Gold has been on an impressive rally since the beginning of 2025, surging to new all-time highs and drawing increasing attention from investors. The price has risen by 9% this year alone, and on Wednesday, it even touched a historic peak of $2,900 per ounce. As of now, gold is trading around $2,880, continuing to spark investor interest.

But is this the right time to invest? What is driving this surge in gold prices, and what gold-related assets should investors consider? Let’s find the answers in this article.

The Drivers Behind Gold's Price Surge

The recent spike in gold prices isn’t a coincidence. Several factors are contributing to the precious metal’s ascent:

US-China Trade Tensions: Escalating trade tensions between the US and China have led to increased uncertainty in the global economy. With concerns about potential new tariffs from the US, investors have turned to gold as a safe-haven asset.

Geopolitical Risks: Geopolitical events, such as statements from former President Trump regarding Gaza and Iran, have heightened market anxiety. These global tensions are pushing gold prices higher as investors seek stability in uncertain times.

Global Economic Slowdown: A slowdown in global economic activity, particularly in the US where service sector demand has fallen short of expectations, has further fueled the demand for gold. Consumers are tightening their spending, and the broader economic outlook is becoming less certain, encouraging safe-haven buying.

Central Bank Demand: Central banks around the world continue to increase their gold reserves. According to the World Gold Council, central bank gold purchases have remained strong, especially as global economic uncertainty grows.

What’s Next for Gold?

The momentum in gold prices remains robust, with many market analysts predicting that gold could push past the $3,000 mark in the near future. While technical indicators suggest gold may be entering an overbought zone, the Relative Strength Index (RSI) is still far from extreme levels, leaving room for further upside. Analysts believe gold could challenge the $2,900 level again, possibly breaking through to new highs.

According to FXStreet analyst Christian Borjon Valencia, gold prices could continue their upward trajectory, with targets set around $2,890 and $2,900 per ounce. Should a correction occur, support levels are seen at $2,800 and $2,730. Investors should keep an eye on these key levels as they navigate the gold market.

What Gold-Related Assets Can You Invest In?

For investors looking to capitalize on this gold rally, there are several ways to play the gold market. The most direct method is through futures trading, with options like $Micro Gold Futures (MGCmain)$ and $Gold Futures (GCmain)$ available for those with futures trading accounts. If you haven’t yet activated a futures trading account, consider exploring gold ETFs, which are a more accessible option.

