Oil Staged Price Target At $96? Long-term Threat May From Iran?

"Crude oil is waiting for a big negative landing. Before that, every adjustment may be an opportunity to get on the bus."--By James Kou, who has 28 Years of trading experience in Options, Energy, Gold, Stocks, Commodities, etc, the former fund manager has earned 240% in the market in less than three years.

Facing the price of WTI crude oil futures, which has been rising wildly for more than a month, he gave his take profit target price at $96.

You may ask, after breaking through $90, can crude oil futures price reach $96? Why is crude oil so high now?

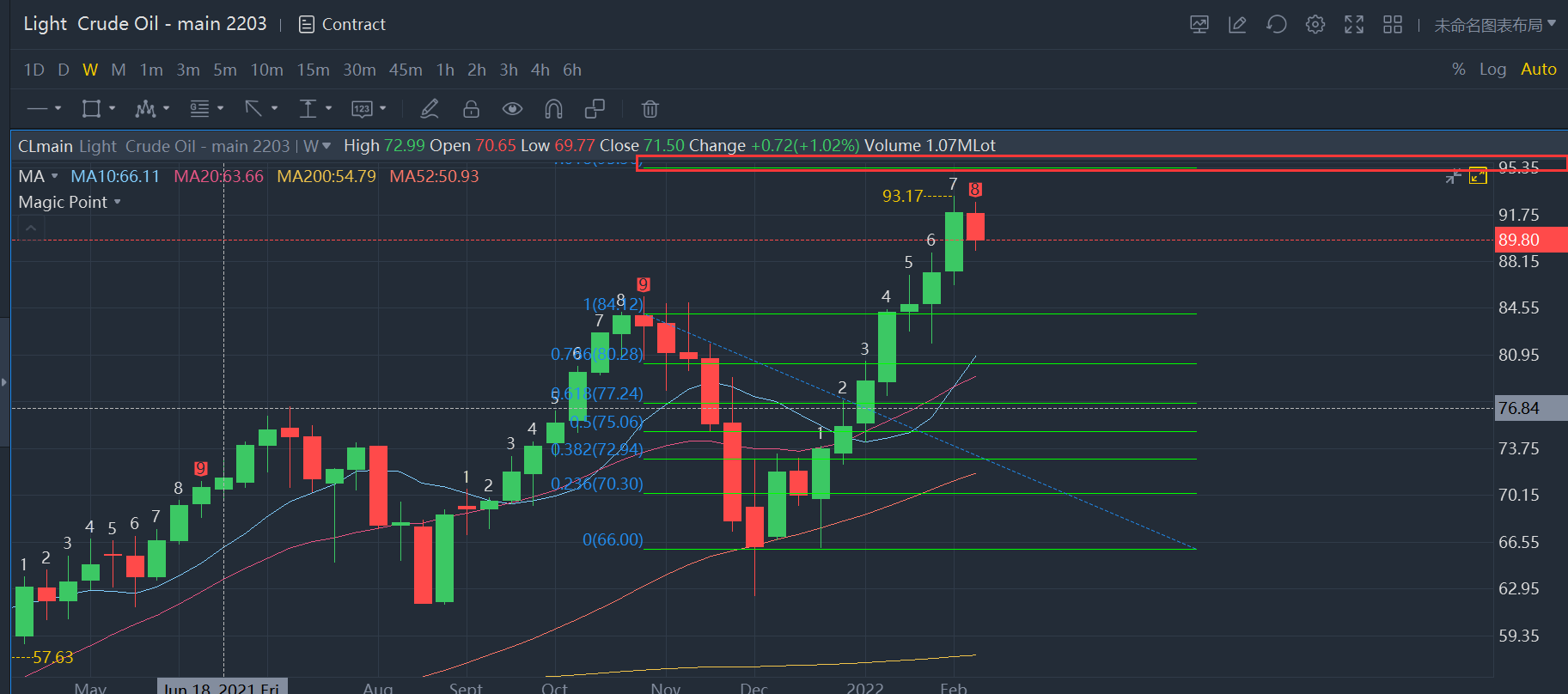

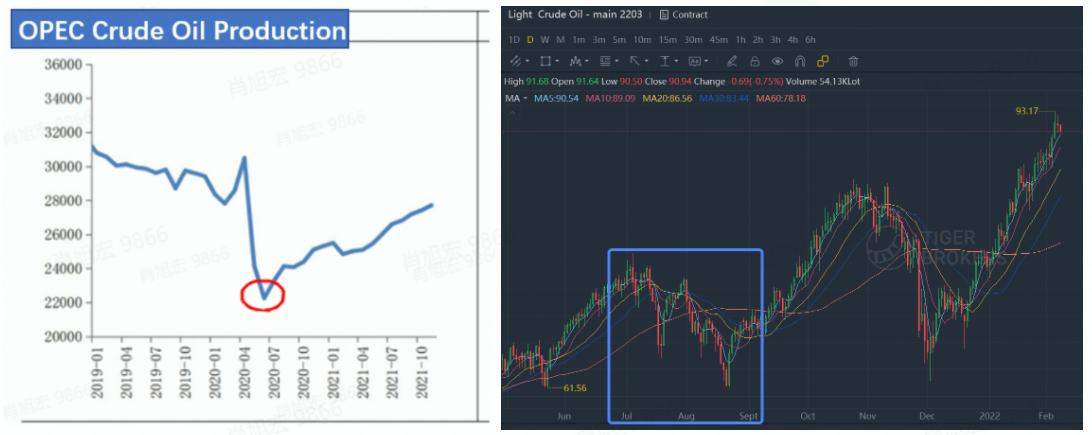

See from the chart above: Since April 2020, crude oil futures prices have risen from negative oil prices for nearly two consecutive years. At the weekly level, the biggest drawdown of WTI price occurred in October 2021, when Omicron suddenly broke out in South Africa; then in July 2021, OPEC announced that it would gradually increase production and raise production baseline.

These two sharp declines were up to15%, Before that, seldom drops succeeded 10%.

The sharpdeclinesare all due to theshaking of fundamental expectations of the oil market: Supply and demand.

1. Supply Side: Crude Oil Producers Squeeze Production, and The Current Production Capacity has been Halved

Since April 2020, the crude oil market saw a sustained retaliatory rise. Reasons like:

- The negative effects of the new epidemic have been exhausted.

- The oil price has been continuously included in the expectation of the recovery of global energy demand.

- In addition, the previous crude oil futures suffered a slump, and the oil price was greatly undervalued.

However, when the price of crude oil rose above $66, the market's faith in the continuation of the rally of oil prices was shaken, because fundamentally, the expectation that crude oil will be in short supply has not fundamentally changed.

Here is some background of oilprices that need to be mentioned:

First: The cost price of most oil producers is around $40 to $45 a barrel. If crude oil falls below this cost price level, spot traders will consider phasing out production, holding crude oil inventories, and shorting crude oil futures to lock in their own profits. Thus the crude oil market will be pressing down on inventories and supply has been reduced, and prices will gradually bottom out.

Second: Once the price of crude oil has risen above $65 a barrel, most of the oil producers are in a profitable state, and they will consider expanding production to seize market share, then the oil price tends to fall.

That's why since 2014, crude oil has been trading between these twoprice levels.

After the impact of the pandemic has gradually faded, oil producers in various countries seem to have formed a special tacit understanding: they are not in a hurry to expand production to grab the final profit of high oil prices, but at the same time "hold down" their own crude oil production and let oil prices soar to increase the profit of each barrel.In July 2021, OPEC members announced they would gradually increase monthly crude oil production. At that time, oil prices fell with a retracement of 18% in response.

