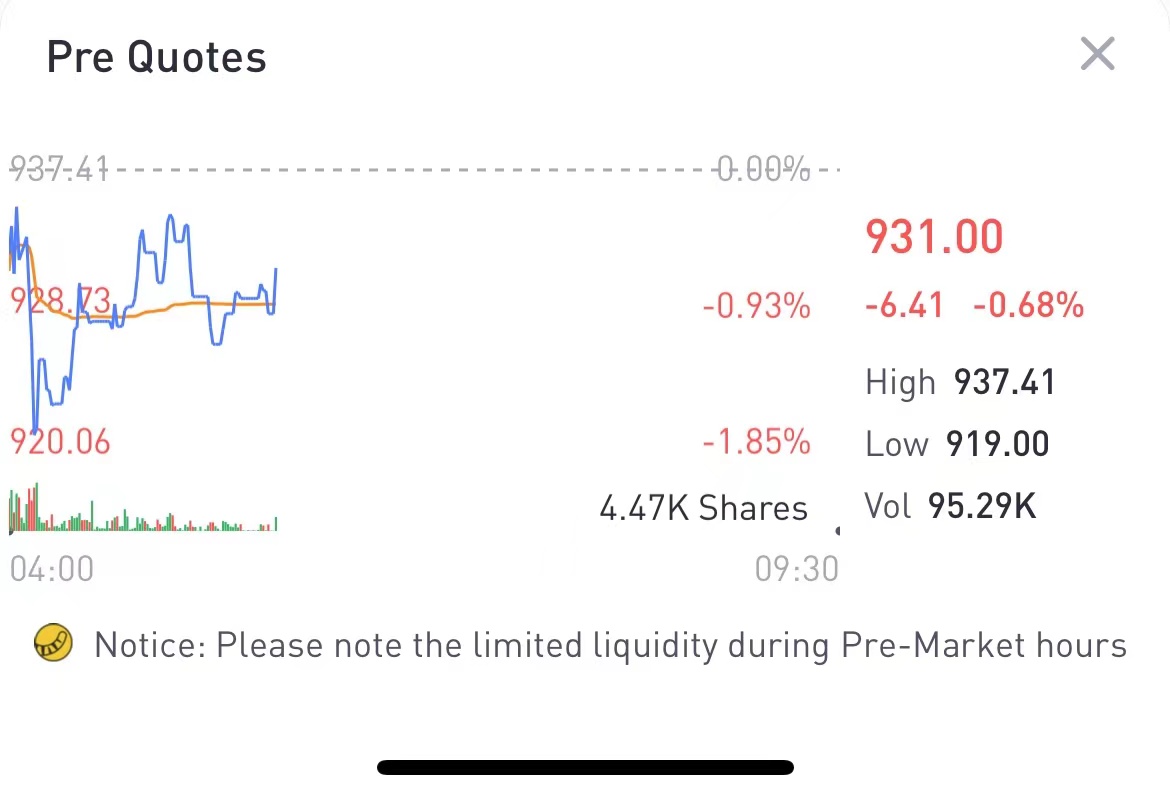

Tesla reported fourth-quarter results that came in stronger than expected on Wednesday. After Tesla warned supply chain issues could persist throughout 2022 ,shares fell slightly in extended trading on Wednesday.$Tesla Motors(TSLA)$

Here’s how the company performed:

