US stocks are the asset that counts for the lowest rate cut?

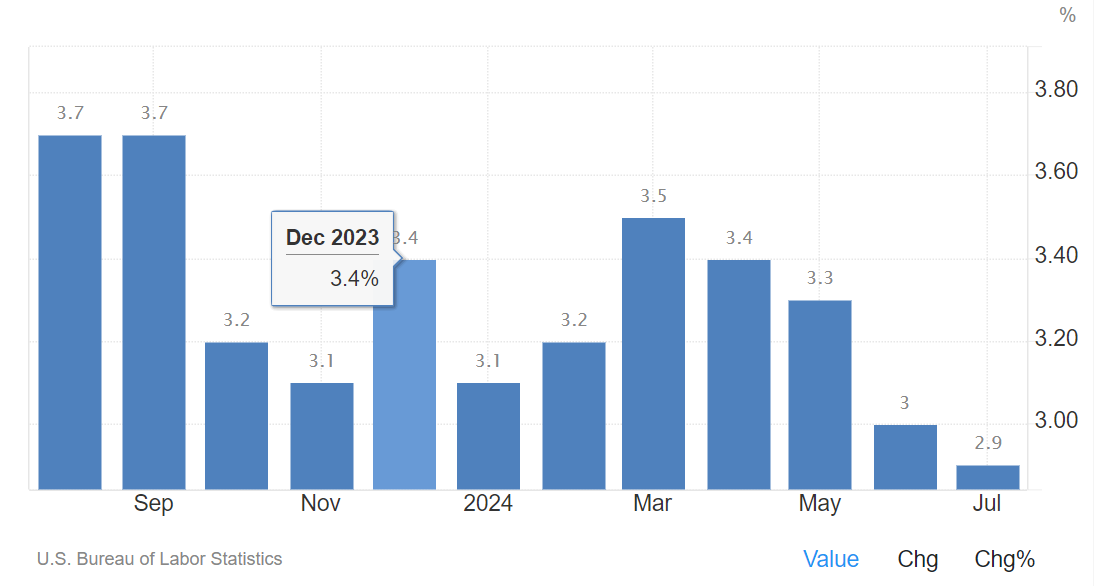

U.S. CPI continued to show a clear cooling trend in July, with headline CPI growth coming in at 2.9% year-on-year, below expectations and the previous 3%.Core CPI, on the other hand, remained unchanged at 3.2% year-on-year, in line with expectations but lower than the previous value of 3.3%, and was also influenced by the following factors:Instead

Reduced inflationary pressures: headline inflation levels eased as energy and food prices stabilized.

Strong retail data: July retail sales rose 1% YoY, well ahead of expectations of 0.4%, indicating resilience in consumer demand.

Labor market cools: the unemployment rate rose to 4.3% and non-farm payrolls added fewer jobs than expected, suggesting that the labor market is less tight.

Together, these data provide support for a possible rate cut that could engage up to 50 basis points that the Fed could open up in September.

The possibility of the Fed's policy path

Based on current economic data and statements from Fed officials, the market generally expects the Fed to turn on rate cuts at its September 2024 meeting.The following is an analysis of the policy path:

Need for a rate cut: with CPI and core CPI falling, inflation is moving closer to the 2% target, which, combined with a cooling labor market, creates the conditions for a rate cut.

Market expectations: CME interest rate futures show that the market has reached a 100% probability of a rate cut in September, with a higher probability of a 25 basis point cut at 75%.

Limitations on rate cuts: Despite strong expectations for rate cuts, the overall rate cuts are likely to be limited, and are expected to be in the range of 4-5 cuts (~100 bps).Market expectations of significant rate cuts are unrealistic, mainly because economic fundamentals have not deteriorated across the board.

Stock and Financial Markets

The impact of changes in US CPI data on global stock and financial markets should not be ignored:

Market sentiment: Lower CPI may boost market confidence in a soft landing of the economy and drive global equity markets higher, and vice versa.

Performance of risky assets: Expectations of rate cuts may make investors more inclined to allocate to risky assets, such as equities and high-yield bonds, thus affecting liquidity and risk appetite in global financial markets.

