Sharp Reversal in USD, Bonds & Stocks: Is US Really a Safe Haven?

It turns out that ever since the financial crisis time and again anytime there is financial turmoil anywhere in the world including in the US itself money tends to come to the US in search of a safe haven.

The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global Finance in 2014

US is the ultimate safe haven for your money. It’s largely insulated from the Russia-Ukraine war fallout.

Blackstone’s Joe Zidle says in 2022

It looks like after 8 years, the world is still trapped in the "dollar trap" and US remains to be the top safe haven.

What kinds of Safe Assets can we buy?

Safe Asset includes: 1) Currency: the US Dollar, the Japanese Yen, and the Euro; 2) Treasuries issued by advanced economies, especially the US Treasuries; 3) Metals like gold and silver; 4) Volatility Index like VIX.

This article will discuss the trends of the US dollar index, the yen, and the euro index.

- To learn more about other safe assets, you can read

Treasuries: US10Y topping 2%? Here Are Three Treasury-related ETFs to buy

Metals: Gold Prices Top $1900, But Still Bullish?

VIX: How to use VIX & SQQQ to Profit From a Down Market

The strong economic power and global influence make the US dollar and US Treasuries become safe assets.

Meanwhile, the dollar along with the Japanese yen also soared. The dollar index once increased to 97.74(up 1.6%), a new high since June 2020, but it fell to 96.90 today as U.S. tech stocks go up.

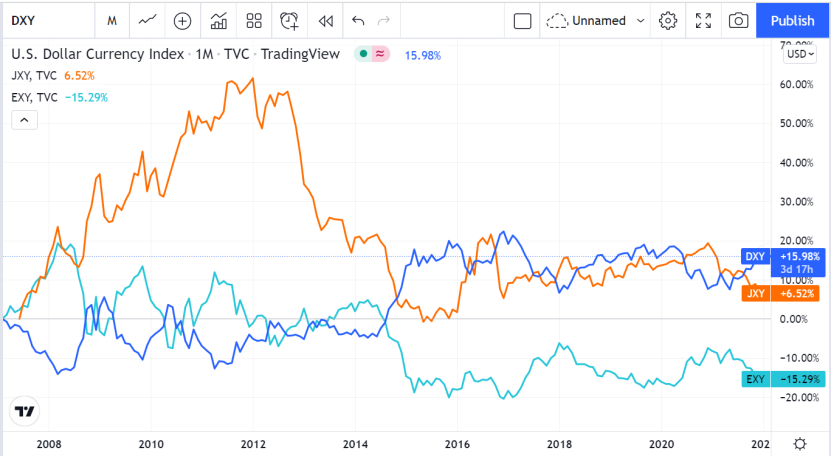

From the chart above, We can tell that the US Dollar Index rose sharply after the event broke out; the Japanese yen also went up; but the euro fell sharply because of the impact from the event as well as its long history of weak movement compared to the dollar and yen.

This chart shows the Dollar-Yen-Euro Trend in the past 15 years.

In general, the dollar and yen have been strong. During the financial crisis in2008, the yen became a top safe-haven option because the crisis was in the US.

Looking at the recent trends, when the US monetary policy turns eagle, the yen climb higher than the dollar. Otherwise, in most cases, people are generally in favor of the dollar, which causes the yen and other currencies to fall accordingly.

Conclusion

From the data analysis, dollar still looks stronger than other currencies. But some people may argue the yen or the Swiss Franc are better than the US dollar because dollar asset is not safe in the long term.

SHARE YOUR VIEWS

Do you think US is the safe haven?

Which kind of safe asset will you buy?

What’s your advice on buying safe asset?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- RKT·2022-02-28US is still the place to invest considering best companies are still there. And, they grow. However, the geo-political issues combined with weaker leadership is a concern in short to mid term😒1Report

- Pris07·2022-02-28Thank you for the analysis! As US remains the world’s strongest economy, I would reckon that US dollars is currently a safe haven asset to hold. But definitely would need to diversify as always.3Report

- Padres·2022-02-28$UUP is safe haven but the real alpha will be generated in US treasuries when things really start going south.1Report

- ZenInv·2022-03-03Hopefully they dont continue to grow their debt indisc riminately1Report

- 叫我發先生·2022-02-28Huathuat, pls givee me a like2Report

- WH the great·2022-02-28没有一个市场是安全的,但我们用有效的理论进行交易1Report

- GOKUst·2022-03-03Tks for good info2Report

- The Steady Investor_TSI·2022-03-03the only safe heaven, is $ umder your pillow1Report

- halohalo·2022-02-28dunno what stock should buy1Report

- Mericula·2022-02-28please like1Report

- YadaYada·2022-02-28ready for the rollercoaster1Report

- tigertitus·2022-02-28ok very good to know1Report

- kellyWin·2022-02-28thanks for sharing2Report

- Joppee·2022-02-28USD still ok to keep1Report

- Michelle Ong·2022-02-28Like back thanks1Report

- Prosperous40·2022-02-28Ok ,thank you for sharing1Report

- K734·2022-02-28Thanks for sharing1Report

- DeepSea·2022-02-28US create crisis to shore up their currency1Report

- ccy1122·2022-02-28[Thinking] [Thinking] [Thinking]1Report

- Winson Lee·2022-02-28please like1Report