🚗Tesla earnings: Short-Term Pain😭, Long-Term Gain⬆️

Despite a record-high number of deliveries, Tesla's Q1 earnings and revenue missed expectations. Gross margins declined significantly as a result of price cuts on cars, resulting in a decrease in the average selling price (ASP). Tesla's stock fell 6.07% after-hours. [Cry]

Source from Tiger Trade App

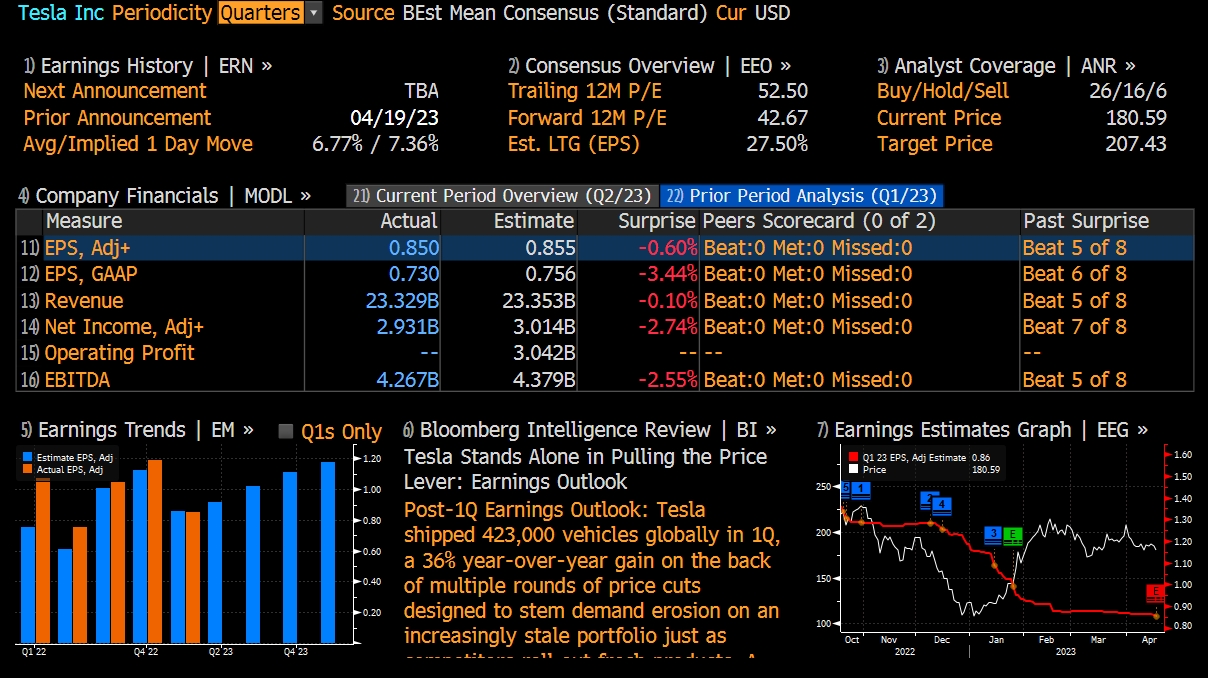

Tesla released its quarterly financial report on April 19th, which showed that its revenue for the quarter totaled $23.33 billion, a 24% YoY increase, slightly below the $23.35 billion consensus estimate of Bloomberg analysts. In addition, adjusted earnings per share (EPS) were 85 cents, a 21% decline over the prior year, slightly below the consensus estimate of 85.5 cents

Source from Bloomberg

Highlights of Tesla's earnings report

Tesla reported a profit of 85 cents a share, meeting expectations, on sales of $23.33 billion, just a touch below forecasts for $23.67 billion.

