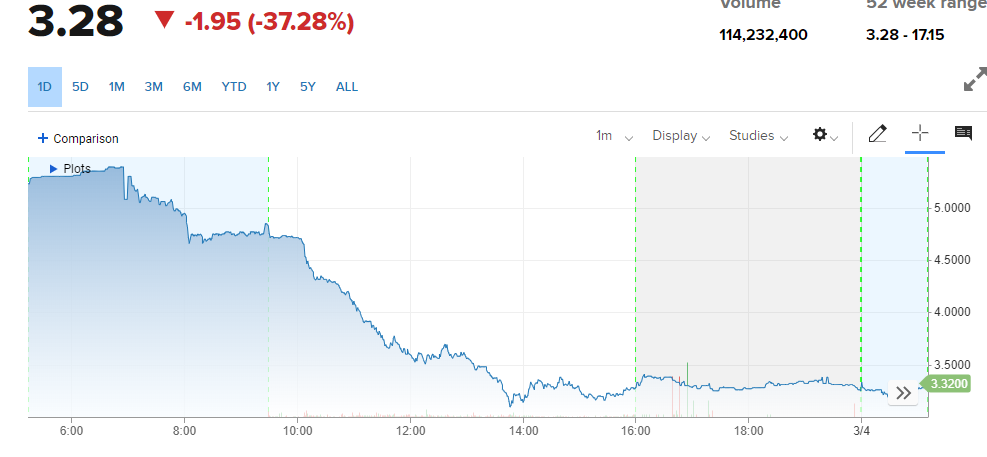

Super APP Grab Plunged 37%, Is it Time to Buy the Dip?

$Grab Holdings(GRAB)$ plunged nearly 40% in a single day, the biggest drop since IPO.How much the market hates losses?

This earnings season can be said to be a nightmare for growth stocks. As long as the earnings report misses expectations, or the loss is enlarged, or there is no clear profit guide, then it will drop 20% at least.

What's even more frightening is that, like Grab, it fell by nearly 40% in a day. This oversold didn't even have any decent counter-pumping before the close.

Just one thing, the downtrend is likely to continue for a long time without any clear signal reversal...

We cleared Grab's financial report, and there are two main mine points:

1) Due to Grab's large expenditure on driver incentives, Q4GMV increased by 26% year-on-year to 4.5 billion US dollars, but its revenue decreased by 44% year-on-year to 122 million US dollars;

2) The net loss nearly doubled, with a single-quarter loss of $1.1 billion, significantly higher than the average analyst forecast of $645 million.

We know that Grab is a super APP in Southeast Asia, covering many businesses such as Mobility, Delivery and payment. At present, Grab is at a very awkward time node, and multi-line operations make Grab lose sight of one thing and the other.

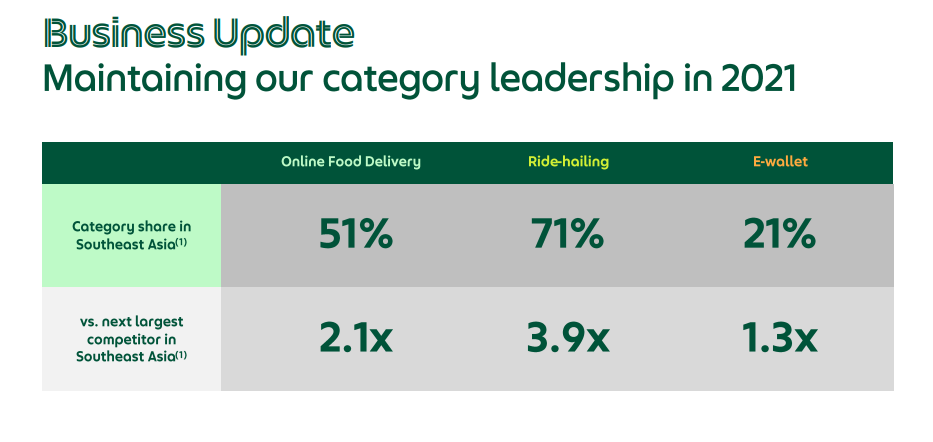

First of all, the Mobility, which accounts for more than 80% of the total revenue, is struggling to recover. As we know, Grab started with Mobility. As all localities have not been completely unsealed, the travel demand is still slowly recovering. Q4GMV has decreased by 14% compared with the same period in 2021, while the revenue has decreased by 37%, indicating that the company has increased incentives for drivers, which is a necessary measure to ensure the steady recovery of travel business and leading market share.

