What exactly is ESG? How to find a boyfriend with ESG indicators?

Recently, I asked a friend at a dinner party:Do you know what ESG is ?The friend is very excited, blurt out: EDG slays in the game !The whole dinner was quiet for at least three seconds...If you are still confused about ESG and EDG, you should read this article carefully.

I will tell you what ESG is in the simplest way.

1. What is ESG?

First, let's talk about the concept of ESG.ESG stands for Environmental, Social and Governance.

It gives ESG more explanation:

"E" mainly focuses on the environment;

It covers pollution emissions, the use of natural resources such as energy and water, the impact of business activities on the environment and resources, greenhouse gas emissions, carbon footprint, biodiversity and so on.

"S" focuses on the social dimension;

It covers employee welfare and health, supply chain management, product responsibility, social welfare and so on.

"G" focuses on corporate governance;

It covers the composition and power norms of directors, supervisors and senior managers, risk management and internal control, investor relations, executive compensation, corruption and so on.

Of course, this understanding is correct, but we can not help but have such a question in mind, how much is the relationship between ESG and investment?

Don't worry, let's first understand what ESG is.

2. How To Understand ESG?

You know, investing is two-dimensional; the first dimension is the return, and the second dimension is the risk. The principle of traditional investment is to take the minimum risk under a certain return, or to obtain the maximum return under a certain risk.Now, the emergence of ESG standards has added a third dimension to traditional investments, which is "sustainability."That is to say, we should not only find the investment method with the highest performance-price ratio of return and risk, but also enjoy this performance-price ratio for a long time in the time dimension.Here, I will give you a common example in life.Many of my friends, like me, have had the idea of finding a boyfriend at a party. What do we expect from a boyfriend at an arranged party?Here, I sum up my long-term love experience, and I divide this expectation into two perspectives.

First, the angle of love.Second, the angle of marriage.

Let's talk about the angle of love first. What do you expect when you meet your future boyfriend for the first time?I think, roughly be these a few: the appearance condition of the other side, salary income, domestic capital, speech deportment.

Similarly, ESG standards have nothing to do with the "fundamental" factors of enterprises themselves, and short-term ESG ratings will not have a decisive impact on the performance of enterprises, but from the perspective of "sustainability", enterprises with higher ESG ratings may have better future development.

Next, let's talk specifically about the impact of ESG standards on investment.

3. Is ESG Useful For Investment?

Many investors may ask, ESG is a standard to show a company's "ethics" or "sustainability", so will a company with a higher ESG rating have an advantage over other companies in terms of return on investment and investment risk?Tiger_Academy tells you that research has found that there is.According to a report by the Center for Sustainable Business Research at New York University Business School, more than half of the more than 1000 research papers from 2015 to 2020 found that ESG factors had a positive or neutral impact on financial performance.

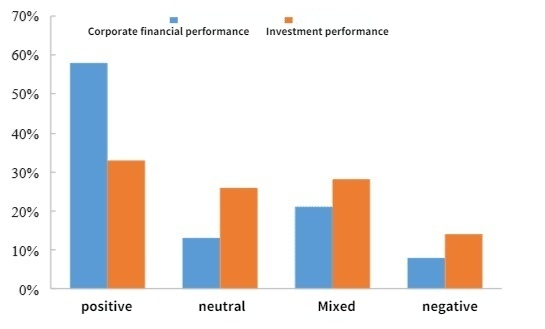

Among them, 71% of the studies found that the impact of ESG factors on corporate financial performance (ROA, ROE, stock price) is positive or neutral; 59% of the studies found that the impact of ESG factors on investment performance (portfolio alpha, Sharpe ratio) is positive or neutral.

Morgan Stanley's Sustainable Reality study found that among nearly 11000 mutual funds from 2014 to 2018, ESG's investment performance was not significantly different from that of traditional funds. However, ESG funds have less market risk, and their downside risk is 20% lower on average than traditional funds.

According to the subsequent updated data, in 2019, the excess return of ESG equity fund is 2.8% compared with traditional equity fund, and the excess return of ESG bond fund is 0.8% compared with traditional bond fund; in 2020, the excess returns of ESG equity fund and ESG bond fund are 4.3% and 0.9% respectively.

