How is Hasbro revised?

$Hasbro(HAS)$ has seen an upturn after several quarters of low stock prices, reporting 2024Q2 results on July 25th that beat market expectations and lifted guidance.

The company turned around despite a year-over-year decline in revenue, but significantly improved profitability by divesting its entertainment business and reducing the burden of high-cost operations.The highlights on the revenue front are still currently focused on a few key titles such as Baldur's Gate 3 in the digital gaming business, and the company still needs to strengthen its new game capabilities in this segment.

Investment highlights

Revenue down but better than expected, with improved performance in the consumer products segment

Q2 total revenue was $995 million, down 17.1% year-on-year, but still beat market expectations by $52 million.

Excluding costs associated with the divestiture of eOne's movie and TV business, revenue declined just 6%.

Despite the revenue decline, meaningful progress was made in transforming the Consumer Products business.

Profitability rebounded significantly, thanks to significant cost controls

The company successfully turned around from an operating loss of $188.6 million to a profit of $212.1 million in the same period last year.

Adjusted EPS reached $1.22, a significant increase from $0.49 in the same period last year.

Adjusted Operating Margin reached 25.0%, significantly improving profitability.

On the cost control front, cost of sales was cut by more than 30%, and total costs and expenses were nearly halved to $783 million by streamlining operational processes and improving supply chain efficiencies.

In addition, the company effectively managed inventory, reducing owned inventory by 51%, with consumer goods inventory down 55%.This not only reduced inventory costs, but also improved cash flow

Strong growth in the digital games business and steady growth in the table games business

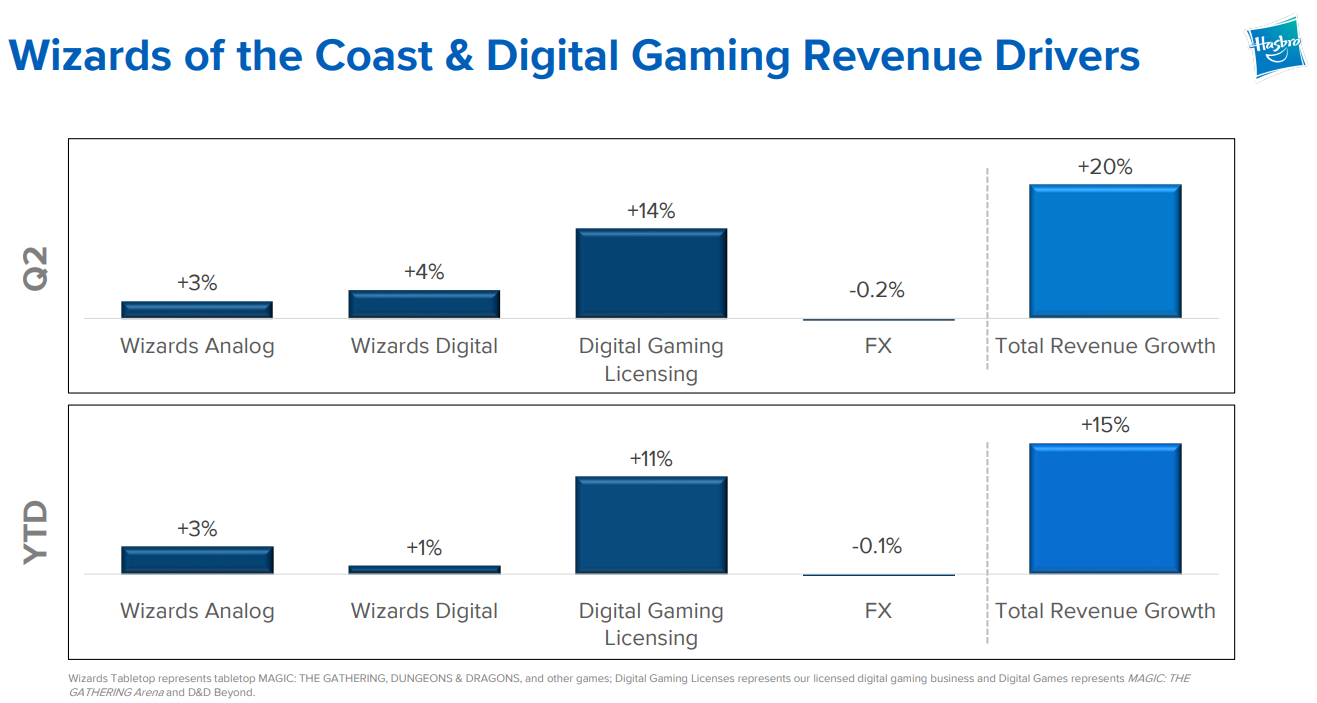

Revenue in the Wizards of the Coast and Digital Games segments grew 20%, driven by the following products

Magic: The Gathering (MTG).

The releases of Modern Horizons 3 and Commander Masters significantly drove revenue growth;

Universes Beyond: continued high sales of The Lord of the Rings series also contributed significantly to revenue growth.

