Weekly Recap: Stocks Pulled Back, New Earnings Season Ready to Roll

The major U.S. indexes gave back some of the gains they recorded in March, as stocks pulled back after a strong start to the week.

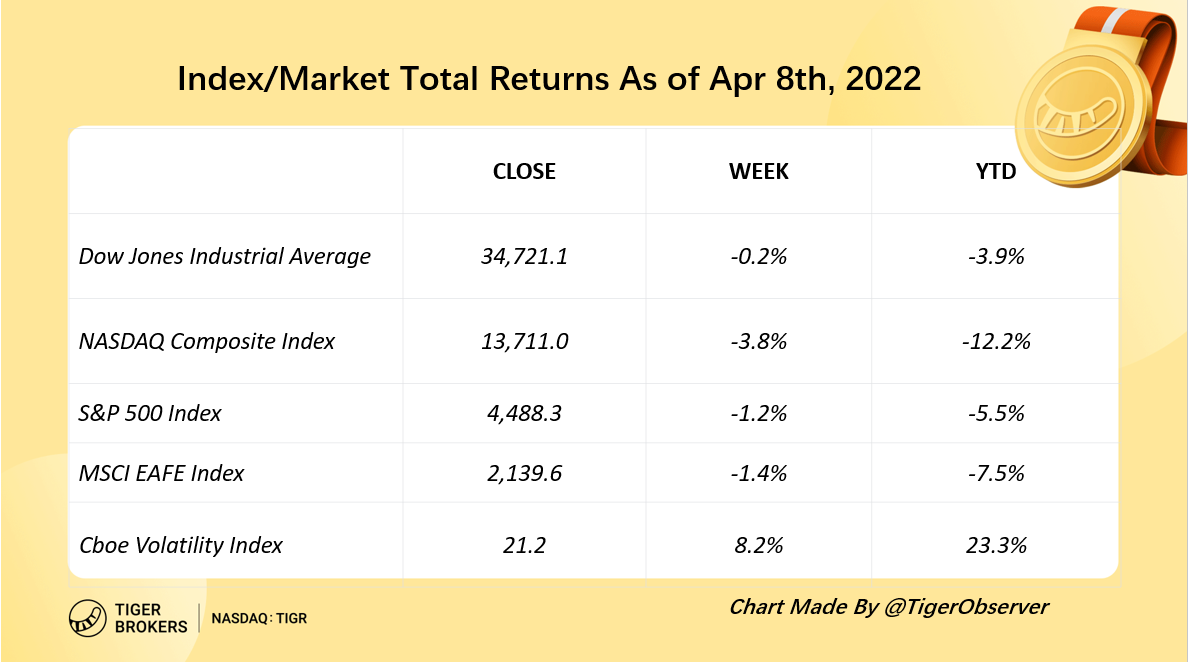

On a total-return basis, the $S&P 500(.SPX)$ fell about 1.2%, the $DJIA(.DJI)$ slipped 0.2%, and the $NASDAQ(.IXIC)$ dropped 3.8%.

The NASDAQ extended its run of year-to-date underperformance relative to the other major U.S. indexes, as it fell by nearly 4% for the week. With its heavy weighting in technology stocks, the NASDAQ has recently come under pressure in an environment of rising interest rates.

Weekly Index Returns From Last Week:

Other Markets:

Oil Pullback: U.S. crude oil prices fell for the second week in a row, slipping below the $100-per-barrel level on Tuesday and ending the week around $98. Despite the recent pullback, the price remained about 30% above its level at the end of 2021.

Macro Data Perspective:

Fed Outlook: Last Wednesday’s release of minutes from the Fed’s mid-March meeting showed that policymakers discussed the possibility of raising the Fed’s benchmark interest rate by a half-percentage point at a meeting.

Earnings Slowdown: As of Friday, analysts surveyed by FactSet were expecting companies in the S&P 500 to post earnings increases averaging 4.5% compared with the same period a year earlier. If the growth rate ends up close to that figure, it would mark the first time in two years that quarterly earnings growth fell short of 10%.

Fleeting Inversion:The yield of the 10-year U.S. Treasury bond rose on Friday for the sixth consecutive trading session, climbing to 2.71%—the highest in three years.

Tight labor market: With the U.S. unemployment rate at just 3.6%, initial applications for unemployment benefits are also dropping to unusually low levels.

Inflation checkup: A Consumer Price Index report scheduled to be released on Tuesday will show whether the U.S. economy got any relief in March from surging inflation. A month earlier, the government reported that inflation accelerated in February at a 7.9% annual rate—the highest in four decades—eclipsing the previous month’s 7.5% figure.

S&P 500 11 Sectors Performances:

Source From finviz.com

Last Week, The Healthcare, Consumer Defensive, and Energy sectors are the top three gainers with 2.64%, 2.01%, and 1.98% increases respectively. Technology, Consumer Cyclical, Communication Services became the biggest loser of industries last week.

