3 Cyber Security stocks break out under the Russian-Ukrainian conflict?

Almost six days into Russia’s invasion of Ukraine, global tensions are continuing to mount. U.S. President Joe Biden has announcedharsher sanctions aimed at Russia’s financial and tech sectors. And while many agree that this type of action is necessary, it has also given rise to a new conflict-driven fear.CNNreports that U.S. officials have issueda dire warningto American businesses — be prepared for ransomware attacks.

This announcement came just minutes after Biden confirmed the new sanctions yesterday. David Ring, a senior cyber official with the Federal Bureau of Investigation (FBI), told businesses that Russia’s cybercrime operations were likely to grow as the conflict continued. In ransomware attacks, a company’s data is held hostage through a phishing scam until a fee is paid. This trend of cybercrime from Russia has beengrowing steadily, but the war is likely to escalate it further.

While there have not been any “specific, credible threats” made to the U.S. homeland, businesses aren’t going to wait until there are. Cybersecurity companies are about to see an influx of demand for their services. Let’s take a look at the top cybersecurity stocks to buy before fears increase even more.

1. Cloudflare

While security isn't Cloudflare's primary objective, it complements its primary task. Cloudflare is on a mission to build a better internet and is doing so by building data centers across the world for customers to host their websites. By storing and managing copies of customers' code and content in Cloudflare's data centers spread around the globe, its customers can deliver faster access to the content to their own customers.$Cloudflare, Inc.(NET)$

On the security side, Cloudflare prevents multiple types of attacks that customers who manage their own servers often have trouble combatting. Cloudflare strives to give its customers the fastest, most reliable, and most secure way to host a website.

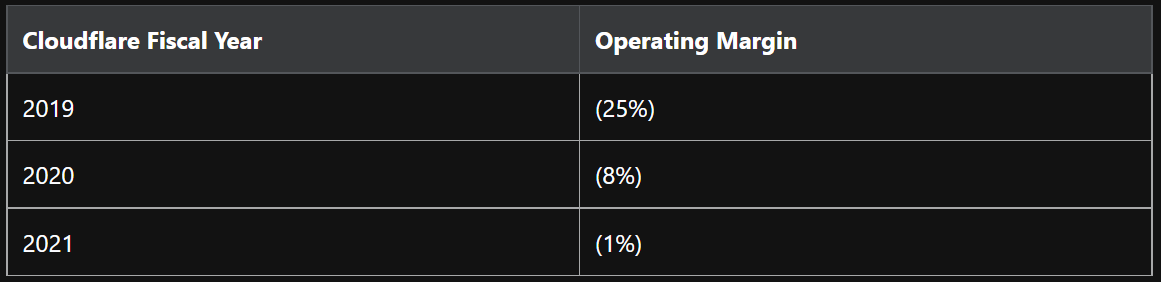

Cloudflare recently reported its full-year 2021 results that showed annual revenue grew 52% to $656.4 million and produced $43.1 million infree cash flow (FCF), adding to its $1.82 billion cash stockpile. While still unprofitable, Cloudflare has made great strides in improving its margins over the past three years.

In the most recent report, management gave strong 2022 guidance, projecting sales to rise 41.5% for the year and predicting a positiveoperating margin. With a Cloudflare-estimated $86 billion total addressable market opportunity, it has a huge growth runway for many years to come.

2. Crowdstrike

Cybersecurity isn't a new thing -- it's been around almost as long as computers have. However, with the transition to cloud computing, existing providers have had difficulty adapting security toward the new cloud era. Crowdstrike was founded as a cloud-first business and is succeeding in its mission to stop breaches.$CrowdStrike Holdings, Inc.(CRWD)$

Its Falcon platform has multiple modules that businesses can add to unlock new functionality, but at its core, it protects endpoints (such as computers or phones) from attacks. It does this by capturing more than 1 trillion events daily and using the information to continuously evolve the program using artificial intelligence. If one business is attacked in a certain manner, Crowdstrike instantly ensureseverycustomer is protected from that type of threat.

