The Commodity Report #72

OPEC+’s big surprise / First the Rhine now the Mississippi River / Chinese Oil Demand is trending down

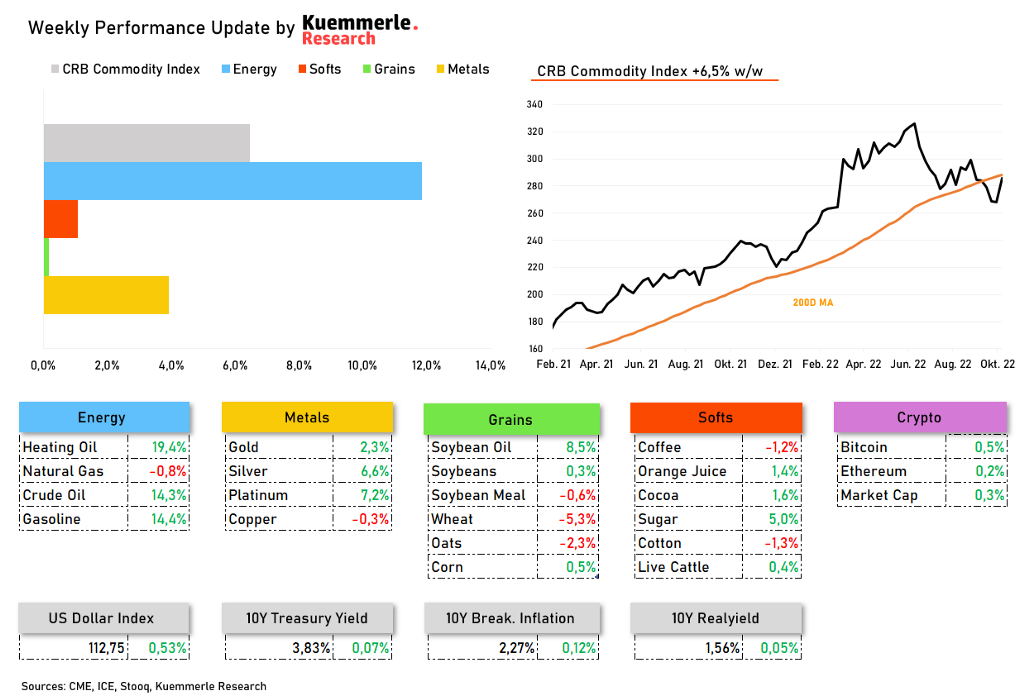

The benchmark, CRB Commodity Index, ended the week +6,5% higher

Welcome to another 99 people that subscribed to the Commodity Report during the last week, bringing the total subscriber count up to 2.418 people!

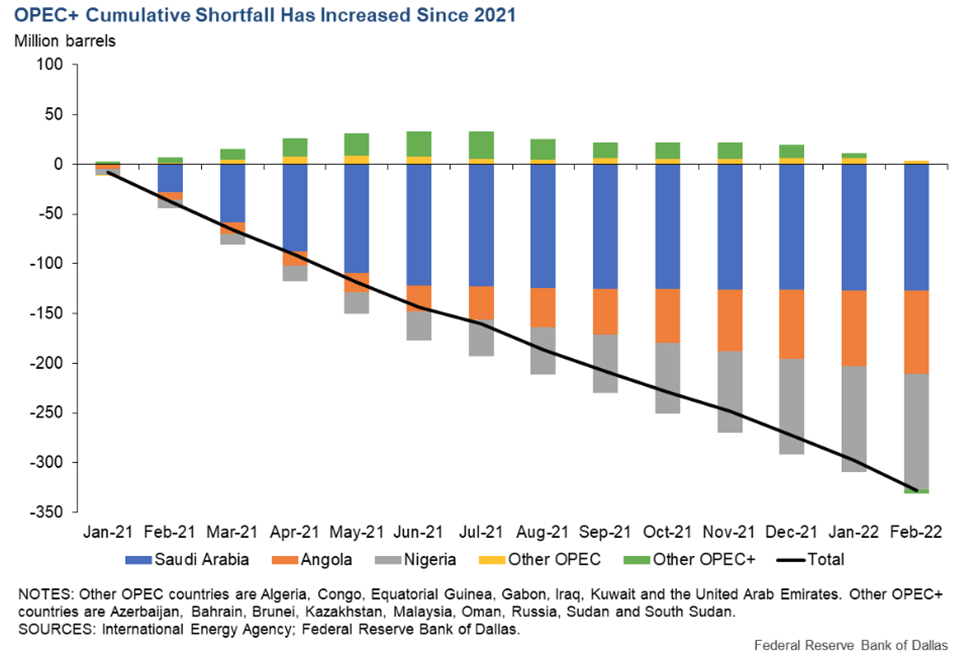

OPEC+’s big surprise

The group announced to cut its output limits of as much as 2 million barrels a day, using current targets as a starting point. While a significant reduction, the impact on global supply will be much smaller because several countries are already pumping below their quotas. Most analysts expect that the real supply cut will be around 700 to 800 bpd. Nevertheless, this is still a large supply cut. No wonder prices were trending higher during the week. We still think it’s too early for a sustained rebound in oil prices as global economic momentum will continue to fade with that oil demand. West Texas Intermediate futures settled close to $93 a barrel on Friday after rallying more than 16% for the week.