Baldur's Gate 3: The RPG developed by Larian Studios has performed so strongly since its August 2023 release that it has been described by Hasbro CEO Chris Cocks as "the equivalent of a major blockbuster release", generating more revenue than all of the company's movie licenses over the past 5-10 years combined.more than all of the company's movie licenses combined over the past 5-10 years.

Monopoly Go!: the mobile game released in April 2023 also performed well, making it one of the best performing mobile games.

Table game revenues (MAGIC: THE GATHERING) grew by 3 percent

Future Outlook:

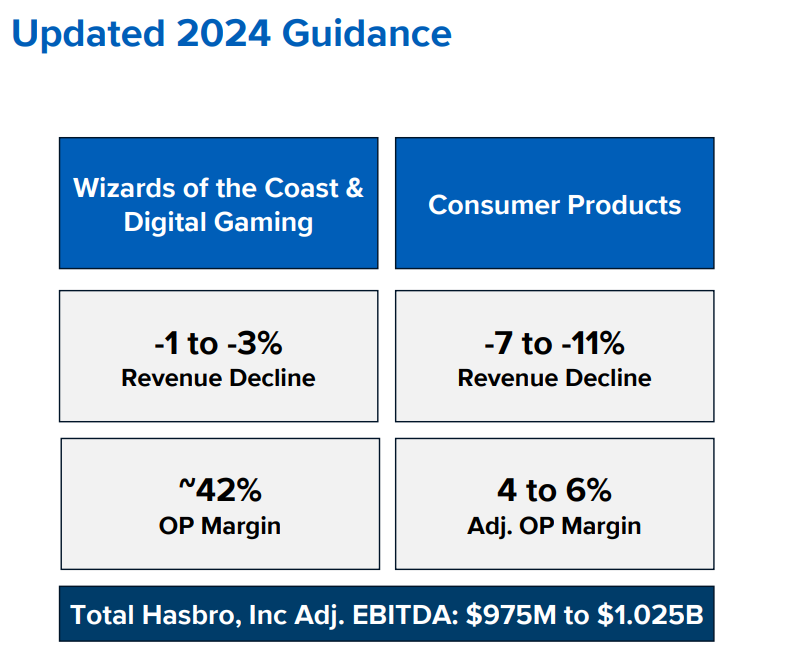

The company expects Consumer Products segment revenues to decline 7% to 11% in 2024, with an adjusted operating margin of 4%-6%, both better than market expectations.

Wizards of the Coast segment revenue is expected to decline 1%-3%, with an operating margin of about 42%.

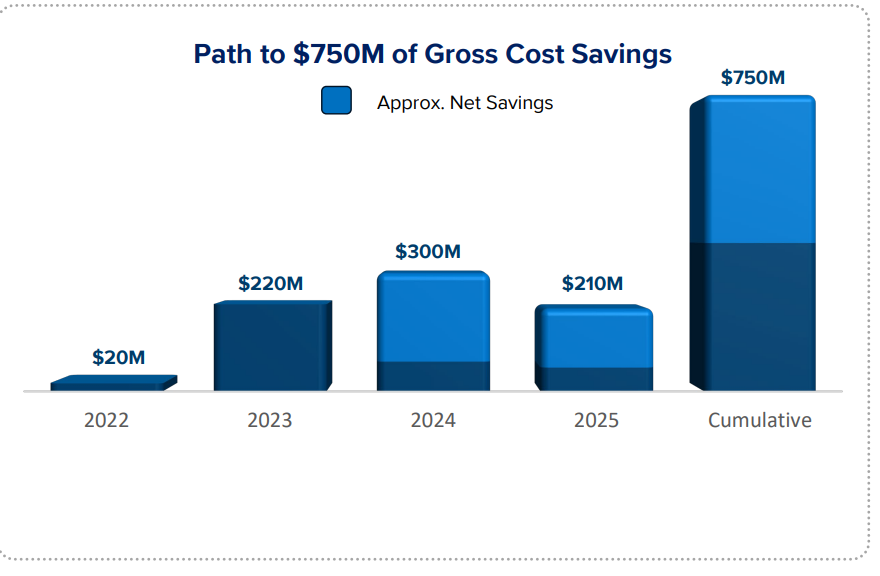

The company has set a goal of realizing $750 million in total cost savings by the end of 2025.

On the divestiture of the entertainment business

The Company divested its eOne movie and television business in Q2, reducing the high costs and capital expenditures associated with entertainment content.This move allowed the Company to focus its resources on its core businesses with more profitable potential;

The entertainment industry, particularly in movies and television, has faced challenges such as actor strikes and rising production costs.

The divestiture of the eOne movie and television business will change Hasbro's revenue mix, with a reduction in entertainment content revenue, but it will also mean that the company can reduce its associated operating costs and capital expenditures, which will improve its overall financial health.

At the same time, the company would gain approximately $500 million in cash flow, which could be used to pay down debt or invest in other high-return business areas, further optimizing the company's financial structure

Additionally, in an interview on July 23, 2024, $Mattel(MAT)$ CEO Ynon Kreiz responded to rumors of a possible acquisition of Mattel by Hasbro with confidence in its ability to create long-term value for shareholders as an independent company.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- blinki·2024-07-26Impressive turnaround by HasbroLikeReport