How to distinguish "Value" and "Growth" Stocks?

Tech stocks has been experiencing a tough time, a familiar view has shown in market, 2022 could be a year of style shifts.

To be honest, this phenomenon seems to appear time to time. For example, in early 2021, the market showed the same sign.

Value investment has always been regarded as a creed by many investors. But the term "value"could mean different things. Among the value investors, those who choose "growth stocks" are not a minority.

Where does the "value" and "growth" come from?

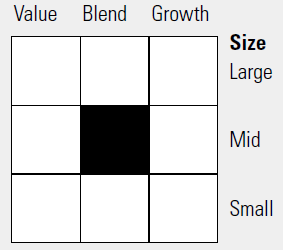

In 1992, an international authoritative rating agency $Morningstar(MORN)$, introduced a "Morningstar Style Box", which for the first time expressed "value", "core" and "growth" with quantitative method.

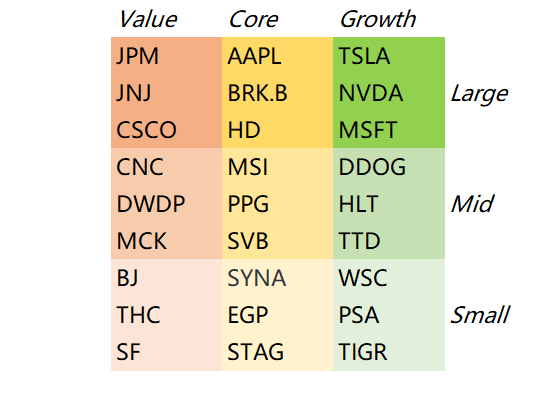

The Morningstar Style BoxTM remains a nine-square grid—three stock investment styles for each of three size categories: small, mid and large. Two of the three style categories are “value” and “growth,” common to both stocks and funds. However, the third, central column definition differs.

The vertical axis indicates the size of the market value of the investment stock, which is divided into Large, Mid and Small. The horizontal axis indicates the value-growth orientation of the invested stocks, which is divided into Value, Core and Growth.

In fact, Morningstar's original purppse is to help select funds. Different investment styles often have different levels of risks and returns, which provides an intuitive and simple analysis tool to optimize their portfolios.

Once it gained favor within the investment community, it has become the mains standard.

How to Distinguish"value" and "growth"?

In 2002, Morningstar updated a complete set of methodology.

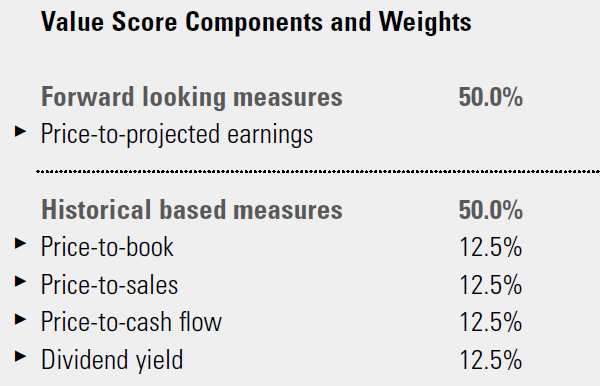

Two parts: "value score" and "growth score", on a percentile basis.

Value points, of which 50% are historical score, including

- Price-to-book ratio 12.5%

- Price-to-sales 12.5%

- Price-to-cash flow was 12.5%

- Dividend yield 12.5%

And the other 50% is the forward-looking measures, price-to-projected earnings ratio.

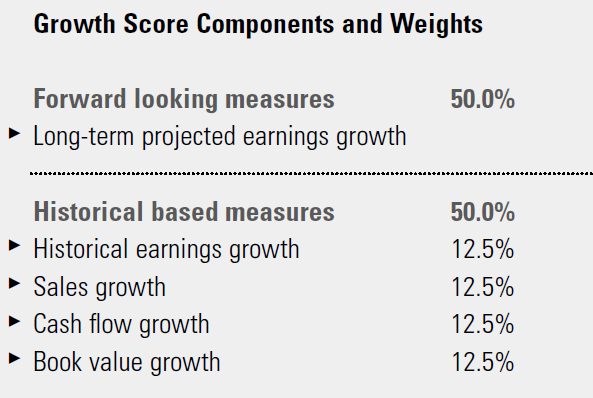

Growth score, which is also a historical scores of 50%, includes:

- The historical earnings growth rate was 12.5%

- Sales growth 12.5%

- Cash flow growth 12.5%

- Book value growth 12.5%

And the other 50% is the long-term projected profit growth rate.

