Berkshire Made A Profit Of 3,641,613% In 57 Years

Hello everyone,

I hope everything is all right. On February 26, 2022, Berkshire announced its 2021 annual earnings results. However, Many people don't want to buy this shares, perhaps because its price is too high; While $伯克希尔(BRK.A)$ is currently trading at the highest price in the market, at $479,345 per share; Even Shares of $伯克希尔B(BRK.B)$, trading at more than $319, are out of reach for many people;

Or because its volatility is low, the annual increase is small so that more people choose to wait and see.But for whatever reason, Berkshire Hathaway is also a benchmark in the stockmarket right now, as evidenced by the company's moves and Warren Buffett's letters each earnings season.

Let's take a look at what clues can be found in the 143-page of Berkshire Hathaway annual report.

After I had sent Q3 2021 of Berkshire's earnings analysis, including some of Berkshire Hathaway history, and the story of the young age of Buffett that he had impulse, is the longest I wrote articles - if you are interested in can refer to: 2021Q3伯克希尔财报分析 | 加码权益法投资并敬畏市场!(https://www.laohu8.com/post/879832620)

There will be no recap again today, and if you want to learn more about Warren Buffett, you can read The book 《Snowball》, the only authorized biography of Warren Buffett.

In my last post, I predicted Berkshire Hathaway's stock price for 2021Q4-2022Q1:

- BRKA target price: $430,000 - $480,000

- BRKB Target price: $288 to $310

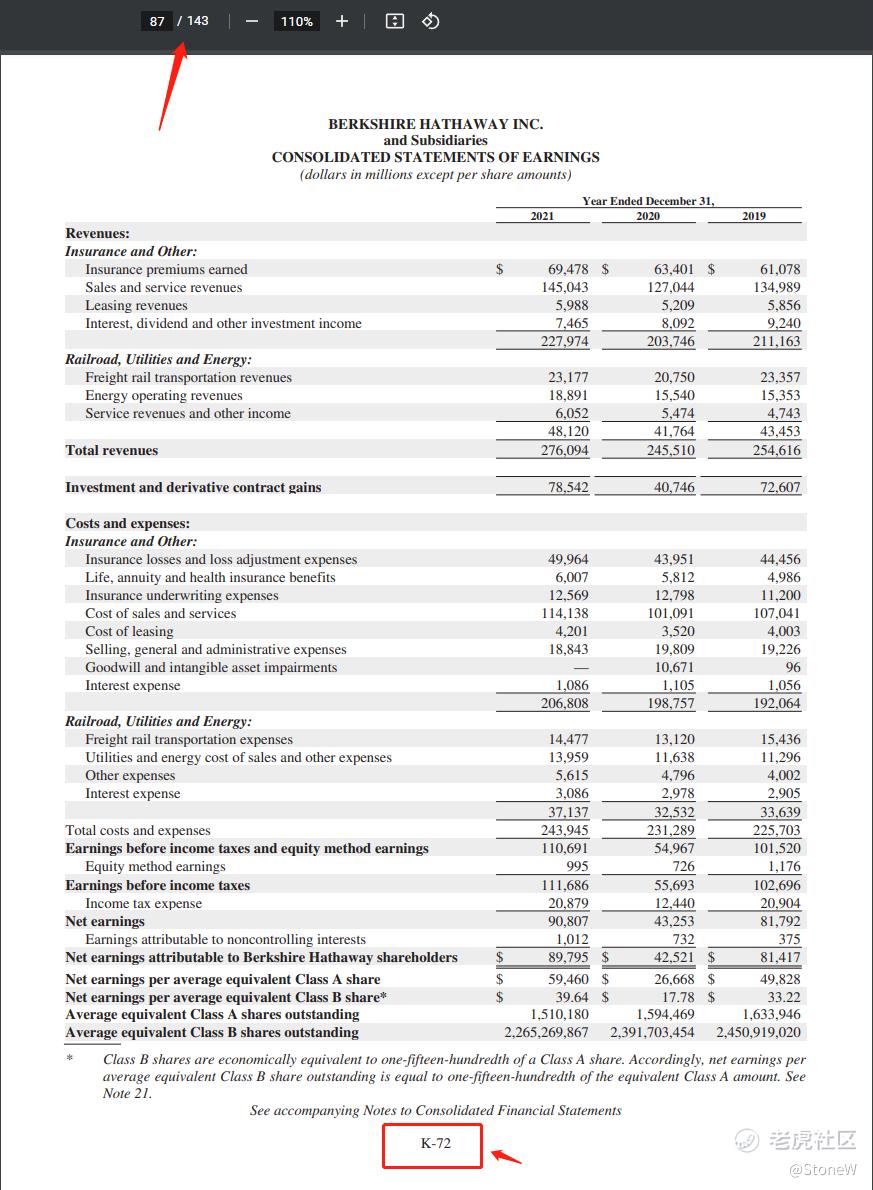

Key Point Of Anual Report

After comparison, I found that the data in Berkshire Hathaway's 2021 annual report is may different from some news data. Please keep your eyes open and do not be fooled by fake news and data.I have to say, in the age of information explosion, speed is king, accuracy is second! The following figures are in Berkshire's annual report K-72, page 87;Cash flow is in K-74, page 89.

- In 2021, Berkshire Hathaway (hereinafter referred to as the Company) reported annual revenue of USD276.094 billion, up 12.46% from 2020

- The net earnings in 2021 of UDS90.807 billion, 209.9% higher than the net earnings in 2020

- The net earnings attributable to Berkshire Hathaway shareholders in 2021 of $89.795 billion, which is 211% higher than the net income in 2020

- In 2021, the revenue of insurance business and other business is USD227.974 billion, among which sales and service revenue accounted for USD145.043 billion

- Rail, utilities and energy revenue in 2021 of USD48.12 billion.

- Cash and cash equivalents and restricted cash of USD$88.706 billion as of December 31, 2021

- Berkshire’s balance sheet includes $144 billion of cash and cash equivalents (excluding the holdings of BNSF and BHE). Of this sum, $120 billion is held in U.S. Treasury bills, all maturing in less than a year.

But $144 billion?

Buffett has this to say about why he holds so much cash and cash equivalents:

Charlie and I have pledged that Berkshire (along with our subsidiaries other than BNSF and BHE) will always hold more than $30 billion of cash and equivalents. We want your company to be financially impregnable and never dependent on the kindness of strangers (or even that of friends). Both of us like to sleep soundly, and we want our creditors, insurance claimants and you to do so as well.

That imposing sum, I assure you, is not some deranged expression of patriotism. Nor have Charlie and I lost our overwhelming preference for business ownership. Indeed, I first manifested my enthusiasm for that 80 years ago, on March 11, 1942, when I purchased three shares of Cities Services preferred stock. Their cost was $114.75 and required all of my savings. (The Dow Jones Industrial Average that day closed at 99, a fact that should scream to you: Never bet against America.)

Charlie and I have endured similar cash-heavy positions from time to time in the past. These periods are never pleasant; they are also never permanent. And, fortunately, we have had a mildly attractive alternative during 2020 and 2021 for deploying capital. Read on.

Share repurchases

Excerpt from Berkshire's 2021 annual report, about Warren Buffett's view on stock buybacks, because there was no company in the stockmarket that interested him, and there is no target worthy of long-term investment, so He chooses buybacks/share repurchses, because there was no better investment target than Berkshire.

So he chose investing in Berkshire again (Berkshire's businesses actually come together like Russian dolls, as Mr Buffett's biography notes).The following is very high-depth and highly recommended:

There are three ways that we can increase the value of your investment. The first is always front and center in our minds: Increase the long-term earning power of Berkshire’s controlled businesses through internal growth or by making acquisitions. Today, internal opportunities deliver far better returns than acquisitions. The size of those opportunities, however, is small compared to Berkshire’s resources

Our second choice is to buy non-controlling part-interests in the many good or great businesses that are publicly traded. From time to time, such possibilities are both numerous and blatantly attractive. Today, though, we find little that excites us.

That’s largely because of a truism: Long-term interest rates that are low push the prices of all productive investments upward, whether these are stocks, apartments, farms, oil wells, whatever. Other factors influence valuations as well, but interest rates will always be important.

