Component of options Contracts——how to read an option?

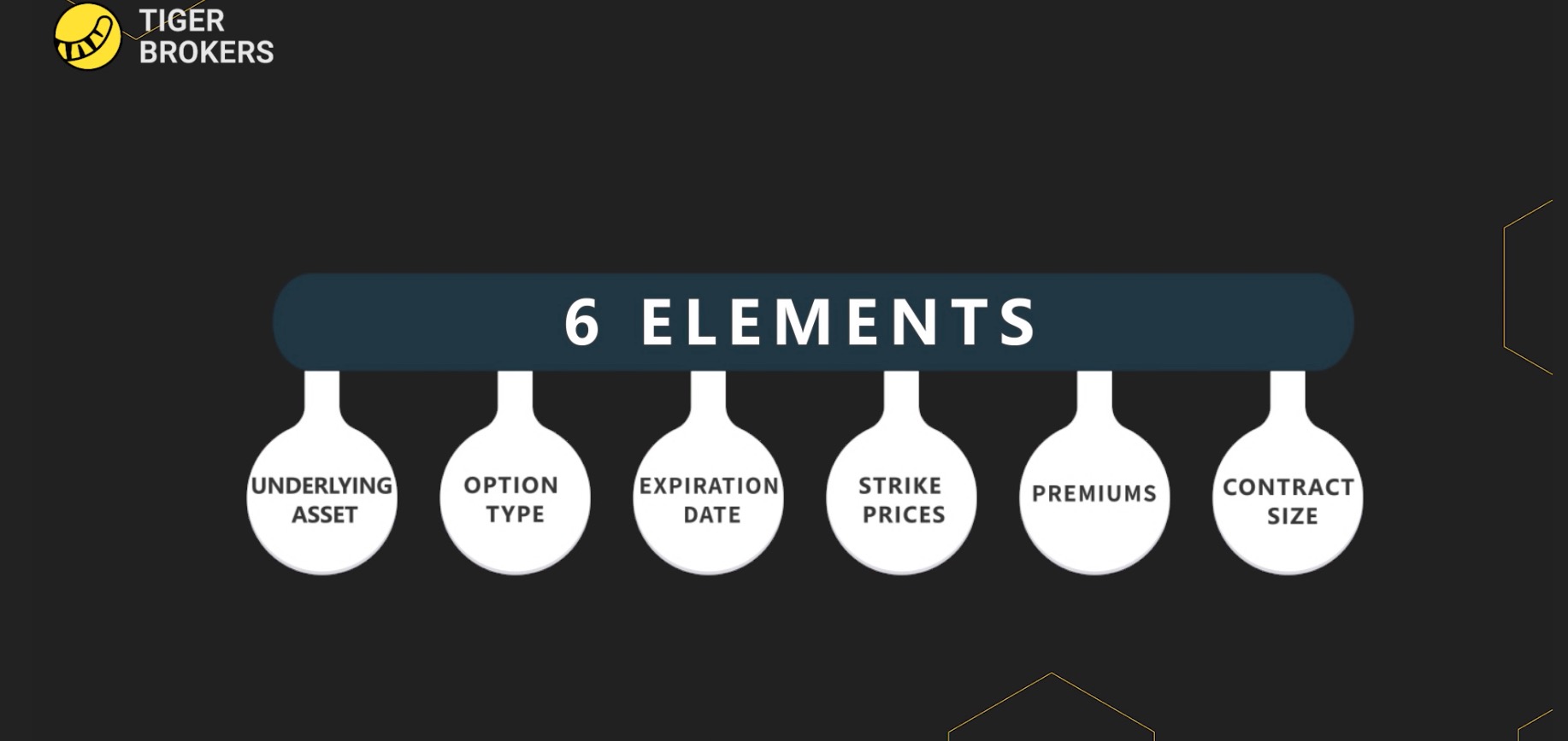

Next, what elements does an option contract contain?

The first elementis the underlying asset. As we already know, an option is a contract. The underlying asset is the asset the contract is based on.

If you buy individual stock options of Tesla or Apple, the stocks of Tesla and Apple are the underlying assets of the options.The trend of options is closely related to the performance of the underlying stocks. In addition to stocks, underlying assets can also include indexes, ETFs, futures, etc.

The second element isthe option type, call or put, which was discussed in the last article.

The third element is the expiration date, which is also one of the biggest differences between stocks and options. You can hold onto stocks for ever, but not options. After the agreed time, options become worthless.

The next question is whether options can only be exercised on the expiration date. The answer depends on the type of options, American options, or European options. American options can be exercised on any day up until the expiration date. European options can only be exercised on the expiration date.

Most stock options are American options.Index options are usually European options. Buffett often sells long-term put options on index. Why? Because as the index option is normally a European option, he doesn't have to worry about it being exercised because of short-term fluctuations.In addition, most US stocks have weekly options and monthly options, while Hong Kong stocks generally only have monthly options.

The monthly options of US stocks expire in the third week of each month, and the monthly options of Hong Kong stocks generally expire at the end of the month. Relatively speaking, there are more options for U.S. stocks, with relatively better liquidity and larger trading volume.

Among them, the options of well-known companies are the main trading objects, such as Tesla and Apple. Very long-term options or those of less well-known companies have little liquidity, so it's best to avoid them.There are also other elements, you can learn them from next video.

Related Ariticles & Videos

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Sharing for save keeping on my published page too for future reference

👍

Option for additional knowledge

Nice learning!