Oil Prices Close to 7-year High, Is It Possible To Top $100?

1. Where are we

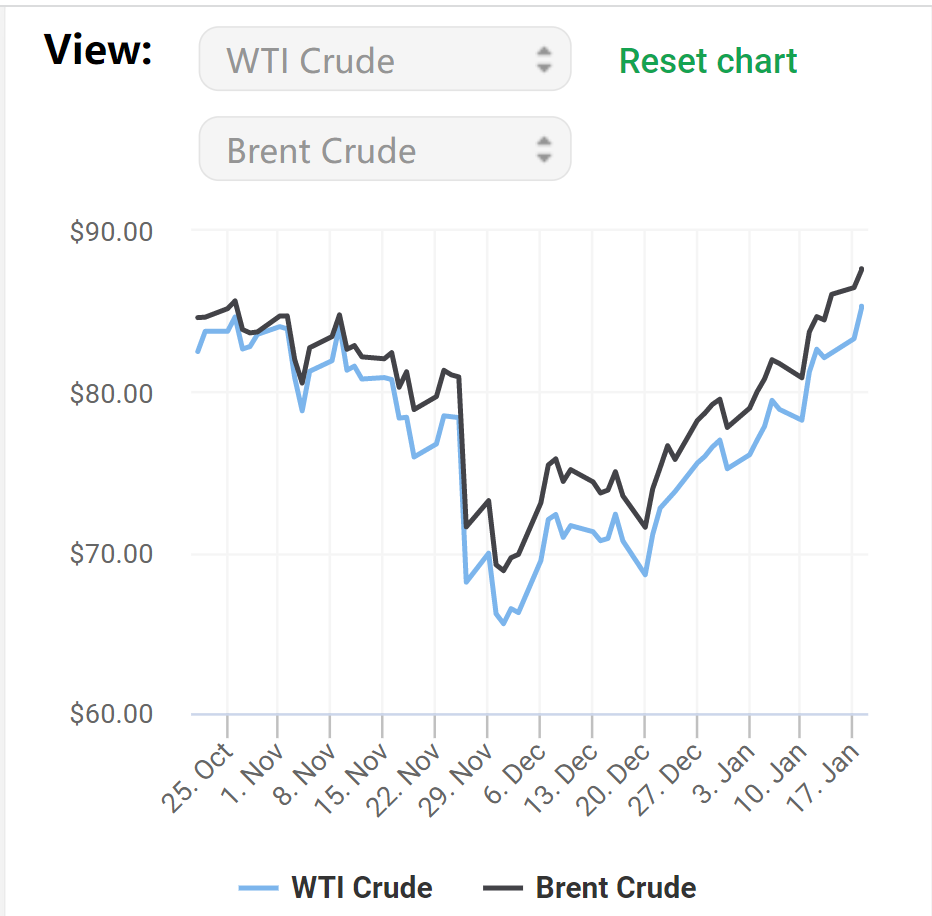

International oil prices have been on the rise since the beginning of this year. U.S. West Texas Intermediate crude was up 29 cents, or 0.4%, at $84.11 a barrel, after hitting $84.78, the highest since Nov. 10, 2021, earlier in the session.

2. What is going on?

(1) The tight supply-demand balance is unlikely to ease.“The bullish sentiment is continuing as (producer group) OPEC+ is not providing enough supply to meet strong global demand,” said Toshitaka Tazawa, an analyst at Fujitomi Securities Co Ltd.

① Some OPEC producers are currently struggling to deliver the 400,000 barrels per month increase agreed with oil-producing allies due to underinvestment and sharp declines in production. According to a recent report, just a handful of OPEC members like Saudi Arabia, and the United Arab Emirates have been able to meet higher production quotas.

② The slowdown in crude oil production growth of non-OPEC countries. Russia's production quota for December 2021 was increased by 105,000 bpd compared to November. However, Russia failed to increase its oil production in December, with actual output lower than the quota allowed, which perhaps reflects its limited production capacity.

③ U.S. crude oil inventories have dropped for seven consecutive weeks, and fell more than expected to their lowest levels since October 2018, which makes overall inventories tighten across the globe. According to the Energy Information Administration, U.S. crude inventories fell 4.6 million barrels last week to 413.3 million barrels, their lowest since October 2018.

