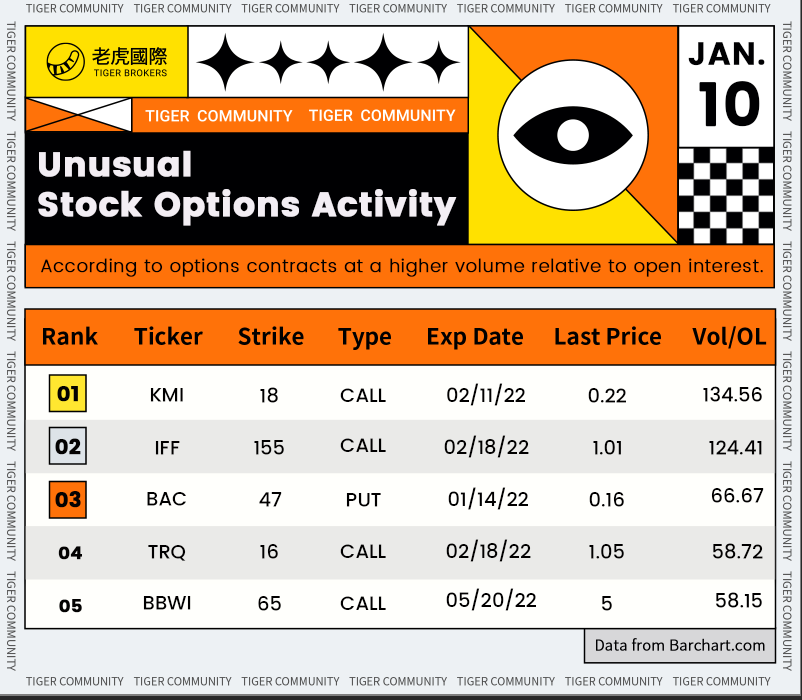

1.10 Unusual Options:Bank stocks continued to rise

On Friday, the Nasdaq index pulled back again, falling nearly 1%. There are a series of important data to be released this week, including Powell's hearing on Tuesday Beijing time, and the US CPI for December to be released on Wednesday. Market analysts believe that the US CPI in December will likely break 7%.Meanwhile, the fourth-quarter earnings season kicks off this week, with banks leading the pack, including TSMC.Markets are likely to remain volatile this week.

$Kinder Morgan (KMI)$shares recently along the Brin line track continued to pull up, continue to be bullish.Energy stocks continued to rise in recent days, helped by higher crude oil prices.The strike option expires Feb. 11 at a premium of about 6 percent.$KMI 20220211 CALL at $18.0

$IFF $stock price is currently in platform shock, after three consecutive days of decline, the stock price has reached the bottom of the range shock, If the Brin line track can form effective support, the stock price is expected to rebound upward.There is still no obvious direction for the share price.The strike option expires Feb. 18 at a 10% premium.$IFF 20220218 CALL at $155.0

Bank of America (BAC) shares have continued to rise in recent days, hitting a record high on Friday, and are expected to continue to rise as interest rate hike expectations continue to fervour and 10-year Treasury rates continue to rise.The strike option expires next Friday at a premium of about 5%.$BAC 47.0 PUT$20220114

Turquoise Hill Resources(TRQ)$Turquoise Hill Resources(TRQ)$Turquoise Hill Resources(TRQ)$Turquoise Hill Resources(TRQ)$Turquoise Hill Resources(TRQ)The strike option expires Feb. 18 at a premium of about 11 percent.$TRQ 20220218 CALL at $16.0

$Bath & Body Works Inc.(BBWI)$Shares have fallen continuously in recent days and are trading near a six-month low.The weekly line has fallen to the Bollinger line and is now in a downtrend. The monthly line is about to return to the middle of the Bollinger line.The strike option expires May 20 at a premium of about 17%.$BBWI 20220520 CALL at $65.0

OptionsTutor is an official account with basic and easy understand options strategies! Please Check his main page! If you have any options questions, please @OptionsTutor!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

UP FROM HERE