What If Nasdaq in Gamma Squeeze?

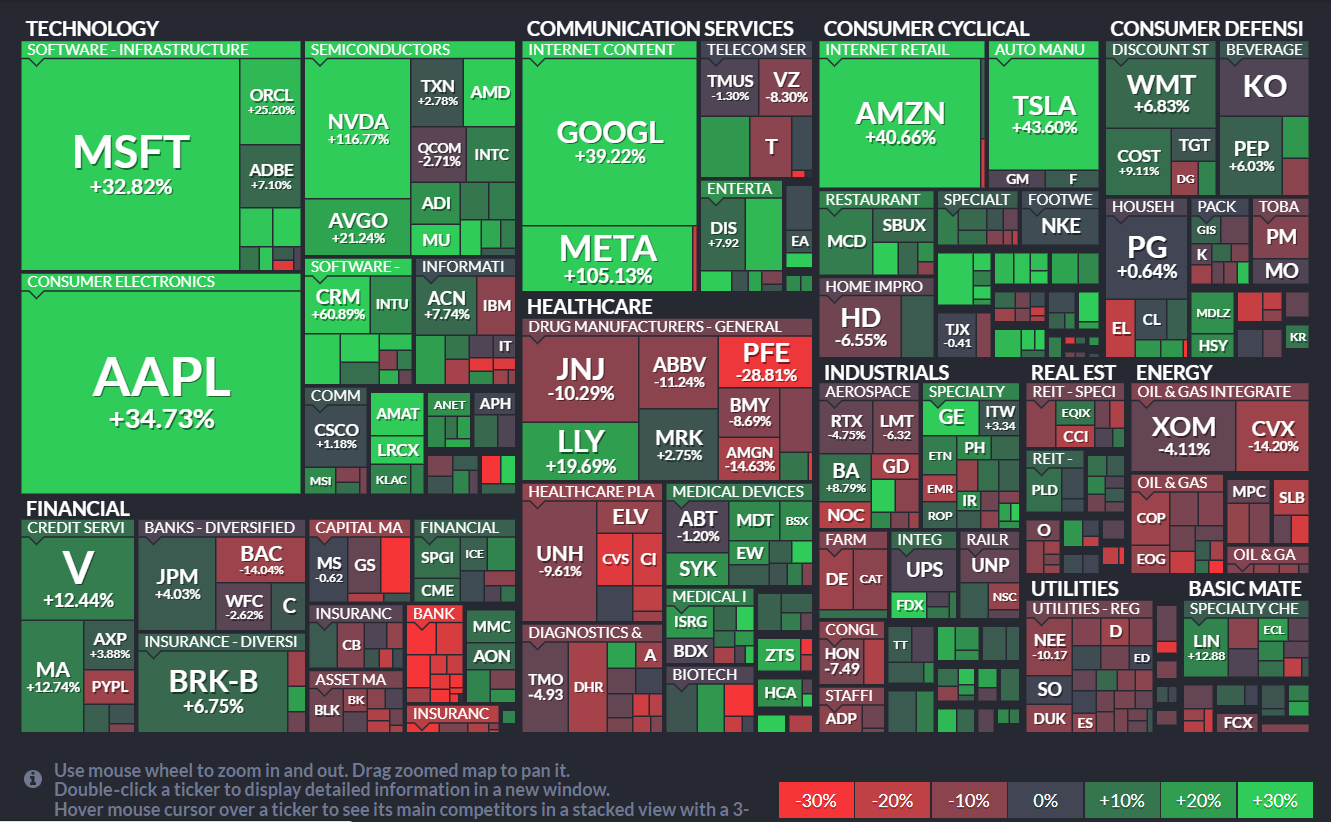

$NASDAQ(.IXIC)$ index has been soaring two consecutive days, especially on May 18th, a surge of 1.5% make it reaching a new high since last August. From a graphical perspective, this breakthrough indicates an absolute victory for the longs.

In comparison, although the $S&P 500(.SPX)$ index is also approaching its new high this year, it has not yet surpassed last August's level. Therefore, it is clear that Big-techs are key driven force.

Big Techs have become the most "valuable" asset in the inflationary circle. Since they are also the main weights, such as $Microsoft(MSFT)$ $Apple(AAPL)$ $Alphabet(GOOG)$ $Netflix(NFLX)$ $Amazon.com(AMZN)$ $Meta Platforms, Inc.(META)$ $NVIDIA Corp(NVDA)$. They share some common characteristics:

1. AI infrastructure in hardware or software or rapid commercialization capabilities;

2. Large amounts cashflow especially USD;

3. Products or services have deep moats.

On May 18th , Netflix performed best among these tech giants because its advertising-supported membership reached five million monthly active users and its advertising commercialization ability was proven. However, to be honest with you,a 10% increase is still quite generous and there were some hedge funds looking for targets to boost tech stocks.