Gold ETFs: A Convenient Way to Invest in Gold

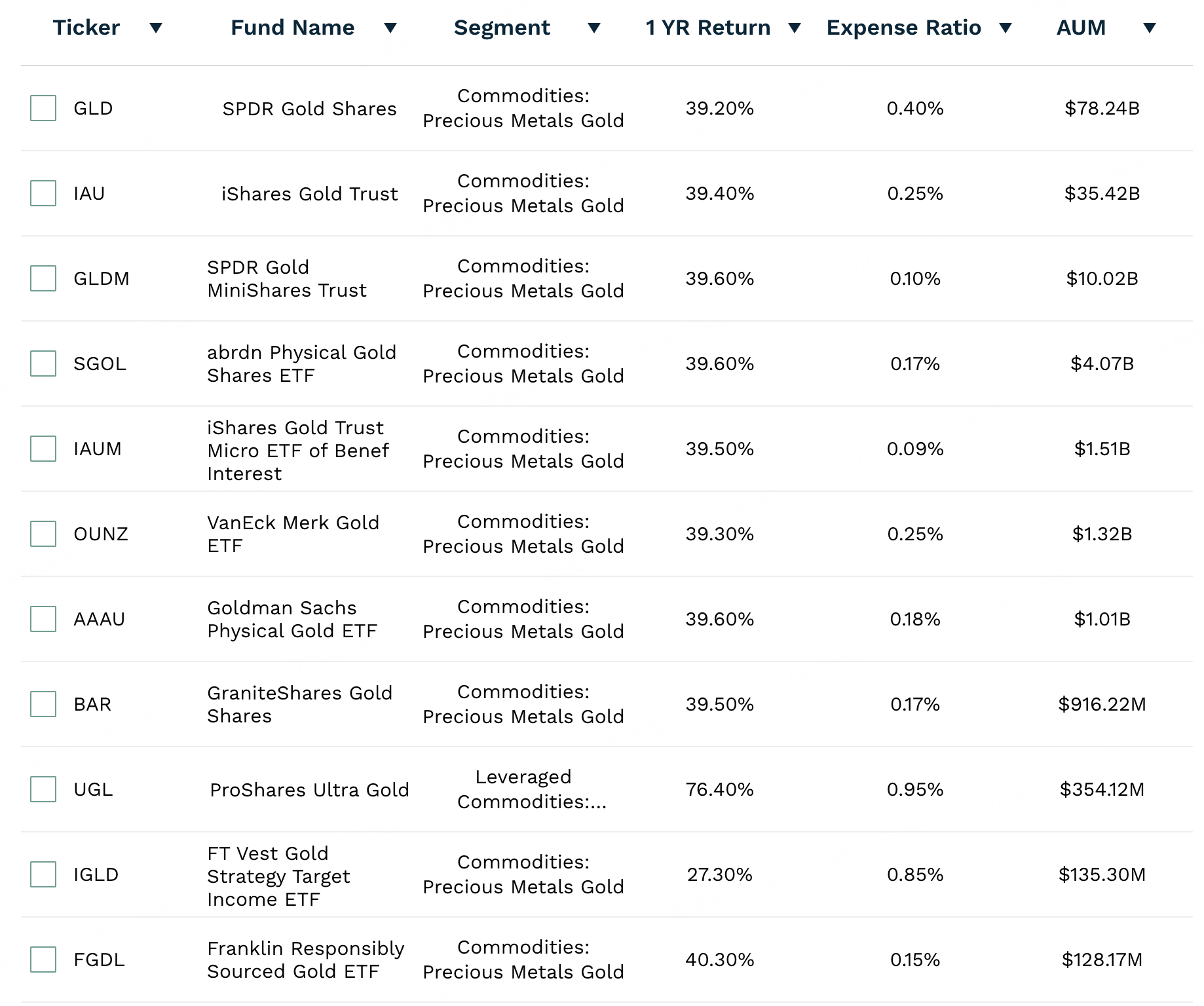

Gold ETFs track the performance of gold in the spot and futures markets, offering investors a straightforward way to gain exposure to gold without the need to physically purchase the metal.

$SPDR Gold Shares(GLD)$ As one of the largest and most liquid gold ETFs, GLD tracks the price of gold in the spot market. It holds physical gold to back its shares, making it a reliable way to invest in gold.

$iShares Gold Trust(IAU)$ Similar to GLD, IAU also holds physical gold and tracks the price of gold. However, it has a lower expense ratio, making it more suitable for long-term investors.

$SPDR Gold MiniShares Trust(GLDM)$This low-cost version of SPDR Gold ETF allows investors to participate in gold investment with a smaller amount of capital, though each share represents less gold.

$abrdn Physical Gold Shares ETF(SGOL)$ invests in physical gold and holds it in Swiss vaults, offering investors both the security of physical gold and a lower management fee.

$ProShares Ultra Gold(UGL)$ This leveraged ETF aims to deliver twice the daily performance of gold’s spot price, making it a popular option for day traders. However, it comes with increased risk, especially for overnight positions.

$ProShares UltraShort Gold(GLL)$ This ETF offers the inverse exposure to gold, providing double the short performance of gold. It is designed for those looking to bet against gold’s price movement.

Gold Mining ETFs

Apart from gold ETFs, investors can also consider gold mining ETFs, which track a basket of gold mining companies. These ETFs can sometimes diverge from the performance of physical gold due to factors like market conditions and individual company performance.

$VanEck Gold Miners ETF(GDX)$ This ETF tracks large-cap gold mining companies, offering exposure to gold miners like Franco Nevada, Newmont Mining, and Barrick Gold.

$VanEck Junior Gold Miners ETF(GDXJ)$ : Focused on smaller gold and silver mining companies, this ETF targets junior miners with higher growth potential but also increased risk.

$Direxion Daily Gold Miners Index Bull 2X Shares(NUGT)$This leveraged ETF provides twice the performance of the NYSE Arca Gold Miners Index, making it a good choice for aggressive traders.

$Direxion Daily Gold Miners Index Bear 2X Shares(DUST)$ Inversely correlated to gold miners, this leveraged ETF provides double the inverse performance of the gold mining index. It is designed for short-term traders looking to profit from falling gold prices.

