Previously on Nov FOMC Meeting, All eyes on December!

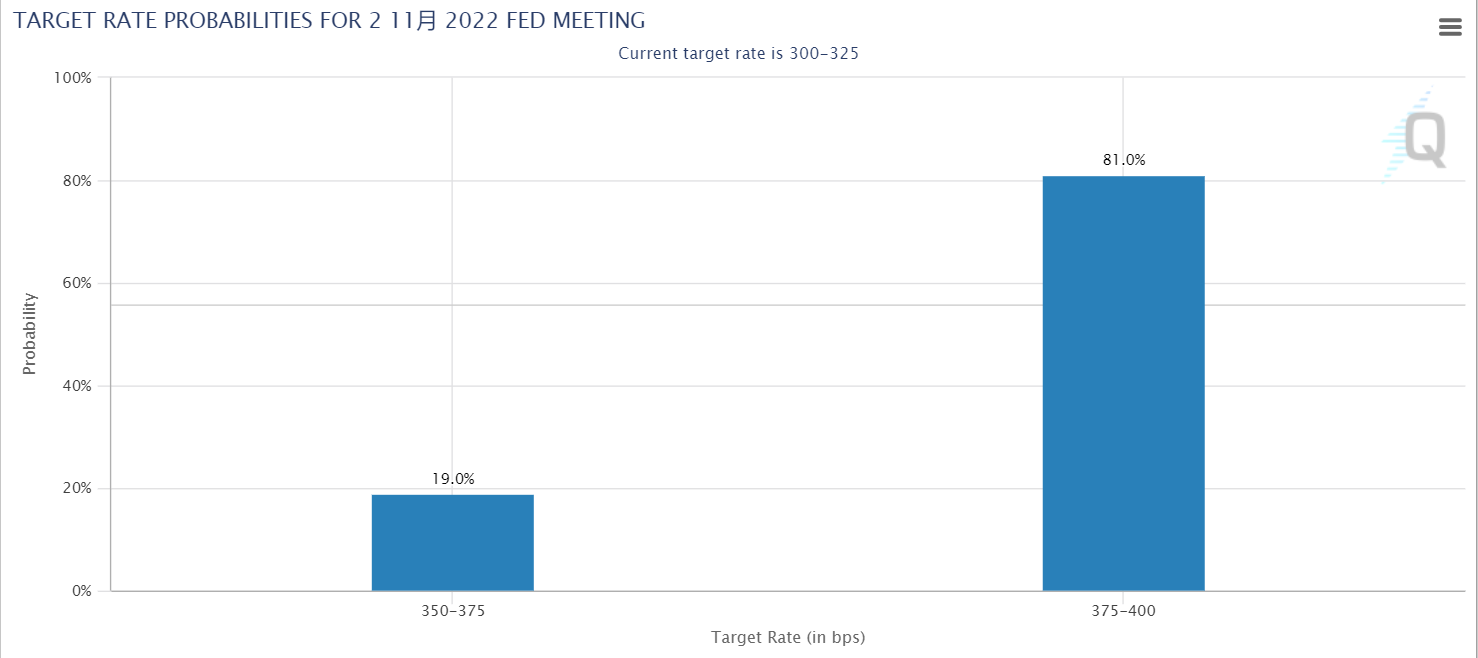

FOMC November meeting will take place on Nov 2. Market is on high consensus of 75bps+.

We believe the market is fully price-in the November results, but there's still room for possible easing on December meeting.

The Fed's decision on interest rates is based on the latest data, but most of them are delayed. CPI in September still beat market consensus, the market is still aggressive on pricing higher interest rate.

The good news is some data shows good sign, like non-farm payralls, September GDP and the inflation forecast of the University of Michigan in October. This also gives the market another reason to ease, and for the first time, Fed officials began to show some doves (San Francisco Fed Chairman Daley made remarks to consider slowing down interest rate hikes).

What information should we investors pay attention to from the Fed Meeting?

