Should Consumer Staples Be A Better Choice?

--Which sector should we put our risk assets in?

As the market volatility intensifies, the defensive sector has been re-favored by investors recently. Utilities sector is a typical one $Utilities Select Sector SPDR Fund(XLU)$ , but there is also another sector that has become the favor of investors, consumer staples $Consumer Staples Select Sector SPDR Fund(XLP)$ .

Compared with utilities, which are not surprised or frightened, the consumer staples are closely related to food and clothing are also affected by a very big macro factor-

Inflation.

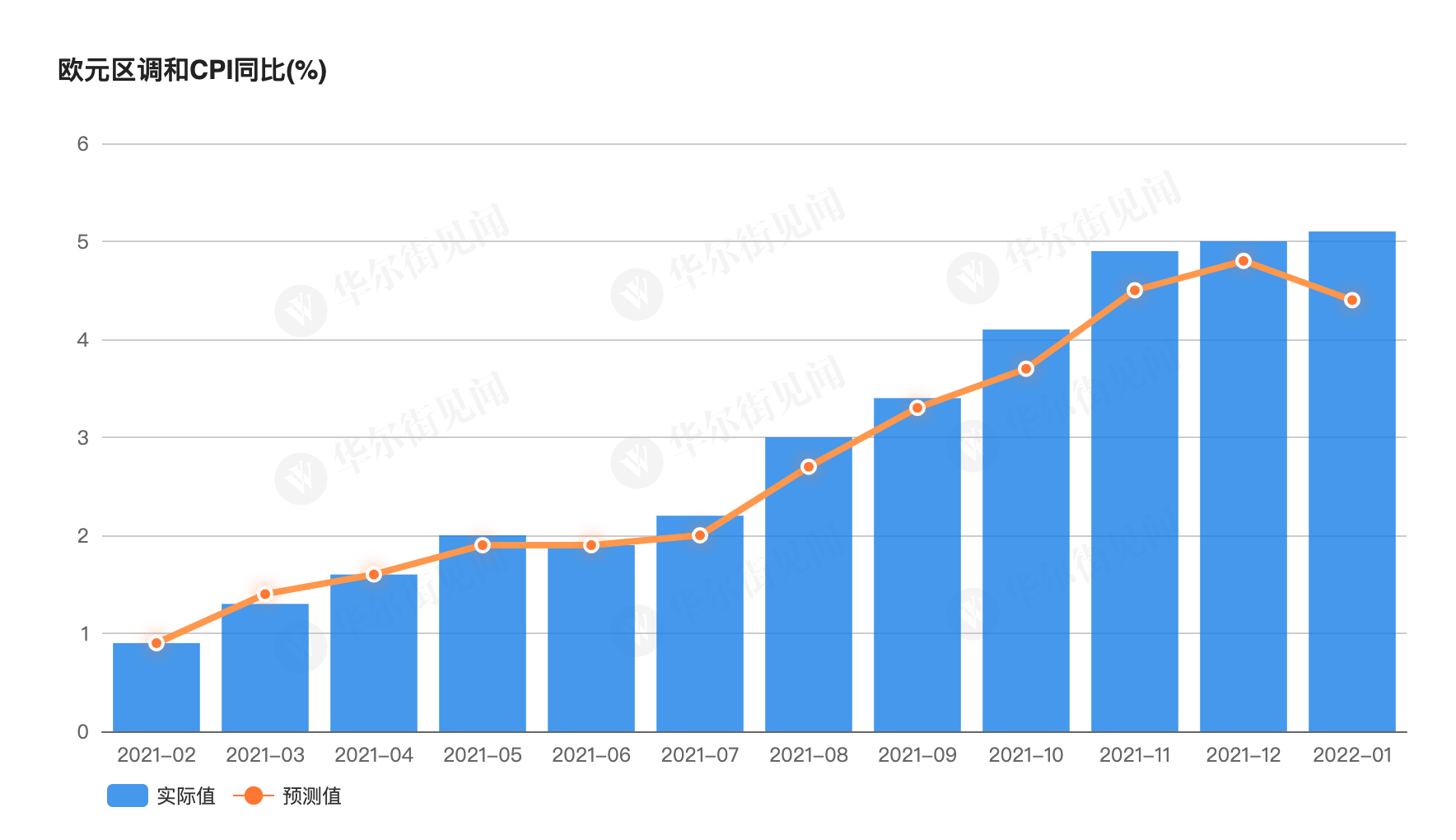

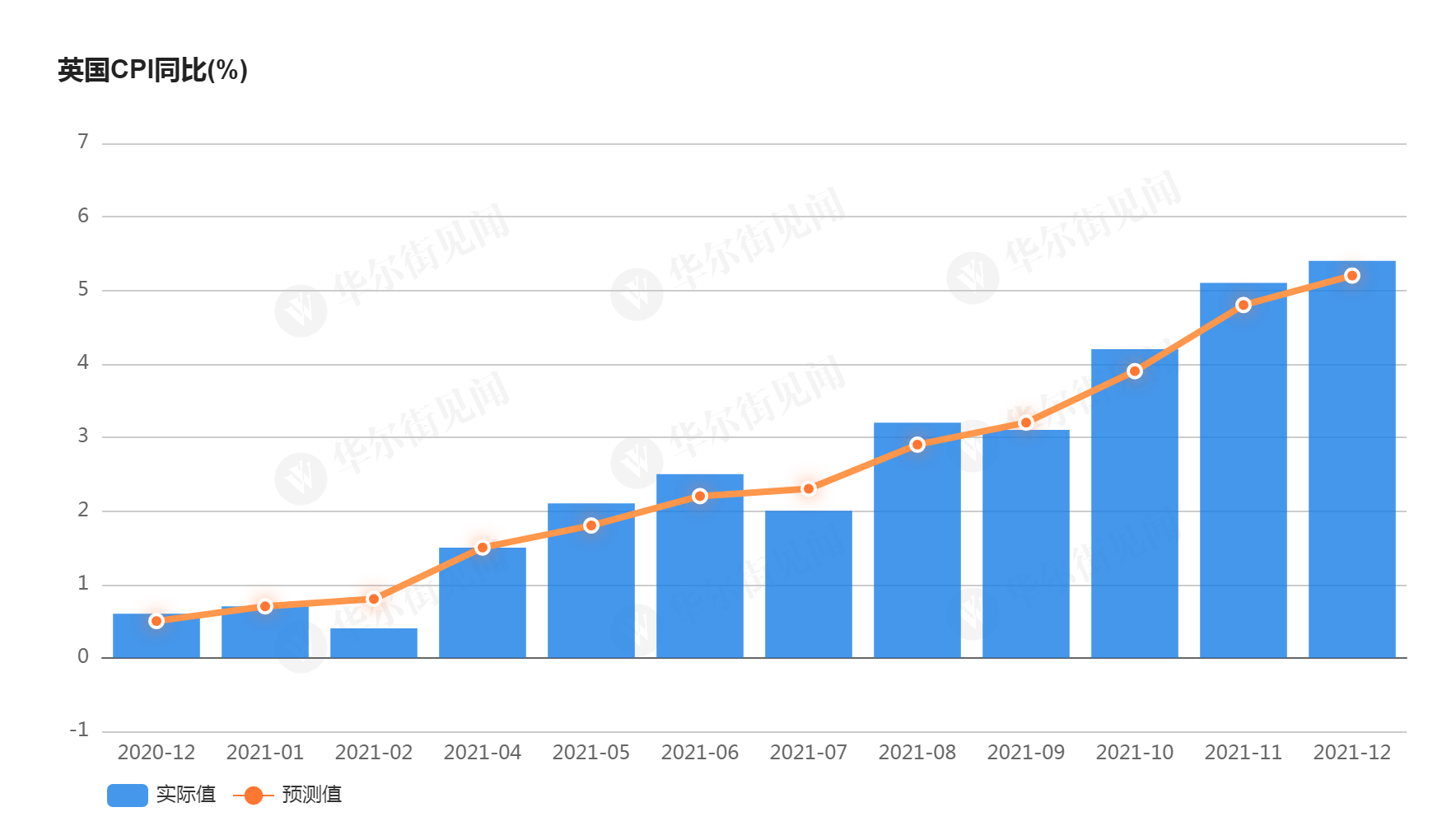

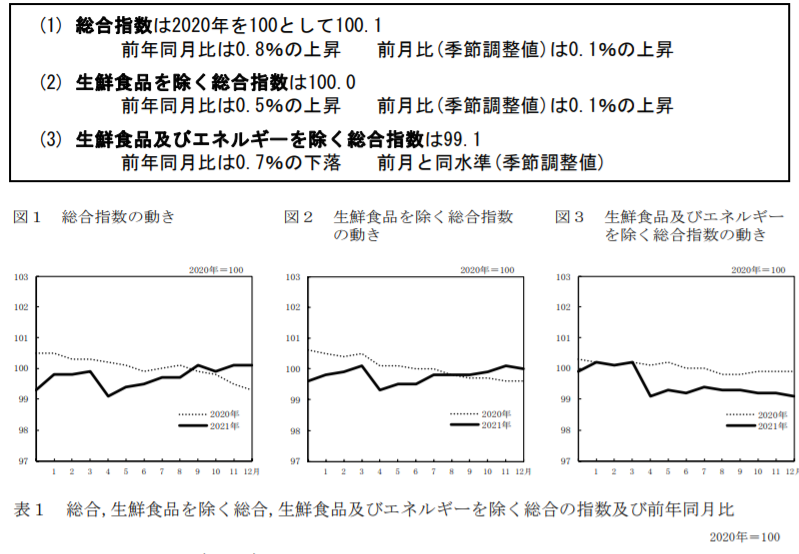

Let's take a look at the recent CPI data of major economies:

