Market Volatility Will Be Back Soon, It`s Not The Best Time to Buy Gold

The Federal Reserve announced its interest rate decision at 2 a.m. this Thursday night. The market has made it clear that the path of interest rate cuts has started. However, there are still differences on whether this meeting will be 25 basis points or 50 basis points.

This is also the focus of market fluctuations this week. 25 basis points is considered as a bad news. 50 basis points are considered bullish, and the market will react to this to a certain extent. As for between recession and interest rate cut, the market will make a choice during the movement. In fact, recession is more of a short-term worry. After all, the Federal Reserve still has a lot of room to cut interest rates, so I still think that if it falls too much, it is an opportunity to buy bottoms, whether it is commodities or stock indexes.

Will there be a big move in the US stock index?

On the weekend, there was news that Trump was attacked while playing golf, so the "Trump trade" drama in the financial market began to be staged again, and the Dow was stronger than the Nasdaq. It is common for the two parties to compete in the election year, but it has little impact on the overall trend of the U.S. stock index. In the end, it only affects the differentiation between the indexes. Therefore, this situation of strength-to-weakness conversion of the Dow and the Nasdaq will last until the end of the election.

The current market is more suitable for investors who engage in hedging and arbitrage between indexes to trade, but this is relatively demanding trading technology, and it is appropriate for ordinary investors to remain unchanged.

Pay attention to the trend of reversing after the gold pulse

Gold prices hit record highs, spurred by news of the Federal Reserve's interest rate cut.

When market expectations reach the extreme, it is very easy to trigger a sharp correction in gold prices. In terms of time period, next week is the key node, but it is not ruled out that the Federal Reserve will respond in advance when it comes to news.

Therefore, everyone should pay attention to the rhythm of the gold price. If you don't get on the bus, don't rush to chase high. After the Mid-Autumn Festival in China, there will be National Day after the domestic Mid-Autumn Festival, It will not be good to cause a large adjustment and a large fluctuation in the account.

As for the overall trend of silver and gold, the correction of gold price will also be slightly adjusted. However, silver rebounded sharply last week, and it is difficult to weaken again, so there is a low point to intervene.

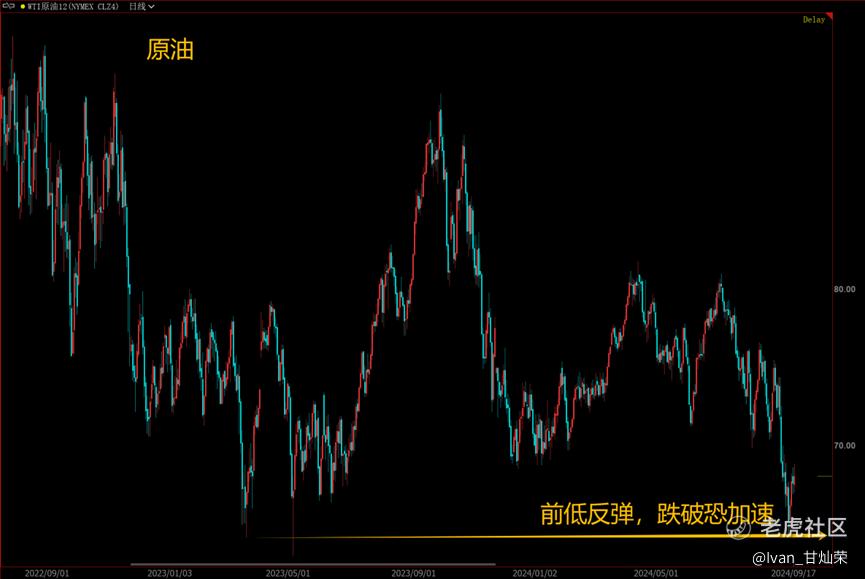

Crude oil pays attention to the rebound and accelerates its decline again

The sharp drop in oil prices surprised many people. However, last month's technical analysis has clearly told everyone that there are clear potential negative factors for the drop in oil prices, but it has just been realized now.

Technically, the process of oil price decline has not yet been completed. According to historical experience, the lowest decline in oil price should also reach the prefix five. At present, the oil price has only rebounded slightly from the previous low. If it falls again after the rebound and falls below the previous low (around US $64), I'm afraid it will accelerate the decline driven by the news, so the current oil price should not easily buy the bottom. After the interest rate meeting and OPEC + begins to increase production, observe the market reaction before making a decision. Of course, if you are looking forward to shorting friends, you might as well buy put options again after the rebound. The accelerated decline in oil prices is still the best way to deal with it.

$NQ100 Index Main 2412 (NQmain) $$Dow Jones Index Main 2412 (YMmain) $$SP500 Index Main 2412 (ESmain) $$Gold Main 2412 (GCmain) $$WTI Crude Oil Main 2411 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Barcode·2024-09-18Fed Reserve Announced? Or will announce? 2am where? Cheers, BC 🍀1Report