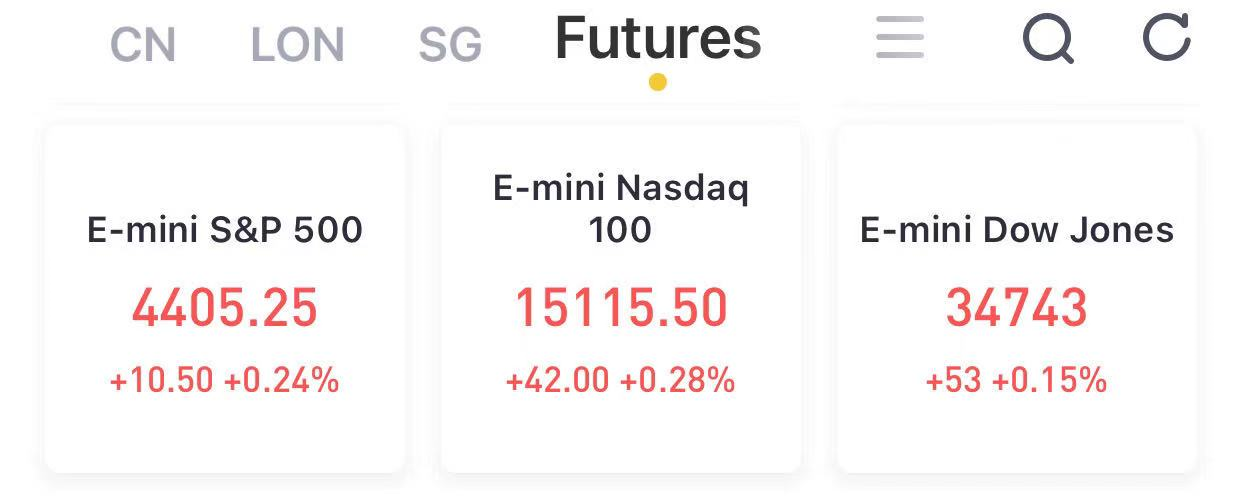

- Futures up: Dow 0.15%, S&P 0.24%, Nasdaq 0.28%.

- Moderna, Cigna, Penn National, Wayfair and others made the biggest moves premarket.

- crude oil was steady after several days of losses on the risks to demand posed by the delta variant.

Futures contracts tied to the major U.S. equity indexes were mildly higher Thursday morning as Wall Street looked to improve upon a mixed week.

At 07:53 a.m. ET, Dow E-minis were up 53 points, or 0.15%, S&P 500 E-minis were up 10.5 points, or 0.24% and Nasdaq 100 E-minis rose 42 points, or 0.28%.

Stocks making the biggest moves premarket:

1) Moderna(MRNA) – Moderna shares fell 2.4% in the premarket, despite reporting better-than-expected earnings and revenue and saying its Covid-19 vaccine is 93% effective after 6 months. Moderna earned $6.46 per share for its latest quarter, beating the $5.96 consensus estimate.

2) Cigna(CI) – The insurance company beat estimates by 28 cents with adjusted quarterly earnings of $5.24 per share, with revenue also beating estimates. It did note a negative impact of higher medical costs, and the stock fell 3.7% in premarket trading.

3) Penn National(PENN) – Penn is buying digital media and sports betting companyScore Media(SCR) for $2 billion in cash and stock, sending Score shares soaring by 72.4% in premarket trading. Separately, the gaming company reported a quarterly profit of $1.17 per share, beating the 92 cent consensus estimate, and its stock gained 2.7% in the premarket.

4) Robinhood(HOOD) – The trading platform company’s stock fell 11.3% in premarket trading after it announced it would sell up to 97.9 million shares over time. The shares will come from various selling stockholders, and the company won’t receive any proceeds from the sale. Robinhood had surged more than 50% in Wednesday’s trading.