First the Rhine now the Mississippi River

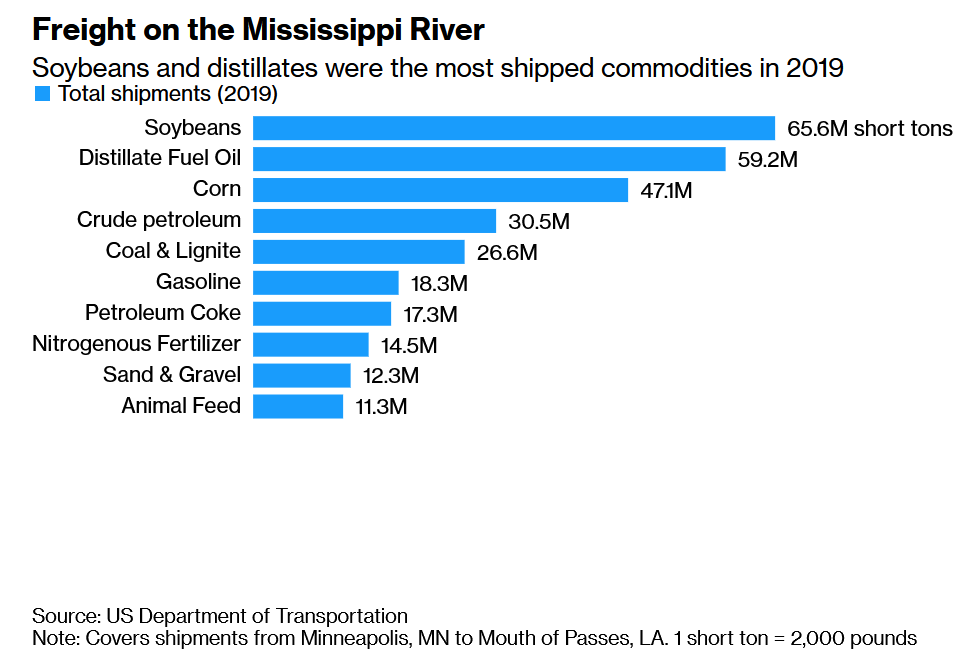

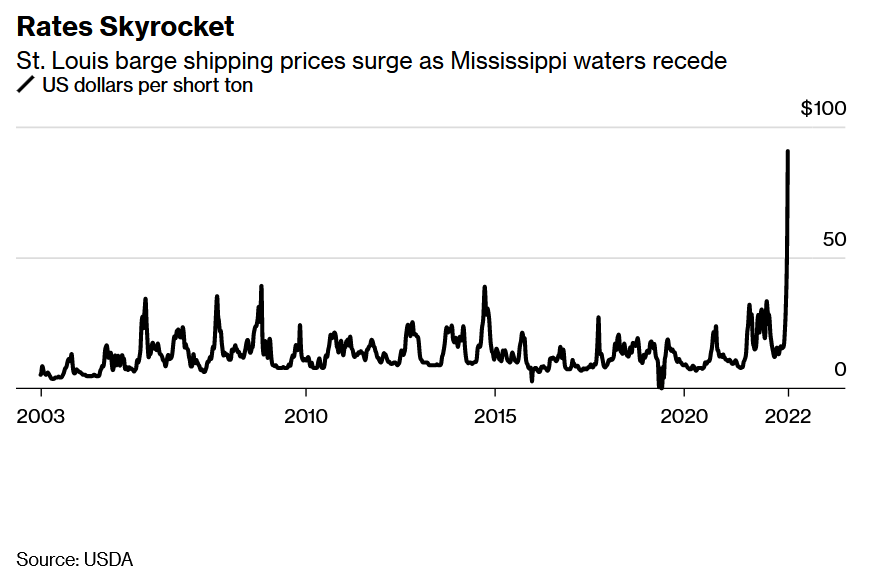

First, we had low water levels at Europe’s most important waterway for trade, the River Rhine, and now we have the same problem in the US with the Mississippi River. About 60% of all grain exported from the US is shipped along the river. Shipping rates went through the roof. According to the USDA also about one-third of US consumption of the common nitrogen fertilizer urea moves on the Mississippi as well.

According to some regional experts, volume on the waterway is effectively 45% lower than usual because each boat is pushing fewer barges, and each barge is carrying less than it normally would, similar to the effects we saw at the Rhine crisis in Germany.

Many parts of the Midwest and Plains states are experiencing drought, which affects water flowing into tributaries that normally feed into the Mississippi. Even more concerning is the fact that the trend of only a few rainfalls will continue, based on the latest weather forecast for the region.

It’s a worrisome development for transporting goods from a river basin that produces 92% of the nation’s agricultural exports, especially during harvest season. The river is the main artery for crop exports, while petroleum, fertilizer, and imported steel also transit parts of the waterway.

