FOMC Minutes: Here are 3 Points to Watch

The newly released January minutes cover the most concerning subjects: rate hikes and balance sheet runoff. But financial stability warned by participants should also be noticed.

Rate Hike

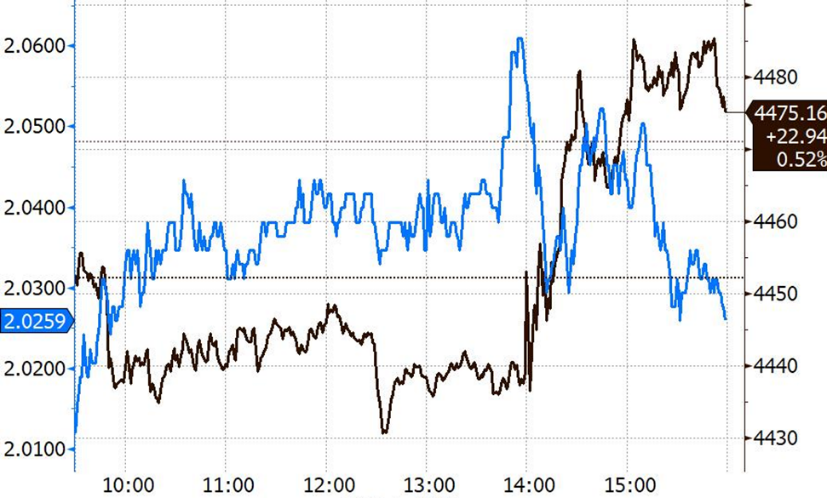

The FOMC committee stated at its two-day meeting in January that it would not raise rates for now, but strongly hinted at a rate hike in March. After the minutes were released at 2 p.m., stocks recovered early losses and the US 10 year Treasury yield fell. The chart below shows today's S&P 500 (black) and US 10-year Treasury yield (blue) movements.

Balance Sheet Runoff

Balance Sheet Runoff

In light of the current high level of the Federal Reserve’s securities holdings, a significant reduction in the size of the balance sheet would likely be appropriate. Details on the timing and pace of balance sheet runoff would be determined at upcoming meetings, participants generally noted that current economic and financial conditions would likely warrant a faster pace of balance sheet runoff. Principles for reducing the size of the Federal Reserve’s balance sheet are set at this meeting.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Im Kamal·2022-02-18I believe the fed might soften a bit rate hike due to market tension Russia and Ukraine issue. If FED push rate panic selling might happen in market and most Tech counter will be strongly effected.3Report

- EricVaughan·2022-02-17Perhaps raising interest rates will help improve the balance sheet. I hope the Fed can balance the stock market and the national economy when adjusting.3Report

- DaisyMoore·2022-02-17Raising interest rates seems inevitable. The market will usher in the next adjustment.2Report

- hellodarz888·2022-02-18lets monitor..lotsa pricing in2Report

- HL Chua168·2022-02-18Wow, don understand2Report

- Kritz_·2022-02-18[微笑][微笑][微笑]2Report

- Oldmanjenkin·2022-02-18Budget is impt to watch!1Report

- Gcwj·2022-02-18很遗憾,但牛年已经过去了1Report

- Malahotpot·2022-02-18Dip i just get more1Report

- 小胖虎虎·2022-02-18[财迷] [财迷] [财迷]1Report

- Jia jia·2022-02-18感谢分享LikeReport

- Chooer·2022-02-18[得意] [得意] [得意]LikeReport

- Korer·2022-02-18[财迷] [财迷] [财迷]LikeReport

- 青苹·2022-02-18好1Report

- GhordofWar·2022-02-18the market is always unpredictable1Report

- 蒋小鱼·2022-02-18hopefully no impact to the stock........LikeReport

- kellyWin·2022-02-22好1Report

- CyberGuard·2022-02-19[Like]LikeReport

- Keong·2022-02-19👍LikeReport

- jason90·2022-02-18Ok1Report