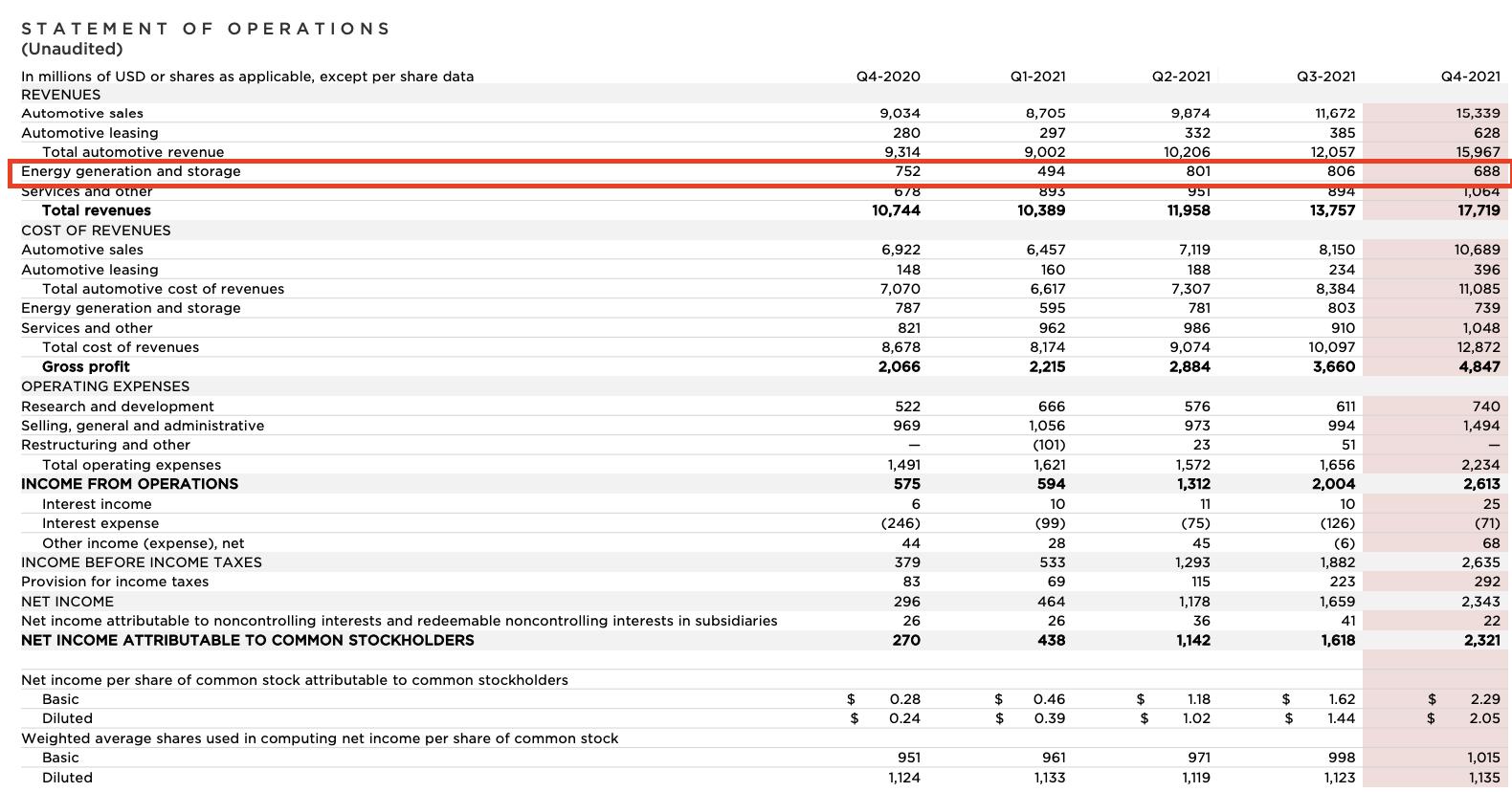

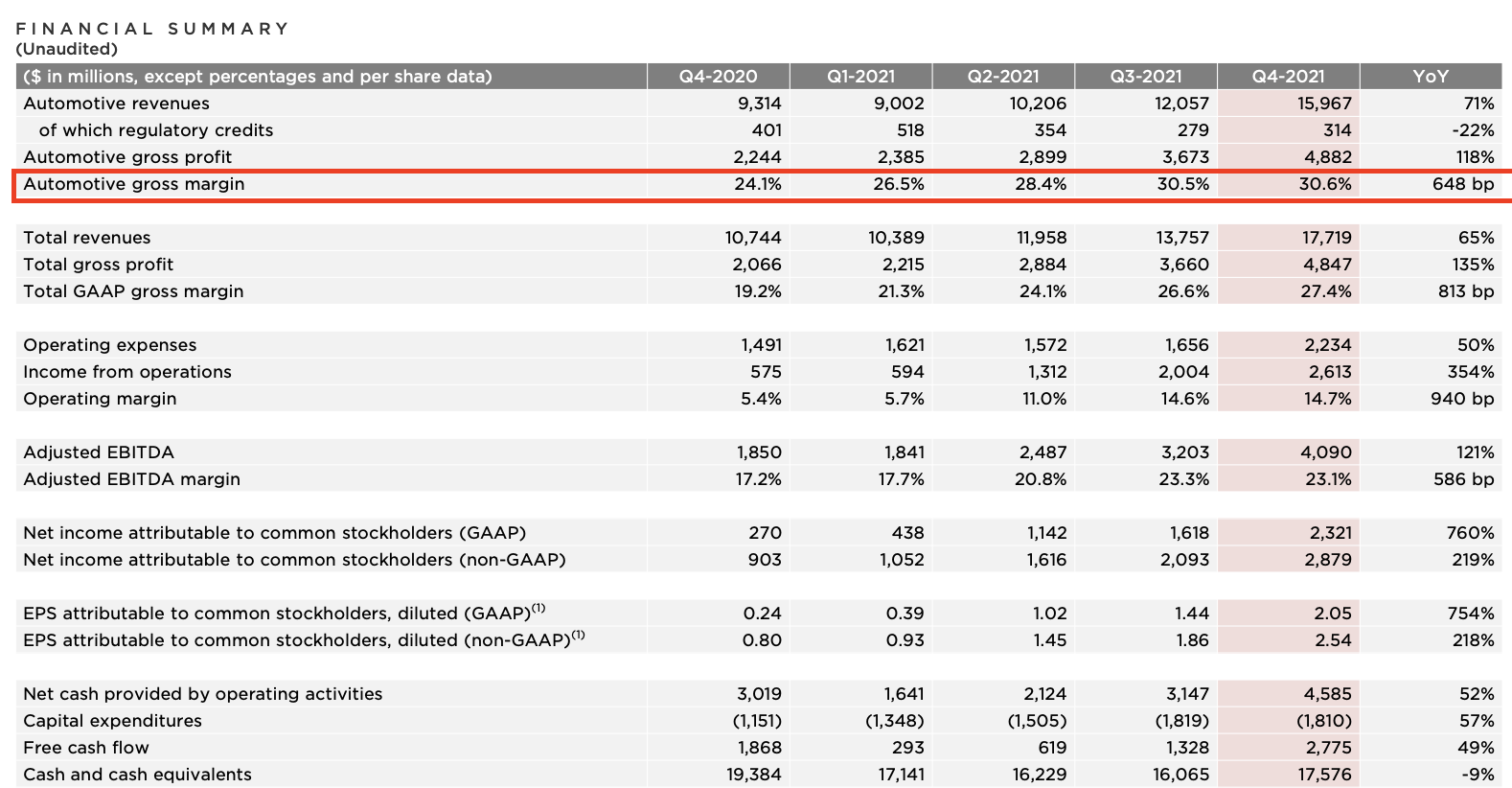

- Revenue: $17.72 billion, vs. $16.639 billion expected by analysts, according to Bloomberg