Our final path to value creation is to repurchase Berkshire shares. Through that simple act, we increase your share of the many controlled and non-controlled businesses Berkshire owns. When the price/value equation is right, this path is the easiest and most certain way for us to increase your wealth. (Alongside the accretion of value to continuing shareholders, a couple of other parties gain: Repurchases are modestly beneficial to the seller of the repurchased shares and to society as well.)

Periodically, as alternative paths become unattractive, repurchases make good sense for Berkshire’s owners. During the past two years, we therefore repurchased 9% of the shares that were outstanding at yearend 2019 for a total cost of $51.7 billion. That expenditure left our continuing shareholders owning about 10% more of all Berkshire businesses, whether these are wholly-owned (such as BNSF and GEICO) or partly-owned (such as Coca-Cola and Moody’s).

I want to underscore that for Berkshire repurchases to make sense, our shares must offer appropriate value. We don’t want to overpay for the shares of other companies, and it would be value-destroying if we were to overpay when we are buying Berkshire. As of February 23, 2022, since yearend we repurchased additional shares at a cost of $1.2 billion. Our appetite remains large but will always remain price-dependent.

It should be noted that Berkshire’s buyback opportunities are limited because of its high-class investor base. If our shares were heavily held by short-term speculators, both price volatility and transaction volumes would materially increase. That kind of reshaping would offer us far greater opportunities for creating value by making repurchases. Nevertheless, Charlie and I far prefer the owners we have, even though their admirable buy-and-keep attitudes limit the extent to which long-term shareholders can profit from opportunistic repurchases.

Finally, one easily-overlooked value calculation specific to Berkshire: As we’ve discussed, insurance “float” of the right sort is of great value to us. As it happens, repurchases automatically increase the amount of “float” per share. That figure has increased during the past two years by 25% – going from $79,387 per “A” share to $99,497, a meaningful gain that, as noted, owes some thanks to repurchases.

So in this kind of volatile stockmarket, if you don't have any idea what stock you want to buy, really why not invest in Berkshire, at least you can sleep soundly and not be scared and have heart palpitations at night.

As Warren Buffett said,never dependent on the kindness of strangers (or even that of friends). And never trust the kindness of the faith of the stockmarket. they won't make you earning money.

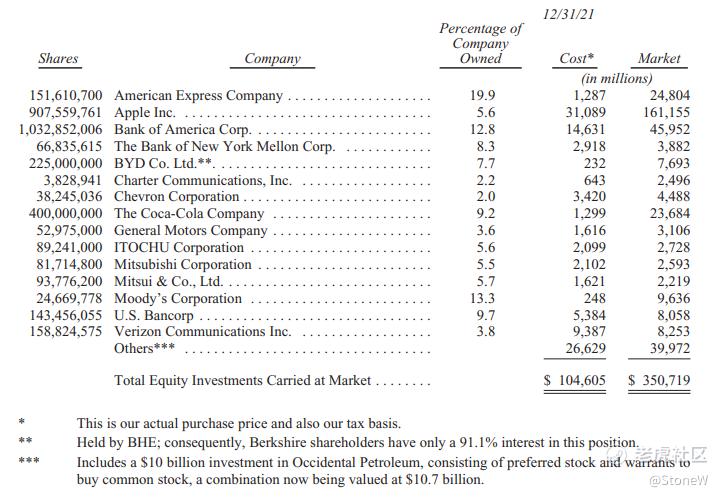

Holding Of Shares

Here's a list of Berkshire's top15 holdings (listed alphabetically in the annual report, I sorted by stock market value), several of which were selected by Berkshire's two longtime investment managers, Todd Combs and Ted Weschler.

In addition, a significant portion of the money Todd and Ted manage is held in Berkshire's various pension plans, the assets of which are not included in this table, a move that is understood as Buffett is delegating power to the next generation.

Watch out for the presence of some overseas companies in heavy positions, such as China's BYD;Japan's Itochu corporation, Mitsubishi Corporation and Mitsui Group.

