Holding My BIDU and Expecting a Bargain Hunting of MEITUAN

On Monday night, many Chinese concept stocks performed well due to the appreciation of the RMB exchange rate, and Chinese ADRs led the ETFs market.$FTSE China Bull 3X Shares(YINN)$ , $ProShares Ultra FTSE China 50(XPP)$ , $CSI China Internet ETF(KWEB)$ show significant increase.

Some quality companies shines: $Tencent Music(TME)$ , $JD.com(JD)$ , $Pinduoduo Inc.(PDD)$ , $Vipshop(VIPS)$ , $NetEase(NTES)$.

I’m still holding my $Baidu(BIDU)$ $BIDU-SW(09888)$ and congrats to its latest earnings report, it continues to rise in the pre-market. Because the $Baidu(BIDU)$ 3Q23 results are just out!

Revenue +6% to $4.72B vs. $4.71B (BEAT)

Adjusted EPS +21% $2.80 vs. $2.34 (Major BEAT)

Free Cash Flow $822M

Operating Cash Flow $1.31B

Tehchnically, i believe $Baidu(BIDU)$ is going to stand up MA60, and the trending path will look like how $JD.com(JD)$ performs after Q3 earnings released on November 15th.

I‘m also interested in $MEITUAN(MPNGY)$ $MEITUAN-W(03690)$, who goes to release earnings on November 28th. The company is in a very low price and lack of market confidence, it is expected to report better than estimate results:

Citigroup expects $MEITUAN-W(03690)$ ’s third-quarter results to be announced at the end of November to once again reflect solid performance. Net profit and EBITDA are expected to be better than market expectations, mainly due to the growth of summer travel and in-store business. Food delivery revenue is in line with expectations, and new business losses are expected to narrow.

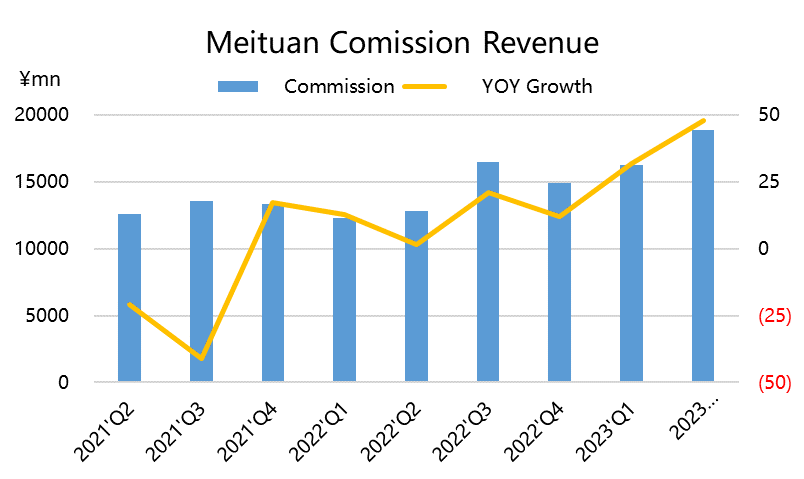

Judging from the last quarter, $MEITUAN-W(03690)$ $MEITUAN(MPNGY)$ is the only Internet company (among listed companies) that still maintains a revenue growth of 25%-30% after $Pinduoduo Inc.(PDD)$ .

Q2 Earnings Highlight:

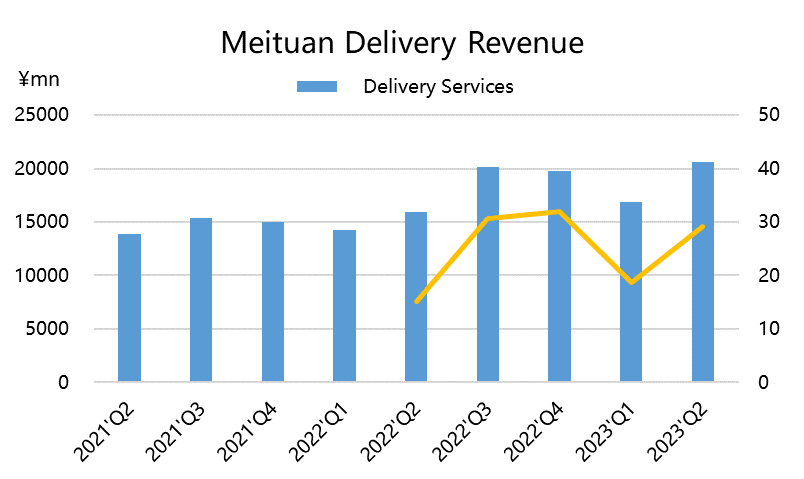

The takeaway business has grown steadily, and gross profit has shown a trend of expansion.

Hotels have fully recovered, and competition in local life affects profits

The group buying business experienced economic decline, and it is obvious that all merchants are engaging in promotions. $MEITUAN-W(03690)$ does have an advantage if promotions are ignored, but promotions have taken away a lot of business from Douyin/Tiktok.

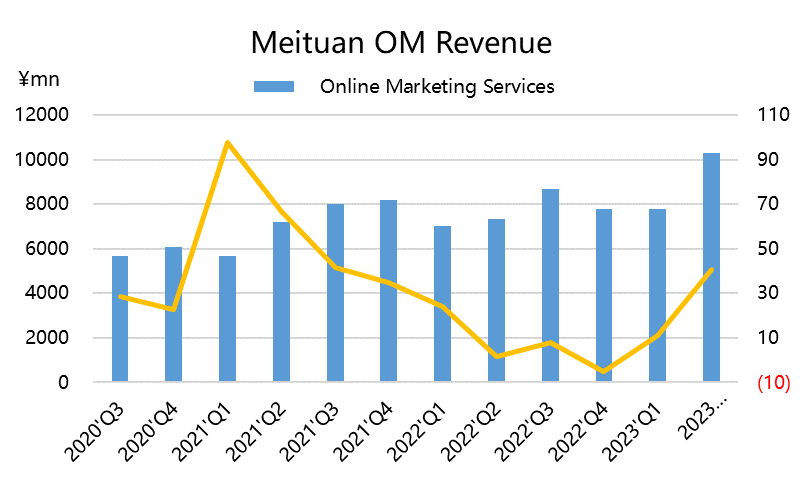

The overall core commercial gross profit margin of Meituan in Q2 was the same as the previous quarter, because marketing expenses in Q2 increased by 62%. In addition to subsidies for innovative businesses, in order to cope with competition, there are also many subsidies for in-store merchants. Fortunately, administrative expenses continued to shrink by nearly 15%, and R&D expenses only increased by less than 4%.

Other income in Q2 also reached 1.5 billion yuan. Due to the recovery of the overall environment and Meituan's strong cash flow, the increase in financial management income and fair value changes was also greater.

From the perspective of valuation analysis, although the profits of each business of Meituan Q2 have changed, the overall profits are in line with linear growth. Since the past two years have just been the first two years of stable profitability, analysts believe that the profit growth rate may be higher in the future.

I think the current price of Meituan has dropped a lot compared to the Q2 financial report stage. The overall market lacks confidence. After a period of consolidation, now is the time to bargain hunting.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

At which price do you think it is better to buy Meituan shares?

It is time to shine post market ... all the A.I. talks ... my forecast post earnings is $128.00 go BIDU!

Hate to say this, but it seems the stock price went down every time after the earning report, no matter how good it was. Let’s see if it is the same this time.

share price is significantly undervalued based on today's earning report. This should get to 125 pretty quickly....

Earnings report meet expectations, there is also no new developmemts/updates on its promising AI or robotaxis.