- EPS (adjusted): $2.54 per share, vs. $2.36 per share expected by analysts, according to Bloomberg

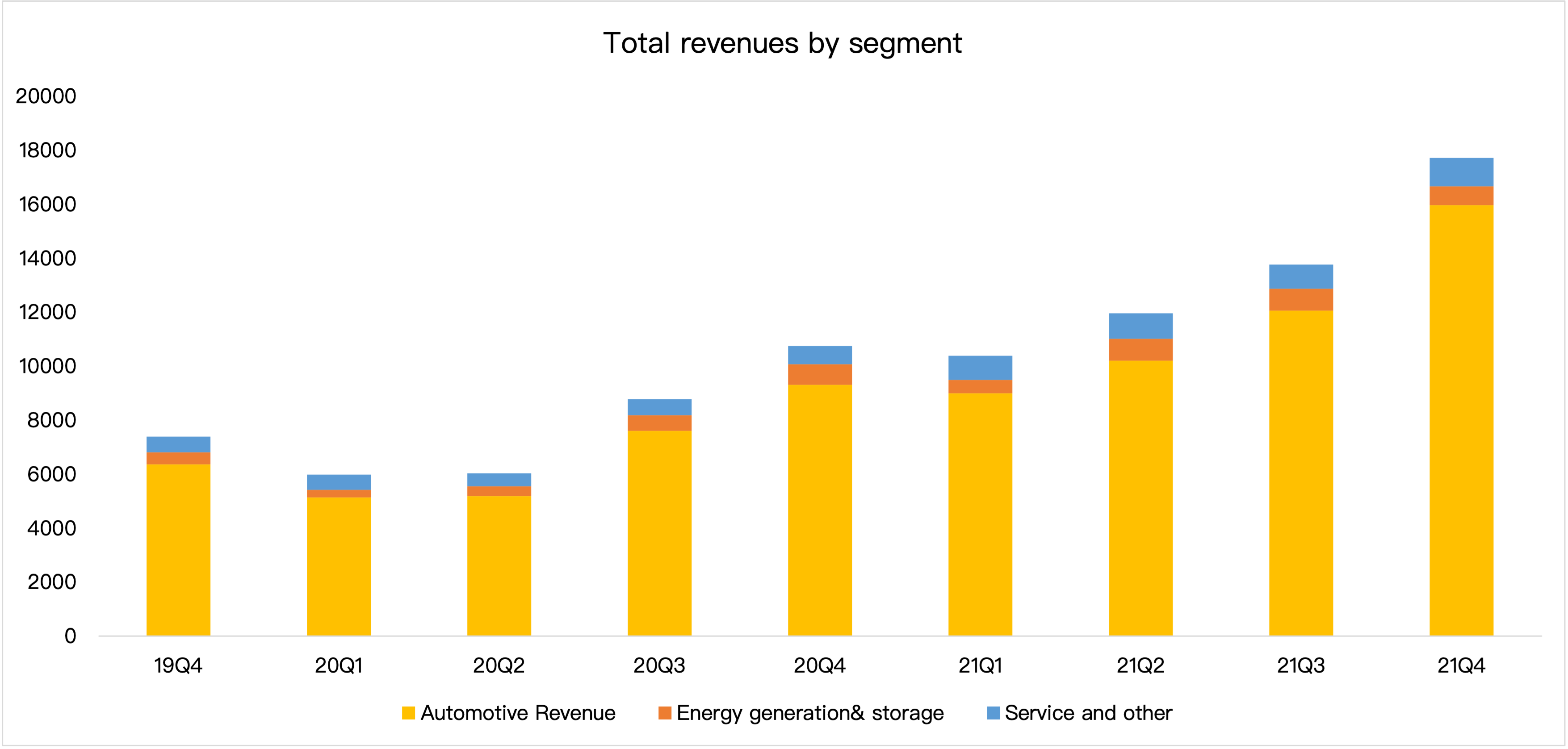

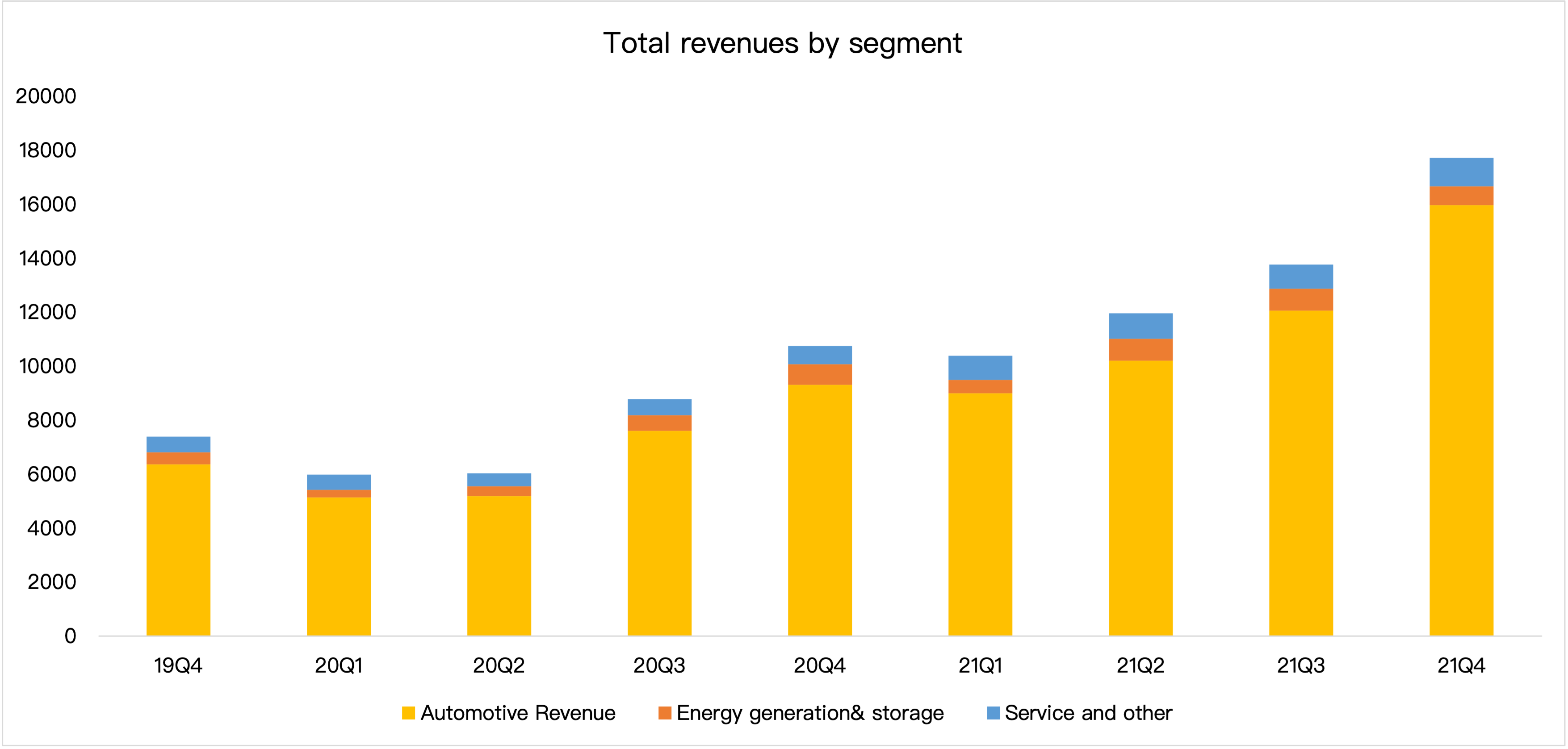

Thanks to a quarterly record delivering data, Tesla reported impressive third-quarter results: revenue soared 65% year over year to $17.72 billion.

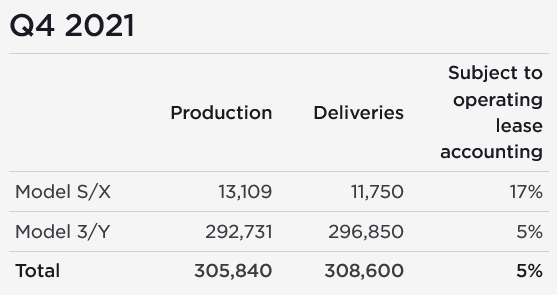

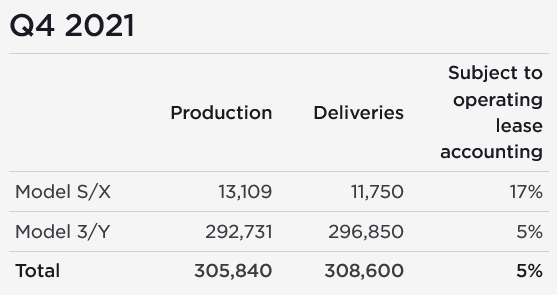

Thanks to a quarterly record delivering data, Tesla reported impressive third-quarter results: revenue soared 65% year over year to $17.72 billion. Tesla increased its overall electric car production in Q4 by about 70% year-over-year to 305,840, which is the best result ever. The growth is related to the high production of the Model 3/Model Y (up 79% to 292,731), as the refreshed Model S/Model X is in the ramp-up phase (down 19% to 13,109).

Tesla increased its overall electric car production in Q4 by about 70% year-over-year to 305,840, which is the best result ever. The growth is related to the high production of the Model 3/Model Y (up 79% to 292,731), as the refreshed Model S/Model X is in the ramp-up phase (down 19% to 13,109). As I discussed in my Tesla earnings preview article, analyst estimates were just too low as usual. The company has beaten on the top and bottom line basically every quarter in the last two years. Asuming Tesla’s average selling price is $50,000, the car sales revenue is roughly 15.4 billion. According to historical data, revenue from energy and maintenance services is around 1 billion, adding up to around 16.4 billion.it is easy to beat on the top and bottom line.

As I discussed in my Tesla earnings preview article, analyst estimates were just too low as usual. The company has beaten on the top and bottom line basically every quarter in the last two years. Asuming Tesla’s average selling price is $50,000, the car sales revenue is roughly 15.4 billion. According to historical data, revenue from energy and maintenance services is around 1 billion, adding up to around 16.4 billion.it is easy to beat on the top and bottom line.

