Why August CPI beat market consensus?

The August CPI made the market focused since the beginning of the month, as the risk-on mode back again, investors wish the inflation peaked and slightly falling back. But it didn't...

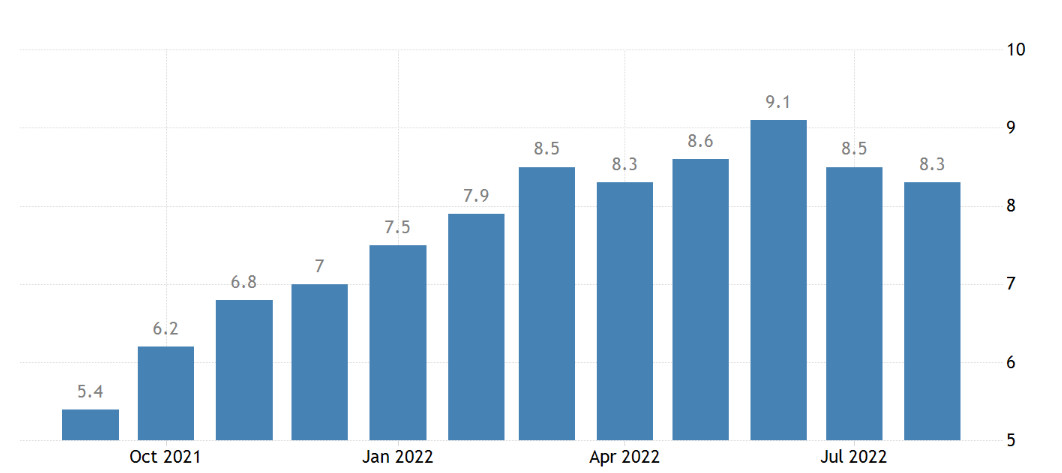

Over the last 12 months, the all items index increased 8.3% YoY in August on a seasonally adjusted basis, beat the market consensus of 8.1%, slightly less than July's 8.5%. From a MoM perspective, CPI increased 0.1% month-on-month, higher than the market consensus of -0.1%, and July's 0% too.

The core CPI increased 6.3% YoY in August on a seasonally adjusted basis, higher than the market consensus of 6.1%, higher than July's 5.9%; From a MoM perspective, CPI increased 0.6% month-on-month, higher than the market consensus of 0.3%.

Why the market expect inflation to slow down?