As a result, Grab's Mobility market share reached 71% in the fourth quarter, nearly four times that of the second. However, there is not much room for adjustment in the 23% commission rate, and Grab may face the choice between guaranteeing market share or income (commission) in the future.

Second, Delivery revenue dropped by 98% to $1 million, which is almost all the income used for incentives. At present, the market share of Delivery exceeds 50%, followed by about 21%. With greater deregulation in various places, the pressure on Delivery business will only increase. The management expects that by the first half of next year, the adjusted EBITDA of the food delivery department will break even, which is actually not small.

Southeast Asia used to be a Blue Ocean, but now it is more like the Red Ocean. The leading enterprises in various fields have basically got money when the stock price is at a high level, and the book cash is abundant. As a result, the competition will only become more intense.

The current valuation is also very unfavorable to Grab. The company expects GMV growth from the second quarter to the fourth quarter of 2022 to increase by 30% to 35% year-on-year. Under this growth rate, even if the revenue can double in 2022, the market value of Grab is only 6-8 billion US dollars, and there is still 40% room to decline.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Asphen·2022-03-05bear flag consolidation, fail to break fib, and price will break down to 1.60+ and possibly soften more if no reversal candles appear.7Report

- Joel Chua Hiang Yang·2022-03-05The dip doesnt make the investment any more atteactive. It has a negative book value. Unless there is a clear path to profitbability and stupendous growth levels, this company is high risk4Report

- Assassin85·2022-03-06I have deleted grab app for thier poor service. There was a dispute between me and the rider, grab customer service just ask me to settle the dispute between me and the rider myself. Will never invest2Report

- Et1502·2022-03-06$GRAB$, the potential upside is more than the downside. Wouldn’t this be a smart BUY for short-mid term investors OR long term investors for Grab’s growth potentials….2Report

- BLsince2020·2022-03-08Timing couldn't be worst for Grab as Gojek is coming in to take it ride hailing service away. Last weekend, Grab do not have car after waiting 10min, I download Gojek and the car came instantly. Luck?1Report

- Yckit2000·2022-03-06There is still a lot of uncertainty especially if the revenue is decreasing although we do know it is a loss making company for now2Report

- Richard0208·2022-03-05This is a gone case. Company strategy getting mess as too young to manage the expansion and funds4Report

- Tamashii·2022-03-05grab share is something i look forward is a good share but it also facing challenges via their rivals!3Report

- oddox·2022-03-08i'm a newbie investor and truly curious, what make people want to buy stock of a company that is yet to make a profit? please enlighten me thanks1Report

- huathuathuat·2022-03-08Curious and want to hear from you what makes you think this is a dip and it will go back up?LikeReport

- KDL·2022-03-07Look at it beyond a cab-alternative company and what data they are collecting.2Report

- GimaGO·2022-03-07Wait for it to become $2 stock.LikeReport

- GoESg·2022-03-05It is not a good stock to invest in from the beginning. Listing was just an exit strategy for its pioneer investors.1Report

- Guavaxf3006·2022-03-05This was always a far dream. Going against a sea of incumbents who have already captured prized grounds.1Report

- Jademiner·2022-03-05I myse is a frequent user to it, it will rise up graduall as pandemic eased and tourism booming eventually!1Report

- Loolala·2022-03-08Grab is a done deal. The only way for them to go up is another pandemic.1Report

- copycat·2022-03-08increase revenue but their lost widening. not buying it.2Report

- kimmy1234go·2022-03-07Will it be able to be profitable within next 2 years?1Report

- traveleat123·2022-03-07到月球pls2Report

- Ronchan·2022-03-07我需要更多的数量来从规模经济中受益…现在成本比收入太高了…如果我买它是为了撑船1Report