Snowflake's Guidance Down Is A Warning To Cloud Insdustry?

$Snowflake(SNOW)$ 's stock price plummeted 23% after hours due to two negative announcements in its Q4 earnings report, which undermined market confidence.

Q4 Earnings is still a super beat

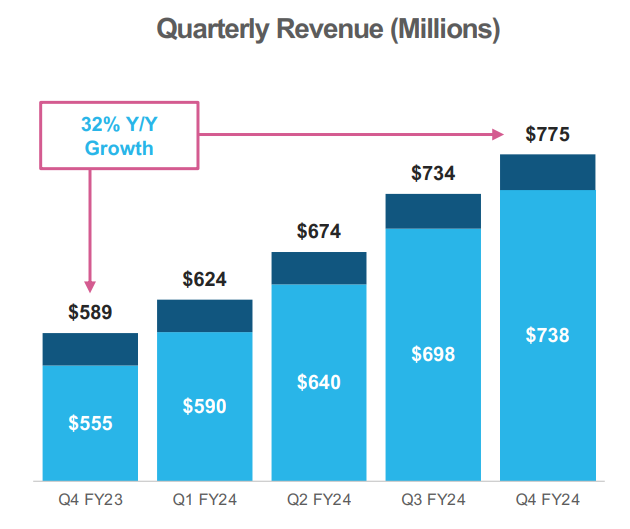

with revenue reaching $774.6 million, a 32% year-over-year increase, surpassing the market's expected $760.4 million. Product revenue also grew by 33% year-over-year, reaching $738.1 million, higher than the expected $723.3 million.

The adjusted EPS was $0.35, exceeding the market's expected $0.18.