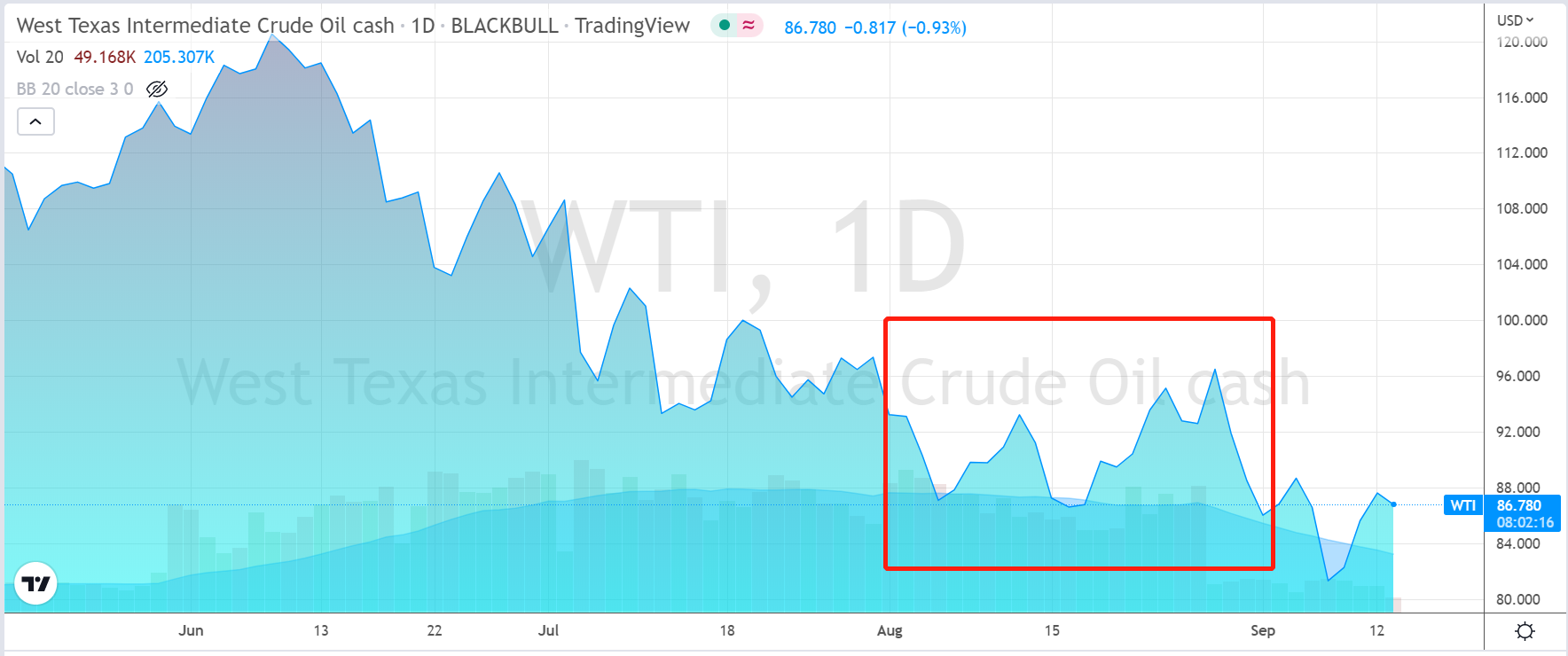

Because oil prices fell in August.

The inflation is mainly caused by high oil prices, than transmitted to the whole supply chain through raw materials. Then, Fed's interest rate increasing affect more industries.

Also, Russia and Ukraine conflicts contributed to the oil prices. Since the market get used to it, the market has been pricing-in the end of the war.

Anyway, a 9.1% CPI might be the peak, but it didn't decline as fast as we expected.

Which segments contributes the surprised inflation?

Let's take from segments.

