The recession just lights up the yellow light,From the data we ran out, the red light of the economic crisis is far from lit up.If the Fed does not raises interest rates beyond expectations, there may be about one year left for the market to fluctuate.

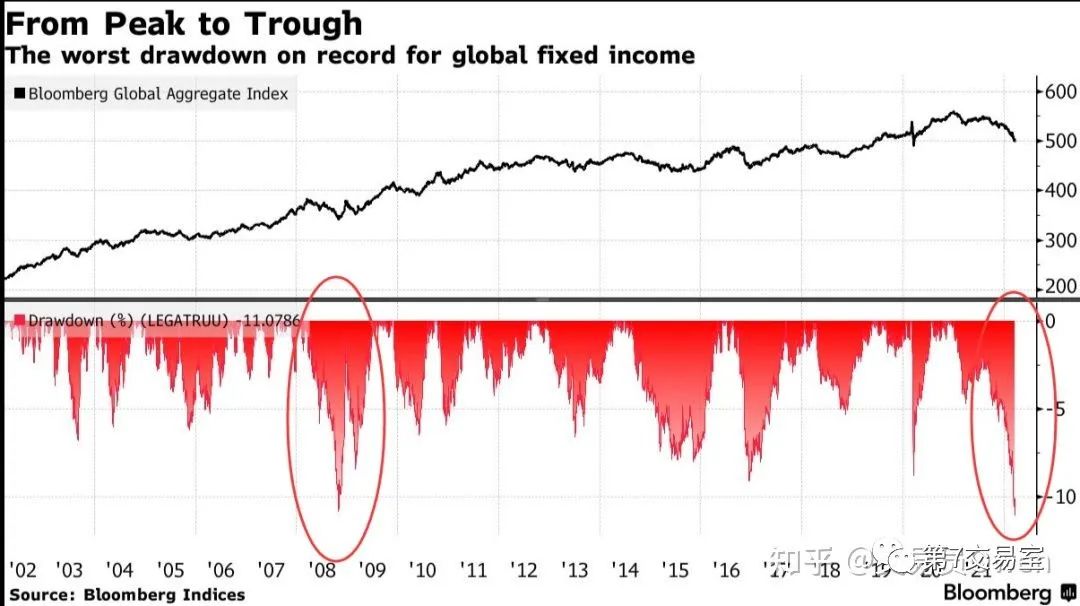

Have you found a very bizarre phenomenon? When the global bond market experienced a rare storm of crushing the market,the stock market remained stable, as if it was not affected by the bond market's decline at all. In addition to the retracement of A shares due to the reasons we mentioned earlier, the peripheral markets such as Nikkei, EU Index and Korea Index are still singing and dancing.

Review: The stock market rise after the Fed raised interest rates may be an illusion

Is it strange? US stocks are still bullish in the short term

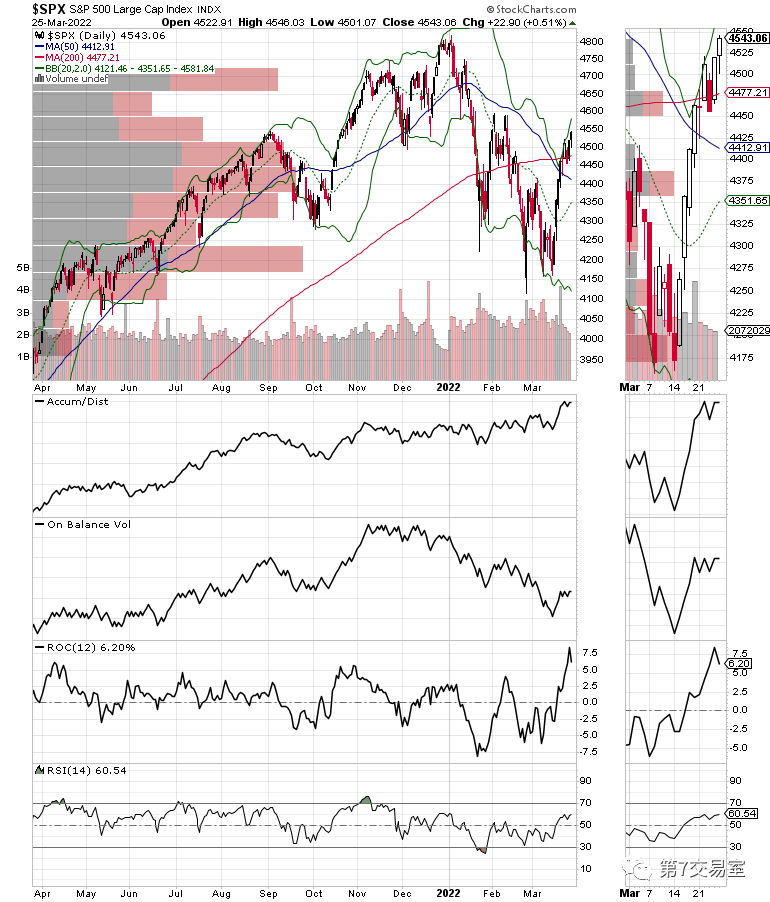

We mainly look at US stocks. In terms of form, the short-term trend of US stocks is still bullish.

S&P has held the 200-day moving average, and two important indicators are also improving. First of all, the rebound of OBV from the bottom indicates that new funds are involved in this rebound, while the continuous rise of ADI indicates that the buyer's strength is dominant recently.

And the RSI of SP500 did not show a sharp retracement, and remained above 50 all the time, so the market buying power was very strong.

The index A/DLine, which we often quote, is also improving, the RSI remains above 50, and the index has rebounded to the 50-day moving average. If US stocks can rise in the near future, A/DLine can cross the 50-day line and successfully win the "bullish" area.

Therefore, in the short term, U.S. stocks tonight are very important. If S&P can rise above the key resistance level of 4600 before, then U.S. stocks are still bullish in the short term.

The rise of US stocks is due to the return of the US dollar abroad, which has a certain supporting effect on risk sentiment. In addition,as far as the current selling range of US bonds is concerned, the impact may not be too great, After studying a lot of data about the yield of US bonds, we find that it is not a direct and short-term process for the decline of US bonds to the decline of US stocks.

However, the rise of Nikkei and EU indexes is probably caused by the fact that the CEB and JOB has implemented an unexpected easing policy under the pressure of inflation, especially the Bank of Japan, whose financial tightening index has fallen the most among the important economic entities since March.

Compared with the rise in the stock market, the euro and yen, as well as other non-US currencies, have fallen in a mess. Of course, except for the RMB,PBOC have not allowed it to continue to fall in order to ensure the stability of the foreign exchange market. Of course, the easing efforts are also the most cautious (red line in the above picture).

You can understand that in the short term, for the stability of R RMB, China paid the price of stock market fluctuation,but I believe that there is still room above Shanghai Stock Exchange and A50, and the retracement will usher in a better rise after the bad news is exhausted.

Well, the question now is, how long will the US stock market rise?

Let's put it this way, the trend of US stocks will be more bumpy in the future, but it is unlikely that there will be a collapse like the bond market within one year.

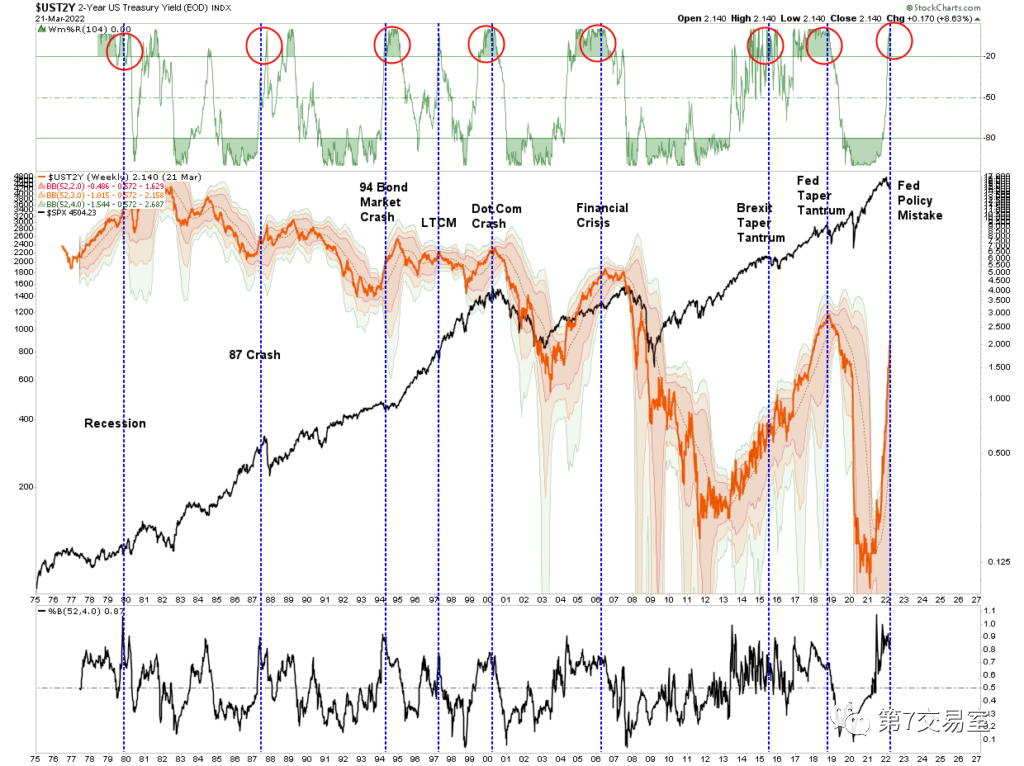

Let's first look at the next chart comparing the yield of 2-year US bonds with the trend of S&P

As the Federal Reserve has pulled the expectation of raising interest rates to the maximum, The yield of 2-year US bonds has soared to 4 times the standard deviation above the 52-week moving average. You can take a closer look at this chart. Since 1975, the weekly chart of the yield of 2-year US bonds has never deviated from the moving average to this extent, and even if it does, it will quickly retreat within 1 to 2 weeks in the short term.

Once the moving average of US bond yields deviates greatly in the past two years, S&P will also have a double dip in the next few weeks, but most of them are shallower than the previous one. Of course, there are also cases where there is a sharp collapse, such as the global stock market crash in 1987.

These plummeting years have one thing in common,There are recessions and economic crises.

So, will the decline of US Bond trigger an economic crisis?

This is difficult to judge in the short term, but one thing we are sure of is that the signs of recession are not obvious at present.

Last week, the Federal Reserve just started to raise interest rates for the first time since the pandemic, but this rate increase is difficult to keep up with the rate of inflation.

The economic recovery under global easing, Has brought the soaring prices close to getting out of control, Now the outbreak of the Ukrainian-Russian war has caused the prices of energy and materials to rise sharply. Therefore, the current global inflation data is already rising freely, especially in Europe and America, which are dominated by free market economy.

Price intervention is difficult, and inflation can be controlled basically by raising interest rates. Unlike china, china directly cut off electric power and cut off demand to ensure stable supply and price, so coal has been suppressed.

When prices soar, forcing the necessary yield of bonds to soar, the consequences will inevitably be:the national consumption level drops, the savings rate rises, the financial borrowing cost rises, and the economic activities decrease, which will eventually trigger the stagflation period with high prices but low growth, and then we have to walk into the recession and depression.

From recovery to overheating, then to stagflation, and finally to recession, this Merrill Lynch clock has been inescapable to the world economy for many years.

Therefore, we generally judge the coming of recession by the Yield inversion of US bonds.

When high prices and monetary tightening triggered a sell-off in the bond market, The yield of short-term bonds will definitely rise first. Because the selling is concentrated on short-term bonds, while the selling amount of long-term bonds is small and the expectation of GDP increase is weakening, the yield of long-term bonds will rise slower than that of short-term bonds, resulting in Yield inversion.it is the most obvious signal of economic recession.

For now, we have seen yields inversion on five-and 30-year bonds : for the first time since 2006.

5-year and 10-year bonds are also upside down

But the most important signal still needs to wait, that is, 2-year bonds, 10-year bonds and 30-year bonds. The yield between the two pairs is close to inversion,

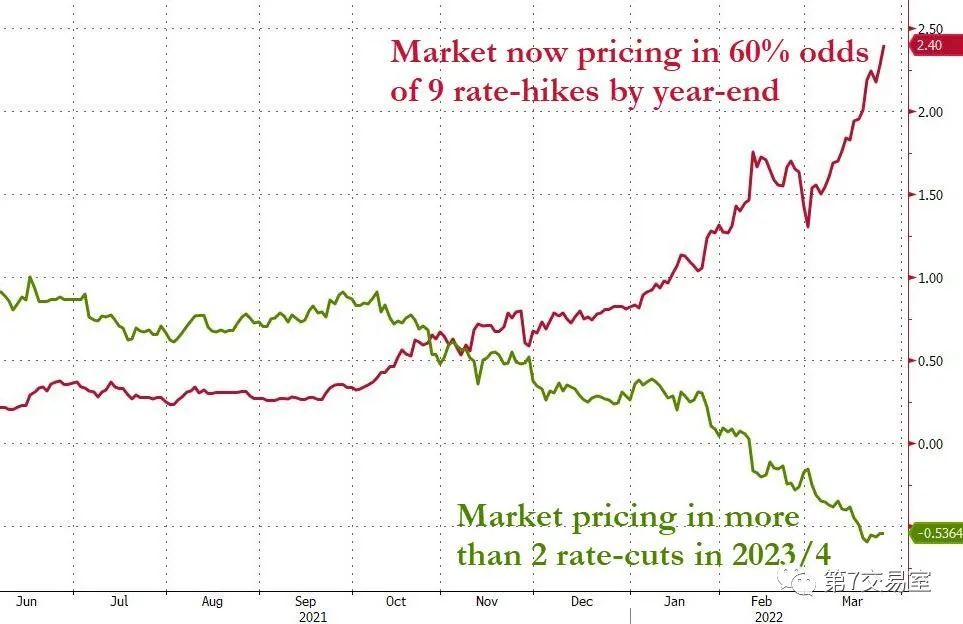

But even if the yield of short-term bonds has risen so wildly,The short-term US bond market has obviously prise in the 200 basis point interest rate increase in the past year,but the trend in the Eurodollar market tells us that 200 basis points,which is, seven interest rate hikes are still not enough. To control the current inflation level, at least nine interest rate hikes:

You see, the expectation of raising interest rates continues to rise, but the expectation of cutting interest rates has not changed after June 2023, which shows that people believe that the Federal Reserve will have to cut interest rates in 2023. This interest rate market trend also slows down the rise of long-term US bond yields and makes Yield inversion happen faster!

TheYield inversion of US bondhas just begun, and there is still a long way to go before panic

In early 2019, investors were becoming increasingly concerned about yield curve inversions. As we saw at the time, inversions across the curve were spiking, with several short-term maturities yielding more than longer-term maturities. Using 55 different combinations of Treasury yields from 11 different maturities ranging from 1 month to 30 years, more than half of the curves were inverted.

Historically, when more than half of the combinations inverted, a recession was close at hand. It ultimately rose above 65% of curves being inverted, a more consistent signal.

Headlines are stuffed once again with concerns about yield curves. But across maturities, inversion is still rare. Fewer than 10% of the combinations are currently inverted.

sentimenttrade

Therefore, how should we judge the current trend of US stocks? It may be appropriate to compare the market movements when the Persian Gulf War broke out, because crude oil prices are most similar to the S&P index

Therefore, the US stock market will definitely have a double dip, but it is likely to be similar in magnitude, and the decline will not break the previous low, and then continue to rise slightly, don't you think?

$E-mini Nasdaq 100 - main 2206(NQmain)$ $YMmain(YMmain)$ $Gold - main 2206(GCmain)$ $Light Crude Oil - main 2205(CLmain)$

Comments

嗯[自鸣得意]你觉得怎么样?