3Fs Portfolio Review – 2021

I will be doing a slightly early version of the portfolio review for the entire of 2021 since today is a public holiday and I’ve got to go back to the office starting tomorrow to catch up on some end year work.

There is still a few days left this week to the end of the week but I am likely to take no further positions other than a few options I have left outstanding which will expire by the end of this week.

Portfolio Review and Thoughts:

I started the year with about 23% of HK/China weightage holdings and ended the year with about 97% of my entire portfolio in either HK/China stocks. If you include the leverage portion, it’s probably closer to 130%.

This is a year where the China regulatory impact takes headline and impacted over many Chinese stocks. I was originally not too interested in many of these stocks as their valuations were not attractive but after some beatings, I started to enter the market a lot more since April and May onwards.

Things continue to go downhill as sentiments are severely damaged while we cannot ascertain for sure if fundamentals can return to where they are before the regulatory takes place. One thing I am more certain is I think the share price has taken a beating much more than the fundamental impact of their businesses and this is where many other investors, myself included find value in the price-fundamental mismatch.

I kept averaging down with my proceeds from options, dividends and also monthly injection from my salary – to the point I am getting a good amount of traction in vested position in the top few positions.

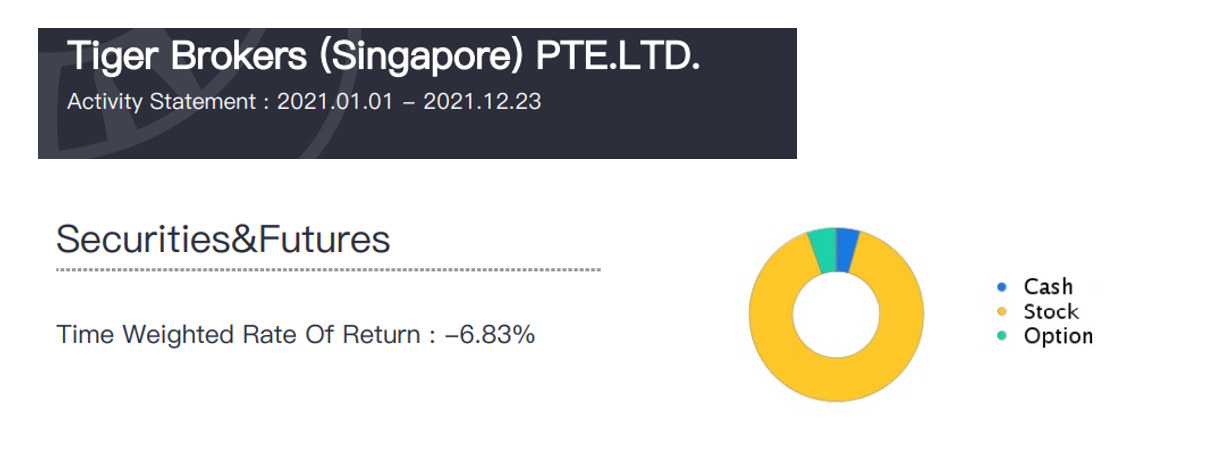

This is the consolidated statement report I have pulled from my Tiger Brokerage.

Most of my positions in HK and US (other than SG) have been bought using the Tiger Brokerage so this gives me a quick snapshot of how I am doing for the year.

The time weighted return for the portfolio is at -6.83% for the 12 months period (excluding the last few days).

For those who are not aware, the time weighted rate of return is a measure of the compound rate of growth in a portfolio.

The time-weighted return breaks up the return on an investment portfolio into separate intervals based on whether funds was added or withdrawn. The TWR provides the rate of return for each sub-period or interval that had cash flow changes. By isolating the returns that had cash flow changes, the result is more accurate than simply taking the beginning balance and ending balance of the time invested in a fund. The time-weighted return multiplies the returns for each sub-period or holding-period, which links them together showing how the returns are compounded over time (Source: Investopedia).

