Big-Tech’s Performance

If the tide goes out, who's the first to be caught swimming naked? I'm afraid that's a topic tech companies are starting to worry about this week.

While NVDA's earnings continue to indicate strong demand, the hardware cycle tends to lag behind software, and this week's earnings reports from several software companies gave sensitive investors in the market a hint of danger. Combined with poor Treasury auctions, U.S. bond yields remain high, and hawkish responses from top Fed officials have put pressure on stock market liquidity as well.

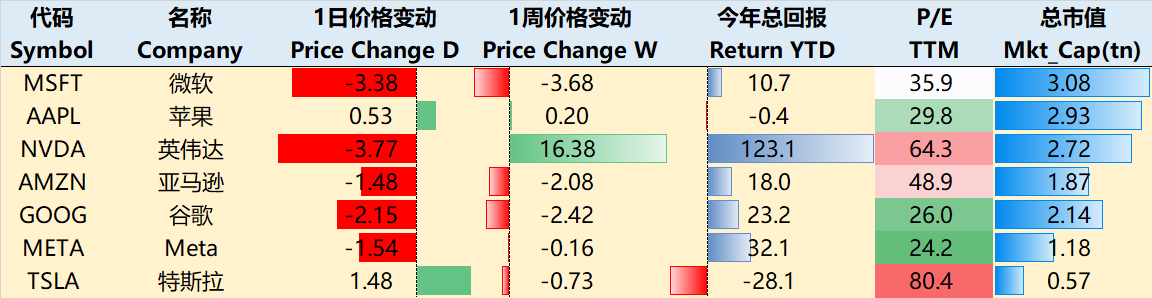

By the close of trading on May 20, the best performer over the past week was $NVIDIA Corp(NVDA)$ +16.38%, followed by $Apple(AAPL)$ +0.2%, while all others closed lower, $Meta Platforms, Inc.(META)$ -0.16%, $Tesla Motors(TSLA)$ -0.73%, $Amazon.com(AMZN)$ -2.08%, $Alphabet(GOOG)$ -2.42%, and $Microsoft(MSFT)$ -3.68%.

Big-Tech’s Key Strategy

AI boom starting to flame out?

NVIDIA's market capitalization after the earnings report is pushing Apple, and the two are competing to see who reaches $3 trillion first. But while the carnival is going on, AI appears to be on fire in its backyard.

A number of SAAS software companies reported earnings, and a couple of them plummeted thunderously, including: cloud services company Salesforce, which saw weaker-than-expected revenues (for the first time in 18 years) plunged 20%, UiPath, which is in the same track as Microsoft's offerings, plunged -30%, and by the way, also buried 450,000 shares of ARKK's bet on earnings. The market is starting to question whether AI software companies are facing bottlenecks in their business.

Hardware companies also each have their own difficulties, earnings before the report was pulled up expectations of Dell, although the revenue to meet the standard, but the profit pull crotch. This generates the thought of whether AI is really able to make the whole industry universal for companies;

Macro news is also unfavored, there are rumors that the U.S. government restricts Nvidia and other chip makers to sell AI chips to the Middle East, whether it is useful or not, but also shows that the leading companies also have to withstand the market whack.

Looking at the performance of tech companies this week

The wave of profit-taking by software companies was more pronounced, even if the strongest Microsoft clearly did nothing and retreated to early February levels after new highs. The divergence among software companies, whether it is a company problem or an industry problem, needs to be verified in the next few earnings reports;

Hardware companies are relatively better able to hold up. NVIDIA's earnings were unchanged and there was also a stock split positive, while Apple has rebounded since its lows, and there is even more anticipation of an AI overhaul of Siri, but the market is also trading in a more concentrated fashion;

Speculative trading sentiment is on the rise. From the GME boom of the previous two weeks to the rise of "pseudo AI stocks" such as C3.AI, all represent a rebound in speculative sentiment, as well as the market's expectations for the sustainability of the AI market have come down.