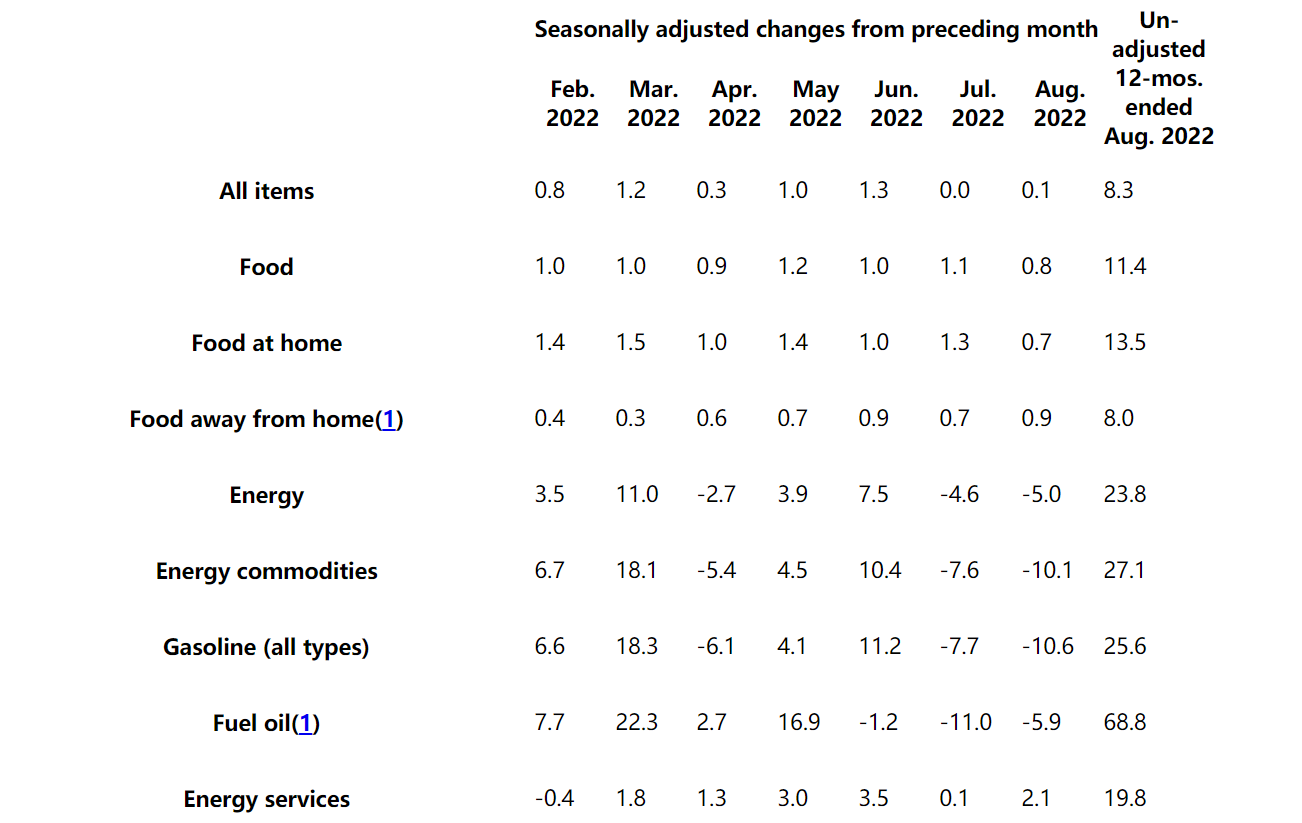

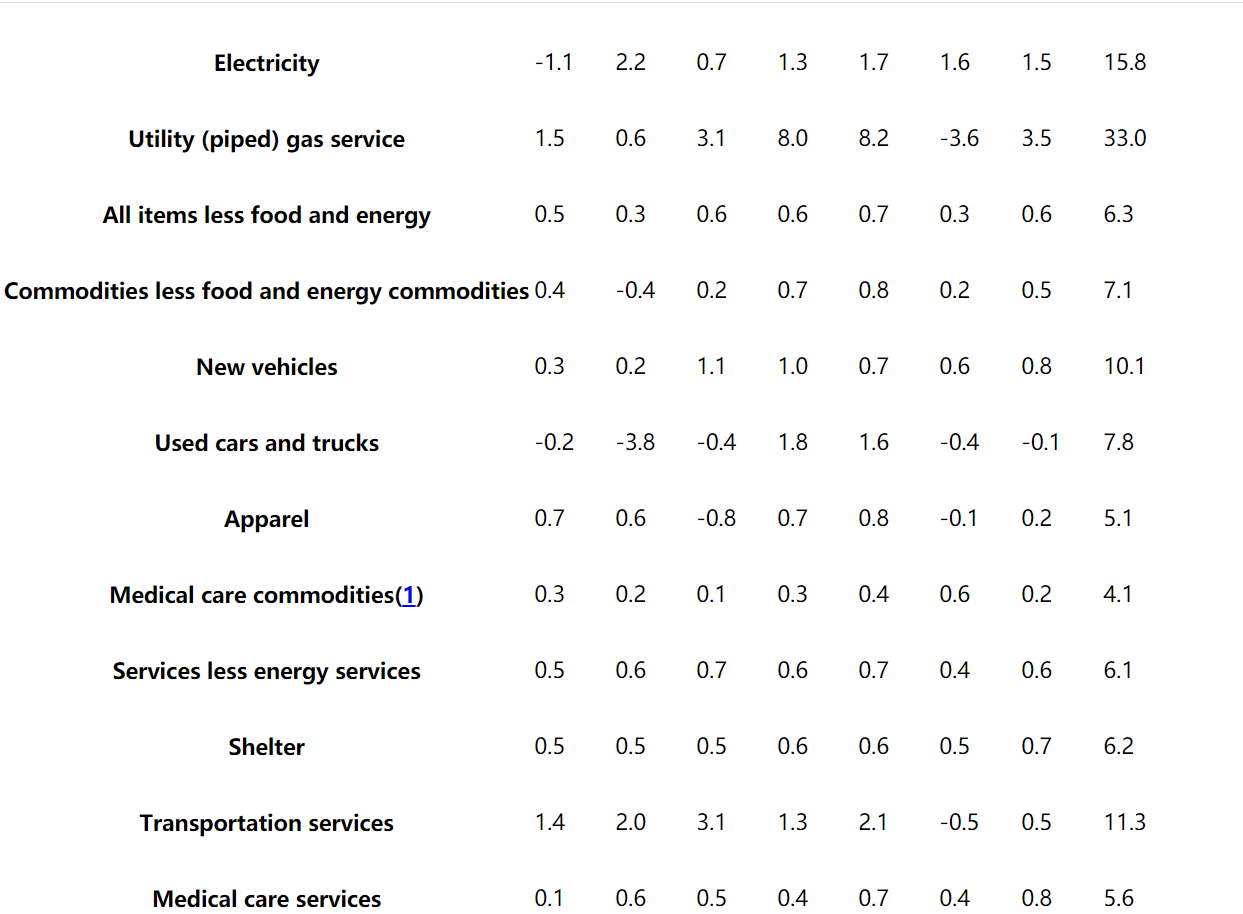

Increases in the shelter, food, and medical care indexes were the largest of many contributors to the broad-based monthly all items increase. These increases were mostly offset by a 10.6-percent decline in the gasoline index. The food index continued to rise, increasing 0.8 percent over the month as the food at home index rose 0.7 percent. The energy index fell 5.0 percent over the month as the gasoline index declined, but the electricity and natural gas indexes increased.

The shelter index continued to rise, increasing 0.7 percent in August compared to 0.5 percent in July, mainly due to the rent. The rent index rose 0.7 percent in August as did the owners' equivalent rent index. The index for lodging away from home rose 0.1 percent over the month after declining in June and July mainly rent and house price changes. It is commonly believed that Fed's interest rate increasing has increased the mortgage rate, which makes more residents choose to rent.

The food index increased 0.8 percent in August, the smallest monthly increase in that index since December 2021. In fact, it is still influenced by supply and demand, espcially the weather. The food away from home index rose 0.9 percent in August after rising 0.7 percent in July.The index for full service meals increased 0.8 percent and the index for limited service meals increased 0.7 percent over the month.

The medical care index rose 0.7 percent in August after rising 0.4 percent in July as major medical care component indexes continued to increase. It was a bit surprised. The index for hospital services increased 0.7 percent over the month, while the index for prescription drugs increased 0.4 percent. The index for physicians' services rose 0.2 percent in August. We believe there are two reasons, One is the salary increase of medical staff, and the other is the price increase of medical equipment.