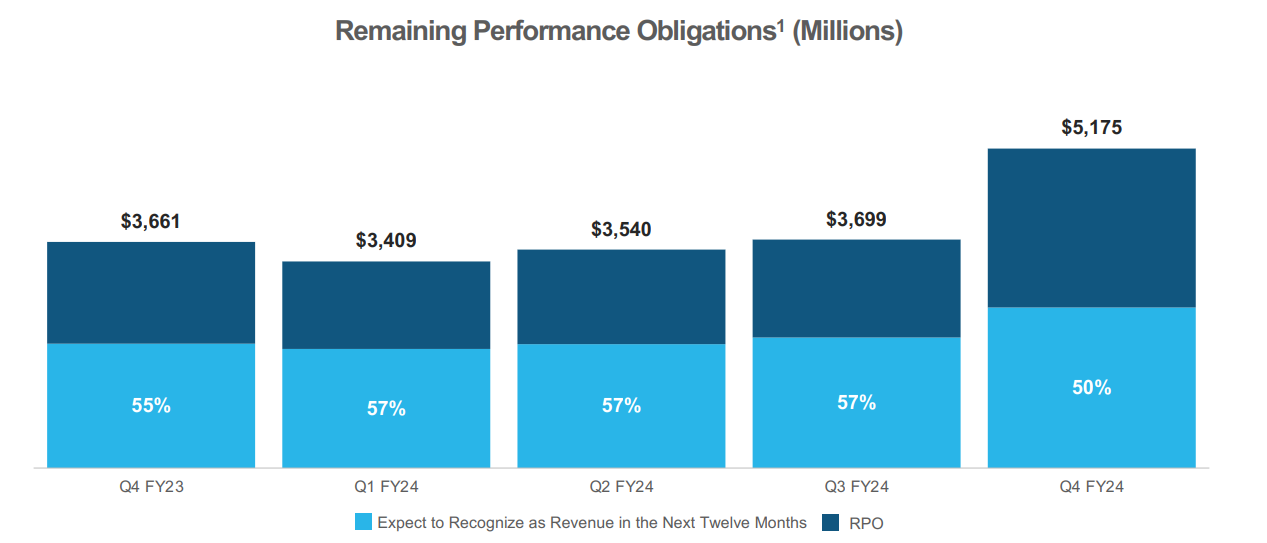

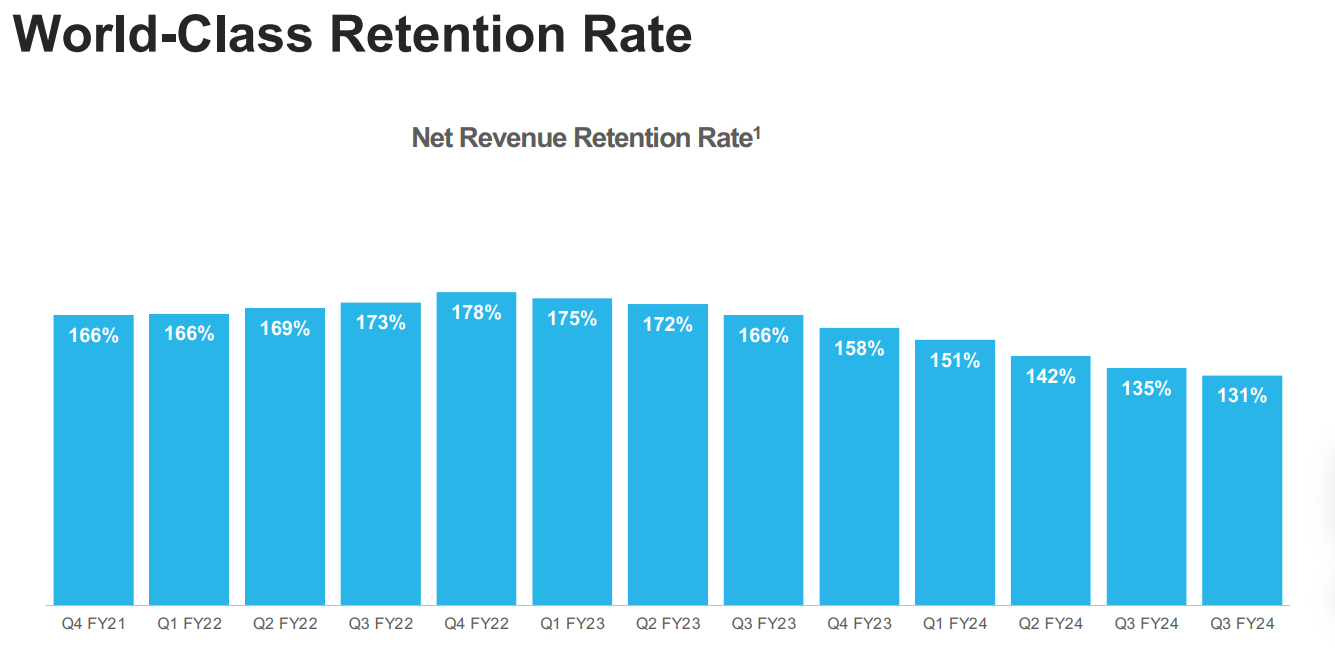

The remaining performance obligations (RPO) during the period increased by 41% year-over-year, reaching $5.2 billion. Although the user retention rate decreased slightly, it remained high at 131% Net Dollar Retention.

Two Negative News

A downward guidance and an expected significant slowdown in revenue for the 2025 fiscal year, with product revenue projected to grow by 22% year-over-year, far below the 38% growth in the 2024 fiscal year.

Additionally, a change in management was announced, with CEO Frank Slootman retiring and being replaced by Sridhar Ramaswamy with immediate effect.

Investment Highlights

1. Snowflake has always attracted investors with its "high growth, high valuation" characteristic. Now, if the company itself believes that its revenue and profit growth are not as strong as before, investors who previously valued it based on high growth models may need to reevaluate it.

2. This indicates a structural trend in cloud data growth, including challenges faced by its consumption model, and the company's net revenue retention rate continues to decline. Due to the current uncertain IT spending environment, the pace of company (customer) spending growth has slowed down, which is why SNOW's financial report led to a significant drop and also affected giants like $Amazon.com(AMZN)$ and $Alphabet(GOOGL)$

3. Management changeovers often make investors worry about the uncertainty of future strategies. In addition, the management in this financial report expressed caution about the recovery of consumer demand, indicating that it will take time to realize demand recovery, leading to increased investor uncertainty.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- LEESIMON·03-01🩷Hang onLikeReport