Stock market crash? It doesn't exist! Instead of selling, I bought in bulk!

Hello everyone,

Wish everyone good.There was a period of time did not update the market stock and account situation. the recent market can be regarded as three days of big news, a day of small news, in the corporate accountability bill to let the chinese concept of stocks plunged a few days later, it seems that the relationship has eased, so we witness the history of the eyes again, the Hong Kong stock market had surged (nearly up to 10%).

I have been thinking about whether to make some adjustments recently, especially in March, the market is more unstable, many stocks are held for years, and I do not have the "cash ability" to buy all the time, so every operation for me needs to be carefully considered.I've heard more than one person tell me recently that there will be a crash in March, or even give a date -- Anand of India predicts a crash on March 16, 2022.

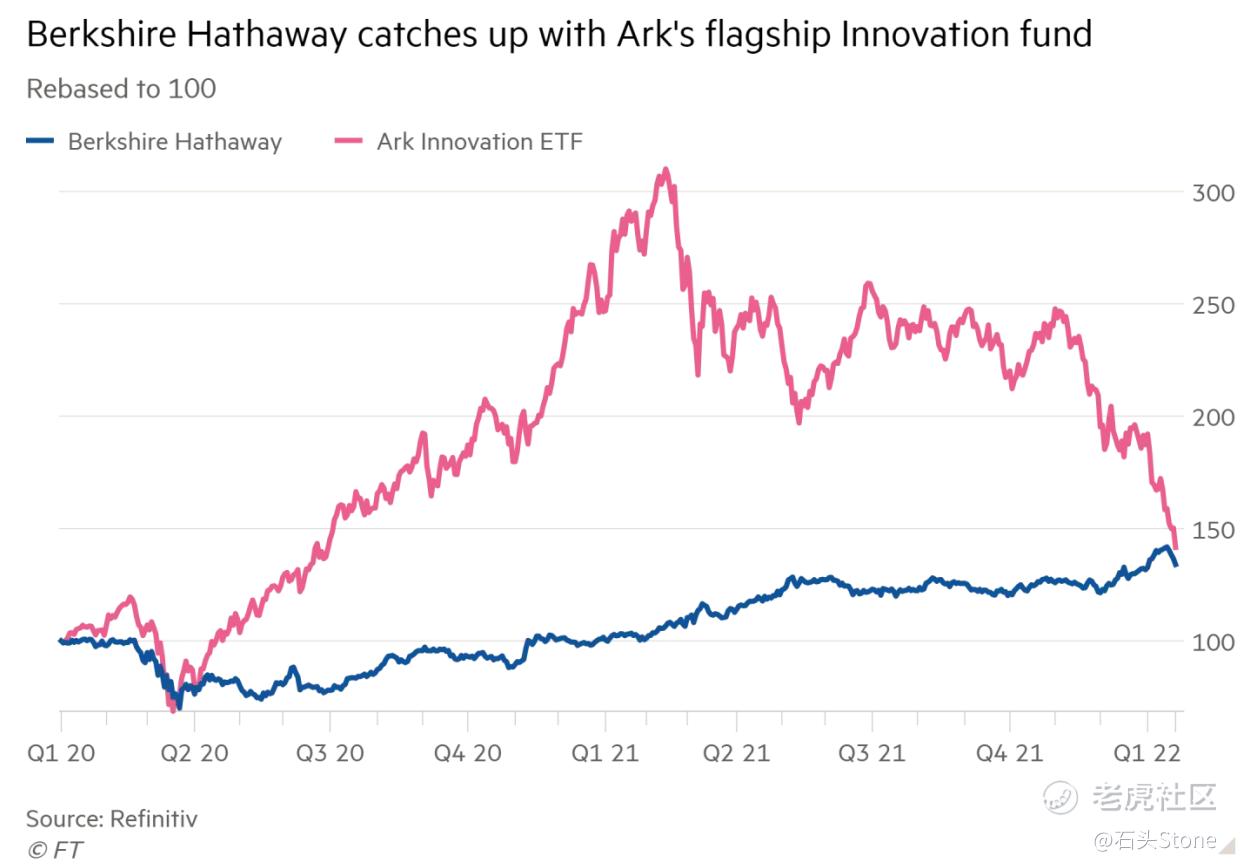

On March 18, 2022, not only did the market not crash, but some stocks did well, especially $Berkshire Hathaway(BRK.A)$, which I have mentioned many times, contributed two earnings analyses and gave quarterly valuations.

I remember I was a little child, nothing about financial concepts, but buffett's story, however, word of mouth, I can imagine one day with the company's shares, even if only buy a share, graduation, later became the office workers to work, I find that more can not afford to buy, Berkshire's share price per share on $100,000 in my impression.

Now, under the rumors of "economic crisis" and "economic collapse", BRK.A stands at $500,000 per share, and I have finally become A shareholder of Berkshire And bought two shares with nearly $1 million.If I had bought Berkshire instead of buying a appartment and a car, I would now have at least 10 shares.Berkshire has taught me the importance of compound interest and a post-consumption perspective, and that every penny I spend now could be a huge profit for me in the future.

This brings me to Berkshire because some of my holdings have overlapped with Berkshire since 2020.With more money in hand, a deeper understanding of the market, and an older age, I am more and more in awe of the market, more and more cautious, stock selection is more and more focused on financial statements.In the Tiger community, I have selected many different types of companies for financial statements and valuation analysis. Although 100% accuracy cannot be guaranteed, the accuracy rate can reach more than 80% after two years of records.

Preface

With the easing of the relationship between China and the United States in the market, I can say more content, mainly cautious and some ideas in the "spit" way to show, see how you understand, I hope these content can bring you help.

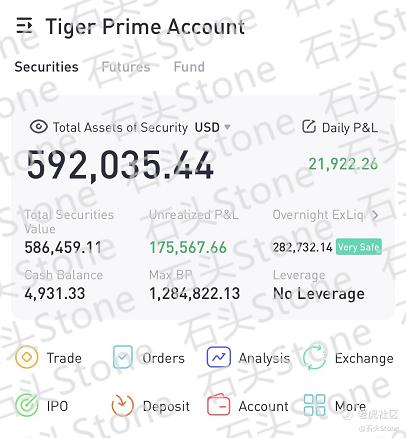

Public account: In 2021, the amount of the account was $460,000 at the time of the final review. After 3 months, the account has grown to $590,000.I will still regularly control the amount of the account (withdrawal) in the future.It is expected that the account will exceed $1 million, or the account will not be disclosed after too many people follow it.

What Kind Of Mentality Is Not Suitable For Investment

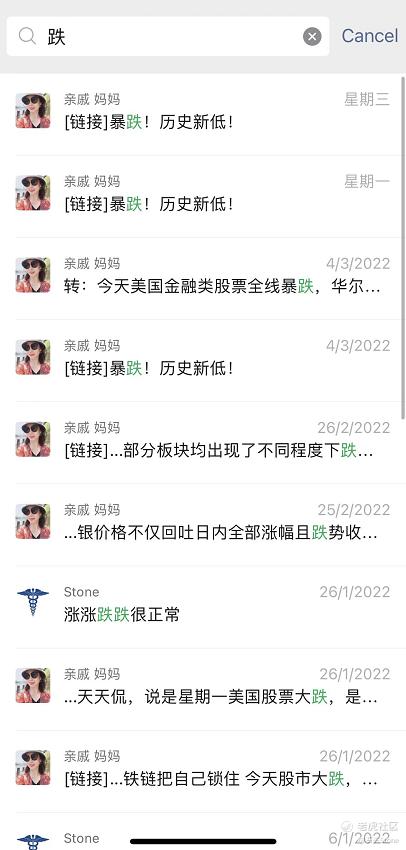

From entering the market so far, I couldn't count how many times to receive all kinds of the news of the crash, and count how many times by friends and the people around you ask: "please let me know if there are signs of collapse", or simply ask: "if you are reducing your shares, also please tell me", and my mother, this type WeChat forward has been a variety of crash" forecast ", please appreciate the "mother" series

She had sent me so many of these messages, I could write a swastika for screen shots.Search with my mother chat keyword "fall", we have a look at what is the real mother:

My mother is the wrong kind of investor: she is afraid of declines, she is afraid of negative news, she is controlled by noise, she is too soft of ear, she will believe everything others say.In her mind, I was the kind of "philanthropist" who gave money to the market.Early in the market.

I also is such, after all, she brought me in my DNA of these effects, I also can not sleep because of the market fall, will also feel anxious, because some news can because people around you tell me more selling has missed the market quickly, but I'm trying to overcome the negative impact of these factors bring to me.

Therefore, I often say to my close friends:

"If you have a stable job, I would very much discourage you from going into the market.Do not have fluke psychology, think you can go to work, while making money.Many professionals spend more than a dozen hours a day studying the market, so why do you think you can beat them with a side hustle?

If you want to invest, find a professional institution or a trusted investor and entrust them with your money.Don't expect to make a lot of money every year, as long as you can beat the market is strong, years of compound interest will let you get a great return.But it's important to be patient and shut down the noise.

If you must get in to stockmarket, consider Berkshire, or if you can't afford class BRKA, buy Class BRKB."

Mother once took millions of RMB to do investment (this was her all life savings), the last is not deceived to lose everything is turned into a "philanthropist", since she is still in with a company see-saw stalling, almost on the court suit each other "deadbeat" -- she invested in 2015 a "health care robot" project, She didn't share any details with our family members, just took to herself DNA with her confidence and enthusiasm, took her money to the "eat people don't spit bones" investment market, AI and robotics hot a few years ago, when the money can get a lot of investors. After cooling, she not only failed to withdraw the principal and also losses.

As you can see from the wechat message my mother sent me above, she does not trust me that much. She thinks that her elders with rich work experience had losed money, and I, a younger generation with less "experience" in her eyes, will also become a "philanthropist" in the end.

I have to admit that my mother's vision was very accurate in the early days. Although she did not speculate in stocks, she was also a person who did not let her money idle. She either bought a house or invested.The explosion of China real estate in the early years of the rise, so that she enjoyed the pleasure of "capital", so "expansion", from then on began a long downhill - loss of money.

Now, there is no money in her hand, and the money floating outside can not be collected back, can only be frugal......To buy food, travel and so on all want to calculate the money in hand, I give her money, she also do not want, do not spend, put in the bank for interest......

My father, on the other hand, is the complete opposite. He doesn't like to make fast money and believes that playing it safe is the most important thing.He's the kind of person who can stand loneliness, and he told me to look beyond the immediate benefits.That's how I was born -- a collection of contradictions that kept quiet about making money but also liked to share ideas;While being disturbed by all kinds of noise, at the same time, we are trying to overcome noise pollution.

Mr. B went for wool and come home shorn

I used my mother's example to tell you a little story.There were many ways to make money by investing, and no one can be sure that this year's good stories will hold up for years to come.

Some ideas may be hot in the market for a while, but sooner or later the tide will ebb.This is also why I like to read financial statements. Financial statements can bring me a lot of data, and I can "predict" the future situation of the enterprise through a large amount of data, so as to increase the success rate of profit.It is a bit like "weather forecast", in which the speed of air mass and cloud can predict sunny, rainy and cloudy days in the future.

Three of us are entrepreneurs and I am unemployed. Two of us are "family businesses", and the other one is self-made and named as Mr. B.I admire Mr B's hands-on, his style is very like the B lady in a "snowball", his company is now in the stage of "asset allocation", he wants to eliminate a partner, and I want to accept him to a partner that part of the shares, or become a major shareholder, but the premise is that he must be in, but I don't participate in the management.

What Mr. B wanted was to give me money management.He knew I wasn't taking the money now, and I knew he had someone else to replace his partner, so I spent the whole trip playing charades with him. He didn't make it clear, and I didn't make it plain.The other two "family business" people, one of whom is Ms. C mentioned before, do not touch the investment market at all, and they are just at the age when the elders start to delegate power to them, so they have no time or energy to invest.

Mr. B had been moving between buy and sell orders of futures, all the way to get my attention.He does futures and knows I used to do gold futures, so he buys gold down.

As we chatted, he asked me what stocks I bought.I'm not that fond of "free rides", but I still have my own insecurities in mind. While telling him that I have a big position in "crude oil Company", he started to tell me about anand's prediction of an economic crash on March 16th.

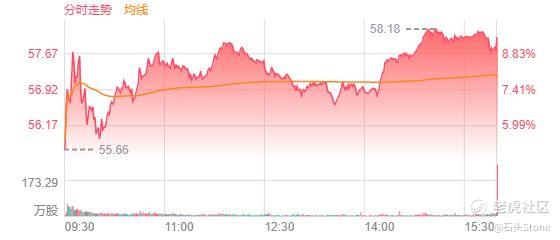

Why don't you sell now?He asked me.When I told him not to sell, I did not sell, and I was going to increase my position in one of the companies. He asked me which company, and I told him "crude oil company", so he cleared all his gold futures and bought long crude oil futures with a leverage of 1:50.I've marked his buying and selling on the graph below.

From the markings above, you can see that Mr. B lost a lot of money. This operation was called "philanthropist" and he later restated that he was prejudged by Anand's economic collapse on March 16, 2022.When he encountered a big drop that he couldn't understand, his first thought was -- run!Crash!

Market view for 2022

Mr. B kept talking about stopping his losses, blowing his positions, why he didn't stick to shorting gold and playing crude oil futures.Embarrassed, I asked him what he thought of his partners and treated them to a meal of hand-held seafood.Over the dinner table, I talked to him in detail about his idea to eliminate the partner and his complaint that the partner was not doing anything.

I asked him if he liked the idea that the equity would provide more money than his partners.He didn't answer directly, but asked me what I thought the market would be in 2022.I told him bluntly that I couldn't predict what would happen this year or how long it would take him to double his money.But I would bet against a crash on March 16th, and so far I don't see any signs of a market crash.

Interest rate hikes may affect the market in the short term, but they have little impact on the long-term market and are not a reason to sell stocks.I don't think the outbreak of war or even the "nuclear bomb theory" is a reason to sell stocks. I think you should buy stocks at this time. If nuclear war doesn't happen, you will make money.

Groundless and irresponsible speculation, the market in the first half of this year will be mainly shock, during this period may be a lot of people can not bear, plus the bank interest rate, the number of retail investors will theoretically reduce, I think this is a very healthy and necessary situation.Too many retail investors will make "jetton" too scattered, which is not conducive to the long-term development of the stock price.

I would describe the recent move as "washing retail investors".

Earnings report is very important, it is the most powerful support for a company's stock price, the stock price should be linked to performance, good earnings companies up, bad companies down.It's hard for me to understand a company that is reporting huge growth in revenue and profits and yet its stock price is at an all-time low.I can't understand how the company blew up, and the stock price rose by the daily limit.That's why I was interested in Mr. B's company. I hinted to him that if he decided to kick out one of his partners and was willing to attract my capital, I would need his financial statements for the last three years, and the capital injection would be in the form of "trust", not personal.

Tech companies are going up too much in 2020-2021. Some companies have seen their share prices rise several times, but their earnings growth cannot be linked to their share prices. I would not buy such companies, even if they are very good and famous.

Consider some companies with good fundamentals. If you are lucky enough to get a bottom pick on a company that was mistakenly killed in the Ukrainian-Russian war, especially in Europe, don't sell in the short term.

Focus on the company in 2022

At the beginning of each year I look for a few companies to add to my pick or hold portfolio, but I also delete a few.Qiwi, for example, was quickly sold before the Ukraina-Russia war. I didn't have much stock in the company, and my position was no more than 2%. Before the war broke out, I had already lost 20%.