In addition, natural gas and electricity services increased on a month-on-month basis, which beat the consensus. Since the United States suffering from ultimately hot this August, it is normal that the electricity more expensive.

Generally speaking, increases were mostly offset by a 10.6-percent decline in the gasoline index, but the electricity and natural gas indexes increased has burdened the whole index.

When CPI will slow down?

According to historical chart, Last October has a ghigher base, it might show some easeness this one. In other words, September still suffers.

$S&P 500(.SPX)$ $NASDAQ(.IXIC)$ $DJIA(.DJI)$ $iShares 20+ Year Treasury Bond ETF(TLT)$ $iShares TIPS Bond ETF(TIP)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- St1143·2022-09-14opportunity to buy11Report

- Aivern·2022-09-14...did you google translate the whole thing12Report

- Henryee18·2022-09-14Guys, no money already… how to buy the deep anyway?5Report

- Remotecam·2022-09-14Going into the year end - Inflation likely to stay high due to spike in energy for Winter. brace yourself for more red.4Report

- pangspurs·2022-09-15No worries lah7Report

- Karma Rider·2022-09-15power啦8Report

- Kacudah·2022-09-14Thanks for sharing. But this event is just a self scripted, directed and acted out by Fed. Max pain to come sooner to take out the trillions pumped5Report

- YiCheng0301·2022-09-15Inflation will be there for a while. Wage and shelter inflation is the key contributor. Seat belt mode on guys!5Report

- lowmy·2022-09-15Market now had priced in a 75 basis point hike6Report

- Snakewood·2022-09-14🤔🤔😵💫🤷♂️🤦♂️🙏🤞5Report

- wingcheong·2022-09-15Thanks for sharing.4Report

- GerryLoh·2022-09-14good sharing thanks4Report

- blue sky·2022-09-16等待机会 [你懂的]2Report

- mark01bravz·2022-09-15well at least Powell have the data to not give in under pressure from politiciansLikeReport

- Joshigan·2022-09-15Interesting readLikeReport

- JntEu·2022-09-15Thanks for sharingLikeReport

- Jason1616·2022-09-14Thanks for sharingLikeReport

- InvisibleP·2022-09-19Ok1Report

- 建稳的朋友·2022-09-16💪💪💪1Report

- ethanlam·2022-09-16ok1Report