United States: The overall CPI reached 7% in December 2021, of which the core inflation excluding energy and food was 5.4%, while the inflation of food and energy was even worse!

Eurozone: In January, the reconciled CPI increased by 5.1% year-on-year, which was much higher than the expected median of economists surveyed by Bloomberg, which only increased by 4.4%;

UK: Consumer prices rose 5.4% year-on-year in December, the fastest growth rate in 30 years, mainly driven by food and non-alcoholic beverages.

Japan: Inflation rose 0.5% year-on-year in December (already low), showing the fastest growth rate in the past two years for the second consecutive month, mainly driven by energy and food.

In the American food industry, $Tyson(TSN)$It is one of the largest food companies, providing almost all protein meat varieties such as beef, pork, chicken and mutton.

Obviously, it has benefited a lot during the CPI rising cycle. Therefore, the pre-market financial report on February 7th surprised the whole market, and pulled up the whole market and daily consumer goods sector against the trend on that day.

To sum up, it has the following advantages:

- There are many channels in the industry, and companies are comfortable in the upstream and downstream supply chains;

- In the upward cycle of CPI, the cost rise can be completely transferred to downstreams, and the profit rate is expected to increase by leverage;

- The price elasticity of demand of their products is low (the lower the better), and the demand is stable.

In this way, food material is the best choice.