Big-Tech Weekly Options Watcher

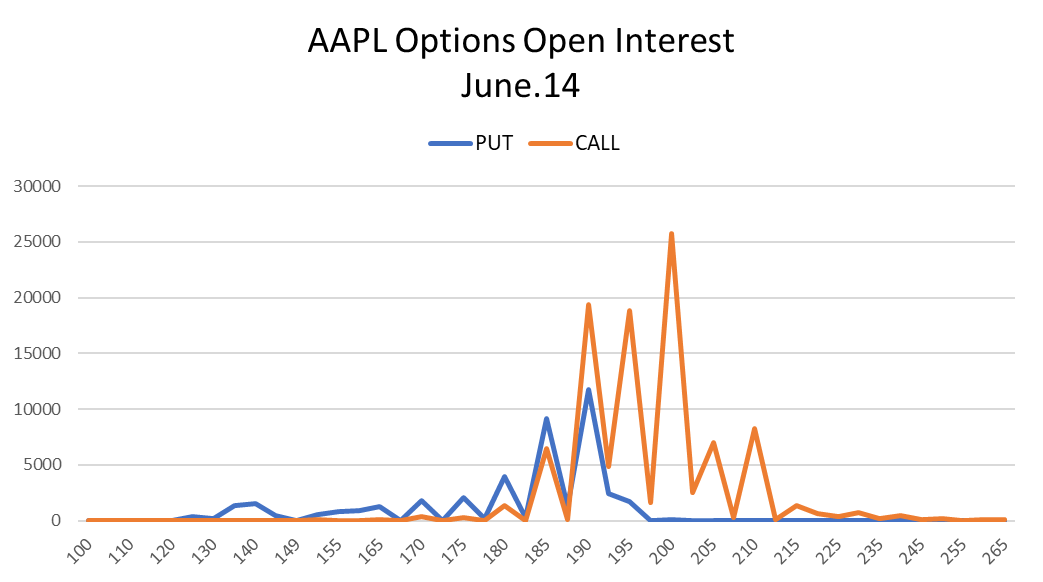

Apple's WWDC 2024 will be held on June 10, and the market is very much looking forward to having app-level AI embedded, with the current partnership with OpenAI being widely mentioned and has been supporting its share price.

Observing its June 14 expiration of open options, Call's overall unit volume is much larger than Put, concentrated in the 200 position most, also indirectly indicates that the market sentiment is optimistic.