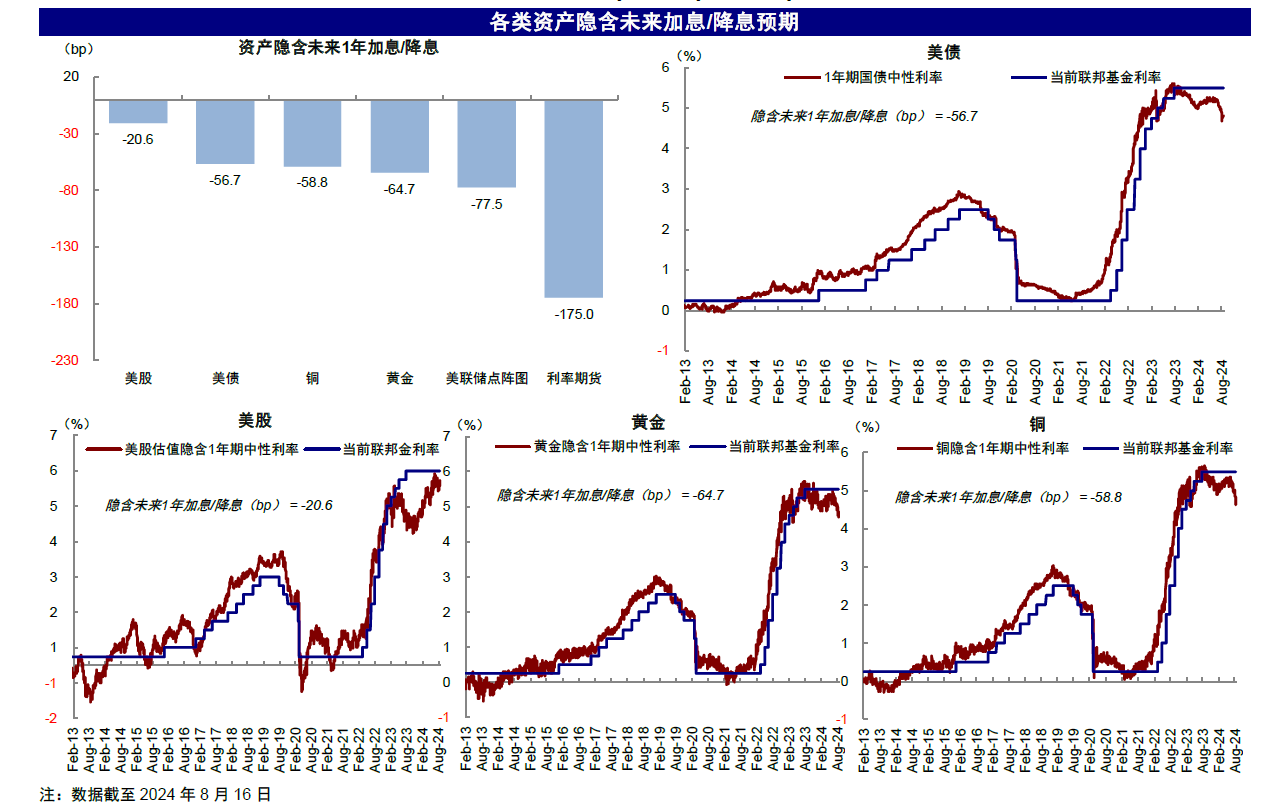

Expectations of interest rate cuts in major asset classes

1. Interest rate futures

The interest rate futures market has been the most responsive to expectations of rate cuts, implying seven rate cuts in the coming year.The current interest rate futures implied August 2025 interest rate level of 3.8% shows that the market's strong expectation of rate cuts is fully accounted for, especially on the possibility of the first rate hike of 25 basis points in September.

2. Gold

$SPDR Gold ETF (GLD)$ Gold, as a safe-haven asset, implies 2.6 rate cuts in the coming year, showing the market's higher expectations for rate cuts.The current gold price of $2,508 per ounce has an implied real interest rate of 1.76%, slightly lower than the current 1.80%.Gold's performance has benefited from the expectation of a rate cut, showing investors' concern about future economic uncertainty.

3. US bonds

Short-term U.S. bonds imply 2.3 rate cuts over the next year, while long-dated U.S. bonds are more fully anticipated in $US10Y(US10Y.BOND)$ The current $US12M(US12M.BOND)$ 1-year U.S. bond counts 56.7 basis points of rate cut expectations, showing the market's reaction to the Fed's possible emergency rate cuts.Despite the short-term recovery in U.S. bond rates, overall rate cut expectations remain.

4. US Equity

U.S. equities are the least exposed to rate cut expectations, implying only 0.8 rate cuts over the next year.The current dynamic valuation of the $S&P 500(.SPX)$ index implies a 10-year U.S. bond rate of 4.45%, which corresponds to an expected rate cut of 20.6 basis points.This suggests that the U.S. equity market has reacted relatively conservatively to the rate cut, focusing more on the earnings outlook and fundamentals.

Various types of assets on the rate cut expected to count the situation shows a clear "rush" degree of ranking: interest rate futures > gold > U.S. bonds > U.S. stocks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- jigglyp·08-19Interesting analysisLikeReport

- YueShan·08-19Good⭐️⭐️⭐️LikeReport