Stocks fell on Tuesday as concerns about a possible recession in the U.S. weighed on investor sentiment.

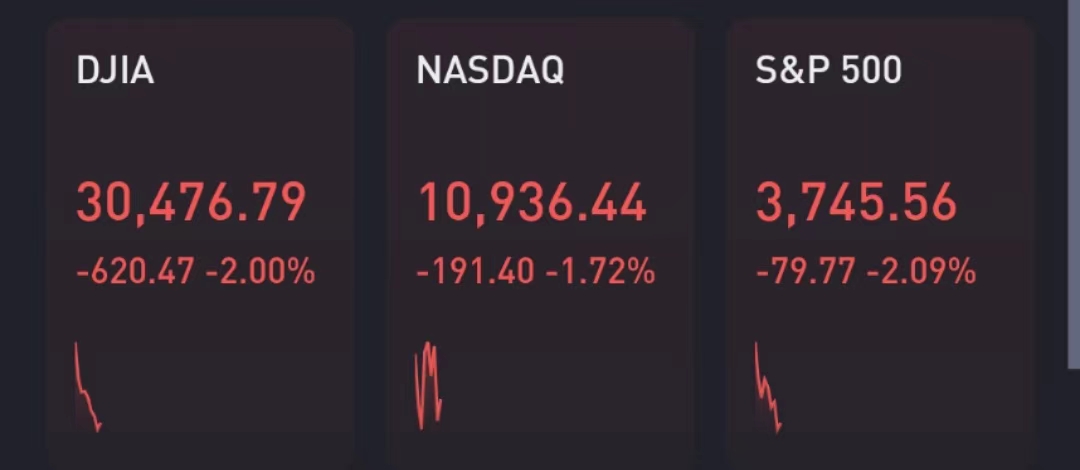

The Dow Jones Industrial Average fell about 620 points, or about 2%. The S&P 500 dipped 2.09%, and the tech-heavy Nasdaq Composite shed about 1.72%. The market has dropped in four of the past five weeks, and the S&P 500 is more than 20% below its record high.

Concerns about economic growth are hanging over investors as the U.S. market looks to recover after a rough first half to the year. Some economists believe U.S. GDP declined for both quarters to start the year, which is a shorthand used by many to signal a recession.

Stocks tied to economic growth fell sharply on Tuesday. Shares of JPMorgan and Wells Fargo shed 2.5% and 2.7%, respectively. American Airlines fell more than 4%. Machinery stocks Deere and Caterpillar hit their lowest levels of the year.

Shares of Ford fell nearly 5% after the automaker’s second-quarter sales rose more slowly than expected.

The benchmark 10-year Treasury yield has declined in recent days even as the Federal Reserve has pledged to aggressively fight inflation. The 10-year yield is now trading close to the 2-year yield, a recession indicator watched by many on Wall Street.

“The US market is all about pricing in a slowdown, and pricing in the fact that the Fed is forced to hike rates into a slowdown,” Allianz chief economic advisor Mohamed El-Erian said on “Squawk Box.”

The price of oil also declined, reflecting a possible economic slowdown. Futures for U.S. benchmark West Texas Intermediate fell below $105 per barrel. Shares of oil giant Chevron dropped nearly 3%.

Among major tech stocks, Amazon fell more than 2% and electric automaker Tesla slid 3.7%.

Markets finished one of the worst halves in decades on Thursday, and major averages posted their fourth week of losses in five despite modest gains during Friday’s trading session.

The outlook for the second half of the year is murky. Credit Suisse strategist Jonathan Golub said in a note to clients on Tuesday that he expects the U.S. to avoid a recession but cut his S&P 500 target for the end of the year to 4,300 from 4,900. The new target would mean Wall Street claws back about half of its losses from the first six months of the year.

“Recessions are most accurately characterized by a meltdown in employment accompanied by an inability of consumers and businesses to meet their financial obligations. While we are currently experiencing a meaningful slowdown in economic growth (from extremely high levels), neither of the above conditions are present today,” Golub wrote.

In this shortened holiday week, investors are looking ahead to the release of June jobs report data on Friday. According to Dow Jones estimates, job growth likely slowed in June with 250,000 nonfarm payrolls added, down from 390,000 in May. Economists surveyed expect the unemployment rate to hold at 3.6%.

This week’s economic calendar also includes Wednesday’s release of minutes from the Federal Reserve’s latest meeting. May factory orders are expected for Tuesday, with earnings from WD-40 and Levi Strauss scheduled for Friday.