- Apple (Market cap: $161.155 billion)

- Bank of America (Market cap: $45.952 billion)

- American Express (Market ca: $24.804 billion)

- Coca-Cola (market cap: $23.684 billion)

- Moody's (market cap: $9.636 billion)

- Verizon (market cap: $8.253 billion)

- U.S. Bancorp (market cap: $8.058 billion)

- BYD (market cap: $7.693 billion)

- Chevron (market cap: $4.488 billion)

- Bank of New York Mellon ($3.882 billion)

- General Motors, GM (market cap: $3.106 billion)

- Itochu Corporation (market cap: $2.728 billion)

- Mitsubishi Corporation (market cap: $2.593 billion)

- Charter Communications (market cap:$2.496 billion)

- Mitsui Group (market cap: $2.219 billion)

- The BYD stake is owned by his other company, Berkshire Hathaway Energy(BHE), Mr Buffett said in his letter to shareholders. As a result, Berkshire shareholders hold 91.1% of the position of BHE.

- Berkshire owned 26.6% of Kraft Heinz ($13.1 billion on an 'equity' basis rather than market value) and 38.6% of Pilot Corp, the company is a leader in travel centers, with $45 billion in revenue last year.

- The Pilot Corp stake has been treated with reasonable equity accounting since it was purchased in 2017.In early 2023, Berkshire will continue to purchase Pilot shares, increasing its stake to 80%, and fully consolidate Pilot Corp's earnings, assets and liabilities into Berkshire's financial statements.

Warren Buffett Is Not A Stock-Picker

After the earnings release, Buffett stated that Charlie and he were not a stock-picker, they were Bussiness-picker:

Whatever our form of ownership, our goal is to have meaningful investments in businesses with both durable economic advantages and a first-class CEO. Please note particularly that we own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves. That point is crucial: Charlie and I are not stock-pickers; we are business-pickers.

I make many mistakes. Consequently, our extensive collection of businesses includes some enterprises that have truly extraordinary economics, many others that enjoy good economic characteristics, and a few that are marginal. One advantage of our common-stock segment is that – on occasion – it becomes easy to buy pieces of wonderful businesses at wonderful prices. That shooting-fish-in-a-barrel experience is very rare in negotiated transactions and never occurs en masse( en masse is French language). It is also far easier to exit from a mistake when it has been made in the marketable arena.

The conclusion is that when they come to investing in stocks, Buffett and Charlie don't pick stocks because "cheap." They focus more on companies with long-term performance.Berkshire Hathaway owns a lot of businesses, and in the stock market, they can buy a lot of good companies at good prices, and they can easily get out of mistakes.

Personally, I think Buffett is bold enough to admit that he made some bad decisions, rather than the kind of success stories that people say he made, as the book 《Snowball》 above also explains.

Making mistakes is not terrible, terrible is making mistakes do not admit mistakes.

According to the annual report, Buffett also had a succession of choice, and put a big power/funds to successor to control, so we can, in the past two years in Berkshire hathaway's portfolio, see he had bought some companies' shares that do not conform to the Buffett way of judgment, even some are not profitable company selected.

Of course, some of these companies have seen their share prices plummet in recent days, and more technology companies have joined the list. So I understand why Warren Buffett says he and Charlie are not stock-pickers but business-pickers.

What Is Berkshire Hathaway

Berkshire Hathaway Inc. (“Berkshire,” “Company” or “Registrant”) is a holding company owning subsidiaries engaged in numerous diverse business activities. The most important of these are insurance businesses conducted on both a primary basis and a reinsurance basis, a freight rail transportation business and a group of utility and energy generation and distribution businesses.

Berkshire also owns and operates numerous other businesses engaged in a variety of manufacturing, services, retailing and other activities. Berkshire is domiciled in the state of Delaware, and its corporate headquarters is in Omaha, Nebraska.

Berkshire’s operating businesses are managed on an unusually decentralized basis. There are few centralized or integrated business functions. Berkshire’s corporate senior management team participates in and is ultimately responsible for significant capital allocation decisions, investment activities and the selection of the Chief Executive to head each of the operating businesses.

Berkshire’s senior management is also responsible for establishing and monitoring Berkshire’s corporate governance practices, including monitoring governance efforts, including those at the operating businesses, and participating in the resolution of governance-related issues as needed.