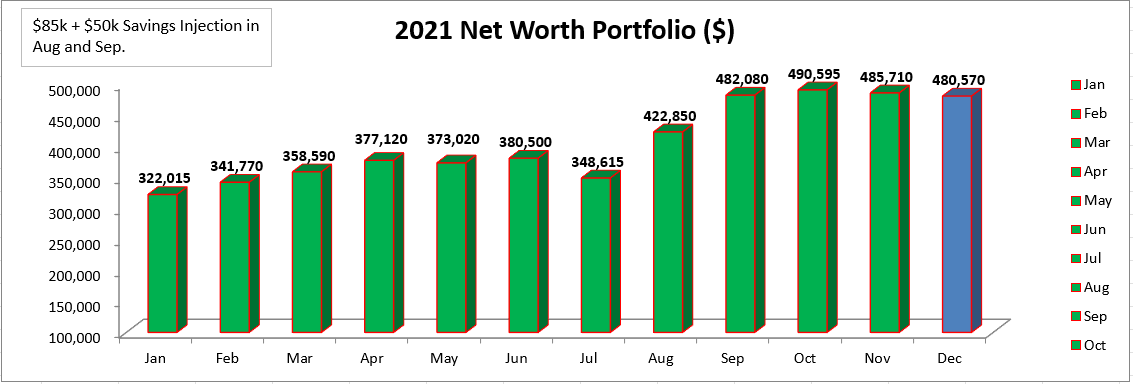

Based on the net worth portfolio published a few weeks ago, the portfolio ended the year at ~ $480k. If we exclude the additional $135k of emergency savings injection, the portfolio would have closed at $345k, which is almost flat from where it started back in Jan.

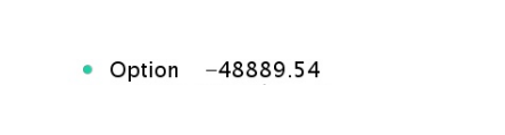

This is despite the regular monthly injection from salary (50%), dividend (5%) and options (45%) which amounted slightly more than $100k.

Most of these options are short-term duration for either puts or calls and they are mostly US stocks in nature.

Conclusion:

I am cautiously bullish going into 2022 with all the current positions already heavily battered this year.

With the US starting to adjust for interest rate, we could be in for a harsh winter correction which might once again impact the overall market. I’ll be keeping most of my strategies relatively the same for next year and see how this pans out over time.

Wishing all readers a Merry Xmas and Happy New Year going into 2022!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- ChrisPulver·2021-12-27I really learned a lot from this. The sharing is excellent! Thanks!2Report

- blinkix·2021-12-27Learned a lot of knowledge and experience. thank you2Report

- blinkix·2021-12-27Wish you Merry Xmas and Happy New Year going into 2022! Good luck.2Report

- snoozii·2021-12-27Thank you for sharing! Good luck2Report

- KYHBKO·2022-01-08thanks for sharing and congrats being one of our favorite authorsLikeReport

- KYHBKO·2021-12-31thanks for sharing. may 2022 be our best year yet1Report

- ChrisM·2021-12-30all the best for 20221Report

- Luckygim74·2021-12-29Thks for sharing1Report

- OneGlanceTrader·2021-12-28学习了很多~谢谢你的分享。1Report

- AmitKukreja·2021-12-28Wish you Merry Xmas ! Good luck! Sincerely hope that you can make a fortune.LikeReport

- MoneyManagement·2021-12-28Yeah! I agree I should also be cautious in investing in 2022.LikeReport

- Orderflows·2021-12-27Thanks! I think it is a particular good material for beginnersLikeReport

- PhillipCapital·2021-12-27Thanks~ It really helps me better learn more about finance and stocks.LikeReport

- JessicaDoosan·2021-12-27Thx~ Merry Christmas~1Report

- JamieBullock·2021-12-27Thanks for sharing! Good luck!1Report

- DanViv·2022-01-09Thanks for sharing your portfolio reviewLikeReport

- Ray19·2022-01-07Hi sir, what are your thoughts on SEALikeReport

- CMCMarketsSingapore·2021-12-28Thanks! Merry X-mas~ Nice sharingLikeReport

- RL93·2022-01-03Best luck1Report

- 偏航·2022-07-04好的LikeReport