Inside the Healthcare sector, $Lyra Therapeutics(LYRA)$ , $Avenue Therapeutics Inc.(ATXI)$ ,$Biofrontera Inc(BFRI)$ , $Reviva Pharmaceuticals Holdings, Inc.(RVPH)$ ,$Purple Innovation Inc.(PRPL)$ are winners which belong to the Pharmacy industry.

The Top 10 stocks of S&P 500 By 5-D % change are: $Twitter(TWTR)$ (+17.6%), $Mosaic(MOS)$ (+12.11%), $AutoZone(AZO)$ (+10.94%), $Target(TGT)$ (+10.83%), $O'Reilly(ORLY)$ (+10.64%), $Advance Auto Parts(AAP)$ (+8.8%), $Dollar General(DG)$ (+8.62%), $HP Inc(HPQ)$ (+8.51%), $CF Industries Holdings Inc(CF)$ (+8.44%), $Lamb Weston Holdings, Inc.(LW)$(+8.38%)

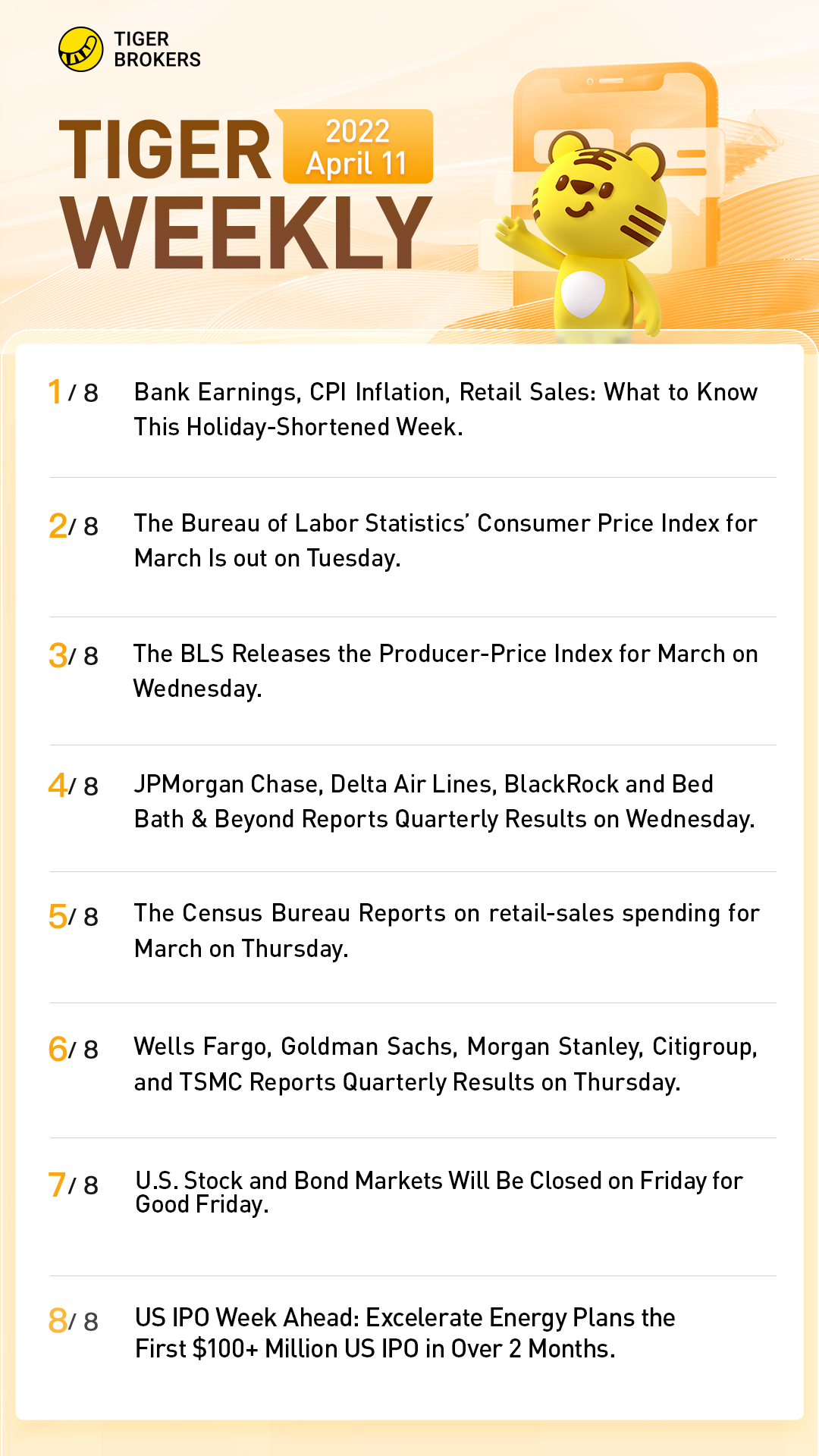

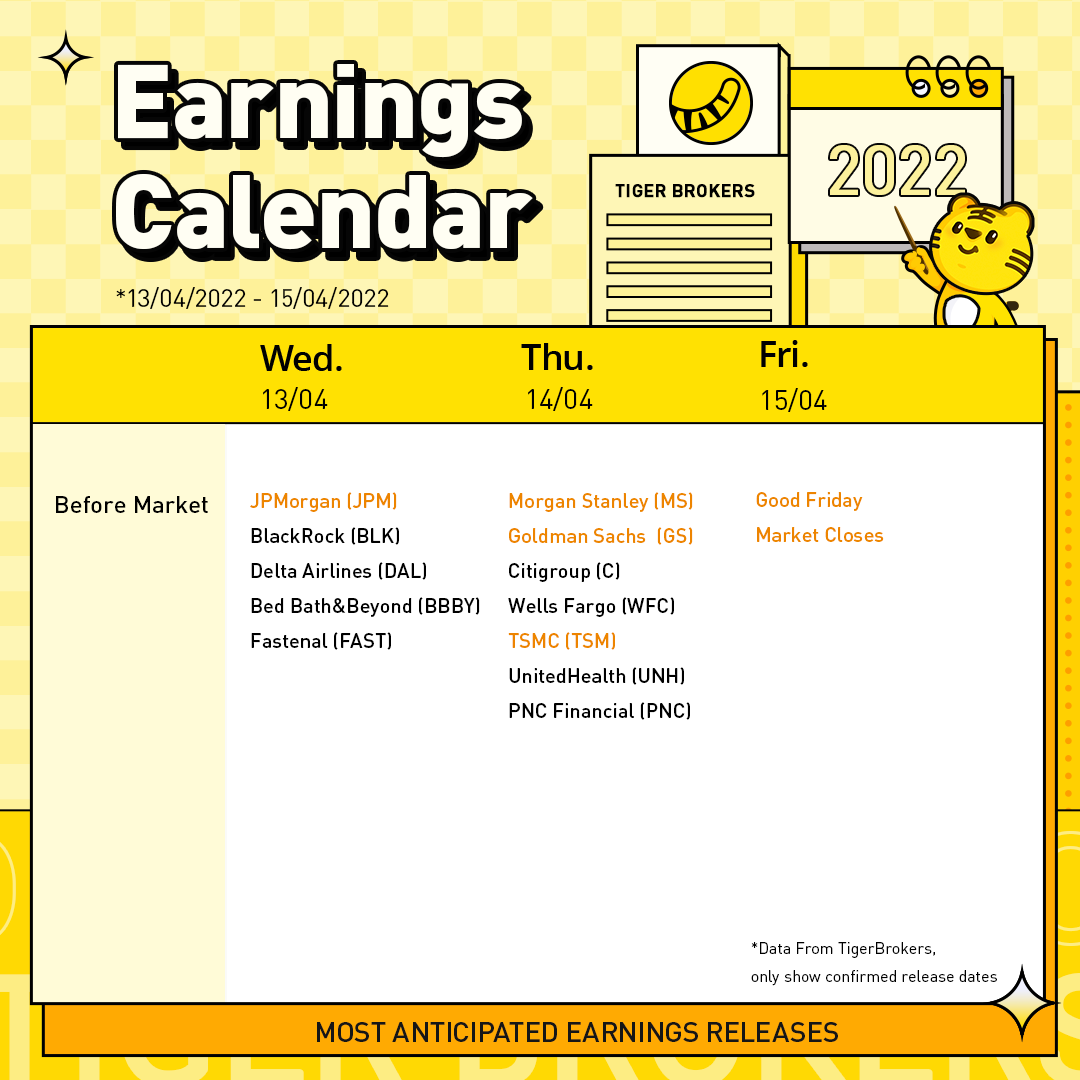

The week ahead: April 11-15

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- pheywei·2022-04-12[smile] [smile]2Report

- DLIM·2022-04-12Thanks for these updatesLikeReport

- erickson·2022-04-12Great ariticle, would you like to share it?LikeReport

- BigStonkz·2022-04-16wowLikeReport

- Lyra83·2022-04-14OkLikeReport

- Zambuk·2022-04-13.LikeReport

- Ghossstsam·2022-04-12Wow1Report

- Stevalv·2022-04-12Latest2Report

- EKTG·2022-04-12wowoLikeReport

- AricLo·2022-04-12thanksLikeReport

- Raymond1986·2022-04-12Good 👍2Report

- losty·2022-04-12like2Report

- 734078af·2022-04-12good1Report

- Cklvin·2022-04-12Good info2Report

- GeorgeOr·2022-04-12niceLikeReport

- Yishunfyuhvb·2022-04-11OhLikeReport

- 方进新9·2022-04-15CoolLikeReport

- Bobopo·2022-04-12Yes2Report

- 期权之虎·2022-04-126662Report

- Joseph80·2022-04-12Nice1Report