U.S. stocks rose on Thursday as investors shrugged off disappointing economic data.

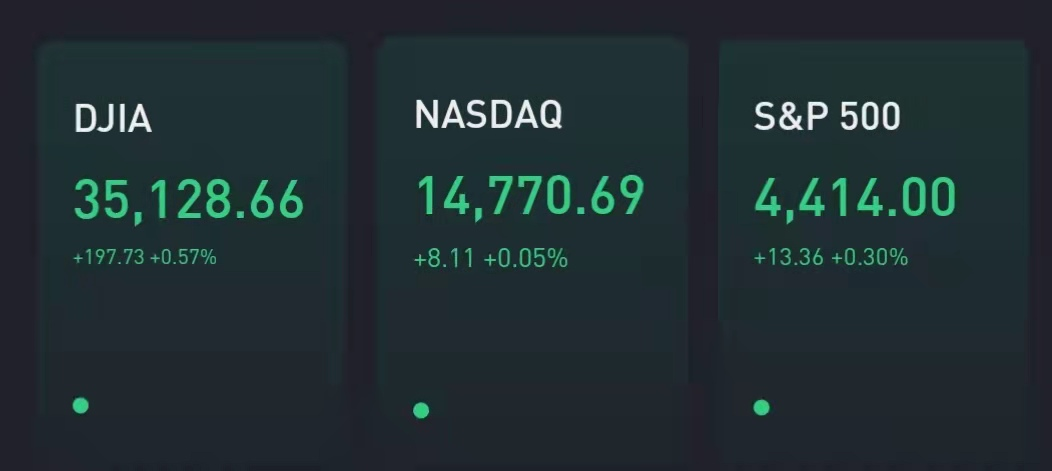

The Dow Jones Industrial Average gained 220 points. Meanwhile, the S&P 500 rose 0.3% and the tech-heavy Nasdaq Composite traded flat amid a drop in Facebook and PayPal shares.

The U.S. second-quarter gross domestic product accelerated 6.5% on an annualized basis, considerably less than the 8.4% Dow Jones estimate.

Meanwhile, a separate data point showed that 400,000 people filed initial claims for unemployment benefits for the week ended July 24. That level is nearly double the pre-pandemic norm and above a Dow Jones estimate of 385,000.

Many investors were relieve that the Federal Reserve signaled no imminent plans for dialing back asset purchases. Fed Chairman Jerome Powell cautioned that although the economy is making progress toward its goals, it has a ways to go before the central bank would actually adjust its easy policies.

"We have some ground to cover on the labor market side," Powell said. "I think we're some way away from having had substantial further progress toward the maximum employment goal. I would want to see some strong job numbers."

PayPal and Facebook fell 6% and 3%, respectively, after warning of significant growth slowdown as they reported quarterly earnings.

Meanwhile, shares of Ford jumped nearly 7% after it raised its 2021 outlook, saying it's selling more cars that are more expensive, though it missed analysts' estimates on earnings.

Amazon,Pinterest and Anheuser-Buschare set to report earnings Thursday.

“The market is understanding we are having a blowout quarter here compared to a year ago,” said Michael Reynolds, vice president of investment strategy at Glenmede. “What’s much more important this season is the guidance we’re getting on quarters ahead, as the economy settles out into what might be the new normal.”

The major averages are on track to end the month higher, with the S&P up 2.4% for July. The Nasdaq Composite and Dow are up 1.8% and 1.2%, respectively.

Meanwhile, the Senate voted Wednesday to advance a bipartisan infrastructure plan, which would put $550 billion into transportation, broadband and utilities.