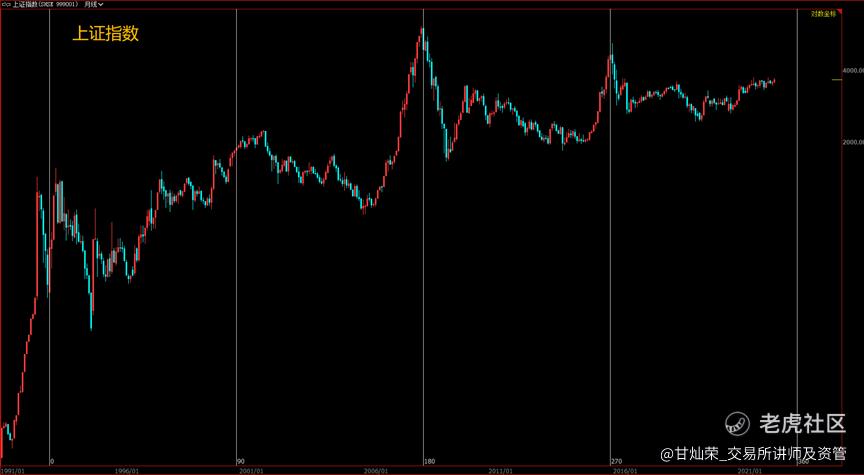

After 2000, the Internet bubble; The 2008 financial crisis; Events such as China's stock market crash in 2015, which led to the decline of global stock markets, are all bad news for the stock market. The next time point will appear around October 2022. What kind of news will lead the world and cause resonance? It is unpredictable at present, but we should pay great attention to the time. (Here's how other stock markets reacted at that point.)

3. Resonance between RMB exchange rate and A-share time point?

Relationship between the change of people's exchange rate and the inflection point of A sharesClose, it is difficult to explain whether the exchange rate affects the stock market or the stock market affects the exchange rate, but for emerging markets (at least from the perspective of real foreign investment, A shares are still emerging markets), exchange rate depreciation often corresponds to stock market decline. The RMB exchange rate has cyclical characteristics for 17 months after the gradual market-oriented reform, and the next node will appear in October 2022. In view of the fact that the RMB has been in the appreciation stage before, does it mean that

Is it possible that RMB will enter the depreciation stage? If so, is there another evidence that A shares may fall at that time?

The inflection point of time period is usually associated with an important event. The derivation based on historical time is only to pay more attention to events and improve vigilance and risk awareness, so as to better deploy trading strategies. Generally speaking, October 2022 is an important time, and investors should be on high alert.

$NQ100指数主连 2203(NQmain)$ $黄金主连 2202(GCmain)$ $WTI原油主连 2202(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Worth reading 👍🏻

Great ariticle, would you like to share it?

God is good