The value score is subtracted from the growth score.If the result is strongly negative, the stock’s style is value, if the result is strongly positive, the stock is classified as growth. If the scores for value and growth are not substantially different, the stock is classified as “core.”

So the total score should be between-100 and 100. The closer to 100 points, the more inclined to "growth style", and the closer to-100 points, the more inclined to "value style".

As for the classification of large, medium and small stocks, it is more simple-

- large-cap stocks as those that account for the top 70% of the capitalization of the Morningstar domestic stock universe;

- mid-cap stocks represent the next 20%;

- small-cap stocks represent the balance.

Do you agree? (even it's not important)

However, we investors, first of all, should find out which companies are included in different grids

For example, $Tesla Motors(TSLA)$ $NVIDIA Corp(NVDA)$ $Microsoft(MSFT)$ $Netflix(NFLX)$ with its outstanding growth points, leads the market growth stocks.

As for $Apple(AAPL)$ Although it has a good growth rate, it is in the balanced large-cap stocks because of its all-round development. And$Home Depot(HD)$ and $Berkshire Hathaway(BRK.B)$ .

As for value stocks, there are more banks $JPMorgan Chase(JPM)$ And medical and health companies$Johnson & Johnson(JNJ)$.

How the different styles performs, growth or value?

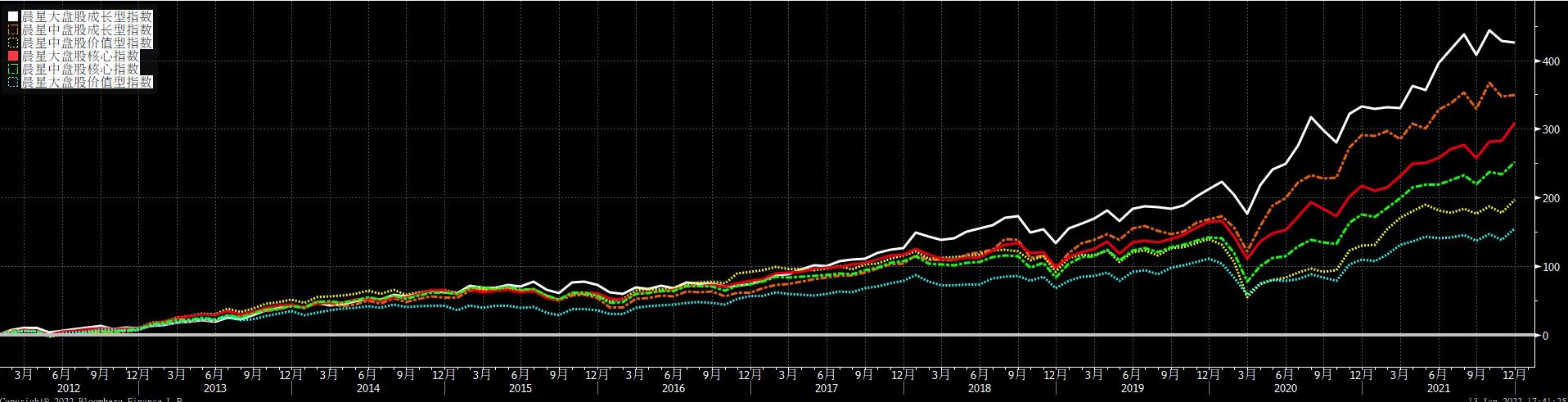

We compared the growth, core and value of large and mid stocks past returns

For a longer time period, the advantages of large-cap growth stocks are best. In the 10-year range, the return rate of large-cap growth stocks is far ahead, while that of large-cap value stocks is the worst.

