$.SPX(.SPX)$ confirmed a bearish WXY model during this sideways price action for a 2nd wave.

Therefore, SPX should not cross today's 6008 high to target 5936, if not 5900, with downside potential for more as it enters a 3/4/5 wave sequence.

Lean remains we topped at the 6017 peak (invalidation) targeting the Weekly FVG at 5700-5636.

$SPDR S&P 500 ETF Trust(SPY)$ $E-mini S&P 500 - main 2412(ESmain)$ $NASDAQ 100(NDX)$ $Invesco QQQ(QQQ)$ $E-mini Nasdaq 100 - main 2412(NQmain)$

Image

Image

Image

Image

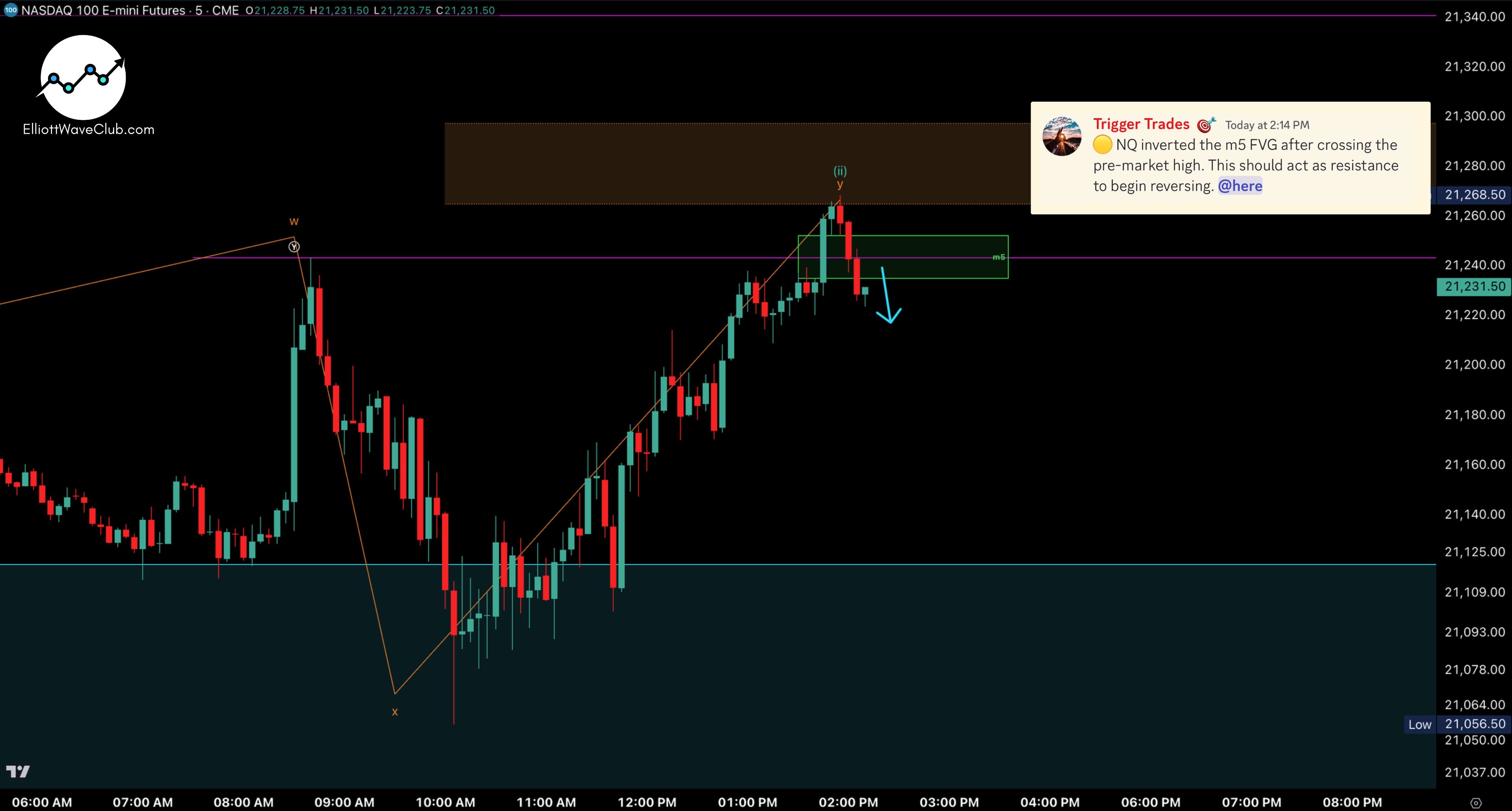

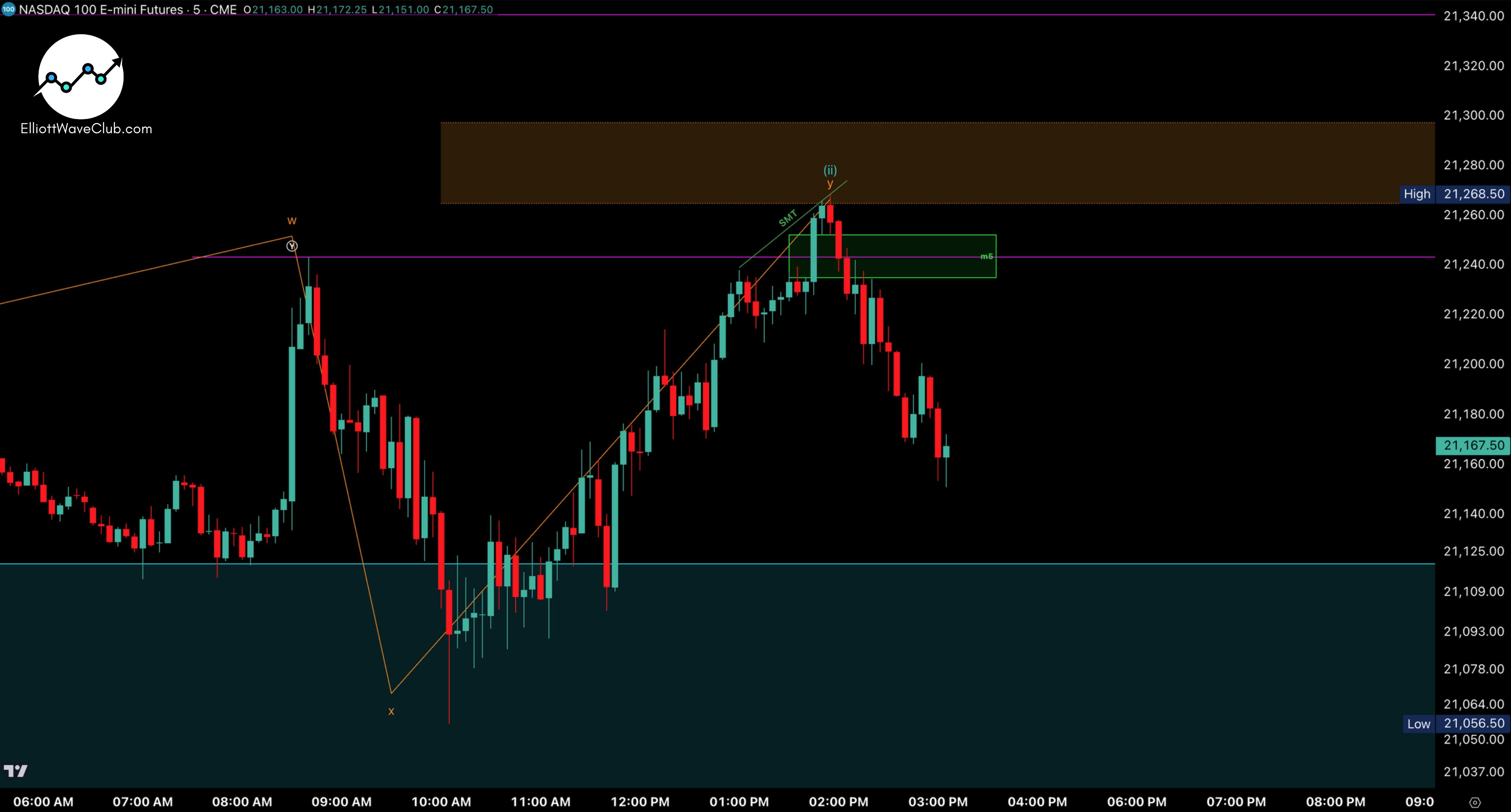

Shorts were alerted after $E-mini S&P 500 - main 2412(ESmain)$ and $E-mini Nasdaq 100 - main 2412(NQmain)$ inverted their m5 FVGs after tracing out a bearish WXY model 📉

Price immediately declined following 🔥

Trade Set Ups🟢🟡🔴:

Image

Image

Image

Image

Image

Image

Image

Image

What’s the Best Strategy for Riding a Bull Market?

Dow and S&P 500 both reached record highs, with the Dow leading gains at nearly 0.7% to cross 44,000 points for the first time, while the S&P 500 surpassed 6,000. There's no doubt we're in an unstoppable bull market.

----------------

What strategy do you use to profit from a bull market?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Image

Image

Image

Image

Image

Image

Comments