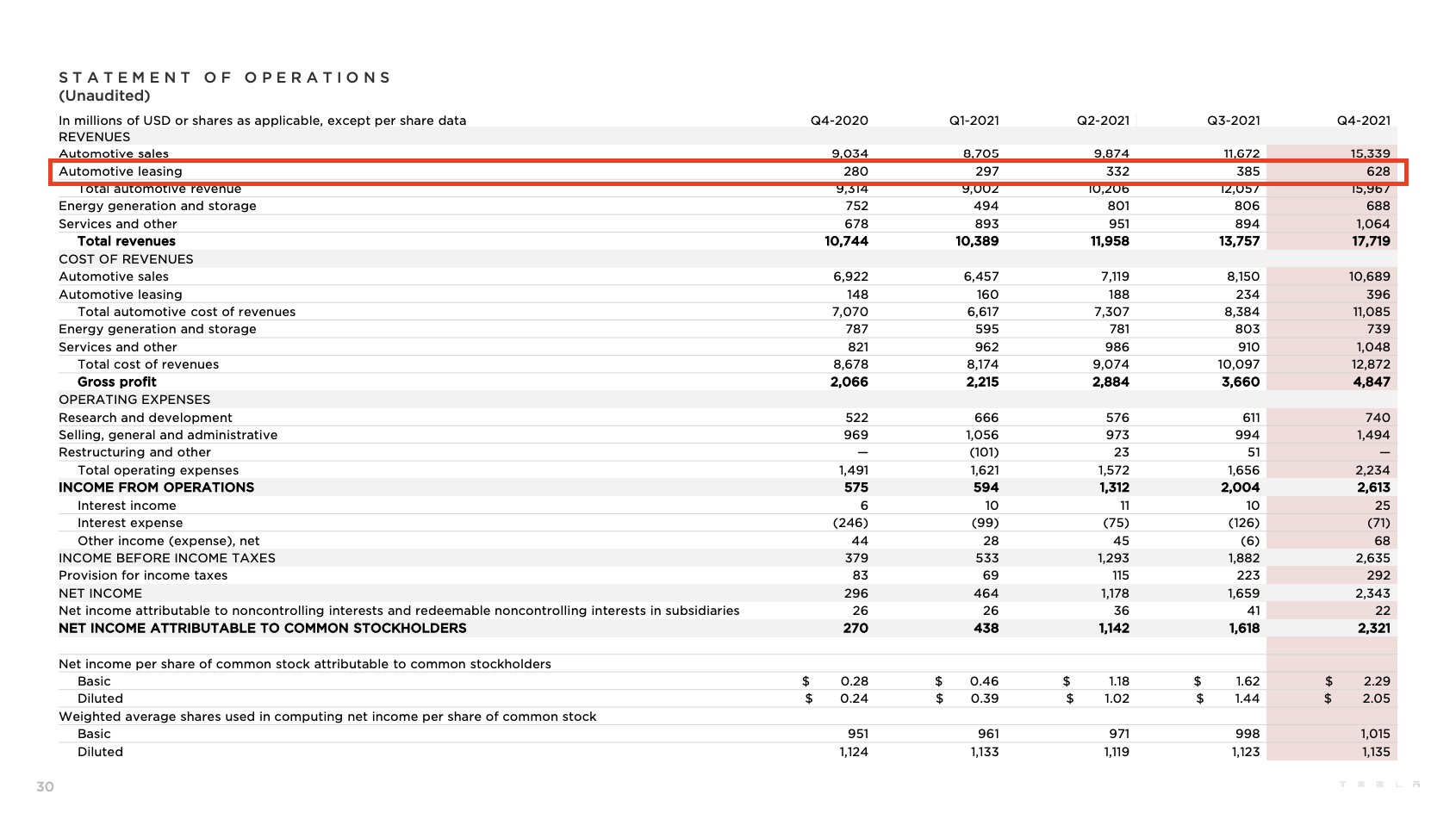

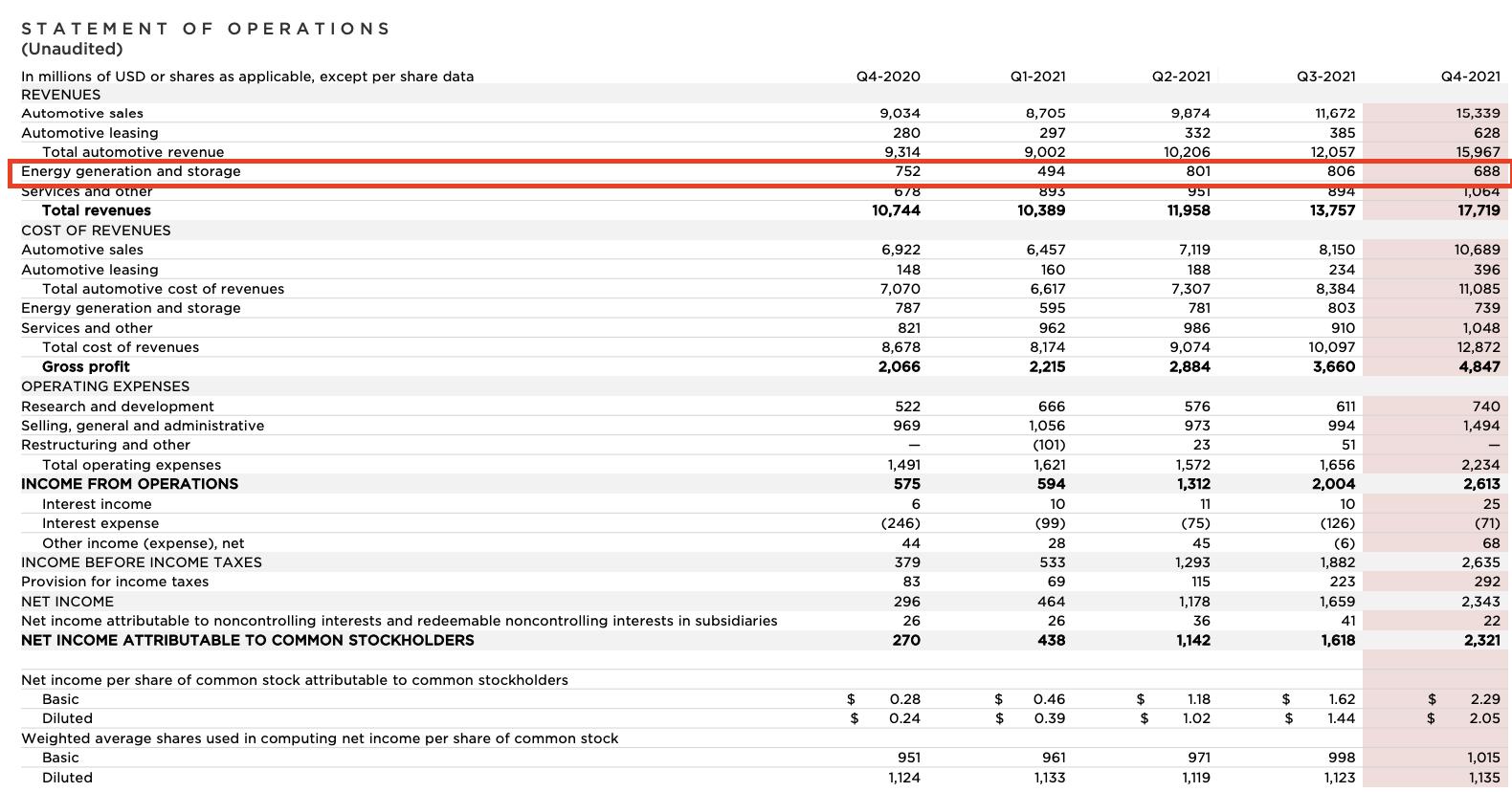

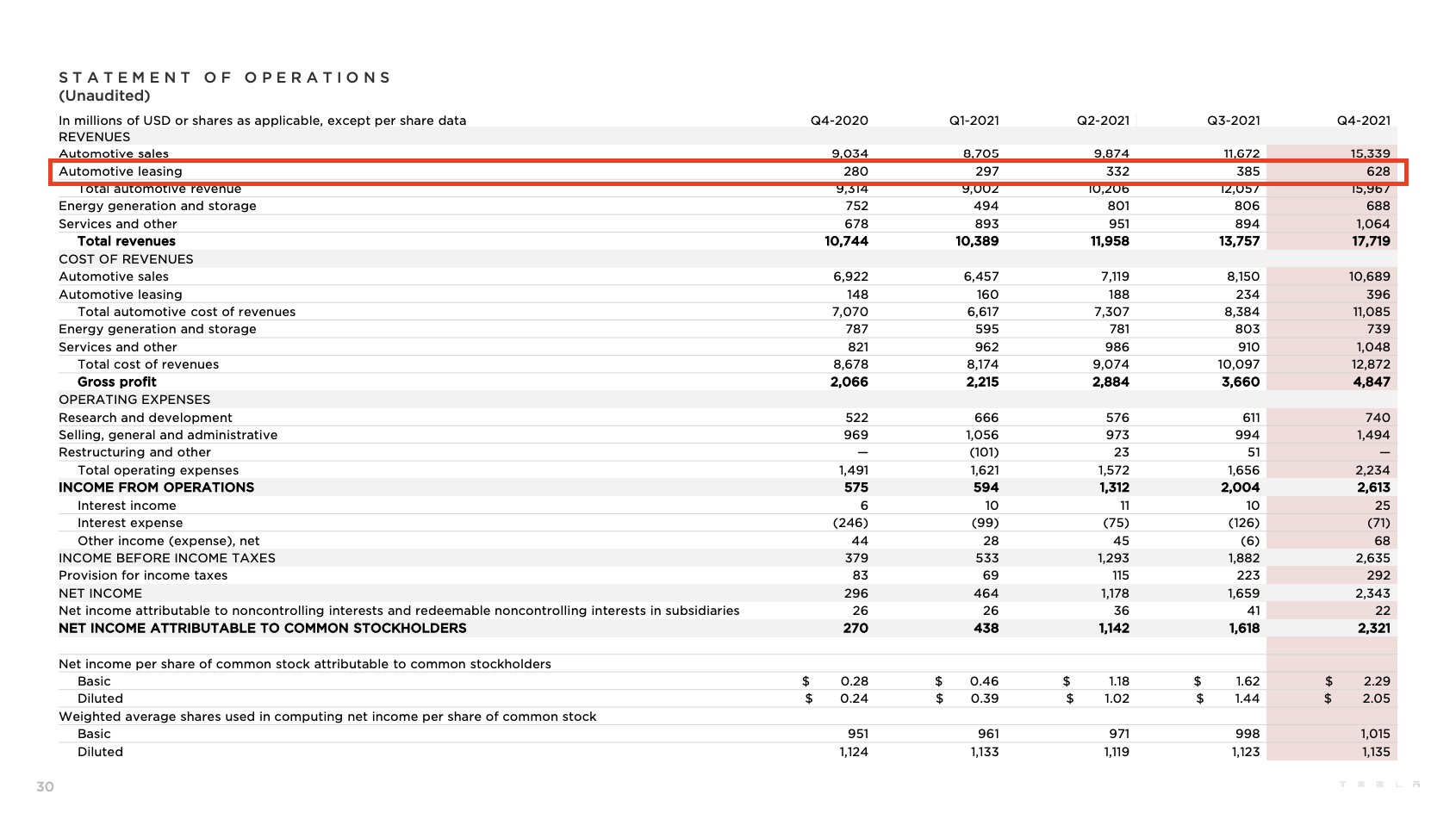

Energy generation and storage revenue was $688 million, which was down 8% and below the consensus of $815.1 million. It was the lowest revenue for that division since the first quarter of 2021. To be mentioned ,Tesla’s automotive leasing revenue was US$628 million, a 63% year-on-year increase. Previously, the revenue of this business has been around US$300 million. The reason for the sharp increase in this business is mainly due to Tesla.launched a 0-down payment leasing service in the fourth quarter.