Big-Tech Portfolio

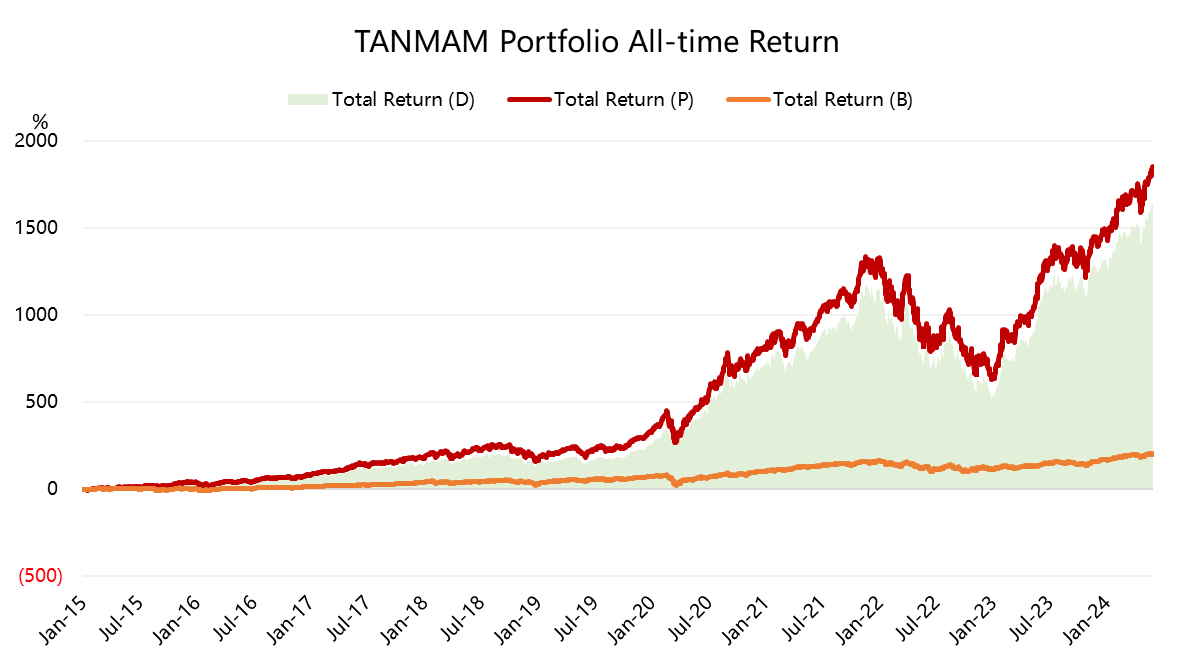

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly. The backtesting results are far outperforming the S&P 500 since 2015, with a total return of 1,822% over the same period $S&P 500 ETF (SPY)$ returned 200%.

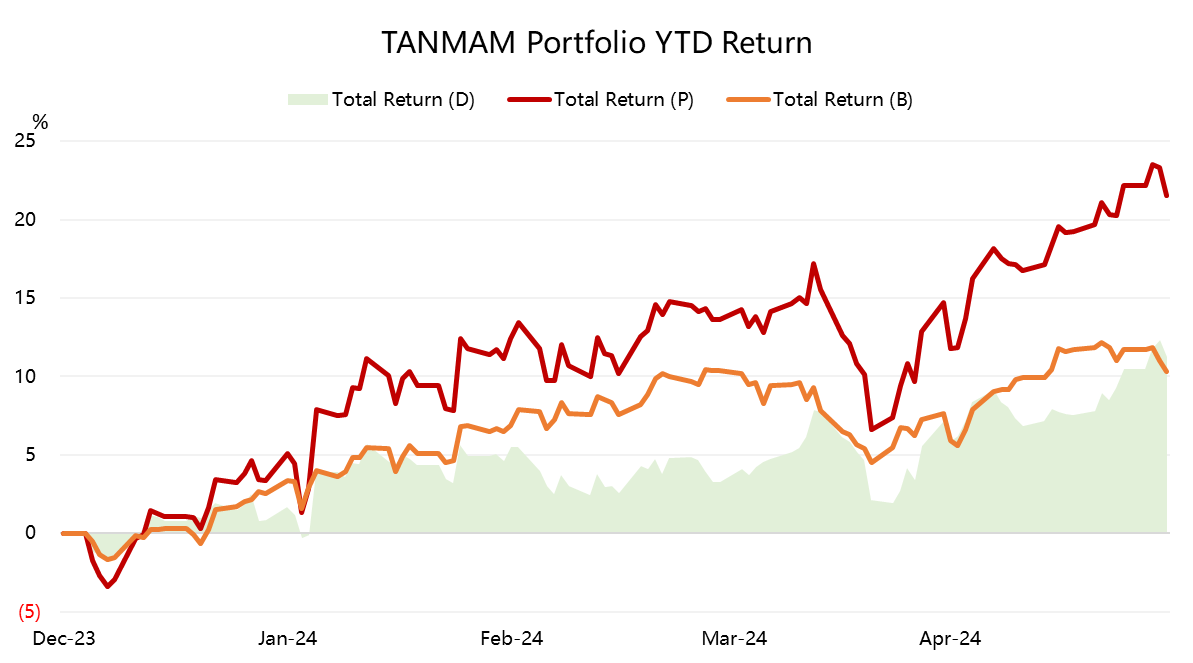

The broader market hit a new high this week and the portfolio's year-to-date return hit a new high of 21.5%, outpacing the SPY's 10.3%.

The portfolio's Sharpe ratio for the past year was 2.7, while the SPY was 2.3 and the portfolio's information ratio was 1.8

Comments