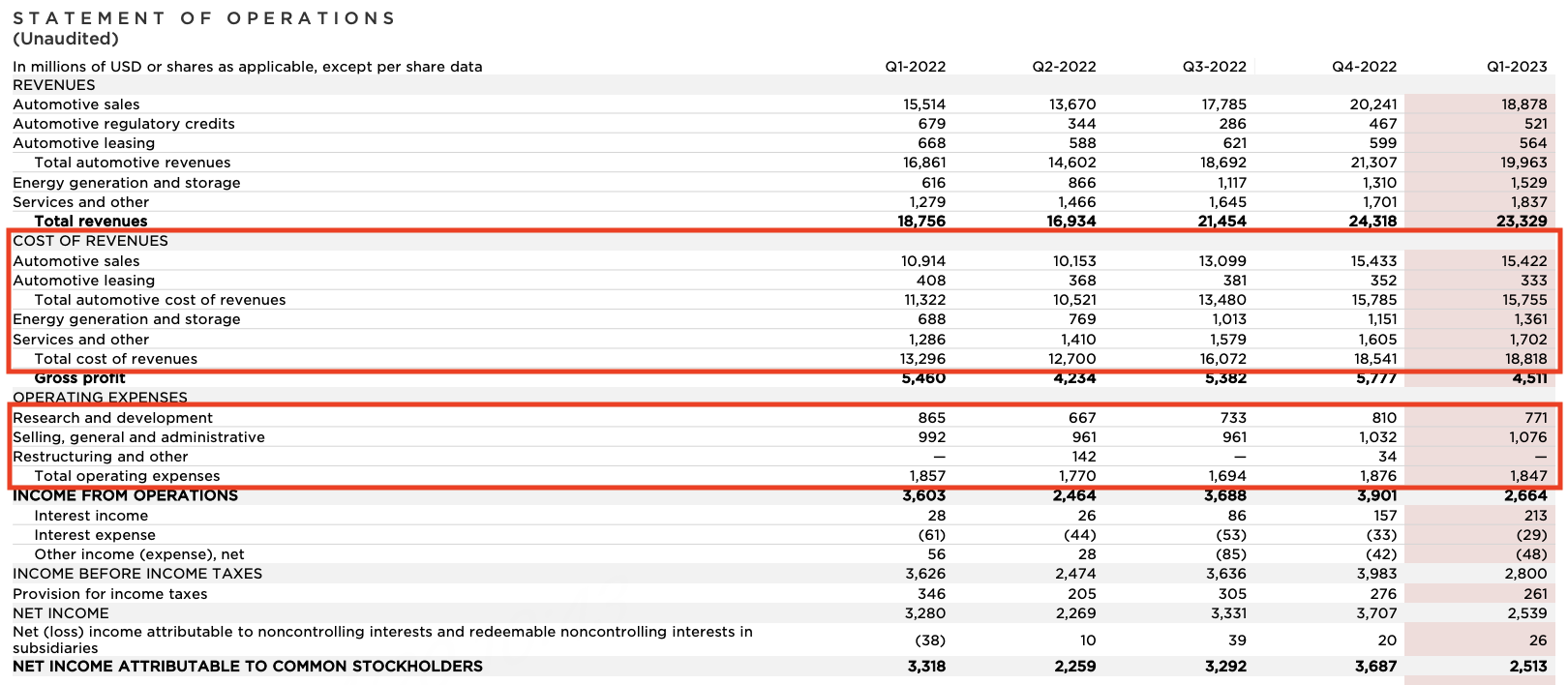

Revenue from the automotive reached $19.96 billion, an increase of 18% YoY and a decline of more than 6% QoQ

For Tesla's automotive business, the gross margin was 21.1%, down from 25.9% in Q4 2022 and 32.9% in Q1 2022.

Overall gross margin was 19.3%, down from 23.8% in Q4 2022 and 29.1% in Q1 2022, lower than the expected 21.2%

Total operating profit reported came in at $2.7 billion, below Wall Street’s expectations for $3 billion.

Operating profit margins came in at 11.4%, down from 19.2% in the year-ago quarter.

The net income attributable to common stockholders (non-US GAAP) was $2.931 billion, a 22% decrease YoY and below market expectations of $3.014 billion.

According to the business segments, automotive revenue in Q1 reached $19.96 billion, an increase of 18% YoY and a decline of over 6% QoQ. Energy revenue was $1.529 billion, an increase of 148% YoY and an increase of 17% QoQ, services and other revenues were $1.837 billion, an increase of 44% YoY and an increase of 8% QoQ.

The main reason for the decline in revenue was the decline in automotive sales revenue from quarter to quarter. Tesla had already reported its Q1 delivery data earlier this month, with 422,875 vehicles delivered, an increase of 36% over the prior year. Delivery of Model S/X was 10,695, a decrease of 27% year over year, while Model 3/Y deliveries were 412,180, an increase of 40% year over year. Although the delivery data is known, it is very difficult to predict Tesla's financial report this time around.

Why? The main reason is that frequent price cuts increase the uncertainty associated with automobile revenue forecasts.

Based on the latest data available, the automobile sales revenue in the first quarter was $18.9 billion, and deliveries were 405,000. The average selling price (ASP) fell from 55,000 US dollars to 44,700 US dollars, a new low in recent years.