(2) Demand

There is an increasingly widespread market consensus that the impact of the Omicron variant is expected to be mild and temporary. Countries around the world are better able to cope with the pandemic and its related challenges, and the economic outlook for developed and emerging economies is stable. As a result, demand for oil has grown significantly.

(3) Dollar

The falling dollar was the main driver of higher oil prices, Kpler's Smith said. A weaker greenback makes dollar-denominated oil contracts cheaper for holders of other currencies. The dollar fell to a fresh two-month low against a basket of currencies after data showed U.S. consumer prices rose solidly in December.

3. What will happen in the future?

Bullish:

(1) Morgan Stanley predicts that Brent crude will hit $90 a barrel in the third quarter of this year, while JPMorgan has forecast oil to hit $125 a barrel this year and $150 in 2023. Meanwhile, Rystad Energy's senior vice-president of analysis, Claudio Galimberti, says if OPEC was disciplined and wanted to keep the market tight, it could boost prices to $100.

(2) OPEC is optimistic about the oil market development in 2022. In its monthly oil market report released in December 2021, it concluded that global oil demand is expected to reach 100.6 million bpd in 2022 and global oil production is expected to increase by 5.3 million bpd compared to last year. In this context, OPEC+ on January 4 decided to increase production by 0.4 million b/d monthly in February 2022.

(3) The Biden administration is pushing hard to decarbonize America’s energy system, funnelling billions of dollars into clean energy technologies and pushing the roll out of wind and solar power. Energy policy has also slowed shale oil and crude oil production growth.

Bearish:

The U.S. Energy Information Administration and the International Energy Agency have expressed concern about the variants' impact on the oil market. International oil prices remain highly volatile, with the pandemic remaining the biggest uncertainty factor. In 2021, three large swings in international oil prices were associated with COVID. If the variants continue to develop or a new variant emerges, the global economy may be stagnant again. They expect production growth in 2022 from OPEC+, the U.S. and other countries to outpace the growth in global oil consumption.

If you want to learn more about energy stocks, we recommend you to read:

7 of the Best Energy Stocks for 2022 to Buy Now

$iShares U.S. Energy ETF(IYE)$ $Energy Transfer Partners LP(ETP)$ $Direxion Daily Energy Bull 2x Shares(ERX)$ $Brookfield Renewable Partners LP(BEP)$ $ChargePoint Holdings Inc.(CHPT)$ $Chevron(CVX)$ $Enphase Energy(ENPH)$ $Enterprise Products Partners LP(EPD)$ $Marathon(MPC)$ $NextEra(NEE)$

What do you think of the oil prices in 2022?

Share your opinion in the comment section!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- StayHome·2022-01-19Oil prices are likely to touch $100 per barrel in 2022 if demand continue and supply doesn’t increase….5Report

- gifftake·2022-01-19i think it is likely to cross $100 in 2022!3Report

- x2espresso·2022-01-19nothing is impossie.especially with the resume of air travel. oil will be needed everywhere.3Report

- Jkjustea·2022-01-19Hi $120 Oil gogo1Report

- Sallyoo·2022-01-19Like and comment3Report

- AlanChang·2022-01-19Great info, tq sharing2Report

- simplyZuan·2022-01-22Biden won't allow😀1Report

- junfeng18·2022-01-22易挥发2Report

- KamiKaze·2022-01-19keep gg pls1Report

- BYLI·2022-01-19Nice article 👍🏻👍🏻🤣1Report

- SleepyCat·2022-01-19lile pls1Report

- Jasonbehr87·2022-01-19wah. . gonna topple one1Report

- bobotrader·2022-01-27yes yes I'm betting on it!1Report

- Linearity·2022-01-22Go energy goLikeReport

- Yani94·2022-01-19When will the market impr oveLikeReport

- 1M40·2022-02-16OioLikeReport

- Vi_Yi·2022-01-22Thanks1Report

- Jessline·2022-01-22[Smile]1Report

- Thonyaunn·2022-01-22Gd1Report

- Starships2·2022-01-22👍🏼LikeReport