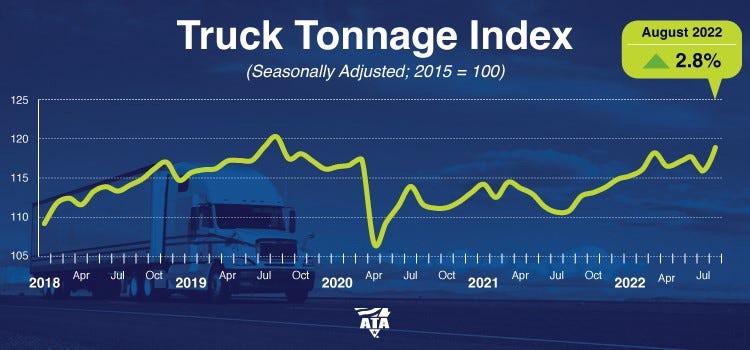

Barge transport is cheaper than rail and truck and has a smaller environmental impact. As customers switch from barge to rail and trucking, the shipping costs accelerate again. It also means more traffic gridlock on US highways and higher costs at the gasoline pump. Moreover, it comes at a time when the cost of trucking continues to stay high, as the latest ATA Truck Tonnage Index shows.

It would mean the world to me if you leave a like or share The Commodity Report if it brings you any value. It helps the community to grow further and to provide more people with practical commodity research.

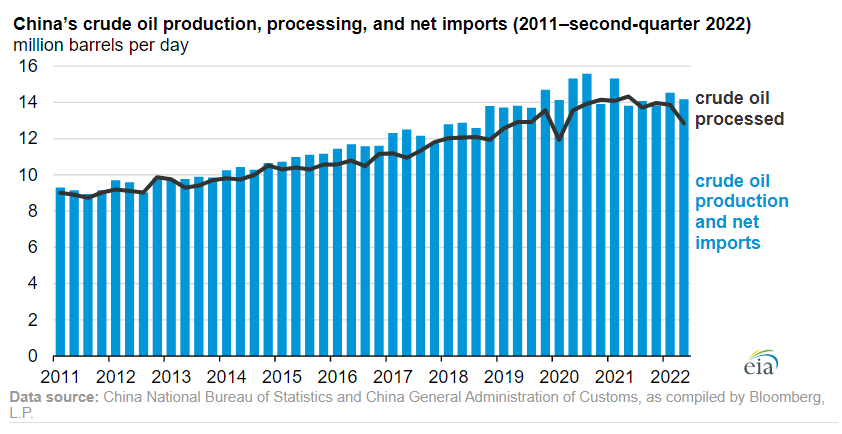

Chinese Oil Demand is trending down

The largest single oil importer in the world is still struggling with many economic headwinds caused by the zero covid policy and a struggling property market. But when this trend changes and China solves its domestic problems, oil demand will probably tick up again. Another big tailwind for oil prices going into 2023!

Check this out as well

With Kuemmerle Research and The Commodity Report, we try to cover the most important topics in commodity trading. My friend Stephan, who is the CEO of AltFunds launched a fund that specializes in alternative assets. I think the investment opportunities in collectibles and other alternative investments are huge. I love to read his regular blog posts about baseball cards and other alternative asset stuff. Therefore I encourage you guys to check out his newsletter as well.

This week look out for the following:

- Bank Holiday on Monday in the US, Canada, and Japan

- PPI data on Wednesday

- FOMC Meeting Minutes and WASDE Report on Wednesday as well

- CPI data on Thursday

- Retail Sales data on Friday

- Prelim UoM Consumer Sentiment on Friday as well

Subscribe to The Kuemmerle Report

Commodity Metrics, Futures Activity and Trading Opportunities

A subscription costs you 34$ a month, and you will receive an additional in-depth report every Sunday evening at 6:00 PM CEST. That information will be only published to members and not to the general public.

Till next Monday, Lukas

If you have any questions in the meantime, please feel free to contact me via Twitter or Mail.

(The Commodity Report is not investment advice)

The Commodity Report #72 was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- 火天大有火天大有·2022-10-10Awesome!!!LikeReport

- tomomeow·2022-10-10[Onlooker]LikeReport

- atsc·2022-10-10OkLikeReport

- TTH4Legs·2022-10-10KLikeReport

- ck1986·2022-10-10okLikeReport

- atsc·2022-10-10OkLikeReport

- Ninderdon·2022-10-10kLikeReport

- Darren77·2022-10-10OkLikeReport

- 火天大有火天大有·2022-10-10Awesome!!!LikeReport

- psion·2022-10-10KLikeReport

- EveTan·2022-10-10[smile]LikeReport

- Hitrun·2022-10-10okLikeReport

- ramius75·2022-10-10👌LikeReport

- tiger cub·2022-10-10okLikeReport

- Firebird27·2022-10-10thxLikeReport

- bananaman123·2022-10-10[Like]LikeReport

- Crevantess·2022-10-10👍LikeReport

- Btyc·2022-10-10👍🏻LikeReport

- Jenn79·2022-10-10ok1Report