Gross profit is below expectations due to frequent price cuts

Automotive gross profit margins, excluding regulatory credits, came in below 16%, down from about 21% in the fourth quarter of 2022. It is the first time that number has been below 20% since the second quarter of 2020.

It is important to note that the market was predicting a worse figure before the earnings report, considering the impact of the price cut, and the earnings data just confirmed this view. However, there are two figures that are quite surprising, namely the COGS cost of goods sold and the overall operating expense performance.

Cost of goods sold refers to the production costs associated with selling products, whereas operating expenses include overhead, sales and marketing expenses, etc. In addition, Tesla does not spend as much money on advertising as traditional car manufacturers, which allows them to save a significant amount of money. Tesla's revenues increased by 24% compared with the same period last year, while its operating expenses decreased rather than increased, reflecting Tesla's precise control of expenses.

2023 Q1 Tesla Quarterly Update

Although Tesla's revenue and profit comparisons are lower than the market expectations, there are several positive aspects to the earnings report, such as the growth of the energy business and the successful control of expenses.

Long-Term Gain⬆️

Despite this earnings report, I still consider Tesla to be a viable investment target. I remain very bullish on Tesla as a business, and I do think that what we’re seeing now is more due to difficult macroeconomic circumstances rather than anything else.

Tesla 2023 Investor Day Presentation

When people hear the term "price cuts," they immediately think of losses and burning money. In contrast to the negative comments that people have made about Tesla's price cuts, I believe that Tesla's price cuts are a wise decision.

China’s growth had been years in the making, with the government offering generous subsidies for electrified cars, in addition to incentives and policies that encouraged production. In 2016, Chinese consumers bought more EVs than the rest of the world combined—and the country hasn’t looked back, accounting for over half of global sales in 2021.

ev sales by country

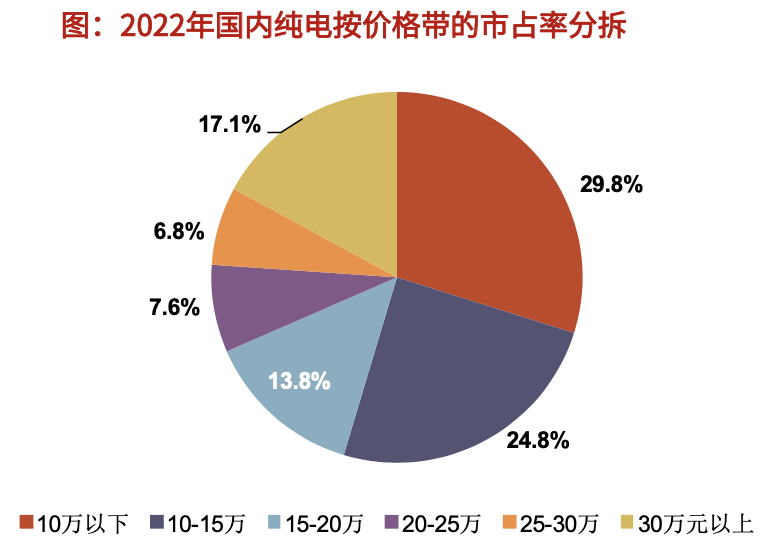

Moreover, if we consider the China market share data for 2022, models below 200,000 RMB account for nearly 70% of the market share. Therefore, Tesla must either lower its prices or launch low-cost models if it wishes to increase penetration of the sinking market and gain more market share.

The reason I am bullish on Tesla, in addition to its ambitions in the market, is the company's recent actions. Tesla mentioned in its post-earnings conference call that it was developing a roadmap for cost reductions through 2026 that included five areas of focus.There was the cell design we discussed, anode and cathode materials, the structural pack concept, and the cell factory itself.

Taking a closer look at Tesla's earnings report alone, it is likely that Tesla's price cut will adversely affect revenue and profits in the short term, however, if you look further ahead, Tesla's future will be far better. $Tesla Motors(TSLA)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

特斯拉的Model S格子和Model X格子——这些车型的性能版本——现在的价格为107,490美元,高于之前的104,990美元。

Space-X's claim that there rockets are reusable is about as accurate as Tesla's claim that their cars are fully self-driving. Both also have a tendency to catch fire and blow up.

BYD sold 207,080 EV's in China in March of which 102,670 were Pure EV's, Tesla sold 88,669 Ev's in March in China.

This could definitely 'double bottom' to $100.

Tesla is crushing the competition like Ford did in the earlier days.

A decent quarterly report

[惊讶] [惊讶] [惊讶]