Gold ETNs: A Unique Alternative

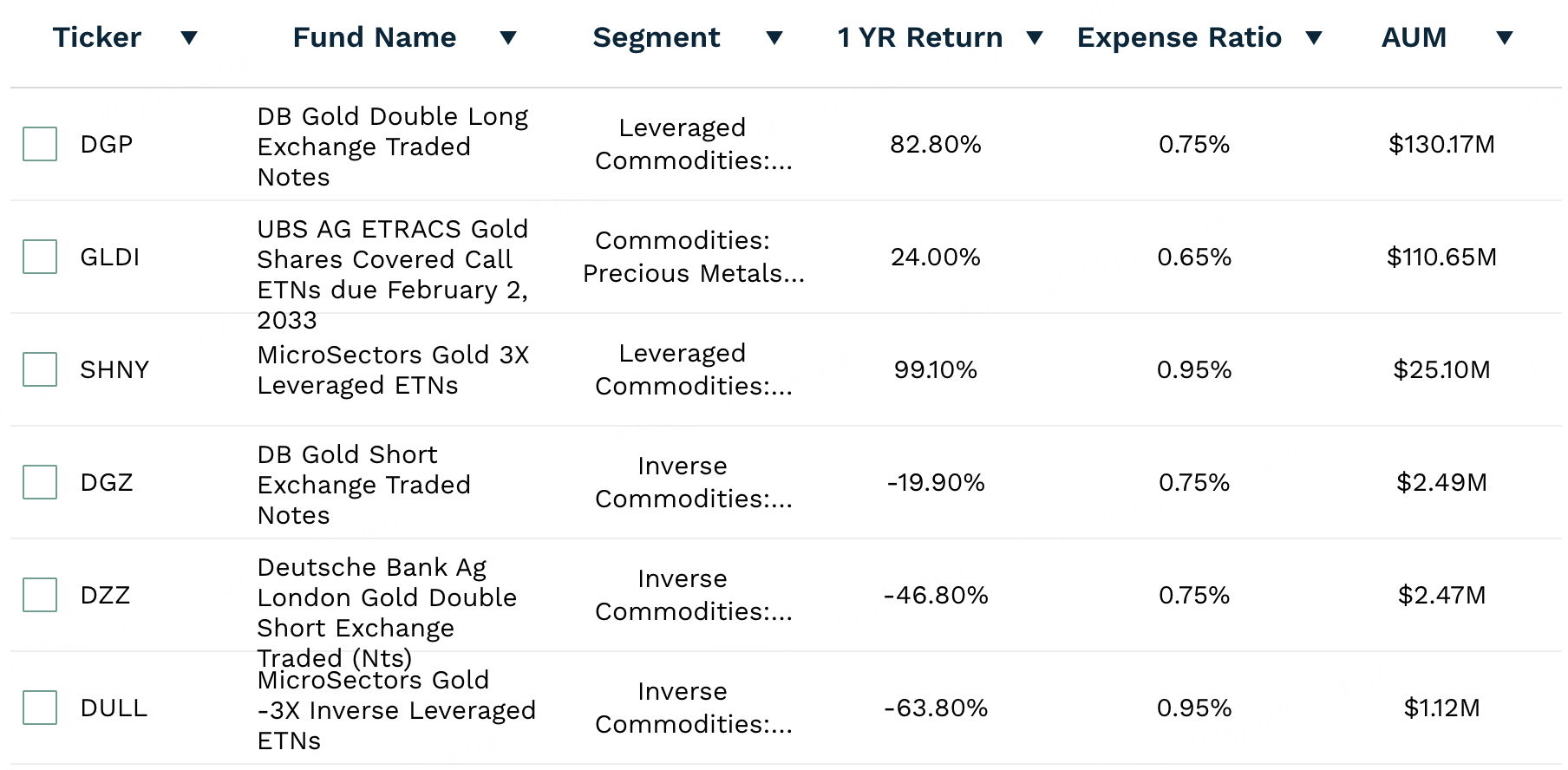

Gold Exchange-Traded Notes (ETNs) offer another way to gain exposure to gold. These notes are debt instruments that track the price of gold futures and can carry different risks depending on the issuer's creditworthiness.

$DB Gold Short ETN(DGZ)$ : This ETN provides short exposure to gold futures prices. It is less liquid but can be a tool for those looking to bet against gold.

$DB Gold Double Long ETN(DGP)$ : A leveraged ETN that offers two times the performance of gold futures, making it suitable for day traders or those looking for short-term plays.

$DB Gold Double Short ETN(DZZ)$ : This leveraged inverse ETN provides twice the short exposure to gold futures, catering to those who are bearish on gold’s price.

Conclusion

The surge in gold prices is driven by a combination of factors, including geopolitical risks, economic uncertainty, and strong central bank demand. As prices continue to climb, investors may want to consider options like gold ETFs, gold mining ETFs, or even gold futures to gain exposure to the precious metal. However, it’s essential to consider your investment goals and risk tolerance before entering the market.

If you’re ready to take advantage of the gold rally, there are plenty of ways to do so—but always remember to monitor key price levels and stay informed about market conditions. Happy investing!

Comments