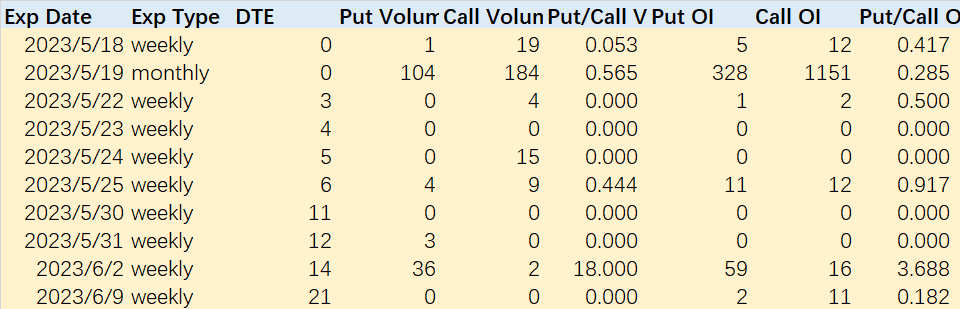

Firstly,a large number of monthly options will expire on Friday(May19)so both end-of-term option delivery and stock trading are unusually active.

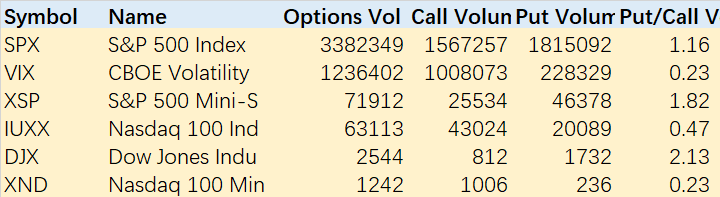

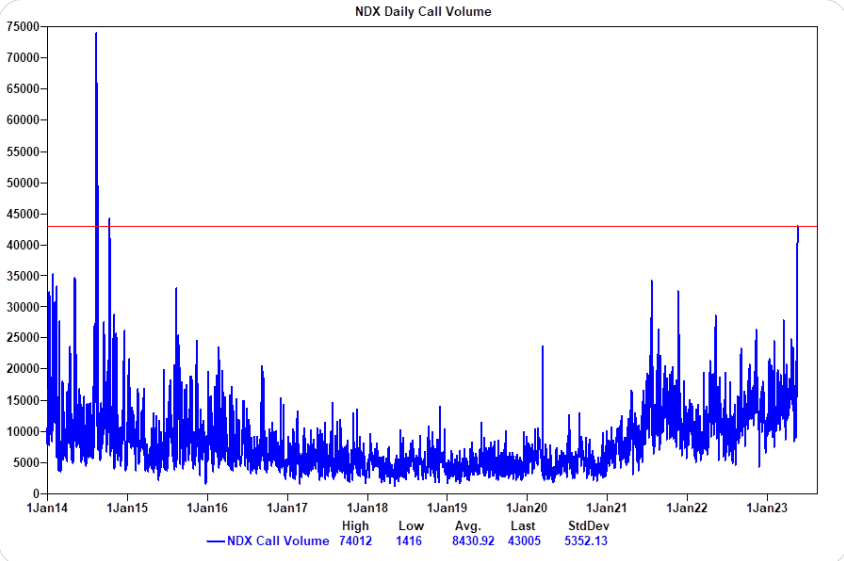

Secondly,the volume of buy call options for technology stock indices far exceeds that of buy put options.

On May 18th, among several major indices such as S&P 500, $Cboe Volatility Index(VIX)$ , $NASDAQ 100(NDX)$ and $DJIA(.DJI)$ ,only the trading volume of NDX (Nasdaq 100) calls far exceeded that of puts.

At the same time, in terms of options trading for Nasdaq 100 index expiring within a month from now on,buy call options are basically much more than buy put options.

It should be noted that generally speaking,the speculation and hedging demand for Call and Put tend to balance each other out. However, there are other factors affecting the PUT/CALL ratio. The reason why the trading volume of PUT is generally greater than CALL is because more "bulls" choose to sell naked (Naked Sell PUT), while bears seldom naked sell CALL.

Therefore, neither S&P 500 nor Dow Jones have seen a situation where call trading volumes exceed put volumes.

