How did Snap's strong results make it soar?

"Burn-after-reading" $Snap Inc (SNAP)$ rose more than 10% after announcing earnings after the bell on Tuesday, with Q3 results showing both revenue and profit beating market consensus estimates, while activity returned again

Earnings Overview

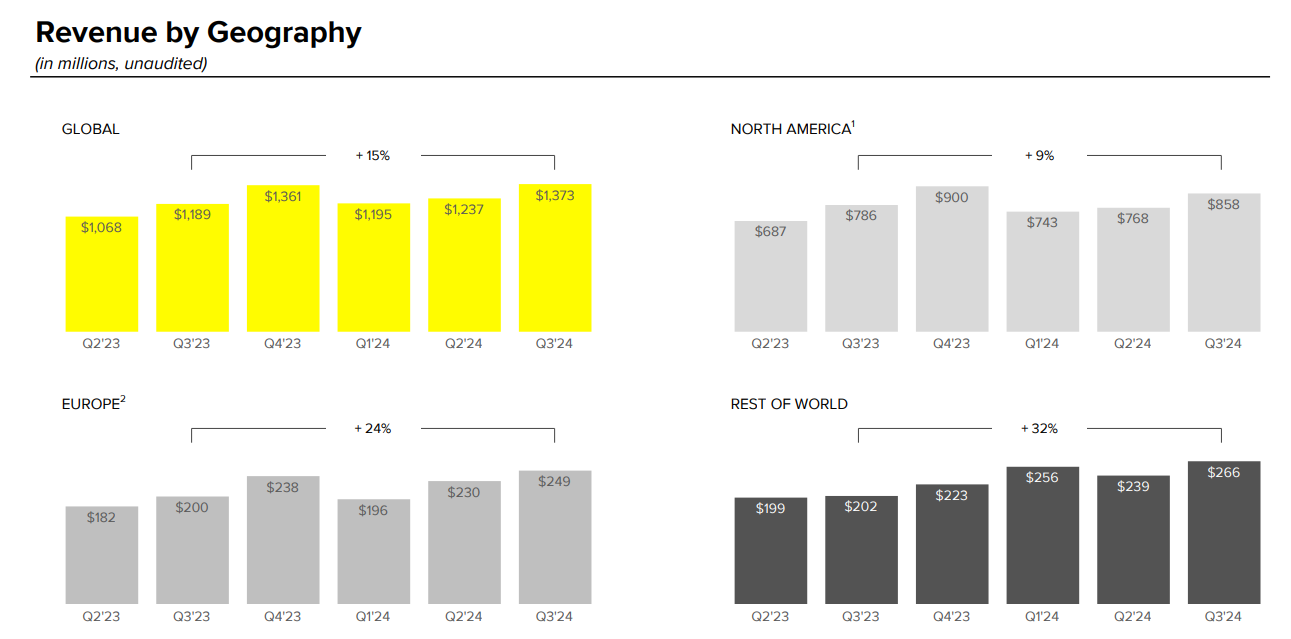

Revenue: Q3 revenue totaled $1.373 billion, an increase of 15% year-over-year, primarily due to the buoyancy of the advertising business.

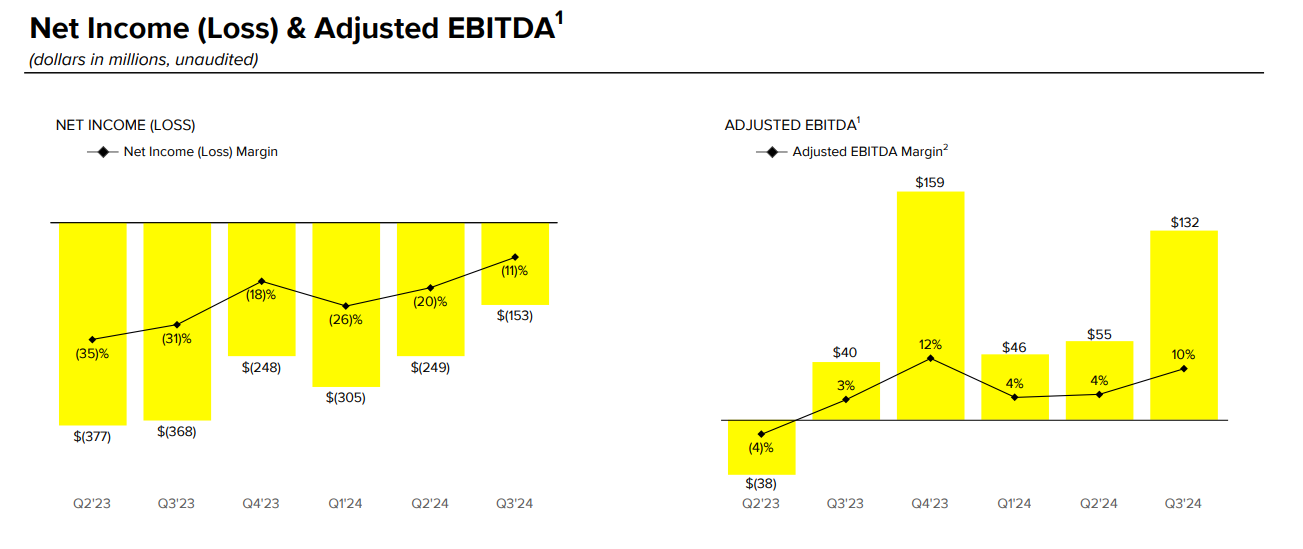

Profit: Q3 net loss was $153 million, down 58% from $368 million a year ago, with the company making significant progress in controlling losses; adjusted EBITDA was $132 million, up 229% year-over-year.