First, the rate peak and the path

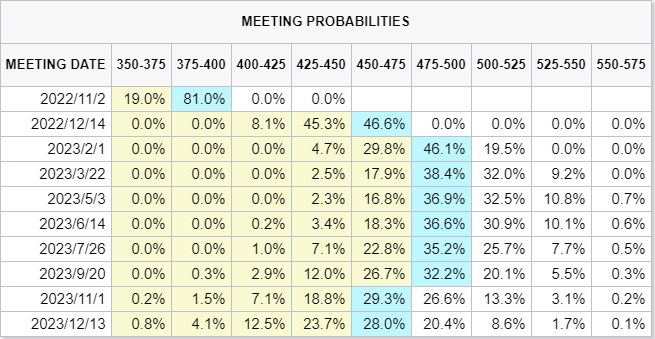

According to observation tools, the high point of the Fed's current interest rate hike may reach around 5%.

It is likely to reach a high point in February next year, which means that after 75 basis points in November, the Fed has two interest rate hike meetings to fill the rest of 100bps. Therefore, the interest rate increase in December is crucial.

If they raise interest rate 75bps in December, it will be 25 basis points in February next year; If it is 50 bps, it will be 50 basis points in February next year.

What's the difference?

If we continue to raise interest rates sharply too fast, we will not rule out the probability of raising financial risks.

Especially, the expectation of recession has intensified, and it is very possible for the Federal Reserve to make some adjustments in the pace of rapid interest rate hikes. After all, after the interest rate hike in December, it will be Christmas and New Year's holidays, and it will be a month and a half before the next interest rate hike in February. And winter may face some unexpected situations again,If the interest rate hike leads to a tightening of US dollar liquidity, it will also cause some unnecessary fluctuations in the US debt market.

An increase of 50 basis points in December also has the advantage of giving more time to observe and decide whether the focus of interest rate increase needs to be that high.

Besides, the rate will burden the US Treasury. The Biden goverment will give them pressure after the Mid-Term.

What path to choose is what the market should pay most attention to.

At present, the market valuation is 75 basis points more, so once it is 50 basis points in December, it is favorable to a certain extent.

Second, the impact of high interest rate on daily life.

The Fed raised interest rates to control inflation, but it could not slow down recession.

Rent, a key item in core CPI data, has surprised the market in September. It is directly affected by Federal Reserve (because higher interest rate caused higher housing cost). The Fed's intention to raise interest rates is to curb inflation, but in fact it's not.

From the historical trend of CPI, food and energy projects actually began to decrease in August, and supply chain problems eased as early as May. At present, the main factor of higher CPI is service items.

Although the GDP of the United States in September also exceeded expectations,but the expansion in exports and decline in imports has contributed 1.6 percentage points and 1.1 percentage points respectively, and together they contributed 2.7 percentage points, which is almost equivalent to all GDP growth.

Consumption and investment continues to slow down, which also shows that the endogenous growth momentum of the economy is weakening.

U.S. GDP Contribution Breakdown Data, source from: wind,CICC Research

Why do import and export has that much contributions?

First, Energies, especially natural gas crisis in Europe.The US has exported a lot to Europeans, while the latter has no bargain. After all, energy is fairly priced in the market. Europeans want cut from Russians, they have to pay more to Americans.

Second, strong dollar. This makes Americans more willing to spend overseas. Especially when the euro is below the parity. Americans prefers to go to Europe (southern Europe and other countries) to spend money. For most countries, a strong currency is good for imports and bad for exports, but the US dollar as a global pricing currency, especially in the current market environment with recession expectations, is just the only exception.

$S&P 500(.SPX)$$DJIA(.DJI)$$NASDAQ(.IXIC)$$S&P 500 Bear 3X ETF(SPXU)$$SPDR S&P 500 ETF Trust(SPY)$$NASDAQ 100(NDX)$$iShares 20+ Year Treasury Bond ETF(TLT)$$iShares TIPS Bond ETF(TIP)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?