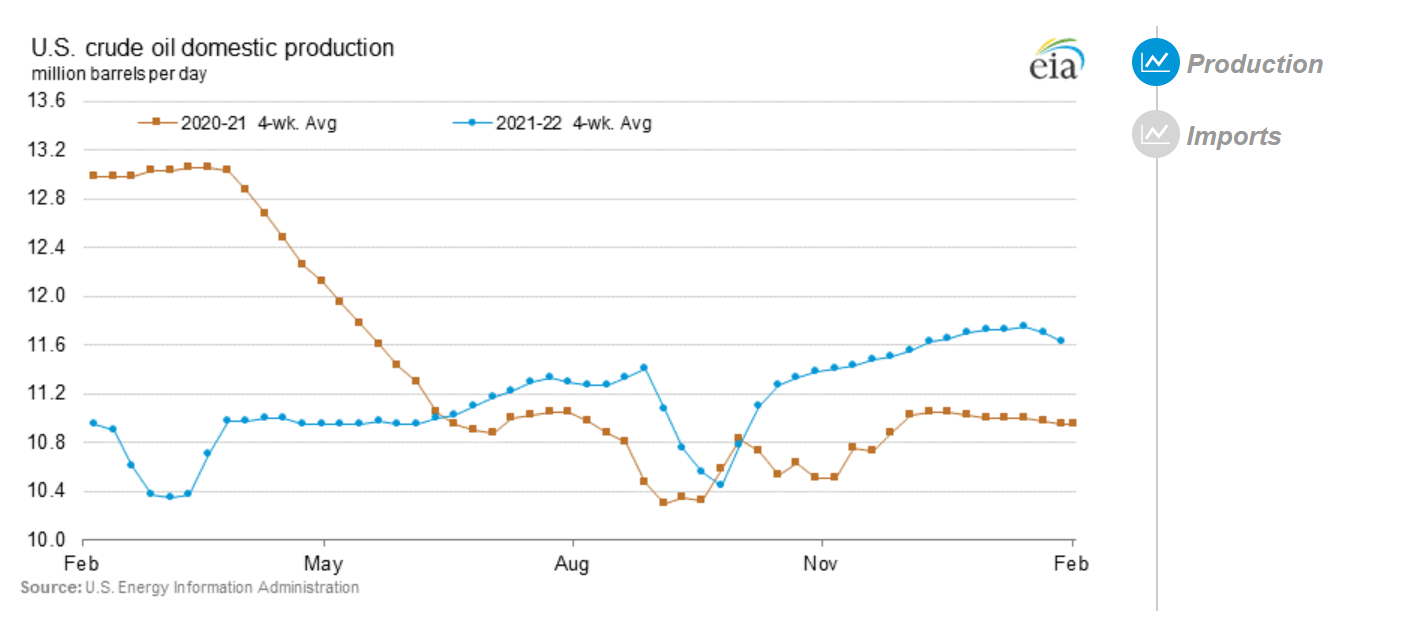

The data shows although OPEC members announced in July that they would increase production by 400,000 barrels per month, the actual monthly increase in production was less than 200,000 barrels on average, then the rise in crude oil began to accelerate.

Besides that, the idle crude oil production capacity of OPEC countries falls off a cliff after July 2021, while the overall production capacity is at a 4-year top range.

It seems that OPEC is indeed operating at full capacity to produce oil, but the actual oil production is not even half of 2016.