This money bought German companies, and if you look at the War in Ur, you will find that many European companies were killed by mistake, not because they were not good enough, not because they had financial problems, but because they were "killed by mistake", and many of them even fell below the market value.I won't point to specific companies, because I haven't eaten enough of those companies' stocks, and I'll consider announcing them when I feel buy them enough for me.

In 2022, I spent three months updating and screening companies. There are no more than five companies so far, and I bought a small amount to make the layout.In addition to the aforementioned Berkshire, there is one other company I have bought substantially...

Transfered shares and changed blood

If you read my previous article, post to the account or the little red book, perhaps you can probably guess what I bought - with Buffett "bump unlined upper garment" $Occidental(OXY)$ , special joy western oil is my main deployment of a company in 2021, has followed the station "stone investment notes" friend,They are all witnesses.Put a weekly chart to show you the buying and selling position of this account:

The reason for buying is also the financial statement. After reading the financial statement of OXY, I felt that the company was very ambitious. Just like Buffett, I read every word, and even posted article in little red book , complaining about why the shares prices flew away just one day after the financial statement was released.I'm really pissed off.

This operation is really a big change of blood, after Nio, I was the first time so crazy to buy a stock.He also used other accounts to buy as well. Although he did not "buy as much as he could" like Buffett, OXY also upgraded to a heavy position after a recent period of time.

Before I bought OXY for the last time, to clear my mind and noise, I found them a place far from the trading market, got up before 5 a.m. and sat on the riverbank watching the sun change from red to gold on the horizon.It has been two years since I was so bold to buy so many stocks in one breath, which made me feel a little empty in my heart. I know that the way to cut off the noise is to cut off the Internet, and then find a place where no one knows me, just thinking quietly...

The week Anand predicted the big bang, I decided to stop buying OXY and share my experience with you.At $50 plus, OXY isn't that sweet anymore, but with the support of the BRK, you shouldn't worry too much.Looks like it's gonna sit out for a long time.After all this time, OXY's stock price is way above my cost.

Last night, March 18, 2022, OXY rose 9.47%, I lost sleep again, happy or empty.I do not know, in short, this matter has passed in the short term, I decided to record this matter, in order to review their own memories of the mood and heart activities at this time.

I couldn't sleep yesterday, so I checked my notes, from 2020 to 2022,: Bank of America, Wells Fargo, American Express, Chevron, Berkshire, Occidental Petroleum, all of these companies have "superposition" with the BRK. there may have been a period of discomfort (shares price decline), but now when you look back, these companies are growing very well.That's why I suddenly bought Berkshire this year -- if I don't know what to buy, buy Berkshire!

Afterword

It's been a long time since we went on a road trip together, so I'm not used to it.Frankly speaking, it is to "pay the bills", I am the most "parsimony" in their mind: I hate to spend money. When I talk with Ms. C, if LET me find "chili pork silk" noodle restaurant, but she always find Cantonese restaurant.

So over time, they get out of balance.Decided to "educate and educate" me, which caused me to bleed out from my wallet and spend me at 2.6KRMB with a seafood meal. The car needs maintenance at least 3KRMB when driving back, so I wanted to change my car: $Porsche Automobile Holding SE(POAHY)$ and Benz GLE/GLS had been hesitant for a long time and have done a lot of works about these cars, but now I hesitate to buy this car for a long time.Now, after their education, I didn't hesitate, straight to a third hand Mazda 2, 98 gasoline plus full without the kind of 300RMB, next time we go on a road trip, take this!

Yesterday, speculation futures Mr. B stretched, he said in his a fierce such as tiger operation, finally burst the warehouse.He asked me if he could fund it so I could help him.I refused him, and said that one day to open a "trust" after the capital injection.I also made it clear that I wanted to invest in his company.As we talked, he didn't seem to figure out what kind of Matryoshka he would be if he invested in my trust, which I am investing in as his shareholder.I'm just kidding. If that were true, I'd have to own other companies, too.

Later, my mother said she got some of the money back.She asked me if I was short of money. In her eyes, I was a "bum".At first I said I didn't need the money, but I thought about it and was afraid that she would be restless and use the money to invest in other things, trying to "recoup her capital".So I told her, recently the stock market is very fierce, I can't make ends meet.I figured if she did give it to me, it would be safer to at least manage it herself.Or give money to Berkshire, is it not illegal for parents to give money?