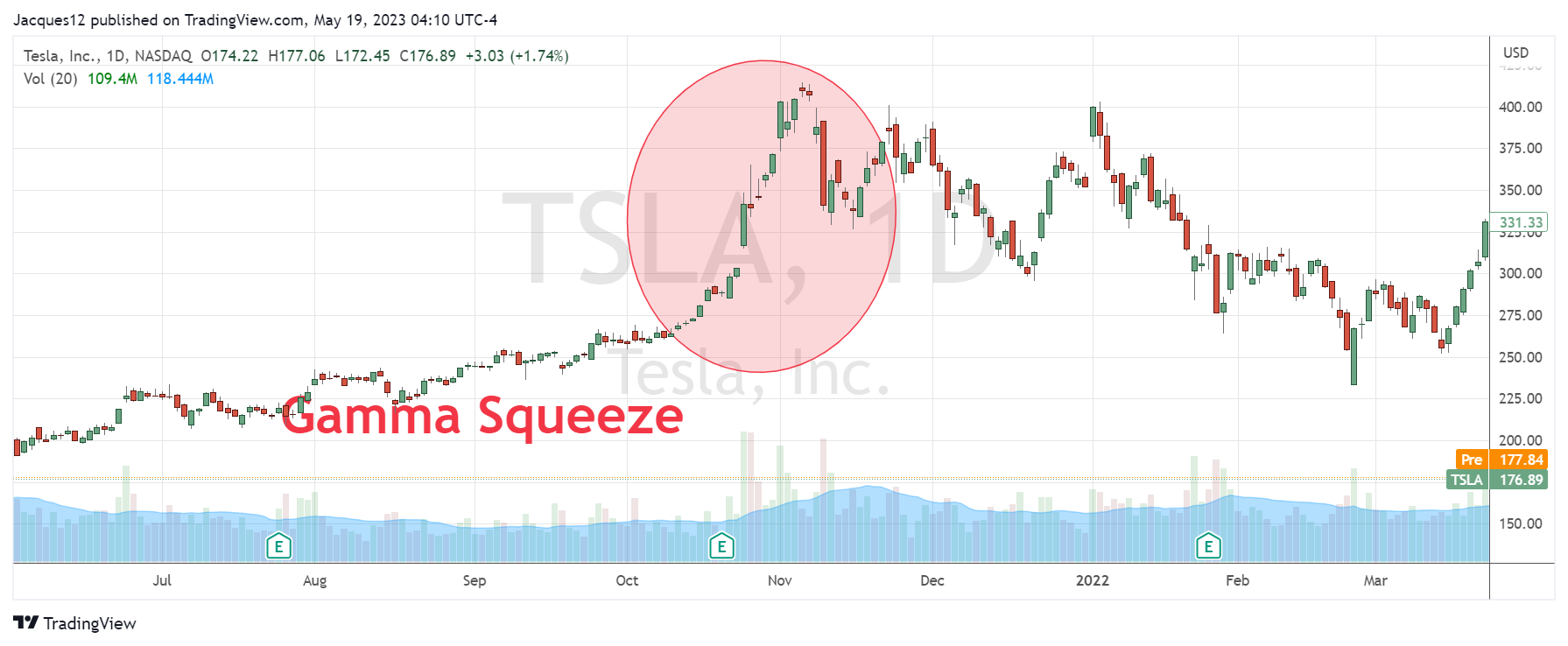

There may also be Gamma Squeeze in NDX trading, just like which was on Tesla in 2021.

Gamma squeeze: When there are many bullish option positions in the market and if the underlying asset price rises,the gamma of bullish options will increase,resulting in traders needing to buy more underlying assets to hedge their option positions.This large-scale buying behavior will further push up the price of underlying assets forming a positive feedback loop.In this case,traders(mainly hedge funds)may feel pressure because they need to continuously purchase more underlying assets to maintain their hedged option positions.

On May 18th ,the call volume for Nasdaq-100 has reached its highest level since late 2014.

What happens after Gamma Squeeze?

It should be noted that Gamma Squeeze is a short-term phenomenon that usually occurs near expiration dates. And recently developed matured zero-day-to-expiration(0DTE)options have deepened this positive feedback mechanism's impact.

The overflow liquidity will eventually be spit out, as seen in Tesla's big drop on November 9th, 2021.

However, the volatility of indices and individual stocks is different. The main components of the Nasdaq-100 index have strong upward momentum and hedge against macroeconomic uncertainties themselves. Therefore, even if there is a liquidity overflow backlash,it may become an opportunity for more hedge funds to build positions.

After all,before inflation falls back and monetary policy shifts,investors should not take risks by increasing their holdings in consumer stocks with greater uncertainty.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Weekly RSI highest since Nov 2021. Rates moving higher. FAST. I'm sure it will be fine...

The FOMO pumpers are going to keep chasing the market higher.

Pullback over (0.14% \at its height). Green and can resume uptrend now