2. Demand side: Global Demand Soars! IRAN's Production Matters to the Market

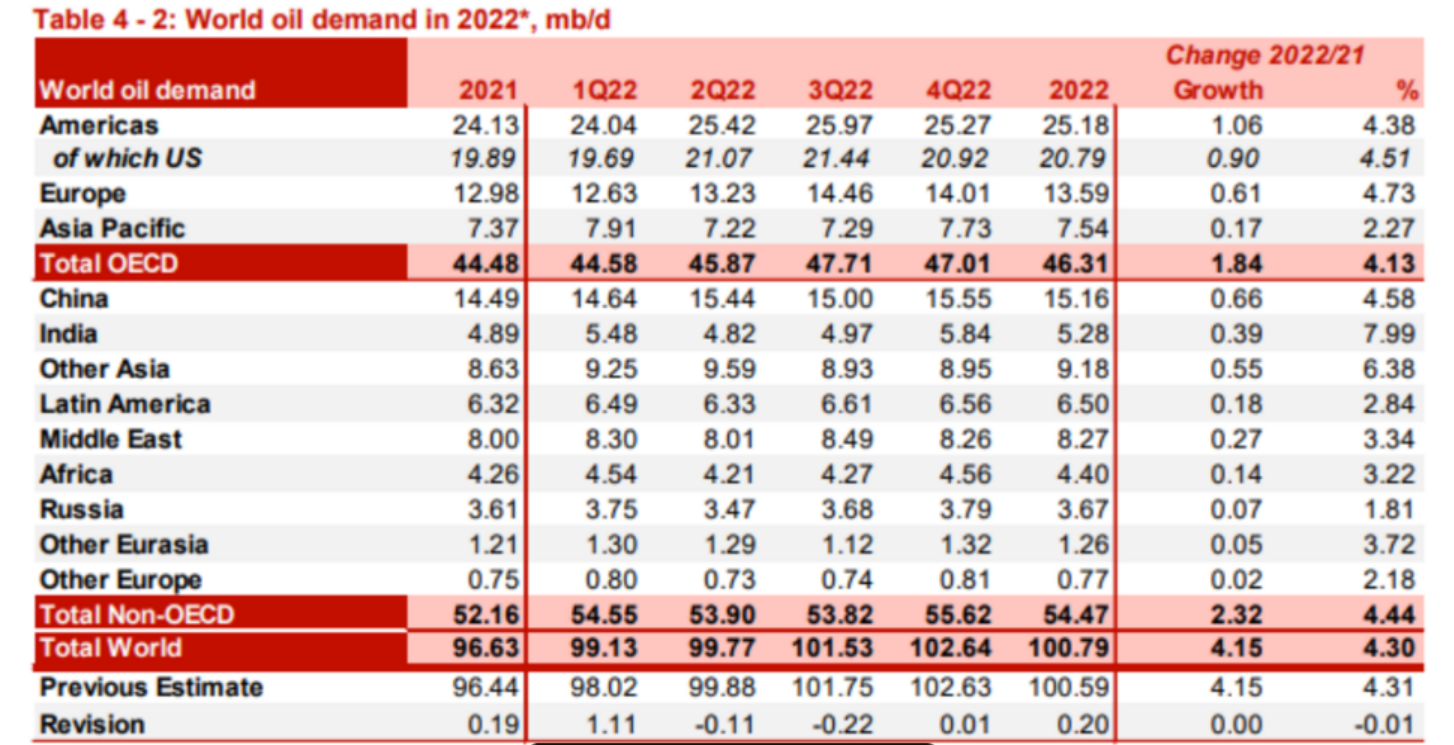

According to Bloomberg's estimates, with the gradual unblocking of the pandemic and the recovery of crude oil demand, the world's demand in 2022 will hit an average of 100 million barrels per day, which is more than 4 million more than the average of 96 million barrels per day in 2021.

To increase the production and supply of crude oil, only three other countries: the United States, Russia, and Iran can be relied on.

- While Russia is an old-fashioned energy power, with a single economic structure, relying on energy to make profits, for sure it is not willing to increase production to suppress oil prices.