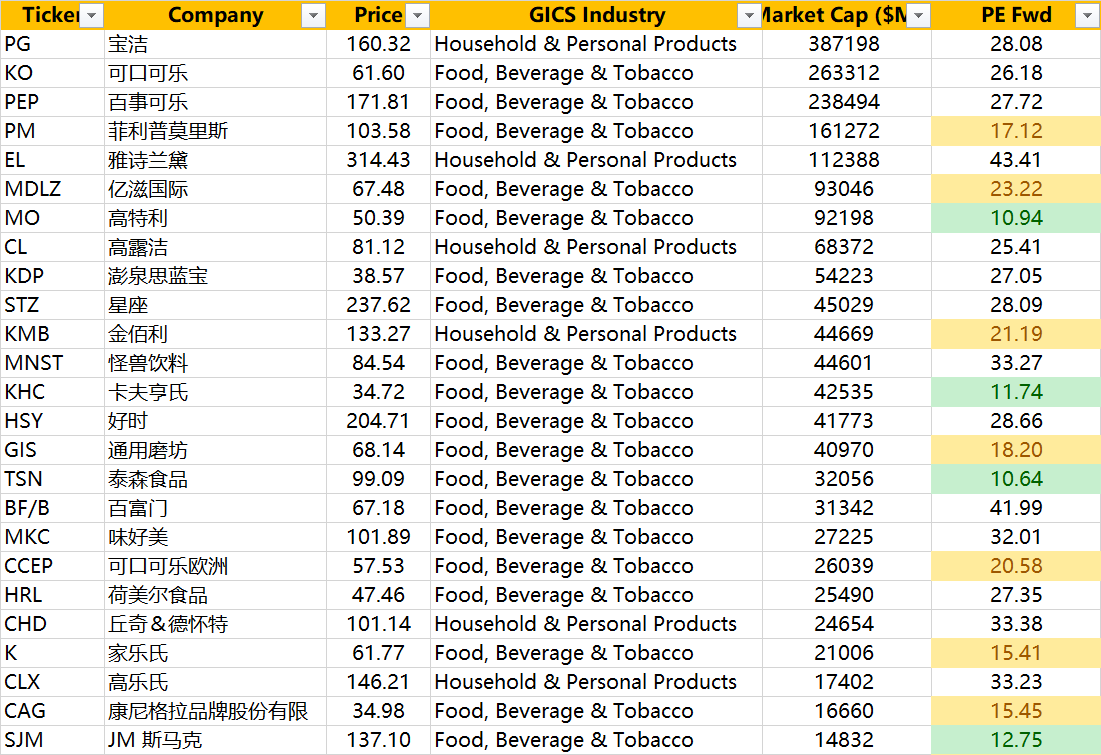

We sort out a 25 largest companies list in this sector-

Companies like $Procter & Gamble(PG)$ $Colgate-Palmolive(CL)$ $Church & Dwight(CHD)$ , with business of personal products, especially cleaning products, have relatively high valuations (around 30+P/E forward), However, Some of their raw materials are oil derivatives, so they themselves will suffer the impact of rising costs. In fact, the pricing of personal care products may not be as flexible as that of agricultural products. Inflation will rise rapidly in the short term, and they may not be able to keep up.

But agricultural products are different. Big meat factories $Tyson(TSN)$ $Hormel(HRL)$ , and other companies in drinks, wines, instant food, snacks, etc. is not very related to oil, so these companies can Get higher revenue with higher profit margin.

At the same time, different companies have different involvement in the supply chain, some are more upstream, while others are more midstream, and different links have different benefits from inflation. Therefore, we need to know more about the business lines of each company.

Of course, there are always risks in buying individual stocks. If you only intend to hedge with this sector, it is also a good choice to buy some ETFs.$Consumer Staples Select Sector SPDR Fund(XLP)$ $First Trust Consumer Staples Alphadex Fund(FXG)$.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Samlunch·2022-02-09你能在助跑开始前进入并在高峰时退出吗?我不能,所以我会坚持广义指数$标普500ETF(SPY)$16Report

- th0mastan·2022-02-10Impact of inflation is much more significant than we think, in fact it cascade down and hit the lower income even more11Report

- jgaldon·2022-02-11agreed, food-commodities- and shelter are there to stay. However with housing facing so many issues...good article!5Report

- Bodoh·2022-02-09Depends on how bad inflation gets?6Report

- Rjn828·2022-02-12$Tyson(TSN)$ very strong financial balanced stock. Invest on this stock on long term and this stock will always grow 👍🏽1Report

- AliY·2022-02-11I think it could be...2Report

- 来真的·2022-02-10Yes. After the big tech. Now is the staple stock. Back to basic as evrryone need to spend on foods and necessitiesLikeReport

- Kashcash·2022-02-11Yes safer bet 👍1Report

- poonhoekit·2022-02-11是的,至少现在1Report

- K734·2022-02-11Thanks for sharing1Report

- Murph·2022-02-11staples will always be consumed1Report

- SPGoh·2022-02-11Good idea1Report

- AhBart·2022-02-10Boring companies but extremely solid companies 💪🏽.........very good read 🤓LikeReport

- Eddywin·2022-02-10What is a better choice ?1Report

- AnnieReis·2022-02-10thanks for sharing 👍1Report

- setia100·2022-02-10Inflation causing "Money Not Enough" worries. How to pick a Better Choice ❓😂LikeReport

- Andrewinho·2022-02-09Of course!!! 👏👏👏1Report

- czarene·2022-08-13Great article! I would like to share it.LikeReport

- czarene·2022-05-20Great ariticle, would you like to share it?LikeReport

- GoESg·2022-02-11Thanks for sharingLikeReport