Why we should be sensitve to Q2 earnings?

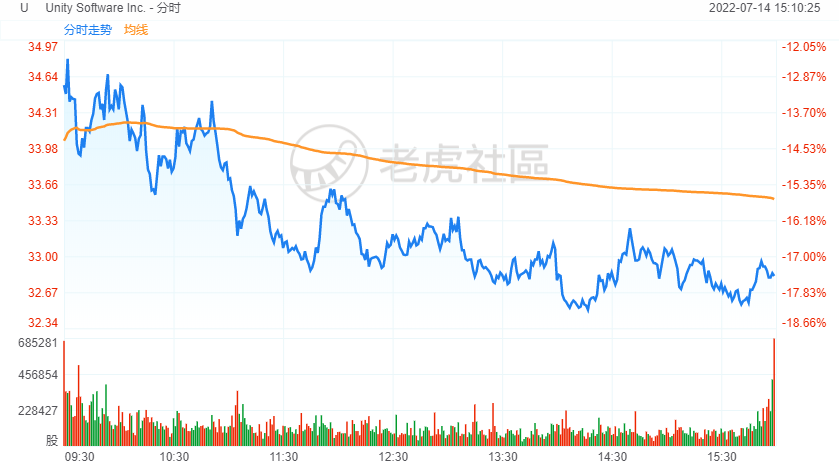

$Unity Software Inc.(U)$ plunged 18% yesterday. Two reasons notable:

One, annual sales outlook cut from previous 1.35-1.42 billion US dollars to 1.30-1.35 billion US dollars;

The other is to buy an Israeli game advertising monetization company $IronSource Ltd(IS)$ at a 50% premium.

M&A cases in bear market increase apparently. The consolidation of companies in the industry intensified. However, compared with acquisitions, the market pays more attention to the company's performance under the current inflation cycle.

For instance, $Pepsi(PEP)$ released Q2 earnings on Tuesday, July 12th. Thanks to the price-increase, revenue beat market consensus, but due to rising costs, net income decreased year-on-year.

How the cost affects companies?

First, rising raw materials prices leads to an increase in the cost of goods sold.This has a greater impact on companies that use oil or oil derivatives and commodities as raw materials. And most companies adopt the "first-in, first-out" cost method, and almost all the cheap raw materials in inventory are exhausted at present;

Second, rising fuel costs lead to rising logistics costs.Mainly due to the increase in fuel prices and logistics labor costs;

Third, wages rising leasds to higher labor costs. Some enterprises overestimate the market demand after the recovery of the epidemic and employ too much labor (retail), while some enterprises are mining high-paying talents, and the overweight is rising (banking)

Fourth, the tax rate rises. In general, during the Democracy's term, the effective tax rate of enterprises are higher to some extent.

Fifth, the foreign exchange cost rises Under the influence of a strong US dollar, the overseas revenue of companies with more international business is more susceptible to the influence of exchange rate.

Refers to: How to long dollar with a dollar?

At the end of Q2 earnings season, we summed up some commonalities of "plunging" technology stocks, among which "current performance is far less than expected" and "next quarter guidance is less than expected" are the main reasons.

Recommended reading:See which technology stocks are plummeting

For example, $Cisco(CSCO)$'s fiscal quarter ended on April 30th gave the bad guidance, which made itself plunged 13% and the whole industry worried.

Recently, some companies have bad news toward the guidances,

- $Microsoft(MSFT)$In June, it lowered its revenue and profit outlook for the new quarter, and mentioned the impact of foreign exchange headwinds. On July 8, some analysts lowered their expectations due to the possible persistent foreign exchange headwinds;

- $General Motors(GM)$: It is estimated that the net profit of Q2 will be 1.6 billion to 1.9 billion US dollars, far lower than the market expectation of 2.46 billion to 2.56 billion US dollars, mainly due to the shortage of chips and parts;

- $Micron Technology(MU)$: It is estimated that the adjusted revenue in the next quarter will be 6.8-7.6 billion US dollars, which is lower than the market expected consensus of 9.14 billion US dollars;

But on the contrary, some have good news,

- $InMode Ltd.(INMD)$: Q2 revenue is between 113-113.3 million US dollars, market company is 103 million US dollars, diluted EPS is 0.5-0.58 US dollars, and market consensus is 0.51 US dollars; The revenue guidelines for the whole fiscal year 2022 were raised from $415-$425 million to $425-$435 million.

- $U.S. Steel(X)$The company's EPS guidance for Q2 is $3.83-$3.88, which is higher than the market expectation of $3.2.

- $Nucor(NUE)$The Q2EPS guidance provided by the company is $8.75-$8.85, which is higher than the market expectation.

Let's see whether the market price those companies in the next month.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Because it had no "filling" [Happy]

TGIF.