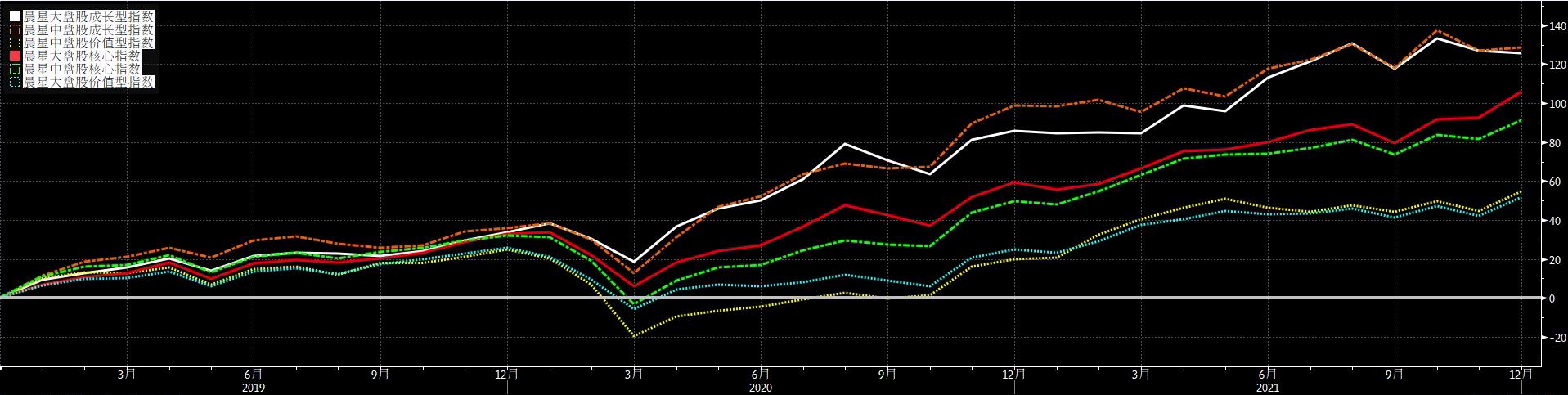

For mid-time, such as past three years, the large-market and mid-market growth stocks keep pace with each other, and both perform well, while the value-based stocks perform badly. One reason for the good performance of heavy growth may be related to the excellent performance of Apple with large market value.

During the year 2021, the growth stocks fluctuated a lot, and the core performance is the best.

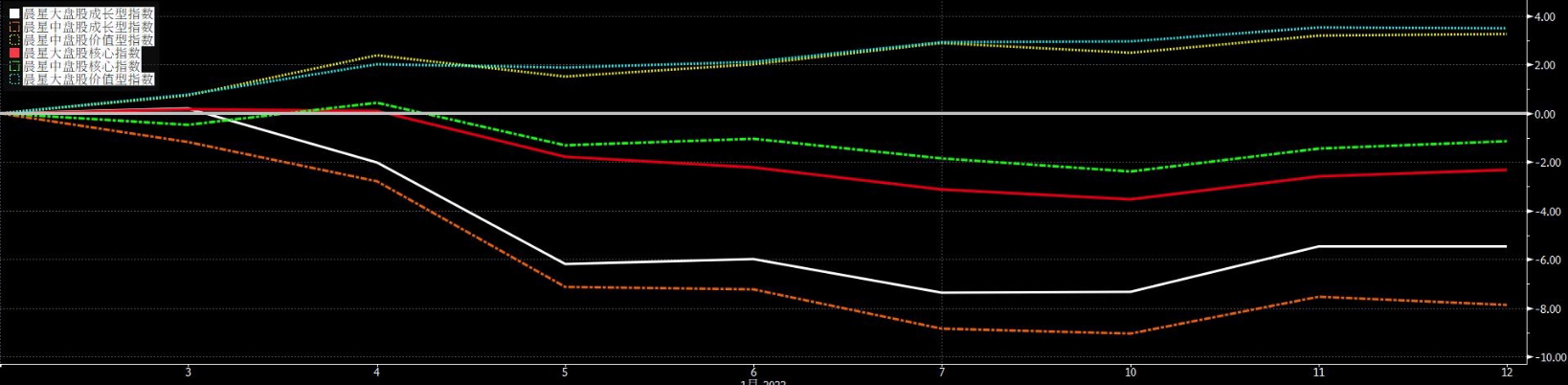

In the past six months, growth stocks have sufferred a lot and played a negative returns!

Entering into 2022, only the values get positive returns.

Now, the market prefer value stocks, but is this style rotation could continue? We believe it's still the macro environment decides it!

Apple is a growth?(Single choice)

Apple is a growth?(Single choice)Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

In any case.. is portfolio management.. to have a mix of different stocks in different categories