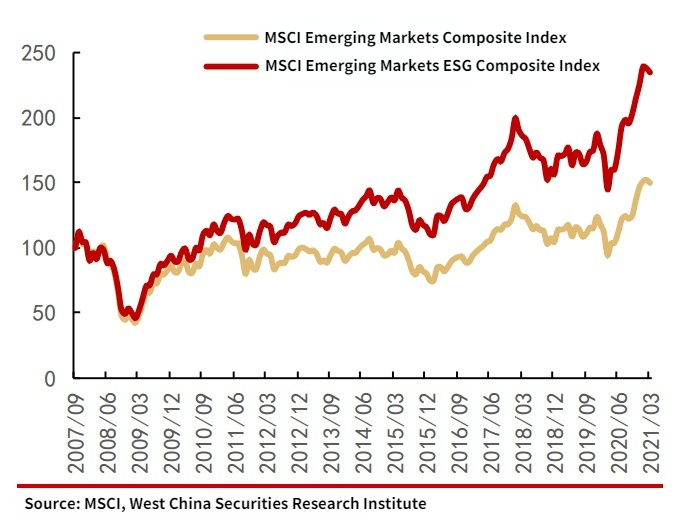

In addition, the research results of West China Securities Research Institute show that ESG investment strategy is more effective in emerging markets and can achieve excess returns.

From the lowest point in February 2009 to March 2021, the cumulative increase of MSCI Emerging Markets Composite Index is as high as 408.5%, which is much higher than the 251.2% increase of MSCI Emerging Markets Index in the same period, and the gap between them has been increasing in recent years.

To put it simply, ESG gives listed companies more requirements such as "environmental friendliness", "social responsibility" and "corporate governance" in traditional fundamental investment, and adds "sustainable" indicators to listed companies to guide listed companies to pay attention to environmental protection and enhance social responsibility while pursuing their own performance and scale.

ESG factors have a positive impact on corporate finance and investment. Compared with the general means of investment, ESG investment has stronger excess returns and lower downside risk.Picking a company is like picking a boy.

If the "fundamentals" are excellent and you have a high "moral" standard, why don't you be moved by such a company and a boy?My friends, welcome to leave your heart story in the comment section and share your "dating" experience ~

See you next time ~

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JefAng·2022-02-22I'm from HR. Humans like to instill their own beliefs that changes the companies morals and values. Manpower movements are drastic in current era. All these are just mere marketing beautifications...13Report

- Vandaluus·2022-02-22Would u pay a premium for a listco who prides itself on ESG at the expense of profitability, or invest in one which ranks low on ESG but thrives on money making and dividend payout?2Report

- ThunderPat·2022-02-22It makes sense to link LT investment perspective with ESG. But how could retail investors obtain the trusted ESG score?1Report

- Kraken 1·2022-02-22imo ESG should be placed alongside large global macro sectors/indicators. as worthy as it is to look at china or India or even commodities sector, it should have a bucket on its own1Report

- dorbymiao·2022-02-22Feel good factor. When the society is struggling for survival, I need my money need to work hard and quick. In my current view, ESG is for the rich with extra cash to invest into the far future.1Report

- Big Little·2022-02-23If a firm is certified that they're now ESG compliant - will this automatically lead to outperformance? Or could those stk outperformance be due to scarcity premium, which will not exist over time?LikeReport

- DanHayashi·2022-03-29nice read2Report

- Hosaid·2022-02-23WIll ESG compliance company perform better n hv better revenue then those not yet ESG Co.?1Report

- Michelle Ong·2022-02-26Like back thanks1Report

- Olegarki·2022-02-23Like back please…thanks1Report

- Enyaw123·2022-02-22$Vanguard Index(VGT)$[财迷][财迷]1Report

- MTamil·2022-02-22👌🏻👌🏻👌🏻👌🏻1Report

- rockchiam·2022-02-23[微笑] [微笑] [微笑]LikeReport

- AnnieReis·2022-02-23thanks for sharing 👍LikeReport

- XiDon·2022-02-22Interesting articleLikeReport

- WinzWorld·2022-02-22Thanks for the enlightenment! 🤓LikeReport

- ming22·2022-02-22Interesting, good to knowLikeReport

- Residue·2022-02-22can you advice on where to get EFP 🤔LikeReport

- The Steady Investor_TSI·2022-02-22thanks for sharingLikeReport

- ychong87·2022-02-22marketing as usual1Report