Crowdstrike has captured many significant customers, with 63 of the Fortune 100 and 14 of the top 20 banks using its software. It also has a vast recurring revenue stream, with its fiscal 2022 third-quarter (ended Oct. 31) annual recurring revenue increasing 67% year over year to now total $1.51 billion. Crowdstrike has upsold customers to use more modules. In Q3, 68% of its customers use four or more which is up from 61% one year ago.

With Crowdstrike's expanding product suite and customer acquisition potential, there is significant sales growth ahead for this cloud security provider.

3. Okta

Okta's security solution focuses on identity management. Its tools give customers the ability to ensure those who are accessing a network or account are who they say they are. Through multifactor authentication and zero-trust security, Okta builds trust with customers and gives employers confidence in letting their employees work from anywhere.$Okta Inc.(OKTA)$

Sticking with the trend the previous two companies set, Okta also reported fantastic fiscal 2022 Q3 (ended Oct. 31) results. Revenue was up 61% year over year to $351 million, and remaining performance obligations rose 49% to $2.35 billion. Management also excited investors with guidance that projects its 2026 fiscal year (ending Jan. 31, 2026) annual revenue will exceed $4 billion and its FCF margin will be 20%.

Including projections for the recently completed fiscal year 2022, Okta has grown its revenue at a 47% annual rate over the last four years. If it accomplishes its revenue goal for fiscal 2026, Okta will have grown its revenue at a 33% clip over the coming four years. Growing at a sustained rapid rate can provide incredible shareholder returns, making Okta afantastic candidate to buyand hold over the next decade.

4. Palo Alto Networks

Palo Alto provides network security, cloud security, and Security Operations Center (or SOC) software products. The company has leading-edge technology that is constantly evolving. It has been named a leader in several product categories, including Zero Trust and Endpoint Security.$Palo Alto Networks(PANW)$

Because of the breadth of offerings and increasing security needs in the market, Palo Alto is predicting that it will have a total addressable market (TAM) of $110 billion by 2024. To grow into this market, the company has a team of over 3,200 sales specialists. This is a wise investment in the race to secure as many customers as possible in the highly competitive market.

Revenue growth is encouraging for investors in Palo Alto. In fiscal 2020, the company earned $3.4 billion. This top-line number jumped to $4.3 billion in fiscal 2021, and the company expects $5.3 billion in sales in fiscal 2022. This is a compound annual growth rate (CAGR) of 25%, and Palo Alto is predicting that its CAGR will remain above 20% through at least fiscal 2024. Palo Alto is not yetGAAPprofitable, which could be concerning to investors; however, the company reported $224 million in non-GAAP operating income on $1.25 billion in revenue for first-quarter fiscal 2022.

5. Fortinet

Fortinet(NASDAQ:FTNT)is another corporation battling for supremacy in the cybersecurity industry. Fortinet offers cloud-based and product-based solutions and operates with a diversified global footprint. This company protected over 550,000 customers worldwide as of September 2021, and it is well-known for its FortiGate next-generation firewall.$Fortinet(FTNT)$

Perhaps the most compelling reason to invest in Fortinet for the long term is its terrific profitability. While the industry is full of growth stocks without GAAP income, Fortinet breaks the mold. In fiscal 2021, the company reported a GAAP operating margin of 19.5% and a non-GAAP operating margin of over 26%.

This is especially important in the current stock market climate. Growth stocks are getting battered as soaring inflation is causing the Federal Reserve to become more hawkish. It will likely raise interest rates several times this year, which hurts the value of future cash flows and lowers the value that Wall Street assigns to growth stocks.

Fortinet also delivered impressive sales growth of 29% for fiscal 2021, with total revenue reaching $3.34 billion. Cash from operations (CFO) was also up from $1.08 billion in 2020 to $1.5 billion in 2021. The increase in CFO indicates that the business is being effectively managed. Fortinet stock currently trades about 16% down from its 52-week high.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Any comment?