Weekly: Major Indexes Rebounding, Watch Jobs Data This Friday

The three major U.S. stock indexes posted weekly gains of around 2% to nearly 3%, rebounding from declines of roughly 3% the previous week. For the $S&P 500(.SPX)$ , the latest result snapped a string of three weekly losses in a row.

As of last Friday, the$Straits Times Index(STI.SI)$ lost1.53% last week and$S&P/ASX 200(XJO.AU)$ dropped 0.32% last week.In February the $S&P 500(.SPX)$ fell 2.6%, failing to maintain the market’s positive momentum from January, when the index rallied to a 6.2% gain.

Technical Observer

3 Major Indexes candle chart

$Straits Times Index(STI.SI)$ & $S&P/ASX 200(XJO.AU)$

Sectors & Stocks Performances Review

Basic Materials, commnunication Services, Industrials are the top 3 winner sectors of last week. For the Whole February, Information technology was the only one among 11 equity sectors to post a positive result.

In terms of stocks,$Alphabet(GOOG)$ gained 5.23%, $Meta Platforms, Inc.(META)$ gainded 8.77%, $Microsoft(MSFT)$ , $Apple(AAPL)$, $Berkshire Hathaway(BRK.B)$ gained over 2%.Companies in the$S&P 500(.SPX)$ posted an average earnings decline of 4.9% over the same quarter a year earlier, that result marked the first quarterly decline since the third quarter of 2020,according to FactSet data .

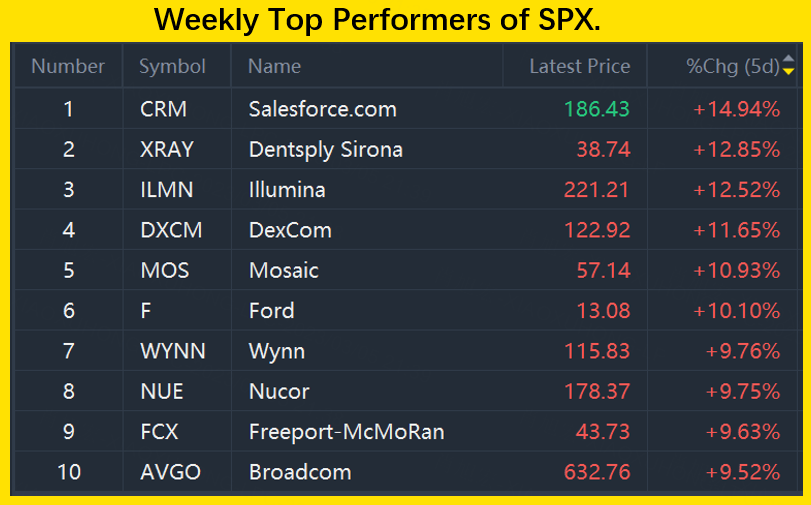

Weekly Gainers of $S&P 500(.SPX)$

The top 10 winners of$S&P 500(.SPX)$ are $Salesforce.com(CRM)$, $Dentsply Sirona(XRAY)$, $Illumina(ILMN)$ , $DexCom(DXCM)$ ,$Mosaic(MOS)$ ,$Ford(F)$ ,$Wynn(WYNN)$ ,$Nucor(NUE)$ ,$Freeport-McMoRan(FCX)$ ,$Broadcom(AVGO)$

Macro Factors to watch

Fed Divergences: Atlanta Fed President Raphael Bostic said that the U.S. central bank may pause interest rate hikes after midsummer this year. While Fed's Daly sounded on Saturday"tighter policy, for a longer time, 'likely' needed"

Services Sector Momentum: the U.S. services sector showed the highest monthly reading since last June, which helped lift the major U.S. stock indexes to gains of 1% to 2% on Friday.

Bonds Yields Surge: Concerns about inflation and further interest-rate hikes continued to weigh on prices of government bonds, sending yields higher. The 10-year U.S. Treasury bond’s yield closed above 4.00% in recent four months. The 2-year note’s yield climbed as high as 4.94% —the highest since 2007.

Oil Comeback: The price of U.S. crude oil climbed more than 4% to nearly $80 per barrel, recovering ground lost over the previous two weeks of price declines.

Housing Trouble: The pending home sales jumped by 8.1% from December to January as reported, a fresh surge in mortgage rates could weigh on the housing market. The average U.S. mortgage rate hit a three-month high, rising to 6.65% for a 30-year mortgage from 6.50% the previous week.

The Week Ahead: March 6-March 10

Notable Earnings to Watch:

$Sea Ltd(SE)$ ,$Trip.com Group Limited(TCOM)$ ,$CrowdStrike Holdings, Inc.(CRWD)$ ,$JD.com(JD)$ ,$Docusign(DOCU)$

Key events this Week:

A labor market update scheduled for release on Friday is likely to be the most closely watched economic report of the week. The U.S. economy generated 517,000 new jobs in January—far more than expected and the most since last July. The unemployment rate slipped to 3.4%, the lowest since 1969.

Monday

- Factory orders, U.S. Census Bureau

Tuesday

- Wholesale inventories, U.S. Census Bureau

- Consumer credit, U.S. Federal Reserve

Wednesday

- ADP National Employment Report, ADP

- Job Openings and Labor Turnover Survey, U.S. Bureau of Labor Statistics

- Trade balance, U.S. Census Bureau

Thursday

- Weekly unemployment claims, U.S. Department of Labor

Friday

- Jobs and unemployment, U.S. Bureau of Labor Statistics

- Treasury budget, U.S. Department of the Treasury

How is your trading plan in this week?

Any special focus?

Please join the the Daily Discussion with Tigers

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

很棒的文章,願意分享一下嗎?