Airbnb's post-hour volatility, bookings grow but guidance miss?

$Airbnb, Inc.(ABNB)$ has had a great after-hours, jumping more than 9% at one point after reporting Q3 earnings as it beat expectations for the period, only to give back all of its gains and fall slightly as guidance fell short of expectations.

Earnings performance

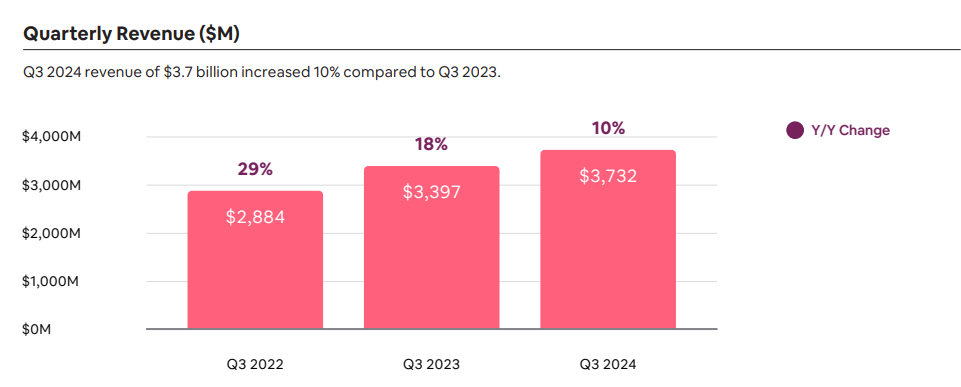

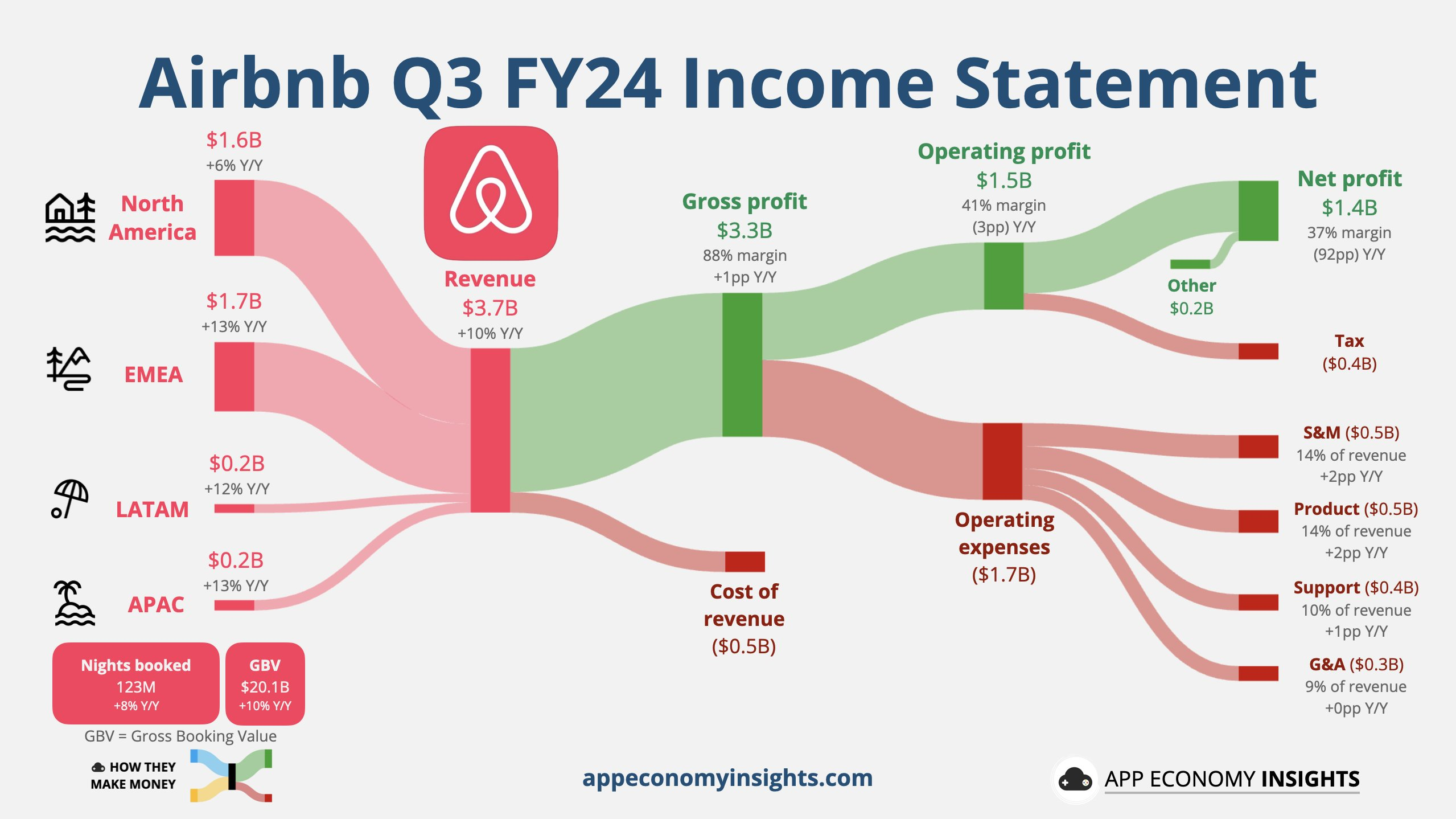

Total revenue: $3.7 billion, up 10% year-over-year, slightly ahead of expectations;

Net profit: $1.4 billion, EPS of $2.13, slightly below market expectations of $2.16.

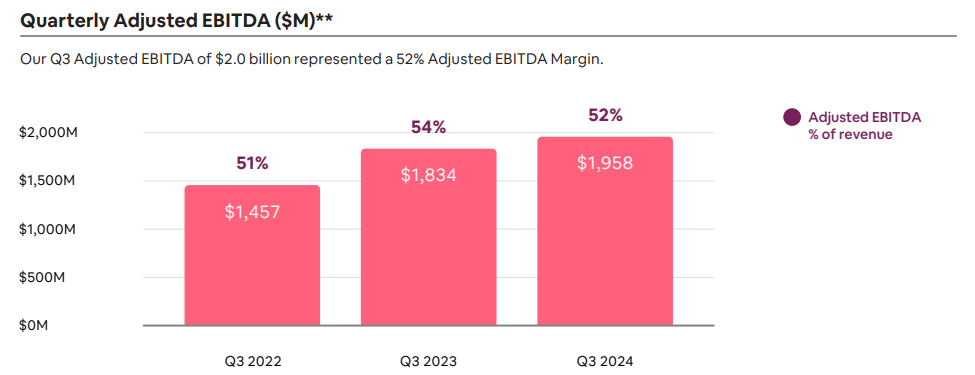

EBITDA profit: $1.958 billion, beating expectations of $1.86 billion.

Total bookings: reached $20.1 billion, up 10% year-over-year, beating market expectations of $19.8 billion;

Booked nights and experiences: totaled 122.8 million, up 8% year-over-year.

Free cash flow: at $1.1 billion, reflecting the company's strong cash generation.

Performance Analysis

INTERNATIONAL MARKET GROWTH: The Company's performance in international markets was strong, with Asia Pacific and Latin America continuing to lead the way in terms of growth.

Bookings in Asia Pacific grew 19% year-over-year, with growth in line with the second quarter, with an overall reliance on cross-border travel, where bookings grew 23% year-over-year.The recovery in Asia Pacific has been gradual, with the recovery in the China outbound business encouraging.

Bookings in Latin America grew 15% year-on-year, a slowdown from the 17% growth rate in the second quarter.However, intra-regional travel continued to be strong, with in-country overnight bookings up 21% year-on-year in the third quarter.

Demand for short-term rentals pick s up: Demand for short-term rentals increased significantly as travel activity resumed, especially in the run-up to the holiday season.

Increased app usage: bookings made through mobile apps accounted for 58% of total bookings, up 18% year-on-year, demonstrating improved user experience and the effectiveness of technology investments.

Company Guidance

Overall, the company's guidance for Q4 results was below market expectations

Revenue: expected to be $2.39 billion to $2.44 billion, median below the market consensus estimate of $2.42 billion.

Lodging and experience bookings: expected to grow over 8.5%, slightly ahead of market expectations of 7.7% growth.

EBITDA: Adjusted EBITDA margin for the full year is expected to be 35.5%, the company had expected at least 35%.

Holiday season demand confidence is still strong as the company expects higher night and experience bookings in the fourth quarter than in the third quarter.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.