5) Wayfair(W) – The home furnishings seller’s shares leaped 8.7% in the premarket after its quarterly profit of $1.89 per share came in well above the consensus estimate of $1.15. The company also said it’s $3.9 billion in revenue during the quarter is well above pre-pandemic run rates.

6) Regeneron(REGN) – The drug company’s stock added 3.3% in premarket trading after beating top and bottom-line estimates by a wide margin. Results were boosted by demand for its COVID-19 antibody cocktail.

7) Roku(ROKU) – Roku shares stumbled 8.8% in premarket trading after the video streaming device maker reported weaker-than-expected user growth. Roku did report better-than-expected earnings for its latest quarter, with a profit of 52 cents per share compared with a 13 cents consensus estimate. Revenue exceeded Wall Street forecasts as well.

8) Fastly(FSLY) – Fastly lost 14 cents per share for the second quarter, 2 cents less than analysts had predicted. However, the cloud software company’s revenue missed forecasts, and it said a widespread network outage in June will continue to impact results for the rest of the year. Shares tumbled 21.8% in the premarket.

9) Uber(UBER) – Uber reported a surprise profit of 58 cents per share, compared with consensus forecasts of a 51 cents per share loss. The ride-hailing company’s revenue beat estimates as well, but the stock is under pressure with Uber’s quarterly profit largely coming from its investments. Uber shares lost 4.5% in premarket action.

10) Electronic Arts(EA) – Electronic Arts beat estimates by 12 cents with adjusted quarterly earnings of 79 cents per share, and the videogame maker’s revenue also topped analyst forecasts. EA also gave an upbeat current-quarter forecast, on strength in franchises like “FIFA 2021”. The stock jumped 3.4% in premarket trading.

11) Booking Holdings(BKNG) – Booking Holdings lost an adjusted $2.55 per share for the second quarter, wider than the loss of $2.04 that Wall Street had been anticipating. However, revenue was above estimates and nearly tripled for the parent of Priceline, Kayak and other travel services, as travel demand jumped amid increasing vaccinations and an easing of restrictions. The stock added 3.1% in the premarket.

12) Etsy(ETSY) – Etsy came in 5 cents above estimates with quarterly earnings of 68 cents per share, and the online crafts marketplace operator also saw revenue come in above analyst forecasts. However, the stock is under pressure after user growth figures fell short of expectations, and its stock suffered a 12.5% drop in premarket trading.

13) Lemonade(LMND) – Lemonade shares lost 8.8% in the premarket after the insurance company reported a sales decline and quarterly losses that more than doubled from a year earlier. However, Lemonade did issue a better than expected full-year revenue forecast.

In rates, treasuries rose modestly with the curve flatter and pivoting around an unchanged 5-year sector. Yields were lower by up to 1.5bps across long-end of the curve, flattening 5s30s spread by 1.2bp on the day; 10-year yields around 1.17%, marginally richer and underperforming bunds by 1bp. Treasuries drifted lower over Asia session as investors reacted to Bank of England policy outcome at midday London time; losses were later pared over early European session as bunds outperformed and gilts little changed after Bank of England policy announcement at midday London time, following 7-1 vote to keep bond-buying target unchanged.

Money-market traders boosted bets for an initial U.S. rate hike in early 2023 after Clarida said the central bank is on course to pull back on the massive support it’s providing to the economy, starting with an announcement later this year that it’s paring bond purchases and moving on to a liftoff in interest rates in 2023. San Francisco Fed President Mary Daly said tapering could start later this year or in early 2022 The benchmark 10-year Treasury yield edged up one basis point to 1.19%.

In FX, moves in most G-10 currencies were muted with FX traders reporting light risk-on flows, with the yen trailing and the Australian dollar leading. The pound rose but was unchanged after the BOE reported that it would begin its balance sheet unwind once rates hit 0.5%. The yen slipped for a second day as traders speculated that the Bank of Japan will maintain an easing bias while the Federal Reserve looks to start withdrawing stimulus.

In commodities, crude oil was steady after several days of losses on the risks to demand posed by the delta variant, especially in the key market of China.