Wall Street charged ahead on Thursday, with the S&P 500 rising 1% to a record closing high while the Nasdaq composite finished up 1.5%, with the biggest boosts from technology and growth stocks on increasing investor optimism about prospects for Federal Reserve rate cuts this year.

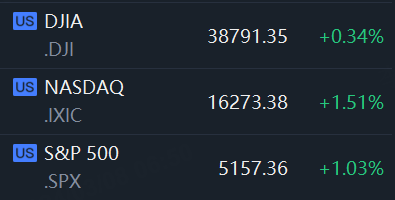

Market Snapshot

The Dow Jones Industrial Average rose 130.30 points, or 0.34%, to 38,791.35, the S&P 500 gained 52.60 points, or 1.03%, to 5,157.36. The Nasdaq Composite hit an intraday record high and narrowly missed a closing record to end up 241.83 points, or 1.51%, at 16,273.38.

Market Movers

Tesla (TSLA) - Tesla rose 1.2%. Shares of the electric-vehicle maker had fallen 13% over the past three sessions through Wednesday, the worst three-day stretch since the one that ended Oct. 20, 2023, when shares fell 16.8%, according to Dow Jones Market Data. The decline reduced Tesla’s market value to $553 billion and pushed the company out of the top 10 most valuable companies for the first time since January 2023.

Rivian Automotive (RIVN) - Rivian Automotive rose 13.4% to $12.51 after shares of the electric-vehicle company were initiated with a Buy recommendation and price target of $16 at Jefferies. Rivian will be unveiling its R2 vehicle, a lower-priced product, on Thursday.

Micron Technology (MU) - Micron Technology was raised to Buy from Hold at Stifel and the price target was increased to $120 from $80. Micron shares rose 3.6% to $98.98.

Novo Nordisk (NVO) - U.S.-listed shares of Novo Nordisk rose 9% after the Danish pharmaceutical company presented early data for a new obesity drug suggesting it could be more effective than its Wegovy treatment.

New York Community Bancorp (NYCB) - Shares of New York Community Bancorp rose 5.8% on Thursday. The regional lender announced Wednesday it was getting an equity injection of more than $1 billion from the investment firm run by former Treasury Secretary Steven Mnuchin and other funds. On Thursday, it said the cash infusion would bring its capital up to 10.3% of assets, comparable to other large regional banks.

Ciena (CIEN) - Ciena fell 14.7% after the optical-networking company issued revenue guidance that missed estimates. Ciena said it expects fiscal second-quarter revenue of between $850 million and $930 million, well below Wall Street estimates of $1.1 billion.

Kroger (KR) - Kroger rose 9.9% after the grocer reported fiscal fourth-quarter adjusted profit and same-store sales that beat Wall Street expectations.

American Eagle Outfitters (AEO) - American Eagle Outfitters fell 1.9% after the retailer unveiled a plan to boost profitability over the next three years, and fourth-quarter adjusted earnings topped analysts’ estimates.

Victoria’s Secret (VSCO) - Victoria’s Secret sank 29.7% after the lingerie and clothing retailer issued sales guidance for its fiscal first quarter and year that was weaker than expected. The company expects sales of $6 billion in the current fiscal year, below Wall Street estimates of $6.19 billion. “As we look into the new year, we recognize the broader intimates market in North America has been down for four consecutive quarters and we are planning the business appropriately conservative in the near-term,” said Chief Executive Martin Waters.

Rush Street Interactive (RSI) - Rush Street Interactive jumped 16.1% after the online casino and sports betting company posted fourth-quarter earnings and revenue that topped analysts’ expectations and said it anticipates current fiscal-year revenue of $770 million to $830 million, higher than Wall Street forecasts of $759.2 million.

Market News

Fed Is “Not Far“ From Confidence Needed to Cut Rates, Powell Says

Federal Reserve Chair Jerome Powell suggested the central bank is getting close to the confidence it needs to start lowering interest rates.

“We’re waiting to become more confident that inflation is moving sustainably at 2%,” Powell said Thursday while answering questions from the Senate Banking Committee. “When we do get that confidence — and we’re not far from it — it’ll be appropriate to begin to dial back the level of restriction.”

Powell’s remarks add some additional color about officials’ thinking around the timing of the first rate cut, bolstering the idea that such a move could come in the next few months.