$TENCENT(00700)$ has released its earnings of Q4 and 2021 full year.

Overview of overall performance

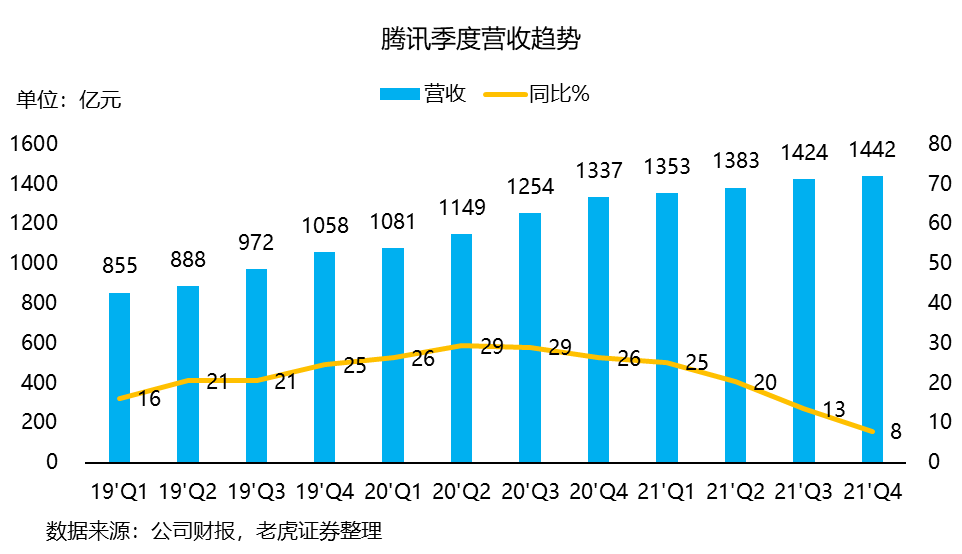

Q4 revenue was 144.19 billion yuan, a year-on-year increase of 7.9%, slightly lower than the consensus of 145.3 billion. After Q3's 13.4% life-time low growth rate, it continues reduced to single digits.

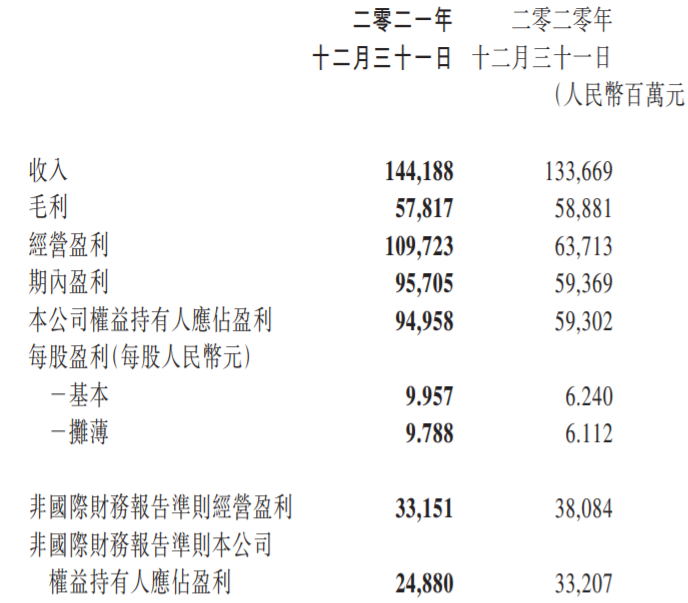

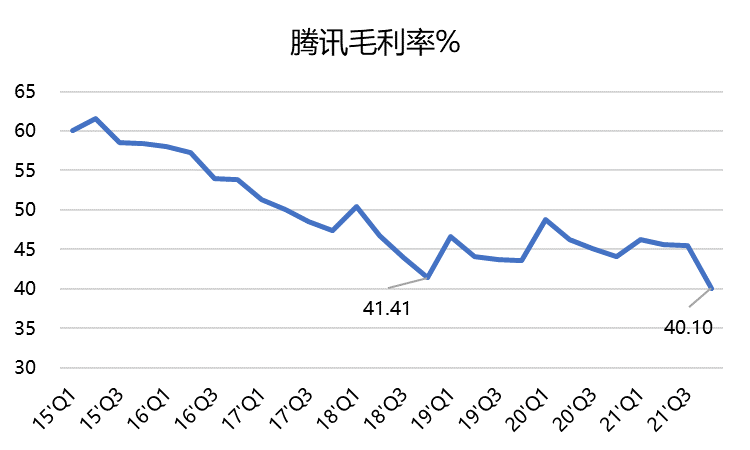

Gross profit decreased rapidly in Q4 to 57.8 billion yuan, down 2% year-on-year, Leading Gross Margin to 40% from a 45-47% level in the previous three quarters, which also lowered the annual gross margin to 44%.

