Copper, as an important industrial metal, its price trend has been widely concerned by the global market.

In recent years, copper prices have experienced a series of fluctuations. Especially last week, copper prices broke through the $10,000 mark for the first time in two years. This increase not only reflects the current heat in the copper market, but also reflects the global economy, supply chain and energy transformation.

The intertwined influence of multiple factors has aroused heated discussions in the market. Will $10,000 be the end of copper prices? Starting from multiple fundamental factors, combined with the latest industrial data, this article will deeply analyze multiple factors affecting the trend of copper prices, and look forward to the future trend of copper prices.

1. Disturbance of supply and demand pattern

Recently, the global copper mine supply has faced many challenges. On the one hand, frequent unpredictable factors such as mine accidents and natural disasters have seriously affected copper mine production.

On the other hand, the distribution of global copper resources is uneven, and some major production areas are affected by geopolitical risks, and the stability of supply is greatly reduced. In addition, the acquisition offer of Anglo American by mining giants such as BHP Billiton has also exacerbated market concerns about future supply. Under the combined effect of this series of factors, the supply of copper mines has shown signs of tension, which has promoted the rise of copper prices.

Over time, some new copper mine projects may gradually come into production, thereby increasing market supply. At the same time, the recovery speed of the global economy and fluctuations in manufacturing activities will also directly affect the growth of copper demand. Therefore, changes in the supply and demand pattern will be one of the important factors affecting the trend of copper prices.

From the perspective of the supply side, according to the data of the United States Geological Survey (USGS), the global mine-produced copper production in 2023 will be 22 million tons. Goldman Sachs predicts that global mined copper production will reach 23 million tons in 2024.

However, from the perspective of mining companies, the total planned copper production of the world's top 15 mining companies (accounting for 50% of the world's output) in 2024 will only increase by 1.6% year-on-year, an increase of about 200,000 tons. This suggests that while global mined copper production is increasing, the growth rate is relatively limited.

From the demand side, China is the world's largest copper producer, consumer and importer. According to the forecast of the China Business Industry Research Institute, China's demand for copper concentrate will increase to 9 million tons in 2024. In addition, with the recovery of the global economy and the increase in manufacturing activities, especially the development of new and renewable energy sources, the demand for copper will continue to grow.

2. The impact of technological progress on copper in the context of manufacturing recovery

With the advancement of technology and the transformation of the global economy, the copper industry chain is also undergoing profound changes.

The traditional copper mining, smelting and processing industries are developing in a more environmentally friendly, efficient and intelligent direction. At the same time, the application fields of copper are also constantly expanding, especially in the fields of new energy, high technology and high-end manufacturing, and the demand for copper is showing a rapid growth trend.

In the context of the gradual recovery of the global economy, manufacturing activities have also shown a strong recovery momentum. In particular, the manufacturing indexes of major economies such as Asia and Europe are at a relatively high level, showing strong market demand. The recovery in manufacturing has had a positive impact on demand for metals such as copper, further pushing copper prices higher.

At the same time, the impact of technological progress on the copper market is double-sided. On the one hand, the emergence of new technologies and new materials may replace the application of copper in certain fields, thereby reducing the demand for copper; On the other hand, the development of new energy and clean energy has also brought new growth points to the copper market. For example, copper plays an important role in the power generation, transmission and energy storage equipment of renewable energy such as solar energy and wind energy. As the global demand for renewable energy continues to grow, the application of copper in this field will continue to expand.

3. The impact of macroeconomic and geopolitical factors on copper

The global economic situation is one of the important factors affecting the trend of copper prices. Economic recovery and growth will lead to an increase in manufacturing activity, which in turn will drive the growth of copper demand. At the same time, macroeconomic indicators such as inflation levels, interest rate policies, and exchange rate fluctuations will also have an impact on copper prices.

Geopolitical risk is one of the unpredictable factors affecting the trend of copper prices. The production and transportation of copper involves many countries and regions, and the geopolitical stability of these regions directly affects the supply of copper. The deeply mired Russia-Ukraine war and the intensifying Palestine-Israel conflict have all had a certain impact on the supply of copper. These uncertainties will provide some support for the rise in copper prices.

4. Prospects for future copper price trends

From a fundamental point of view, the future trend of copper prices is still affected by various factors. On the one hand, the recovery of the global economy and the growth of manufacturing activities will continue to drive the growth of copper demand; On the other hand, the tightening of environmental protection policies and the popularization of the concept of sustainable development will also bring new growth points to the copper market.

However, investors also need to note that the rise in copper prices has not been smooth sailing and may be impacted and fluctuated by various factors. Specifically, copper prices are expected to continue their upward trend in the next few years. This is mainly due to the following aspects:

1. Tight supply and demand pattern: Due to relatively limited supply growth and continuous growth in demand, the copper market will remain in a state of tight supply and demand. This will provide strong support for rising copper prices.

2. Growth in demand in the field of new energy: With the development of new energy and clean energy, the application of copper in batteries, cables and transmission facilities will continue to increase. This will bring new growth points to the copper market.

3. Uncertainty of geopolitical risks: Although geopolitical risks may have a short-term impact on copper prices, in the long run, this uncertainty will also provide some support for the rise of copper prices.

Risk Management of Copper Price Fluctuations

The fluctuation of copper price is one of the important risks that investors need to face when investing in the copper market. To reduce risk, investors can take the following steps:

1. Pay attention to the global economic situation and policy changes:

2. Pay attention to changes in the supply and demand pattern:

3. Diversified investment allocation: Investors can consider more diversified methods when investing in target allocation, such as investing in copper futures, options and other financial instruments to obtain a wider range of investment opportunities.

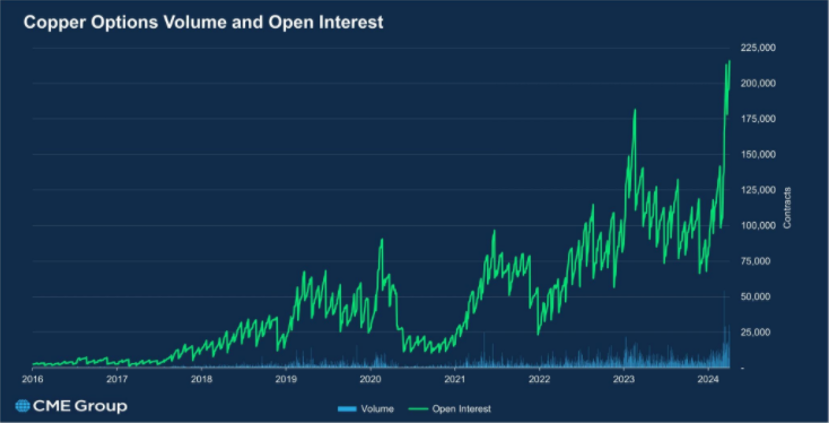

CME group's COMEX copper futures and options are more suitable investment targets for allocating to the global market and managing the risk of copper price fluctuations, and the market liquidity is active.

Figure: Open interest in copper options (product code: HX)

$NQ100 Index Main 2406 (NQmain) $$Dow Jones Main 2406 (YMmain) $$SP500 Index Main 2406 (ESmain) $$Gold Main Company 2406 (GCmain) $$WTI Crude Oil Main Company 2406 (CLmain) $

Comments