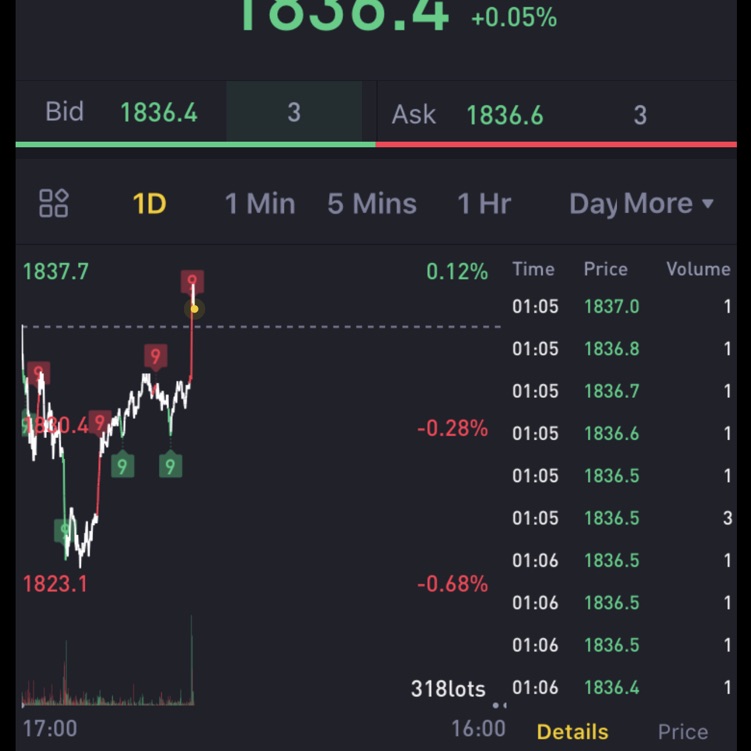

Today, both A-shares and Hong Kong stocks fell, and the decline of Hong Kong stocks was significantly higher than that of A-shares. The Shanghai Composite Index closed at 3878.0 points, down 0.51%, and the Shenzhen Component Index closed at 12955.25 points, down 0.78%. Transactions in the two cities were active, but lacked upward breakthrough momentum. In terms of sectors, technology and consumer stocks performed weakly, and some heavyweights dragged down the index.Hong Kong stocks were under even more obvious pressure. The Hang Seng Index fell 1.28% to close at 25,760.73 points, and the Hang Seng China Enterprises Index fell 1.68% to close at 9028.55 points. The 26,000-point integer mark failed to be held, and the short-term technical aspect was under pressure. H50 futures fell by more th

XPEV, NIO & LI Earnings Out: Which One Is the Best Play?

NIO is still posting losses, with a Q3 net loss of ¥3.48 billion, though this marks a narrowing of over 30%. At the same time, the company’s overall gross margin reached 13.9%, the highest in three years, and both operating cash flow and free cash flow turned positive. This time, NIO not only expressed confidence in achieving profitability in Q4 but also set more ambitious targets, aiming for full-year profitability next year. Li Auto’s Q3 revenue fell 36% year over year, with a net loss of 624 million yuan. Its Q4 guidance came in nearly 30% below expectations.

+ Follow

+13