Q2 Earnings Special: Big Banks In Divergence

This week, major U.S. banks reported Q2 earnings.Overall the results were good, with some characteristic differences in different business categories.

Investment banking continued to recover.

All of the major investment banking segments recorded a return to growth and are recovering from the slowdown of the previous two years, and IPOs and M&A, while nowhere near the peaks of the low-interest-rate era, are beginning to grow.Of course, further investment banking activity is likely to follow the fall in interest rates.Only then will business such as private placements recover further.

Record highs in equity markets lead to continued record highs in wealth management.

Thanks to the strong performance of the stock market in Q2, many banks saw a boost in their asset and wealth management businesses, which they are increasingly relying on to generate steady fee income to offset the downturn in the trading business.Among them, GS's wealth management revenue rose 27% year-on-year.Bank of America, JPMorgan Chase and Wells Fargo all recorded 6% growth.Of course there were underperformers, such as MS's wealth management business whose revenue rose just 2% year-over-year.

The consumer business in divergence.

Consumer borrowing is active due to strong employment and rising wages, but still higher levels of inflation and interest rates are putting pressure on consumer budgets and diverging among higher- and lower-income households.

Q2 More borrowers are actively using credit cards and more are defaulting on payments.While overall credit card loan losses have leveled off, consumers with lower credit scores have seen a greater decline in payment rates and have begun to borrow more, and some banks have begun to raise provisions to cover potential consumer loan losses.

By the numbers.

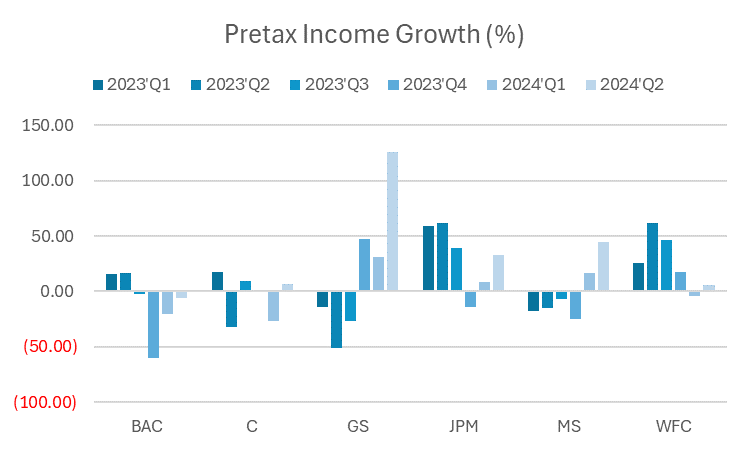

$Goldman Sachs (GS)$ had the largest increase in pretax profit, while $Bank of America (BAC)$ had the most negative impact.

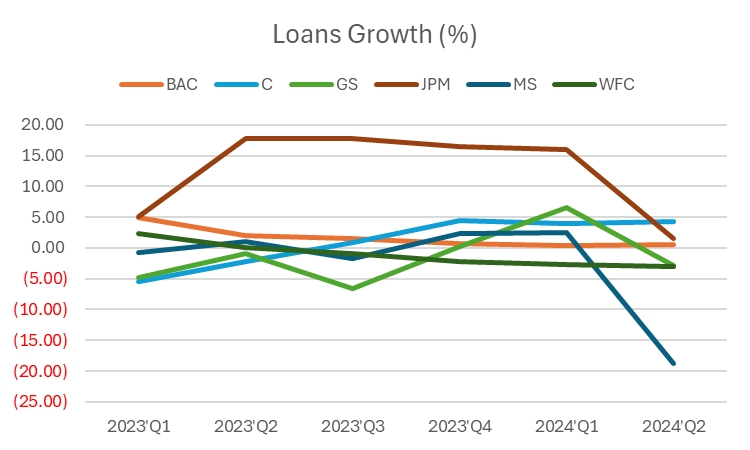

Lending declined overall, with $Morgan Stanley (MS)$ posting the largest decline.