To be mentioned ,Tesla’s automotive leasing revenue was US$628 million, a 63% year-on-year increase. Previously, the revenue of this business has been around US$300 million. The reason for the sharp increase in this business is mainly due to Tesla.launched a 0-down payment leasing service in the fourth quarter.

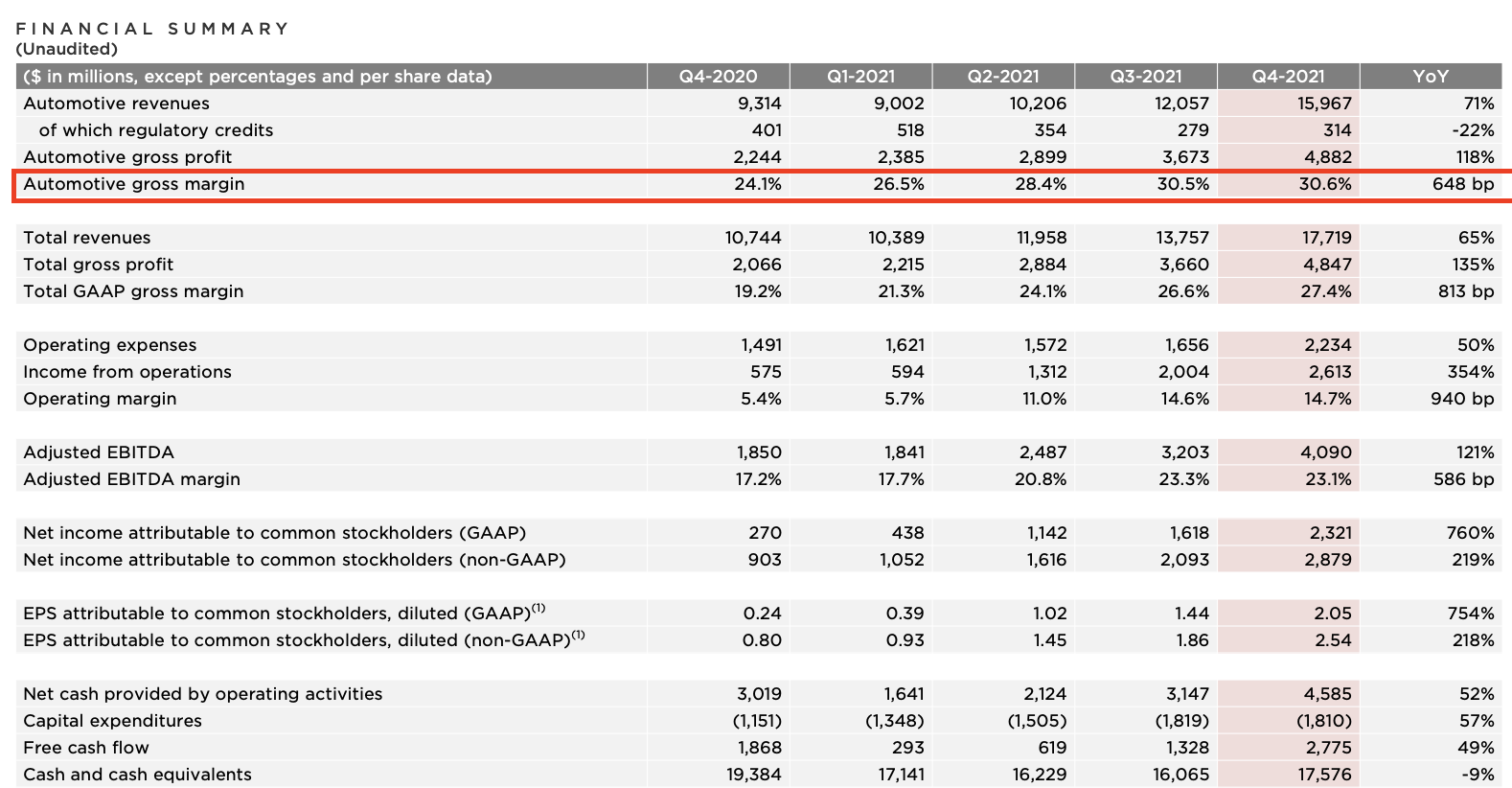

According to the plan, after consumers sign a contract with "0-down payment", 1-5 years belong to the lease period. Auto finance leasing is an auto finance business that is different from auto mortgage loans, and the main purpose is to purchase cars in installments. In the automobile financial leasing business, the ownership of the vehicle belongs to the financial leasing company during the lease period, and the lessee has the right to use the vehicle. Compared with one-time car purchases and auto loan, it is easy way to attract more clients. Net income, at $2.32 billion, was up some 760%, and Tesla said it had a 27.4% gross margin, compared with 26.6% in the previous quarter. Tesla Inc. set a record for profit but warned that supply chain problems will keep it from introducing new vehicle models this year while it focuses on expanding production of its current lineup.