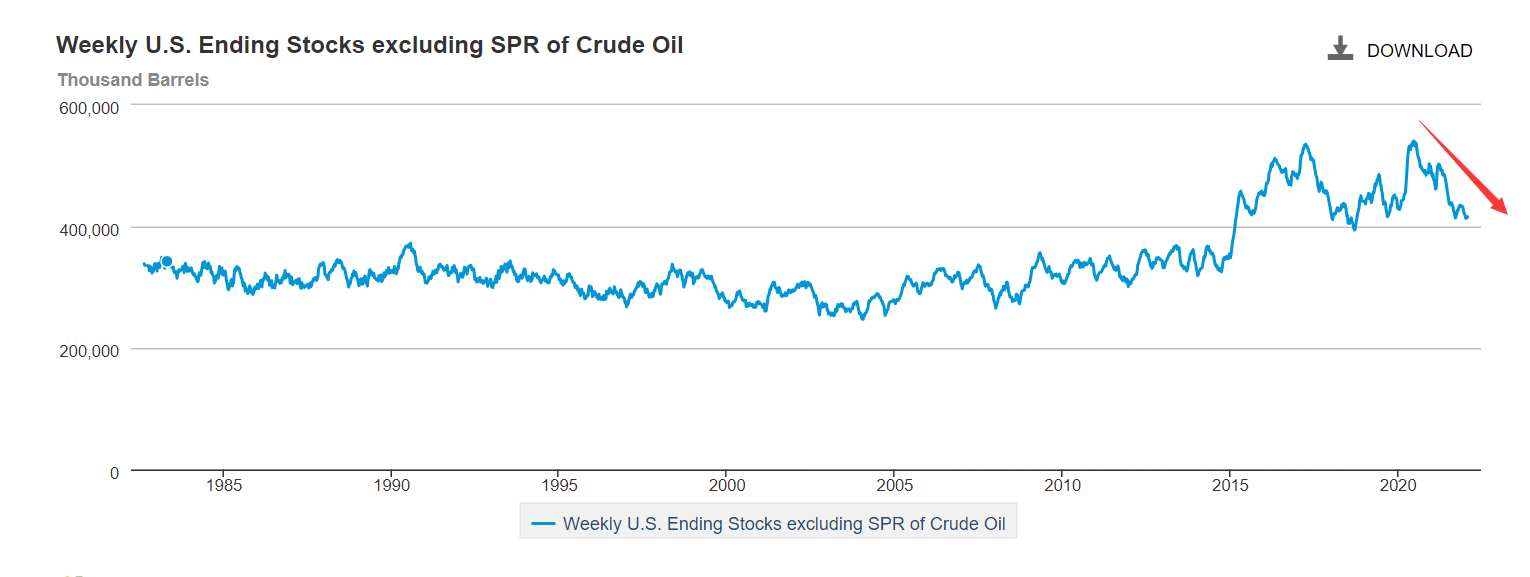

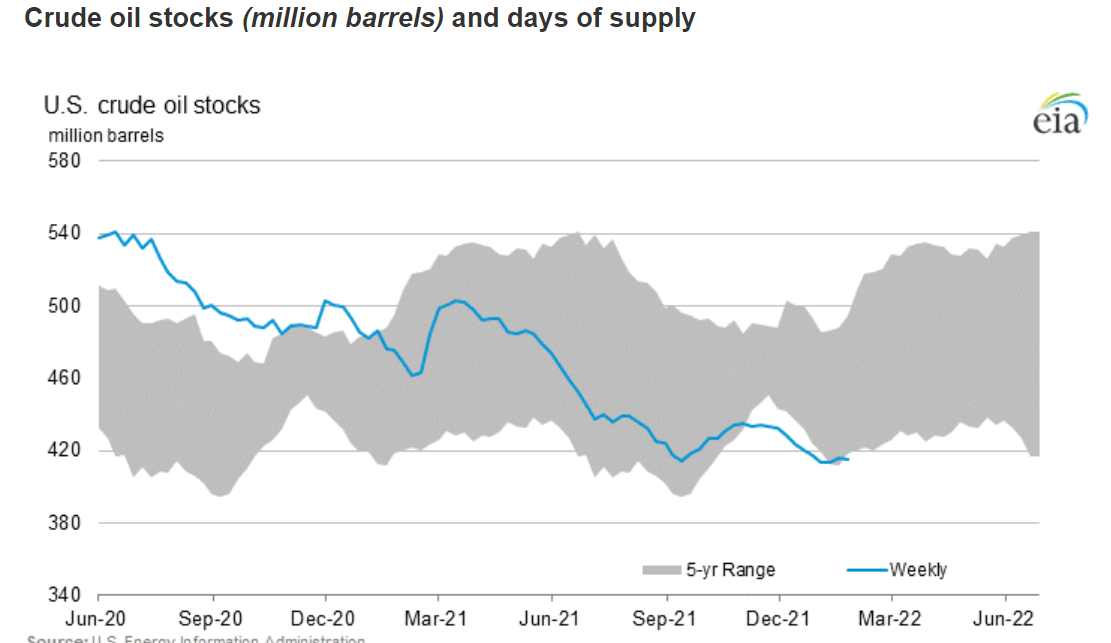

- The United States currently has more than enough to increase production. Let us take a look at U.S. crude oil production, inventory, supply data. Under the influence of the pandemic in the United States, crude oil production in the United States has never been able to rise, and crude oil inventories have been at a low level in five years. Coupled with the blizzard that has just appeared, the crude oil inventories have been greatly reduced, which has given the impetus for crude oil to peak again.

- The world's eyes turned to Iran. The biggest risk to the current crude oil market is whether Iranian crude oil can re-enter the global market. If Iran's crude oil production can be put into the international market, then the oil price will definitely fall by more than 15% or even collapse. Don't forget, Iran has said it can easily increase production to 6 million barrels a day.