Berkshire’s Board of Directors is responsible for assuring an appropriate successor to the Chief Executive Officer. The Berkshire Code of Business Conduct and Ethics emphasizes, among other things, the commitment to ethics and compliance with the law and provides basic standards for ethical and legal behavior of its employees.

Human capital and resources are an integral and essential component of Berkshire’s businesses. Berkshire and its consolidated subsidiaries employed approximately 372,000 people worldwide at the end of 2021, of which approximately 77% were in the United States and 21% were represented by unions. Employees engage in a wide variety of occupations.

Consistent with Berkshire’s decentralized management philosophy, Berkshire’s operating businesses individually establish specific policies and practices concerning the attraction and retention of personnel within the organizations. Given the wide variations in the nature and size of business activities, policies and practices often vary widely among Berkshire’s operating subsidiaries. Policies and practices commonly address, among other things: maintaining a safe work environment and minimizing or eliminating workplace injuries; offering competitive compensation to employees, which includes various health insurance and retirement benefits, as well as other benefits such as incentives to recognize and reward performance; wellness programs; training, learning and career advancement opportunities; and hiring practices intended to identify qualified candidates and promote diversity and inclusion in the workforce.

Berkshire's Profits

As previously mentioned, a lot of people don't want to proceed with Berkshire stock is, one of the reasons for, the rise is too slow.

According to the annual report, Berkshire and make a comparison between the S&P 500, from 1965 until the end of 2021, 56 years on average profit is 20.1% per year on average, compares with an average S&P 500 profit of 10.5%.

Some people might look at this statistic and snort, 'Ugh! I can make 100% profit every year!', Or 'Option, Futures play casually doubled!' This theory may be able to stand for one or two years, but once the battle line is stretched to 10, 20, or 50 years, the gains may be exhausted, and there may was a great probability of losing money, as A Chinese saying goes,' Throw away your wife and losing your troops(赔了夫人又折兵)'.So the value investing that Berkshire pursues is a solid one and no other investment firm has yet surpassed.

When we stretch out the period from 1964 to 2021, Berkshire Hathaway made a total profit of 3,641,613%. Yes, you read that correctly. One dollar invested in Berkshire in 1964 would have returned $3.64 million today, which is a miracle.The S&P 500 earned 30,209% in 57 years, making the gap so huge.

Summary And Estimate

This 2021 Berkshire Hathaway annual report is very insightful and enlightening for me.While many investors seek high risk and high return, Buffett is as steady as a rock.High risk and high return may make us feel good for a while, but it's easy to lose sleep. Warren Buffett doesn't happy to do that, and neither does his partner and friend Charlie.

Over time, the average annual return was 20.1%, but the overall return was a staggering 3,641,613%, which must have been unprecedented.There are some stocks that leave people feeling daze during the pullback phase, questioning whether they will ever return to their previous highs, but Berkshire is the only stock that doesn't, no matter when you buy it.Even in the short term, we know that over time, sooner or later, stock prices will continue to climb higher.

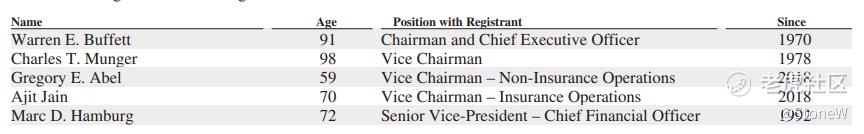

The only thing that worries us is the health of 91-year-old Warren Buffett and 98-year-old Charlie Munger. We hope these two legendary figures can continue to provide us with more ideas and vision for future generations, and we hope they live well past 100 years!

Estimated 2022Q1-2022Q2

- BRKA target price: $480,000 - $525,000

- BRKB Target price: $320 - $350

Reference

BERKSHIREHATHAWAY INC. - 2021 Annual Report

Regards,

StoneW

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

WB是一个真正的长期价值股票投资者,他的投资策略被许多其他成功的投资者效仿。对价值股票投资竖起大拇指。

The business

The management

The workforce

The market

The environment

The legislation

The politic

The competitiveness

The adaptation

The long term model

The price 🤔