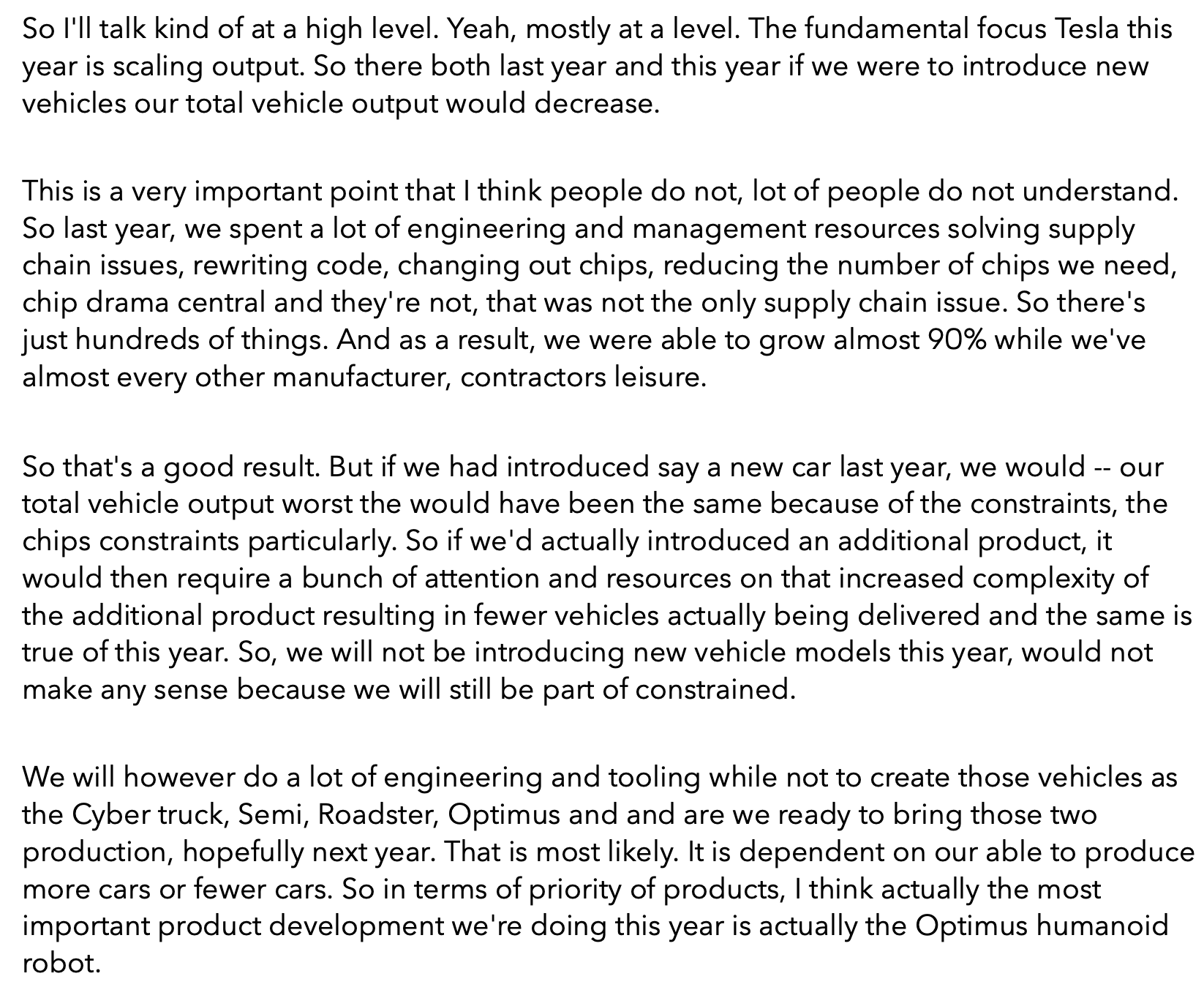

Net income, at $2.32 billion, was up some 760%, and Tesla said it had a 27.4% gross margin, compared with 26.6% in the previous quarter. Tesla Inc. set a record for profit but warned that supply chain problems will keep it from introducing new vehicle models this year while it focuses on expanding production of its current lineup. Tesla Inc. set a record for profit but warned that supply chain problems will keep it from introducing new vehicle models this year while it focuses on expanding production of its current lineup.

Tesla Inc. set a record for profit but warned that supply chain problems will keep it from introducing new vehicle models this year while it focuses on expanding production of its current lineup.

According to the Tesla Earning Call, the Cybertruck will delay at least 2023,Musk confirmed that in 2022 the company won’t be introducing the Cybertruck, a prototype Musk recently said he is personally testing at Tesla’s new factory in Austin, or any other new models until 2023. He was also asked about the prospect for a $25,000 vehicle, which would make his cars affordable for many more buyers.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments