The semiconductor bubble is starting to burst!

Last night, the Nasdaq continued its decline, plunging 2.28%.

The semiconductor concept stocks decline significantly: ASML 5.65%, Nvidia 4.48%, AMD 4.6%, even the VanEck Vectors Semiconductor ETF(SMH) fell 3.96%.

The semiconductor is considered as the “epicenter” of this U.S. stock market crash.

According to the news, Nvidia prepares to abandon the acquisition of ARM. SoftBank is stepping up efforts for ARM IPO as an alternative to the acquisition.

In September 2020, Nvidia announced a $40 billion acquisition of ARM, the world's dominant mobile CPU, which shocked the market. If the acquisition were completed, it would become the largest chip merger in history.

Although the historical acquisition failed, the earning results and the unprecedented Fed QE policy can explain the 125% jump in Nvidia's stock price.

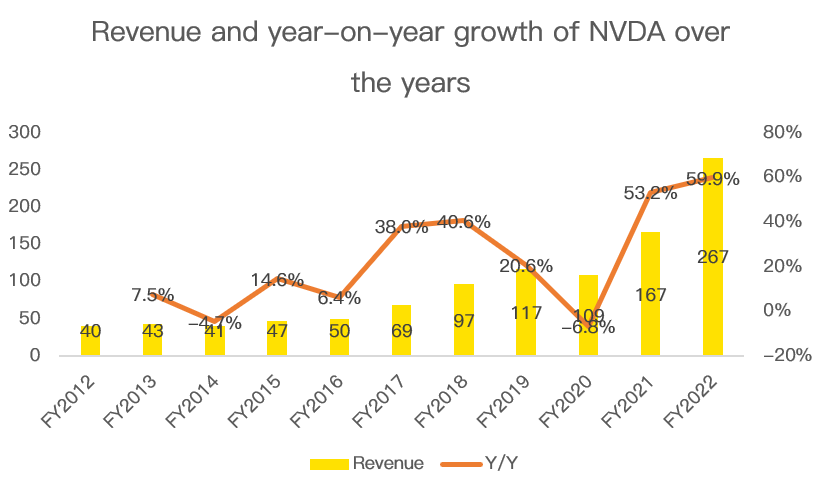

Bloomberg analysts consistently forecast that Nvidia's FY2022 revenue will be about $26.7 billion, a 60% year-over-year jump and the fastest growth rate in the last decade.

However, according to Bloomberg analysts' forecast on FY2023 revenue, Nvidia's revenue growth rate may slow to 19% this year.

By reviewing Nvidia's stock price trend over the years, it is not difficult to find that high revenue growth means stock price increase, while slower growth rate may put stock price under great pressure.

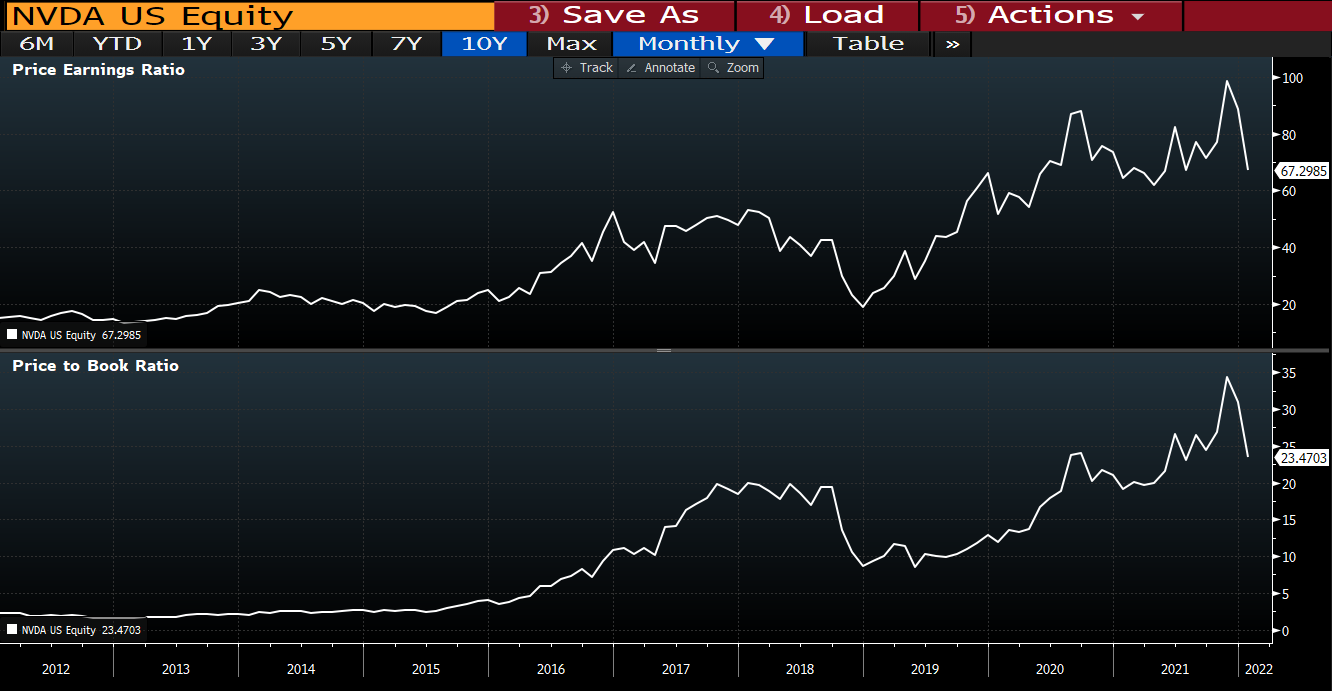

Currently, based on the traditional P/B ratio for the semiconductor industry or the P/E ratio, Nvidia is unprecedentedly overvalued.

Except for Nvidia, other semiconductor concept stocks are also not optimistic.

TSMC and ASML both have given 2022 revenue growth guidance that exceeds expectations. But due to the high valuation, stellar earning results can not survive the U.S. stock selloff.

According to management's guidance, TSMC's 2022 revenue growth rate is above 20% and ASML is around 20%.

Even using the P/E(LYR) valuation, TSMC is 30x and ASML is 40x.

ASML, which has a higher valuation, has fallen significantly more than TSMC in the recent correction.

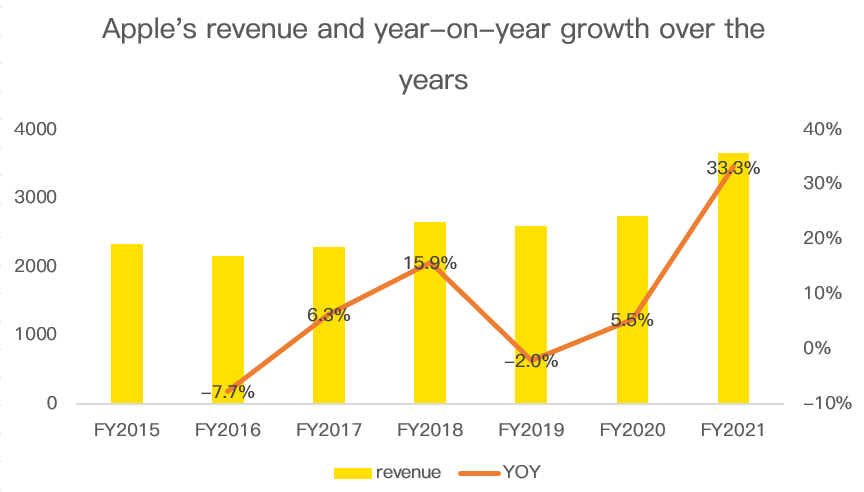

Apple ranks among the top in terms of market cap, but may face fluctuated stock prices in 2022.

Looking at the historical revenue, Apple's growth rate is variable:

In any case, the bubble of highly-valued semiconductor stocks have begun to burst under the Fed’s rate hike and tightening policy.$NVIDIA Corp(NVDA)$ $Apple(AAPL)$ $ASML Holding NV(ASML)$ $Taiwan Semiconductor Manufacturing(TSM)$ $VanEck Vectors Semiconductor ETF(SMH)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Standby bullets is paramount.

Great article on value investing

sgx $UMS HOLDINGS LIMITED(558.SI)$

#aem

#isdn

#