Global stock markets made moderate gains on Monday as increasing confidence about the rapid recovery of economies from the COVID-19 pandemic offset concerns about the speed of the market’s rally.

The start to the week was quiet as investors refrained from taking on large positions before a two-day meeting of the Federal Reserve that will begin on Tuesday and the impending release of U.S. quarterly gross domestic product data.

Investors have been ebullient in recent weeks, with Wall Street hitting another intraday record high on Friday and European shares not far off their own record highs.

In morning trading on Wall Street, the Dow Jones Industrial Average rose 64.86 points, or 0.19%, to 34,108.35, the S&P 500 gained 12.33 points, or 0.29%, to 4,192.5 and the Nasdaq Composite added 51.01 points, or 0.36%, to 14,067.81.

The pan-European STOXX 600 index rose 0.32% and MSCI’s gauge of stocks across the globe gained 0.39%.

Asian shares rallied. MSCI’s broadest index of Asia-Pacific shares outside Japan closed 0.58% higher, while Japan’s Nikkei rose 0.36%.

That MSCI’s helped gauge of stocks across the globe, which gained 0.39%.

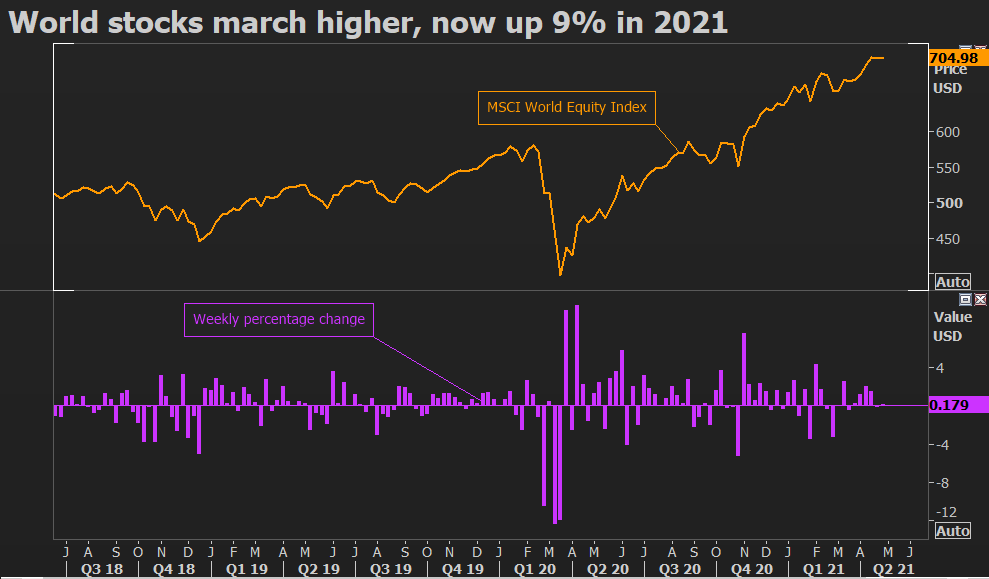

Stocks - as well as most other risk assets - have ridden a massive rally. The MSCI world index has registered only three down months in the past 12 and is up nearly 5% this month and 9% for the year as investors bet on a rapid post-pandemic economic rebound turbocharged by vast government and central bank stimulus.

For a graphic on MSCI World Equity Index:

Analysts, however, say stocks look a little over-valued and that the rally will run into hurdles after setting such a lightning pace and with so much of the economic recovery and fiscal stimulus splurge already priced in.

“The real crux of the issue, however, is ‘What’s in the price?’ The year-to-date rally has increasingly eliminated upside to our targets,” noted Andrew Sheets, a strategist at Morgan Stanley.

“Across four major global equity markets (the U.S., Europe, Japan and emerging markets), only Japan is currently below our end-2021 strategy forecast.”

BOLSTER CONFIDENCE

Still, recent data pointing to a solid global economic recovery has bolstered confidence and limited any investor nervousness, as have strong corporate earnings and the continued rollout of COVID-19 vaccinations in developed economies.

Early April manufacturing activity indicators last week pointed to a robust start to the second quarter, with data hitting record highs in the United States and signaling an end to Europe’s double-dip recession.

First-quarter U.S. gross domestic product data due later this week is likely to show activity returned to pre-pandemic levels, analysts said.

Most observers expect the Fed will stick to its pledge to keep stimulus flowing until the economy has recovered sufficiently and downplay the threat of rising inflation - any suggestion otherwise could hit market confidence sharply.

“The equity market is happy that the Federal Reserve is likely to continue with no new guidance on eventual tightening of policy as it wants to react to outcomes rather than anticipating them and believes that any inflationary rise in coming months will prove transitory,” said Steen Jakobsen, chief investment officer at Saxo Bank.

In currencies, the dollar - which had benefited from rising Treasury yields the past few months - fell 0.003%, with the euro down 0.22% to $1.2072. Other major currencies were little changed.

Bitcoin snapped a five-day losing streak with a 6.2% jump. Cryptocurrencies fell on Friday on concern that U.S. President Joe Biden’s plan to raise capital gains taxes would curb investments in digital assets.

Those tax proposals, while raising hackles among some investors, caused only a temporary blip in stock markets’ march higher.

Government bond yields rose as investors dumped safer assets.

Yields on U.S. Treasury benchmark 10-year notes last rose 3/32 in price to yield 1.5579%, from 1.567% late on Friday.

Turkey’s lira rebounded 1.3% following its recent slide but remains close to an all-time low as a chill settled on relations with the United States and after the new central bank chief signaled rate hikes would harm the economy.

In commodities, U.S. crude recently fell 1.42% to $61.26 per barrel and Brent was at $65.10, down 1.53% on the day.

Spot gold added 0.1% to $1,778.99 an ounce. U.S. gold futures fell 0.25% to $1,772.50 an ounce.