Net profit during the period reached 95.7 billion yuan, compared with 59.4 billion yuan in the same period last year. Mainly due to net income of investment company with one-time disposal, including $JD.com(JD)$ .

Under Non-IFRS, the operating profit in a single quarter is 33.1 billion yuan, compared with 38 billion yuan in the same period last year, while the profit attributable to equity holders of the company is 24.9 billion yuan, compared with 33.2 billion yuan in the same period last year. This is less than expected, and also the second consecutive quarter of negative growth rate.

Highlights and disadvantages of businesses

Tencent's business consists of different sectors.

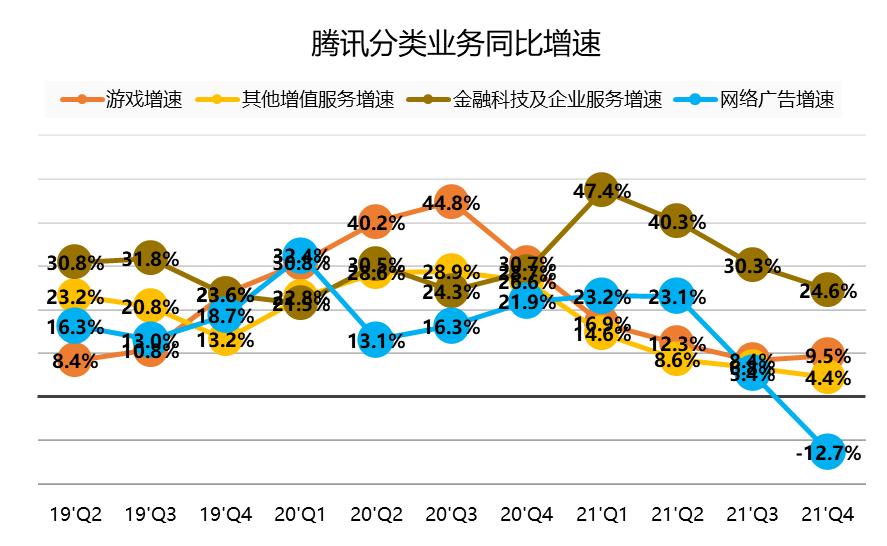

Value-added service business,including games and videos, take a revenue of 71.8 billion yuan, a year-on-year growth rate of 7%. The game independantly keeps strong.

Domestic games was 1%, indicating the whole industry experiencing a period of contraction.

Overseas games, on the other hand, up34%, due to the deferred revenue of previous acquisition, like Supercell, and excellent operation of new games.

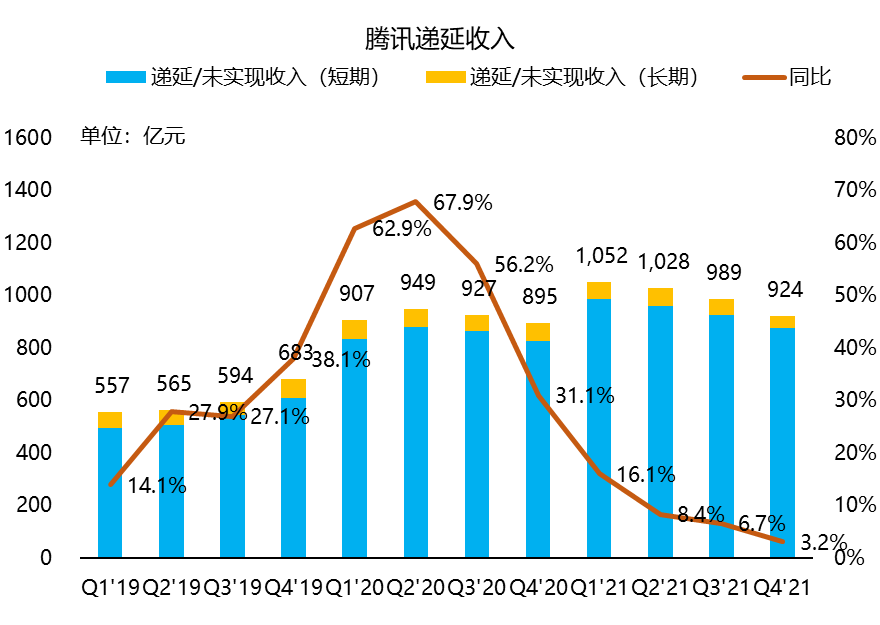

From the perspective of overall deferred revenus, Tencent is still facing real challenges in the next few quarters.

What was interesting, is that revenue from computer games increased by 4% year-on-year, the best in the last few quarters. Especially on the launch of "League of Legends Mobile Games".

Advertising revenue, dropped directly from double-digit growth rate, to negative in the last two quarters. Slowing demand and regulatory changes have caused Tencent's social media advertising business in headwind. Q4's media advertising has dropped by 25%, and mobile advertising alliance has also dropped by 10%. The clients in education, and related Internet service, all facing headwinds.

Fintech and cloud business was the best, and increased by 24.6% year-on-year, and its single-quarter revenue reached 48 billion yuan, which was the fastest growth rate of all businesses online. On the one hand, the payment amount of merchants increases, on the other hand, the service income of enterprises increases.

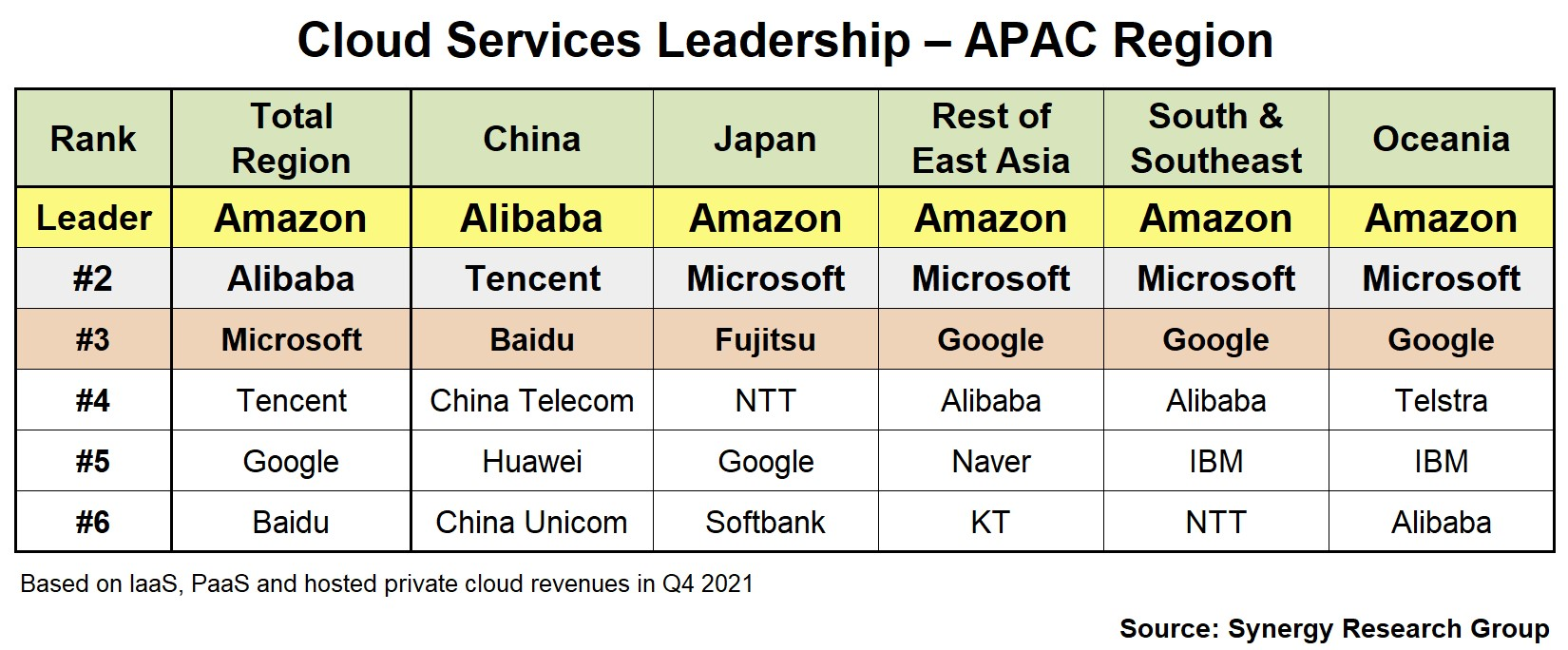

According to IDC's report, Tencent Cloud's IaaS and PaaS have a market share of 11%, ranking second in China, SynergyResearch reports similar results. The two main directions of Tencent Cloud are financial cloud and government cloud. At present,The best chance is in retails. Tencent could take the advantage of WeChat ecosystem.

However, COGS of this quarter has risen too fast, among which, the cost of server and broadband, the deployment cost of cloud service projects and the cost department of financial payment business are the most. Gross profit suddenly dropped by 5 percentage points, and the impact on the overall profit margin through operational leverage is huge.

Among them, some of the server and bandwidth costs must start from depreciation and amortization, which may be completed in the next several quarters, and there is no lack of one-time investment.

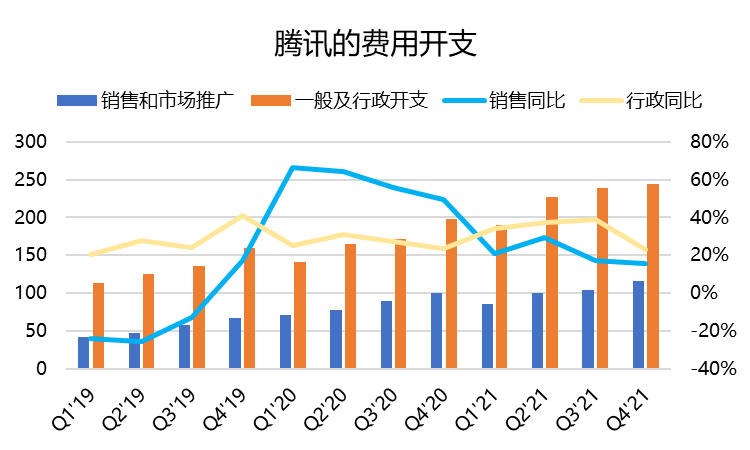

On the video value-added service,The cost of game channels has increased, and the content of video numbers has increased in the short term, its till has to maintain the status The video number still does not gain enough advantage in the competition with short videos such as Vibrato Aauto Quicker, and it is not enough to tighten expenditure immediately. And the cost of the game channel, if the version number is stopped, needs to be strongly maintained for many quarters. Including market investment in games and events, Tencent still does not have the ability to shrink. In this respect, Tencent needs to continue to maintain a large number of market and management expenses.

According to the recent news, Tencent is also starting to lay off employees to reduce management expenses.

This leads to the benchmark of gross margin not be maintained at 45% as before, but may be around 40% for a longer time. Tencent's lowest gross profit margin in a single quarter in the past six years also occurred in the 18 years when the version number was stopped.

Of course, on the other hand, after the expectation is lowered, every point of growth will exceed the expectation.

Several points of investment

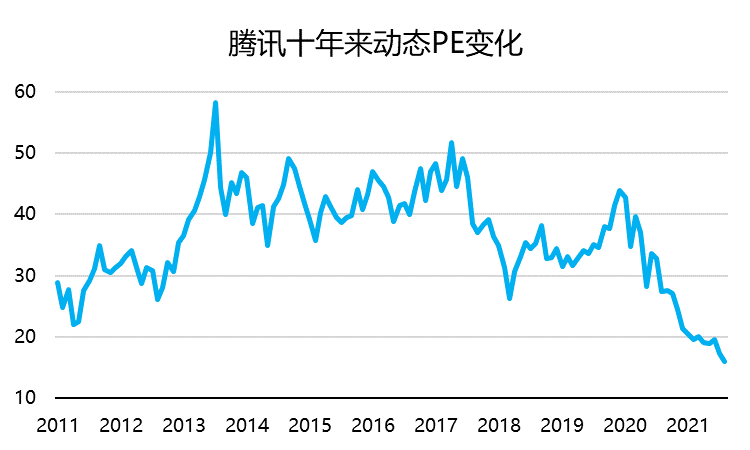

Judging from the price-earnings ratio (PE) that investors are most familiar with, Tencent's TTM PE on March 23 is just 18 times, Far below the average level of the past 10 years, which is also about 26 times lower than the lowest in 2018.

Another indicator closer to the actual operation level-EV/EBITDA, was in a five-year low (Although it is not lower than the level in 2018) of 18 times.

However, when we pay attention to these multiple indicators, we must understand that, With the decline of profit level, the price-earnings ratio and enterprise value multiple will also rise Rather than the only way for stock prices to rise. Therefore, according to Tencent's general valuation standard,The change of profit margin is indeed worthy of investors' attention.

However, from the perspective of cash flow, Tencent is obviously too good. Hundreds of billions of cash lying on the balance sheet can help the company resist the disadvantages brought by the economic downturn to a great extent. Valuing Tencent from the perspective of discounted cash flow will be higher than the current multiple valuation level.

More importantly, Tencent has enough cash to buy back in the secondary market as much as possible.While providing liquidity, it also increases the confidence of bulls.

Of course, at present, the headwind of economic downturn is not over. The biggest advantage of Tencent's huge size is that it is easier to survive.

After all, every figure in Tencent's report reflects China's economy.

Comments