But the premise is that the United States has to lift the blockade and sanctions on Iran. On February 8, the Iran nuclear negotiations will resume. It seems that Iran has decided that the United States wants to combat high oil prices, and uses it as a bargaining chip to play a game with the United States, but what the final outcome will be, let's wait and see, this may take a longer cycle.

- In Short-term, the geopolitical crisis between Russia and Ukraine is intensifying. Since Ukraine wants to join NATO, but Russia is unwilling, the veteran NATO members welcome Ukraine to join, as this is to facilitate the future to restrain Russia from sending oil to Europe and the United States. Natural gas is used as a bargaining chip, so the conflict between the two sides is on the verge of breaking out.

The direct impact of this escalation of the geopolitical crisis caused the soaring oil price recently. While The United States has been sending troops to the front, it seems that the United States is not worried that the high crude oil price will break out again. The reason behind this is likely to be the United States and Iran have reached some kind of agreement, and there is a high probability that Iran's crude oil will eventually be unblocked, so we must guard against this big risk.

3. Technical Analysis of Crude Oil Price: Why is $96 The Target Pressure Level?

From the current technical point of view, after the continuous rise for a week, crude oil has a strong demand for correction. This Monday and Tuesday, WTI crude oil futures have already made a two-day small correction, investors might suggest waiting then consider getting on the bus after a callback in place.

In addition, judging from the 4-hour price fluctuation chart, MACD shows a dead fork. If the red column continues to expand, it is likely to have a sharp retracement. Technically, we can pay attention to a support price of $86.4 per barrel that has been repeatedly tested before.

If this support levelfails, then the short-term bullish sentiment will be completely reversed, and the depth and magnitude of the adjustment need to be further studied.

From the perspective of the weekly level cycle, taking the oil price when the Omicron virus broke out in December 2021 as the starting point to make the golden section upward, the first resistance level extended from the golden section of 1.618 is around $96.

Of course, such technical analysis is based on the historical trend of futures and the conclusion drawn from experience. The content of this article is only for reference, not as a direct trading recommendation.

Other Related Reading Recommendations:

Correction may be on its way!Be careful when you go long oil future

Oil Price Touches New High Since 2014: 3 Top Oil Stocks to Buy

Questions For You:

What is your opinion on crude oil prices?

What is the target level for crude oil to rise in this round?

Comment your reasons, please?

$(NQmain)$ $(CLmain)$ $(NGmain)$ $(GCmain)$ $(YMmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Anzygart·2022-02-12Oil remains high and there are conflicting opinions of how high it will go. My guess is it hits 100. Oil stocks are also rising rapidly since late last year. Without geopolitical risk, oil stays high3Report

- ViviSUJU44·2022-02-12Like pls thank you :)5Report

- Tyliew·2022-02-12[Money obsession] [Proud]2Report

- Lynn098·2022-02-13100 is a psychological target. The market will likely try to test it as there will be short sellers whose stop loss is slightly above this level.1Report

- MoneyGuru·2022-02-15inflation on the rise1Report

- Oldmanjenkin·2022-02-14Oil prices also threatened by russia1Report

- hj489·2022-02-13Hope for oil price producing country raise production to moderate the increase.LikeReport

- jayfalcon·2022-02-12thanks for sharing 😊1Report

- power ranger·2022-02-12least lo1Report

- Lao Tzu Ang·2022-02-12Current fundamental is up for oil.1Report

- erickhoosg·2022-02-12my shifu say will go to 121.1Report

- Yani94·2022-02-12Inflation up again1Report

- Winner168·2022-02-12Everything will be costly again[Glance]1Report

- Zedloh·2022-02-12go go go1Report

- InvisibleP·2022-02-10Project when will reach $96?1Report

- Blessedme·2022-02-15agree w you. Anyway it is a cycle.LikeReport

- Jamesim·2022-02-14[财迷] [财迷] [财迷]LikeReport

- Mom of 2·2022-02-12$Exxon Mobil(XOM)$ will increase??1Report

- Eda95·2022-02-12这篇文章不错,转发给大家看LikeReport

- yuannn·2022-02-12so exp omg1Report