As far as predictions go, I think I'm pretty good too.Last year it was said that Internet companies would face big job cuts;Predictions of a big tech correction were also correct;In the expression of the concept of stock drop or in the;Reading companies' share prices through their earnings was also right;Of course there are other things, I won't list them all. What does that mean?So I can predict, too?I can read the astrolabe, too?I can see from the distance, too?No, no, no!I don't have any of these skills, just through financial statements and market conditions.

So please be careful to believe in the "prophecy", but also beware of the "master", this Indian "child prodigy" Anand has overturned the car.The "master" predicts thousands of hits and tells you how amazing he is.If stock theory works, why is there only one Buffett in the world?So the direct masters to the stock market, buy lottery tickets.

Tune out the noise and listen to yourself.

Finally, thank you very much for your personal letters of thanks. Your kindness is the driving force of my renewal.I hope I can accompany you go farther and farther!

Part of the machine translation, because some slang do not know how to describe in English,

Please forgive me

Regards,

StoneW

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Remotecam·2022-03-18TOPThat was enjoyable reading. You have a great mother. I only started making money in the stock market after I stopped listening to people and make my own decisions. Yes, block the noise.18Report

- 666huat666·2022-03-18TOPI hope to hold till the end... stocks market won't crash the government won't allow it to happen...14Report

- GoodLife99·2022-03-18TOPstill learning to shut down the noise, no choice, I'm very new & small investor, have to follow the news closely. well sharing, tq& appreciated.11Report

- Swordmerlin·2022-03-18Thanks for the sharing. Especially a newbie like me only follow the wind. Hope can learn from some investors to gain more knowledge on how to invest n be calm. Cheers !!!17Report

- Ahleepapa·2022-03-18THANK U FOR UR CONFIDENCE. I WILL SHORT UNTIL I BECOME A MILLIONAIRE🤡 Thanks for putting money in my pocket in future🤡🤡🤡 dun cry ok12Report

- YiCheng0301·2022-03-18We need to remember: never bet against the FED. Interest hike to kill the demand indirectly and tapering is happening. Dollar cost average and accumulate high conviction stock is a good strategy9Report

- ClaudiaTiger·2022-03-18It feels like you are showing off. And to advise people to not invest if they have a job! So that means that you are superior? Everyone is entitled to their own opnion, including this Ananda guy!4Report

- Cedric77·2022-03-19Timing and Predicting Market is nvr WISE and a Taboo in Investment.Buy and DCA on valued stock will nvr go wrong.Day Trade is for retail investor earning some quick pocket $.3Report

- MoneyFace168·2022-03-19这里也一样,下去的东西会上来。我指的是那些有潜力和市场的人。5Report

- RieslingHawk·2022-03-18Good luck in the coming months7Report

- historyiong·2022-03-18Hmmmm.......I don't believe you, I believe what the trend goes.6Report

- AaronJe·2022-03-18如果你有足够的钱,你可以这样做。7Report

- Maky·2022-03-25Thanks for sharing. Your sharing reminds me what investment gurus like to say “it is time in the market, don’t try to time the market”. Choose great companies and let them compound returns over time3Report

- JPStudio·2022-03-20thanks for sharing your reflection. your wealth is gained from the life experiences around you and making the decision on your conviction. ignore the noises1Report

- Willo88·2022-03-18yes! turn out the noise and listen to yourself by doing own research and studying! power writeup!6Report

- lappiloco·2022-03-18can i borrow $100k from u3Report

- LimLS·2022-03-20Many "experts" calling for crash. Many in the past and even more in the future. Almost all got it wrong all the time so why even listen to them in the first place? Stay vested in quality companies2Report

- Chris_CHRIS·2022-03-19pls like2Report

- Forest33·2022-03-18Buy when others are fearful2Report

- JesseRW·2022-03-18I don't think we should buy too much stock at this moment3Report