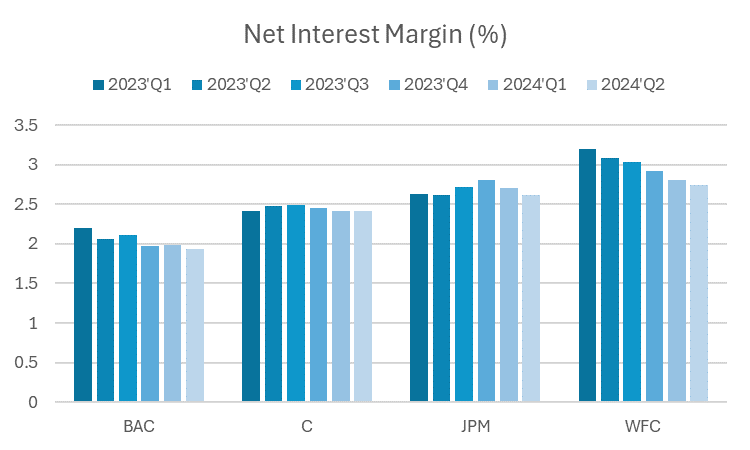

The downward trend in net interest income was most pronounced at $ Wells Fargo & Co (WFC)$ due to instability in the consumer business and the impact of the high interest rate environment on consumers.

JPMorgan Chase (JPM) $JPMorgan Chase(JPM)$

Strong earnings beat expectations

Net interest income (NII) grew 4% to $22.7 billion

However, the bank has had to raise deposit rates, which could impact future net interest income

Despite the good results, shares fell 1.21% after the earnings report

Citigroup (C) $Citigroup(C)$

Earnings beat estimates, up 4% to $20.14 billion

Earnings per share of $1.52 exceeded expectations of $1.39

Investment Banking revenue increased 60 percent to $853 million

Fixed Income revenue down 3% from Q2

Shares down 1.80% after earnings despite strong overall results

Wells Fargo & Co (WFC). $Wells Fargo(WFC)$

Revenue and earnings beat estimates

However, net capital income (NII) declined 9% to $11.92 billion, below expectations of $12.12 billion

NII for the remainder of 2024 is forecast to decline 7% to 9% year-over-year

Worst performer in the S&P 500, with shares down 6.02% post-earnings

Goldman Sachs (GS) $Goldman Sachs(GS)$

Net income: $12.73 billion, beating analysts' expectations Earnings per share (EPS): $8.62, sharply up from $3.08 a year ago

Investment banking revenue: $1.8 billion, up 70% year-over-year

Equity trading revenue: $3.17 billion

Assets under management hit $2.9 trillion, an all-time high

Shares are +2.19% following the earnings report

Additionally, the company announced a quarterly dividend increase to $3.00 per share.

Morgan Stanley (MS). $Morgan Stanley(MS)$

Net income: $15 billion, up 12%; earnings per share (EPS): $1.82, beating analysts' expectations of $1.65

Institutional Securities revenue: $6.98 billion, up 23% year-over-year

Wealth management revenue: $6.79 billion, up 2% year-over-year

Investment Management revenue: $1.3 billion, up 22%, with total client assets of $7.2 trillion

Shares were +0.91% the day after the earnings report

Bank of America Corp (BAC). $Bank of America(BAC)$

Net income: $25.4 billion; earnings per share (EPS): $0.83, beating analysts' expectations

Net interest income (NII): $14.2 billion, down from $14.4 billion in the previous quarter

Fixed income trading revenue: $2.5 billion, up 18% year-over-year

Equity trading revenue: $1.7 billion, up 16% year-over-year

Investment banking fee income: $1.2 billion, up 7% year-over-year

Shares rose 5.35% after the earnings report

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- cheezzy·07-17Great results from the big banksLikeReport