Business.

Advertising revenue was up 10% year-over-year, with direct response (DR) advertising revenue up 16%, illustrating the strength of SMB advertising demand, and the total number of active advertisers more than doubling year-over-year;

Brand advertising revenue declined slightly (down 1% year-over-year) as a shift in the company's overall advertising strategy appears to be attracting more advertisers

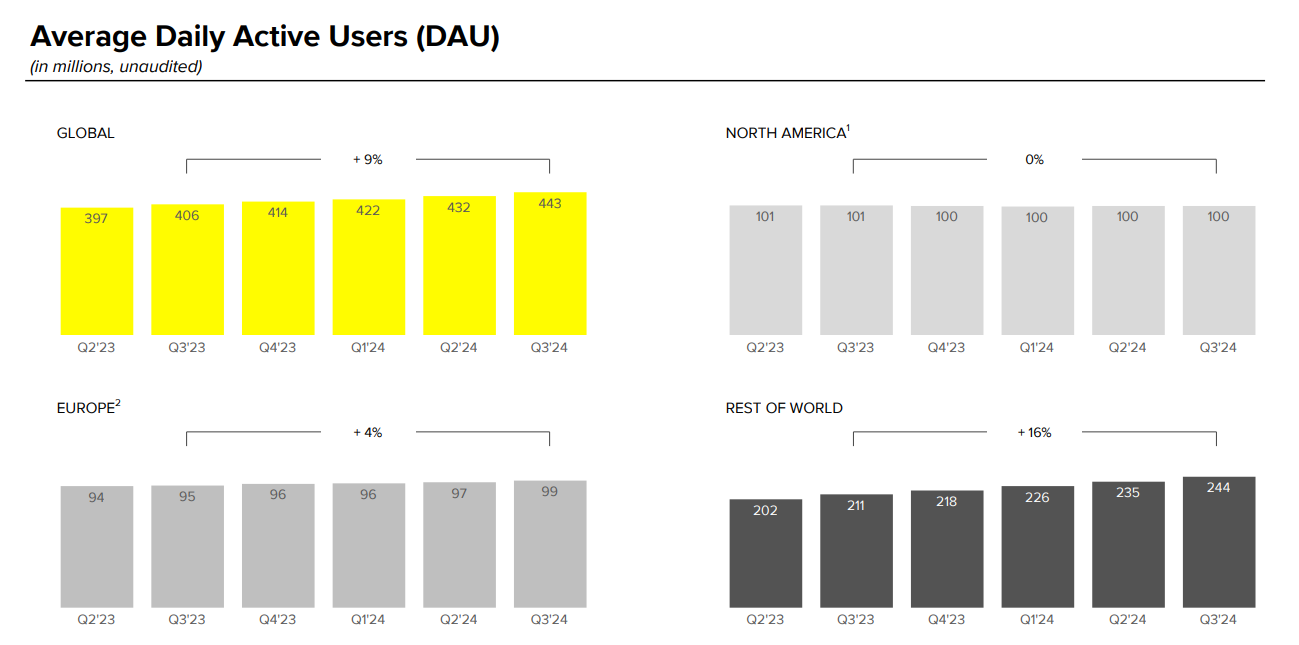

In terms of user growth, DAUs reached 443 million, up 9% year-over-year (an increase of 37 million users).Users increased their viewing time on video content by 25%, further boosting user engagement.

The Snapchat+ subscription service has more than 12 million users, doubling from last year and bringing in about $123 million in revenue.The service includes a number of additional features, such as AI-powered chatbots, which have attracted more users.

In addition, the company's board of directors approved a $500 million buyback that will take place over a 12-month period.

Guidance

Q4 revenue is expected to be in the range of $1.510 billion to $1.560 billion (midpoint of $1.535 billion), up 11% to 15% year-over-year.

Adjusted EBITDA is expected to be in the range of $210 million to $260 million (midpoint of $235 million), ahead of the last voyage estimate of $233 million.

Daily active users are expected to be around 451 million versus the consensus estimate of 448.63 million.

Full-year results will be 4% to 5% below the low end of its guidance range due to a "modest increase in stock-based compensation expense" in the fourth quarter.

Investment highlights

The company said it is in the early stages of trials of two new ad formats - Sponsored Snaps and Promoted Places - which will further drive revenue growth.

Snap will continue to invest in augmented reality (AR) technology and content creation tools to enhance the user experience.In addition, the company plans to attract new users and retain existing users through personalized recommendations and social interaction features.

Snap demonstrated strong financial performance and user growth in Q3 2024, but still has to deal with weak demand for brand advertising.Management is optimistic about the future and plans to drive further growth through technology investments and new product launches.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.