RivianQ4: "Tesla Killer" Survives in Dilemma

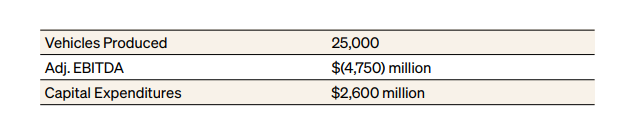

"Tesla Killer"$Rivian Automotive, Inc.(RIVN)$ announced Q4 and full-year results. Due to the tight supply chain, the production capacity was cut in half this year, from 50,000 vehicles to 25,000 vehicles. At the same time, the loss in the fourth quarter exceeded expectations, and the stock price plummeted by 13% after market.

2021Q4 highlight:

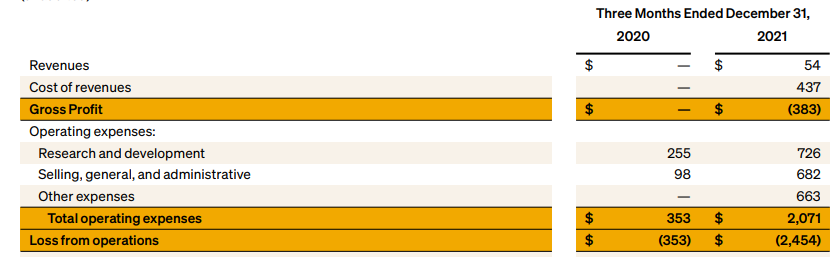

Q4 net loss was 2.46 billion dollars, compared with a net loss of 353 million dollars in the same period last year; Adjusted loss per share was $2.43.

Q4's revenue was 5,400 US dollars, lower than the expected value of 60 million US dollars, and 909 electric vehicles were delivered throughout the year;

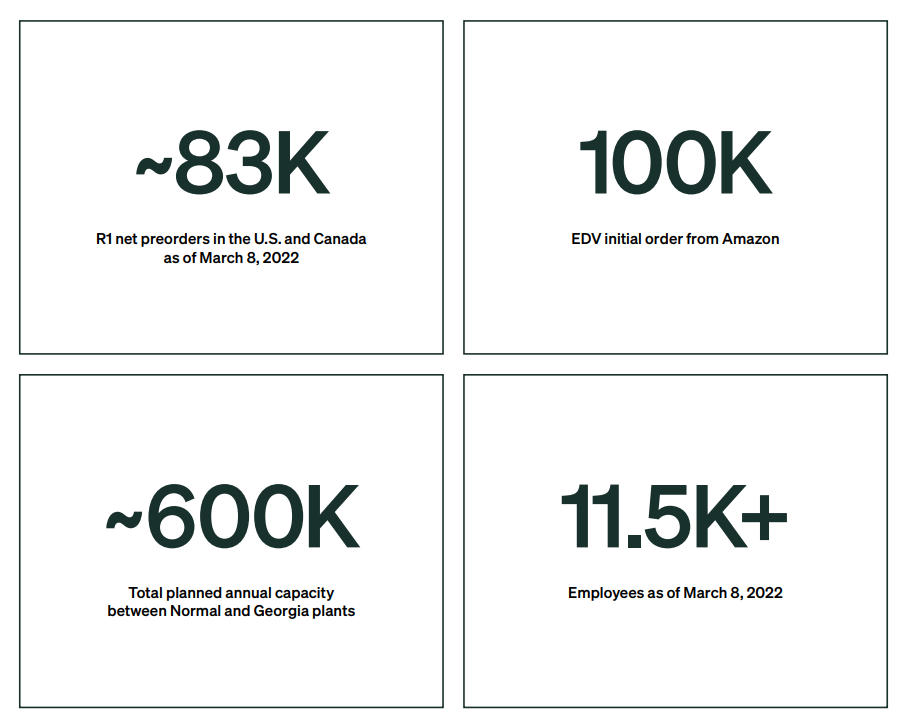

The pre-order for Q4 electric trucks and SUVs is 83,000.

The production capacity target is halved

Incestor focus on the delivery guidelines in 2022.

Rivian updated its production capacity target for 2022 in its shareholder letter, and expects to produce 25,000 electric trucks and SUVs in 2022, which is half less than the target of 50,000 vehicles in IPO last year and lower than the market expectation of 40,000 vehicles, due to the widespread supply chain restrictions and internal production difficulties in the industry.

By 2021, the company has produced 1015 electric vehicles and delivered 920. As of March 8th, Rivian produced 1,410 vehicles in 2022, which is still far from Rivian's production capacity target of 25,000 vehicles in 2022.

Even $Tesla Motors(TSLA)$ cannot achieve mass production in the absence of supply chain disturbance. Nowadays, the supply chain of the whole industry is tight,$Lucid Group Inc(LCID)$Rivian may face more severe mass production difficulties than Tesla.

In addition to the supply chain restrictions continuing until 2022, Rivian also pointed out that the epidemic, bad weather and the planned closure measures to adjust the production line (the factory was shut down for 10 days this quarter) are all factors affecting production, and the only factory in Illinois has just started to run smoothly.

The only good news is that the pre-order of R1T pickup truck and RIS SUV owned by Rivian reached 83,000 vehicles, up from 71,000 vehicles before. And of course Amazon's 100,000 EDVs.

The price increase was blocked, and the gross profit margin in 2022 was negative

Due to the blocked production capacity, Rivian has to cope with the supply chain challenges and persistent inflationary pressures, and the price increase cannot be achieved. The management expects the gross profit margin for the whole year of 2022 to be negative.

In order to pass on the cost and achieve a positive gross profit margin, the company tried to make up for it by increasing the price of R1T pure electric pickup truck by 17% and its R1S electric SUV by 20%. Of course, this move caused dissatisfaction among customers. After strong opposition from customers, Rivian quickly withdrew the previously announced price increase plan and said that from March 1, all orders will be carried out at the original price.

As mentioned before, the retrospective price increase reflects not only the damage to Rivian's brand value, but also highlights the company's helplessness, that is, to achieve the mass production target and the bicycle manufacturing cost much higher than expected, the company may have to endure the current situation of losing money for every car sold in 2022.

In 2021Q4, the loss in a single quarter was 2.4 billion, mainly due to the sharp increase in sales, administration and R&D costs compared with the same period of last year, and a non-cash expenditure of 660 million dollars. As of the fourth quarter of 2021, the company has cash and cash equivalents of 18.423 billion dollars; Capital expenditure is expected to be $2.6 billion in 2022.

In addition, Rivian will follow Tesla and plan to use new batteries in its electric trucks, delivery vans and SUVs, including lithium iron phosphate (LFP) chemical batteries for standard-life vehicles and high nickel chemical batteries for vehicles with ultra-long battery life.

This adjustment is obviously related to the supply chain, because lithium iron phosphate batteries do not need any nickel or cobalt, which are expensive or difficult to obtain. Tesla announced in October last year that it would switch to cheaper lithium iron phosphate batteries worldwide as the prices of key materials soared.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

can you make up your mind lol